What is a Demat Account? If you are a beginner in the stock market and are wondering what a Demat account is, then don’t worry, you are not alone. Every month, nearly lakhs of individuals ask this very question – What is a Demat Account? Some follow up questions include, ‘what is a trading account?’ what are the different types of Demat accounts?’, ‘what is the difference between Demat account and trading account? And the list goes on.

As a stock market beginner, the formalities of the market might seem tedious or even annoying to you. But nevertheless, you must know how to open a Demat account. Why? Because you cannot invest in the stock market without a Demat account. So, let us understand what a Demat account is and how a Demat account works in enabling you to create wealth in the stock markets.

What is a Demat Account? - Introduction to Demat Account

Watch this video to understand what is a Demat Account

A bank account stores your cash and other assets like fixed deposits, recurring deposits etc. right? In the same way, a Demat account is a digital locker (tijori) which stores your financial assets in ‘electronic’ form. A Demat account stores assets like shares, bonds, mutual funds, exchange traded funds (ETFs) etc.

The term Demat, is short for Dematerialisation account. What is Dematerialisation? It is the process of converting physical shares into electronic form. You see, Demat accounts were introduced in India in 1996. Before that, physical share certificates were bought and sold among investors.

So, suppose you bought 100 shares of Reliance Industries Ltd in 1992. The company would send you actual physical paper shares. If you then wanted to sell these shares, you had to give physical share certificates to your broker who would then look for a buyer. Once sold, the broker would hand over the physical share certificate to the buyer and the money would be credited to your account. So, before Dematerialisation, you could actually hold shares in your hands!

But naturally, this process is time consuming, prone to theft, loss, fake certificates, and not scalable. Can you imagine the courier charges a seller sitting in Punjab will incur if he is selling his stocks to a buyer from Chennai? Huge! It’s no wonder then that before Demat accounts, the settlement cycle used to take 14 working days!

But everything changed in 1996 as Indian markets adopted ‘Dematerialisation’. With Dematerialisation, the settlement cycle reduced from 14 to 2 working days. Demat account has made trading in the stock markets scalable. The reach of the stock market increased. Today, a person sitting in even the remotest village in India can trade in the stock market through a Demat account.

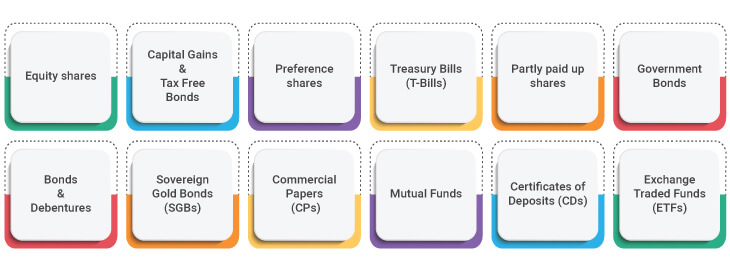

What ‘securities’ can be stored in a Demat account?

A lot of novice investors believe that a Demat account is only for storing shares. This is not true. You can also hold the following assets in a Demat account:

What is Trading Account?

This is another area of confusion for novice investors. Demat and trading account are not the same. A trading account is used to buy and sell securities whereas a Demat account only stores your securities. You cannot buy or sell shares using a Demat account. To buy and sell shares, you compulsorily need a trading account. Let us understand the difference between Demat account and trading account with this simple example.

You go to a shoe shop to buy new sneakers. You try them on and decide to buy them. As you head to the payment counter, the salesman shouts, ‘Chotu packed piece de’. And a packed box falls from the sky! (The overhead godown). Observe that the buying and selling takes place in the shoe store. But the actual shoes are stored in the godown. Every time a customer buys a shoe, a new box is given from the godown.

[ Read More: Demat Account Vs Trading Account ]

In this example, the godown is your Demat account and the shoe store is your trading account

- You store assets in a Demat account

- You buy and sell these assets using your trading account.

Now at this point, you might have a few questions about Demat and trading account. Let us answer them one by one.

Can you only open a Demat account?

Yes, you can open a Demat account without opening a trading account. But this should be done only if you never plan to sell your stocks. So, if you only buy stocks and are sure that you will not sell them for 10 or 20 years, then you can only open a Demat account, without a trading account.

Can you only open a trading account?

Yes, you can only open a trading account without opening a Demat account. But in that case, you can only trade in the Futures & Options (F&O) segment as they are cash settled. Without a trading account, you cannot conduct intraday trading. Though not compulsory, it is recommended to have both Demat and trading account with the same broker for easy share trading and settlement.

