What are call options: definition of Call Options?

call options in the stock market are a kind of a contract between buyer and seller, where the buyer pays a premium, commonly known as option premium to buy shares at a fixed price, (commonly known as the strike price) on or before a specific date. This specific date is basically the expiry date of the call options contract. Under this contract, the buyer has the right but is not obliged to exercise the contract. Buying a Call option gives the buyer an option to “BUY” underlying asset at an agreed-upon price with an expiry date on this contract. So the buyer wants the price of an underlying asset to go up. On the contrary, since call option seller has agreed to sell underlying expects prices to fall.

Now let's understand call options with an example

To explain this in a layman's term lets taken a practical call options example. Imagine you want to buy a house and have shortlisted a house and a price with the current owner of the house. But you need a few days to arrange for the money to complete the purchase. In such a case, buyers often give the sellers, what we call "token money" which is essentially a right to buy the house at the agreed price in a pre-determined period. In case the buyer defaults on his promise to complete the purchase in the agreed time period, then the seller will forfeit the token money and book the same as his income. This token money is nothing but a call option premium. Example of call options in the context of stock markets Pooja wants to invest in ABC Ltd Stock and the stock trades at Rs.100. 1-month call option of ABC ltd is Rs.10. Pooja expects the price of ABC Ltd to go up so instead of buying 5000 shares at Rs.50,00,00 (Rs.100/share X 5000) she buys a call option for a premium Rs.10 X 5000 shares at Rs 50,000. Now if the price of ABC Ltd goes up the call option premium of Rs.10 will also go up and probably faster than the share price itself. At this time Pooja will sell her call option at let's say an option premium of Rs.15. In this example, pooja made Rs.10 (buy price) -(minus) Rs.15 (Sell price) = Rs.5. per share. Her total profit will be Rs.5 X 5000 shares = Rs.25,000 The above example is only to explain the concept of Call options, now let's look at how call options work When a buyer buys a call option he pays a premium to the seller for a particular contract, in this transaction, there are three important elements of call options.- Strike Price: Strike price is the price of the underlying stock or share at which you could buy the actual share

- Premium: Price of the option contract

- Expiry Date: The date when the options contract expires

How are call options different from put options?

The fundamental difference between call options and put options is that call options give the buyer a RIGHT TO BUY the underlying asset whereas Put options give the buyer a RIGHT TO SELL the underlying asset.Important things to note about call options

- Lots: One can trade call option in lots only, Lot sizes are predetermined like 100 shares in 1 lot

- Fixed Expiry Date: As in India, we have adapted European Options style, the Expiry date is fixed viz. last Thursday of the month (in the case Thursday is a trading holiday previous working day).

- In the money call option – when the strike price is lower than the price of the underlying asset.

- At the money call option – when the strike price and price of the underlying asset are identical.

- Out of the money call option – when the strike price is above the price of the underlying asset.

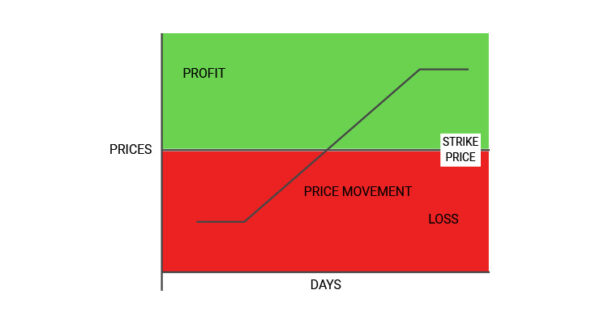

As we trade call option or any other stock market instrument with the sole purpose of making money. The important thing to understand is Payoff. Payoff and Profit isn’t the same thing. Pay off means premium of the desired option at the time of expiry. For calculating Profit, one needs to take investment from payoff.

Eg. Trader A has bought a call option of 100 strike price of ABC Company at Rs. 2. A premium of ABC Company at the time of expiry is 10 then, Payoff will be Rs. 10 but profit will be Rs. 8.

In the case of option writer (seller), if call expires below strike price meaning worthless then the payoff is what he collects in terms of option premium.

A Call gives the buyer an option to “BUY” underlying asset at an agreed-upon price with an expiry date on this contract. Whereas, Put gives the buyer an option to “SELL” at agreeing upon a price with an expiry date on this contract.

Call buyer would want prices of the underlying to go up and put buyers would like to see prices of underlying falling.

A call buyer makes a profit when the price of an underlying asset is more than the strike price at expiry. A put buyer makes a profit when the price of an underlying asset is less than the strike price at expiry. You can get a complete visualisation of options payoffs on the Samco Option Payoff Value calculator.

As we trade call option or any other stock market instrument with the sole purpose of making money. The important thing to understand is Payoff. Payoff and Profit isn’t the same thing. Pay off means premium of the desired option at the time of expiry. For calculating Profit, one needs to take investment from payoff.

Eg. Trader A has bought a call option of 100 strike price of ABC Company at Rs. 2. A premium of ABC Company at the time of expiry is 10 then, Payoff will be Rs. 10 but profit will be Rs. 8.

In the case of option writer (seller), if call expires below strike price meaning worthless then the payoff is what he collects in terms of option premium.

A Call gives the buyer an option to “BUY” underlying asset at an agreed-upon price with an expiry date on this contract. Whereas, Put gives the buyer an option to “SELL” at agreeing upon a price with an expiry date on this contract.

Call buyer would want prices of the underlying to go up and put buyers would like to see prices of underlying falling.

A call buyer makes a profit when the price of an underlying asset is more than the strike price at expiry. A put buyer makes a profit when the price of an underlying asset is less than the strike price at expiry. You can get a complete visualisation of options payoffs on the Samco Option Payoff Value calculator.

There are some popular call option strategies

- Long Call Strategy: In Long Call strategy, the trader buys a call option of an underlying which is already in his portfolio.

- Bull Spread Strategy: In Bull Spread strategy, a trader creates a spread by buying in the money call option and selling out of the money call option.

- Covered Call Strategy: In covered Call strategy, trader writes at the money call option of an underlying which he holds in the portfolio.

Important Facts for Trading Options

- Buying Call Options

- Margin Applicable - None, however, the option premium is payable upfront.

- Risk - Reward - Maximum Loss is restricted to the premium, whereas the maximum profit can be unlimited.

- Selling Call Options

- Margin Applicable - Premium is received by the seller and credited to ledger however margin is payable for holding the short position.

- Check the Margin requirements for writing options on the Samco Margin Calculator.

- Risk - Reward - Maximum Profit is restricted to the premium, whereas the loss can be unlimited.

Leave A Comment?