Can you open multiple Demat accounts?

Yes, absolutely! There is no restriction on the number of Demat accounts that you can open. But remember, that you need to pay separate annual maintenance charges for each Demat account you hold.

[ Read More: All About Demat Account Charges in India ]

Now that you understand what a Demat and trading account is, let us look at the various participants which help in efficient functioning of a Demat account. All the Demat accounts in India are maintained by depositories.

What are Depositories?

A Depository is an entity like your bank. All your securities (shares, bonds etc.) are stored safely with these depositories. The main role of depositories is to transfer securities from one Demat account to another. This is similar to you transferring money from one bank account to another. Like a bank has branches, depositories have Depository Participants (DPs).

The two main depositories in India are:

NSDL is one of the largest depositories in the world. It was established in August 1996 under the Depositories Act of 1996. NSDL has 276 registered depository participants (DPs) with nearly 2.70 crore active client accounts. NSDL’s total Demat custody value is a whopping Rs 2,93,20,536 crore.

Growth of Demat Accounts in India

-

Demat Accounts in India29558112+ Accounts

-

Demat Custody Value

32009

+ Billions -

New Demat Accounts Opened20+ Lakhs

What is a Depository Participant?

Your broker is your Depository Participant. As an investor, you cannot directly approach NSDL or CDSL to open a Demat account. You can only open a Demat account with your broker. He acts as the vital link between you and the depository.

Samco Securities Ltd. is one of the most popular depository participants in India with more than 2.5 lakh clients. A depository participant helps you buy and sell shares using a Demat and trading account.

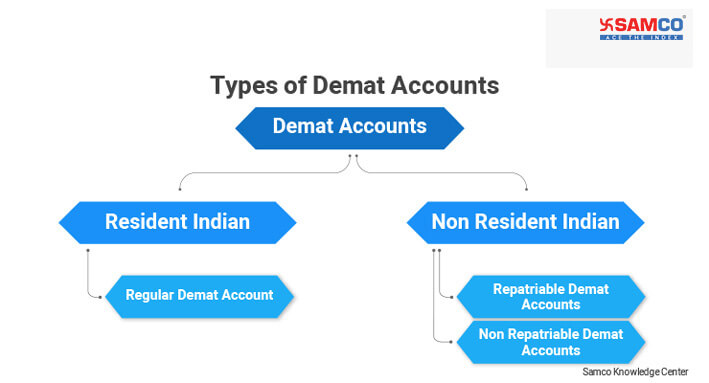

What are the Types of Demat Accounts in India?

There are 3 main types of Demat accounts in India. This bifurcation is based on whether you are a Resident Indian (RI) or a Non Resident Indian (NRI).

Regular Demat Account: This is the most common type of Demat account in India. This Demat account can be opened by all resident Indians. You can open a regular Demat account in either single or joint holding. If you open a joint Demat account, then it cannot be in ‘either or survivor’ mode. A maximum of three holders are allowed to open a joint Demat account.

You can also open a Demat account in the name of a minor (person below 18 years). Either of the parents can act as the guardian. But the account must be converted into ‘major’ or single account once the child becomes a ‘major’. Learn how to open a minor Demat account in India.

Repatriable Demat Account: A Repatriable Demat account allows you to transfer funds to foreign countries. This is perfect for NRIs who want to participate in the Indian markets but take profits or earnings overseas.

To open a Repatriable Demat account, you will need an NRE bank account. Repatriable Demat accounts are governed by the Foreign Exchange Management Act (FEMA). All brokers do not provide Repatriable Demat accounts. They can be opened with only authorised brokers specified by the Reserve Bank of India (RBI).

Non Repatriable Demat Account: A Non Repatriable Demat account is also for NRIs. But you cannot transfer funds back overseas. To open a Non Repatriable Demat account, you must have a Non Resident Ordinary (NRO) bank account.

[ Read More: Learn How to Open a Demat Account in 3 Simple Steps ]

These are the three main types of Demat accounts in India. But there is a special type of Demat account called ‘Basic Services Demat Account (BSDA). BSDA is a type of Regular Demat account but it carries no or low annual maintenance charges (AMC).

Only individuals fulfilling the below criteria can opt for BSDA:

- Individual should own only one Demat account across both the depositories.

- Value of securities in the Demat account should not exceed Rs 4 Lakhs.

- For Demat accounts whose holding value does not exceed Rs 1.5 Lakhs, no AMC is applicable.

How Does a Demat Account Work? – Demat Account & Trading Account

- Can you buy shares using a Demat account?

- What happens to the trading account when you sell shares?

- How does a Demat account work?

These are questions that majority of investors have when they start trading. The rule is simple: ‘You CANNOT buy or sell shares using a Demat account’.

For example: Let’s say you subscribed to an IPO and received 100 shares. These shares will be ‘stored’ in your Demat account. After a month you want to sell these 100 shares. But you do not have a trading account. Will you be able to sell these shares? No.

You can buy or sell shares ONLY through a Trading account. A Demat account merely acts as a ‘locker’ for your securities.

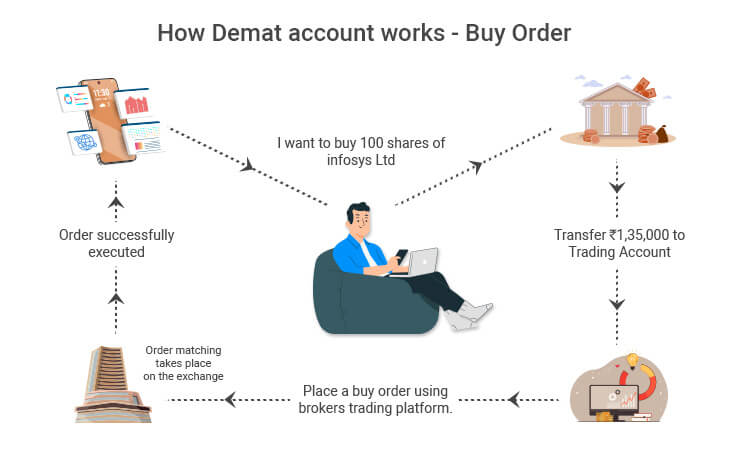

Demat and Trading Account Flow – Placing a Buy Order

Let us understand how Demat and trading account works when you place a buy order.

- Ram decides to buy 100 shares of Infosys Ltd. The share price on May 12, 2022 is Rs 1,509.70.

- Ram transfers Rs 1, 50,970 from his bank account to his trading account.

- He logins to his trading account and places a BUY order.

- The stock exchange finds a SELLER for Ram. Once a seller is found, the buy order is executed.

- Now Rs 1,50,970 will be debited from Ram’s trading account and given to the exchange.

- The exchange will collect 100 Infosys shares from the seller and in return transfer him Rs 1,50,970

- The exchange will credit Ram’s Demat account with 100 Infosys shares. These shares are transferred to Ram’s Demat account in T+2 days. This is known as the settlement cycle.

This is how a Demat account works when you buy shares. The process might seem complicated, but it works like a well-oiled machine. The order matching takes place in seconds.

Remember, Ram uses his ‘trading account’ to buy shares but the stock exchange ‘stores’ (credits) shares in his ‘Demat account’. The same process will happen for the seller as well.

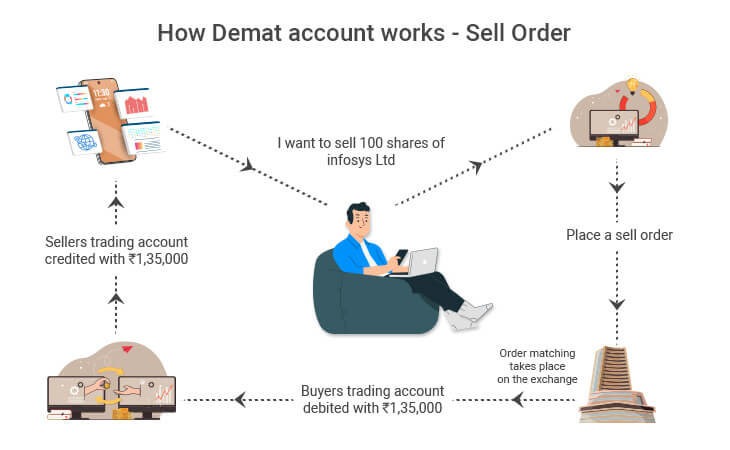

Demat and Trading Account Flow – Placing a Sell Order

Let us look at how Demat account works in case of a SELL order.

- Shyam wants to SELL 100 Infosys shares at Rs 1,509.70.

- Since he is selling shares, he does not need to transfer money to his trading account.

- Shyam goes to his trading terminal and places a SELL order.

- The exchange matches the order with Ram’s buy order.

- The depository takes (debits) 100 shares from Shyam’s Demat account and credits them to Ram’s Demat account.

- Similarly, it debits Ram’s trading account with Rs 1,50,970 and credit Shyam’s trading account with Rs 1,50,970.

| Buyer | Seller |

|---|---|

| Demat account credited with shares | Demat account debited with shares |

| Trading account debited with cost of shares | Trading account credited with sale price |

We hope this clears any queries you might have on how Demat and Trading account works. Let us now understand the advantages and disadvantages of a Demat account.

Why should you open a Demat account? – Top 10 Advantages of Demat Account

The short answer is because you cannot participate in the stock markets without a Demat account. Yes, as per Securities and Exchange Board of India (SEBI), a Demat account is mandatory to trade in the Indian stock markets. The other benefits for opening a Demat account are:

Single point of storage for all your financial assets: A Demat account does much more than just store stocks. It also stores your mutual funds, government bonds, ETFs etc. all in one place. This is perfect as you do not have to maintain different accounts or coordinate with multiple brokers to know the value of your portfolio. You can simply login to your Demat account and know the current value of all your financial assets.

Easy and quick settlement: Before 1996, all trades were settled physically. To buy shares, you had to give the cash to your broker. He would then go to the stock exchange to find a seller. Similarly, the seller would hand over physical share certificates to the broker who would search for a buyer in the market. When both brokers met, a transaction would be ‘brokered’. The entire process took 14 days. But with Demat accounts, all settlements take place in T+2 days. T stands for transaction date. For example: If you bought shares on Monday, they will be credited to your Demat account by Wednesday evening. This is possible only because of Dematerialisation.

No risk of theft, loss or fake share certificates: Physical shares would easily get stolen or lost. There were many instances where fake shares were being sold in the market. But with Demat accounts, you no longer have to worry. ‘Registrars & Transfer Agents’ ensure that the transferred securities are ‘original’.

Easy liquidity: With Demat accounts, you can easily sell shares on the exchange in seconds. This was not possible during physical settlement. Your broker had to physically find the seller and make a deal. This process would take days! But with Demat accounts, you can easily sell your securities and even get a loan against them. Banks provide easy loan against securities held in electronic form.

Cost-Efficient: Reduced cost is one of the major advantages of Demat accounts. Earlier, investors had to pay high stamp duty charges. But now investors have to pay only 0.015% stamp duty charges for transfer of shares.

Ease of Transfer: With a Demat account, it becomes easier to transfer assets to the next of kin in case of death of the account holder. This was quite difficult when shares were held in physical form. The legal heirs had to go through various legal hoops to claim the assets. This led to emotional, physical and monetary stress. But with Demat accounts, assets can be seamlessly transferred to legal heirs.

No problem of ‘Odd Lots’: Before Demat accounts, shares were usually traded in lots. So, you could not buy or sell single shares. For example: If you wanted to buy 1 share of Infosys, you can easily buy it today using your Demat account. But before 1996, you had to either buy an entire lot or buy nothing!

Eradication of Vanda (Bad) Trades: Physical share trading involved a lot of manual work. This also resulted in manual errors also known as Vanda trades. Elimination of Vanda trades has been one of the biggest advantages of a Demat account.

One point for information Update: Earlier, if you changed your residential address, phone number or email id, you had to inform multiple companies. But with Demat account, you can update your Know Your Client (KYC) records at one central location and the same will be updated across all your stock holdings.

Easy accounting and management: Before Dematerialisation, investors spent hours and days trying to reconcile their Demat statements. Calculating taxes was a nightmare. This is no longer the case. With a Demat account, your broker sends you your reconciled Demat statement every month.

Should you open a Demat Account? – Major Disadvantage of a Demat Account

-

High Demat Charges: The biggest disadvantage of a Demat account is the cost involved in opening and operating a Demat account. Traditional brokers charge as high as Rs 400 for just opening a Demat account. Discount brokers like Samco Securities provide free Demat account opening. So you get instant benefit of Rs 400. Additionally, discount brokers charge flat brokerage which leads to 98% brokerage savings!

The best way to avoid high Demat charges is by opening a FREE Demat account with brokers like Samco Securities. Samco has also waived off 1st year AMC! So, you are practically trading for FREE.

-

High Churning: Intraday trading was not popular before Demat accounts. Investors would often buy shares for the long-term. But with Demat account, a host of trading opportunities have become available. Investors are indulging in excessive trading and not focusing on long-term investing. The best way to deal with this is to divide your investible amount between trading and investing.

-

Technology Savvy: Introduction of Demat accounts led to a revolution in online share trading. Computers replaced broker’s office. Everyone and anyone with an internet connection and mobile started trading. But investors who were not tech savvy suffered. Fortunately, there are brokers like Samco Securities which provide high tech trading platform which is user-friendly.

Like everything else, even Demat accounts have their disadvantages. But luckily, advantages of Demat accounts far outweigh their disadvantages. Hence, every investor should open a Demat and trading account. But how to open a Demat account? What are the documents required to open a Demat account? And most importantly who can open a Demat account? Let’s find out.

Who can open a Demat Account?

Any individual above the age of 18 years can open a Demat account. Even a person of Indian origin (PIO) currently a citizen of any country except Pakistan and Bangladesh can open a Demat account. Additionally, even a Hindu Undivided Family (HUF), and domestic Indian companies can open a Demat account. In the case of a HUF, the Demat account can be opened in the name of the oldest male member or karta.

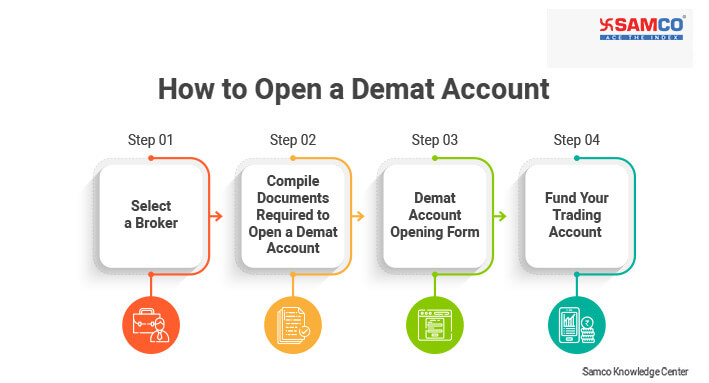

How to Open a Demat Account? – A Step-by-Step Guide on How to Open a Demat Account in 2023

Step 1: Select a broker

By now you know that a Demat account can be opened with a broker, also known as a Depository Participant (DP). The Indian markets are flooded with brokers. But before selecting a broker to open a Demat account with, you need to ensure the following:

- Your broker must be registered with SEBI.

- Your broker must provide a FREE Demat account.

- Your broker must be well-capitalised.

- Your broker must provide high tech trading platform with 99.99% uptime.

- Your broker must provide high leverage against minimum margins.

[ Read More: Do’s & Don’ts of an Effective Demat Account ]

Once you select the broker, the next step is to compile the documents required to open a Demat account.

Step 2: Documents required to open a Demat account

The following documents are required to open a Demat account.

- Pancard - You cannot open a Demat account without a valid pancard.

- Photograph

- Address proof – Aadhaar card, passport, voter card, recent electricity or telephone bill.

- Bank proof – Cancelled cheque or 1st page of the passbook.

- Income proof – ITR form 16, Demat statement

- Signature

Step 3: Fill Demat account opening form

Fill the Demat account opening application form and submit the above mentioned documents. In 24-48 hours your Demat account will be active. Brokers like Samco Securities offers 3-in-1 account. So, you get a Demat, Trading and Mutual Fund account at the cost of one!

Step 4: Fund your Trading Account

Once your Demat account is opened, you need to fund your trading account (linked to your bank account) and start trading! It’s as simple* as that.

*Simple: Many traditional brokers still insist on physical forms and visiting their office for in-person-verification. The account opening process can take days. It is recommended to avoid such brokers and open a Demat account with a discount broker like Samco Securities which helps you open a FREE Demat account with 0% paperwork under 5 minutes.

By Deepika

KhudeDeepika

Khude

The author is a Certified Financial Planner (CFP) with 5 years

experience in Investment Advisory and Financial Planning. Her strength lies in

simplifying complex financial concepts with real life stories and analogies. Her goal

is to make common retail investors financially smart and

independent., Samco.in | Last Updated: Jun 21, 2022

Frequently Asked Questions about Demat Account

- Resident individual

- Hindu Undivided Family (HUF)

- Domestic Companies

- NRIs

- Clearing members

The documents required and the procedure changes for each category.

How to Check Demat account number

How to Check Demat account number

Easy & quick

Easy & quick