In this article, we will discuss:

- Implied Volatility Definition

- Implied Volatility vs Historical Volatility

- Implied Volatility Chart

- Impact of Implied Volatility on Call options and Put options

- How to check Implied Volatility or Option IV?

Implied Volatility Definition

Implied Volatility is the expected volatility in a stock or security or asset. In simple terms, its an estimate of expected movement in a particular stock or security or asset.

The implied volatility is high when the expected volatility/movement is higher and vice versa. This expected volatility may be higher due to a variety of reasons like corporate announcements, macro economic announcements, financial result updates, etc. Due to these, the markets may expect a knee jerk reaction in the prices of the underlying asset which shall result into heightened activity and high volatility in prices i.e. a higher IV or implied volatility.

Implied volatility is a very important factor amongst the 5 factors which impact option prices, the others being the asset price, strike price, time to expiry for the contract and the prevalent interest rates.

Implied Volatility vs Historical Volatility

Vis-a-vis the implied volatility as explained above, historical volatility is the actual computed volatility of the stock/security/asset over the past year. It acts as a good reference point for understanding whether the IV is higher/lower as compared to the historical volatility.

Implied Volatility Chart

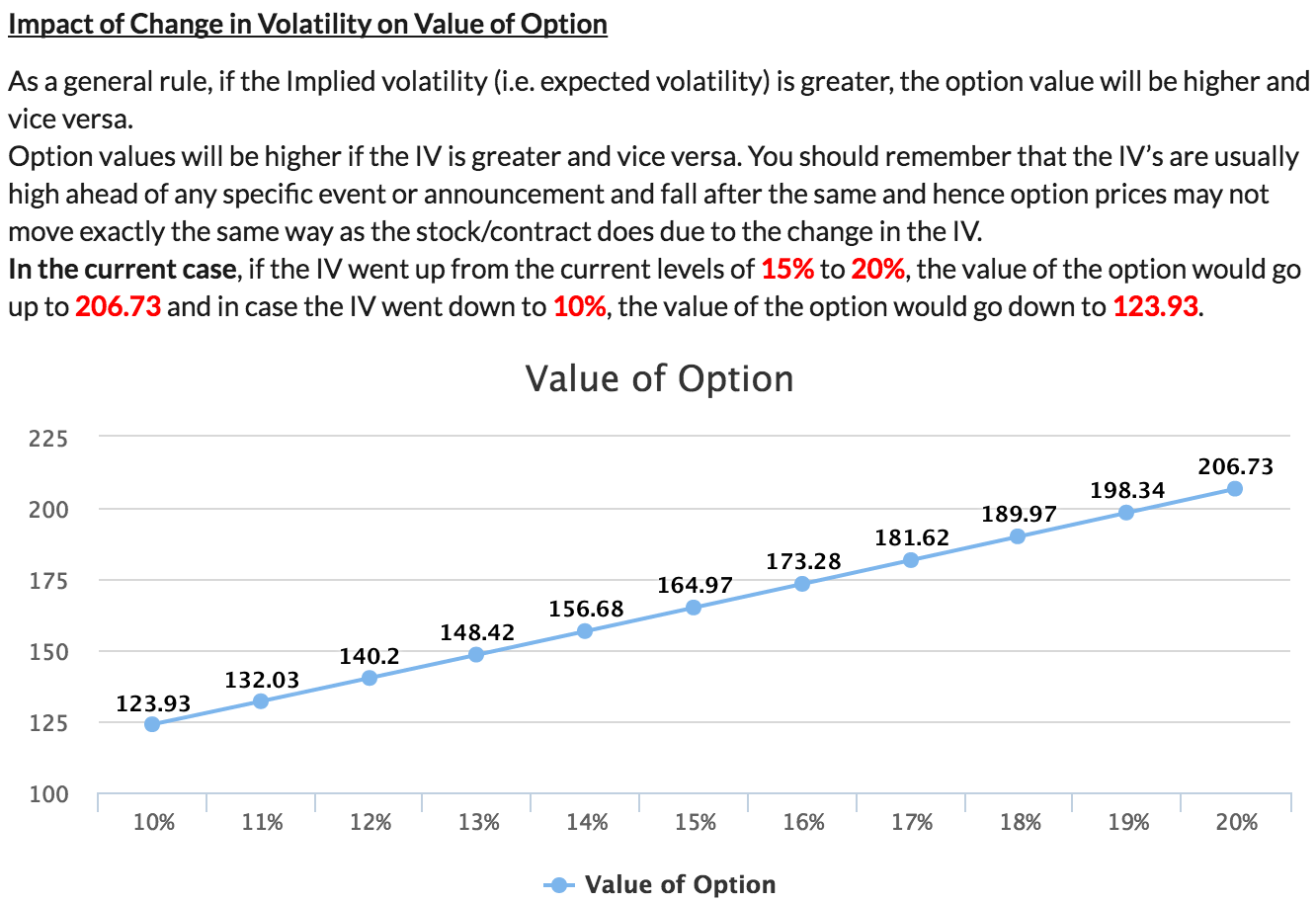

The impact of implied volatility or IV on option prices is directly proportionate.

As the IV goes up, option prices increase and vice versa.

Check the Image below which explains the impact of change in IV on the option value, all other factors remaining the same. This is very well illustrated in the SAMCO option price calculator.

Impact of Implied Volatility on Call options and Put options

Traders often ask if the impact of implied volatility on call options is different from the the impact of implied volatility on put options. The answer to this question is NO.

The impact of IV as explained earlier on both call options and put options is the same i.e. directly proportionate. As the IV goes up, the option prices go up irrespective of the fact that it may be a call option or a put option. This is very well demonstrated in the SAMCO Option Calculator.

How to check Implied Volatility or Option IV?

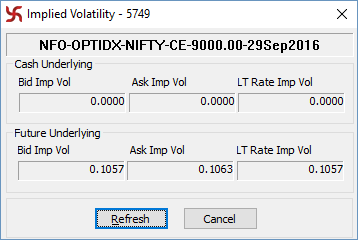

One can check the Implied volatility of an option from the market watch of the SAMCO NEST Trader via the short cut key F5.

When a trader, selects an option as a line item on the SAMCO NEST Trader and inputs F5, the following window pops up.

As you can see a value of 0.1057 in the Bid Imp Vol of the Nifty option of 9000 Strike Price. Similarly, a value of 0.1063 can be seen the Ask Imp Vol and a value of 0.1057 can be seen in the LT Rate Imp Vol.

These are nothing but the computed values of IV for the options (in this case Nifty options) at the Bid Price, Ask Price and the Last traded price respectively.

In percentage terms, this stands for 10.57% (IV at Bid price), 10.63% (IV at Ask price) and 10.57% (IV at Last Traded price) respectively.

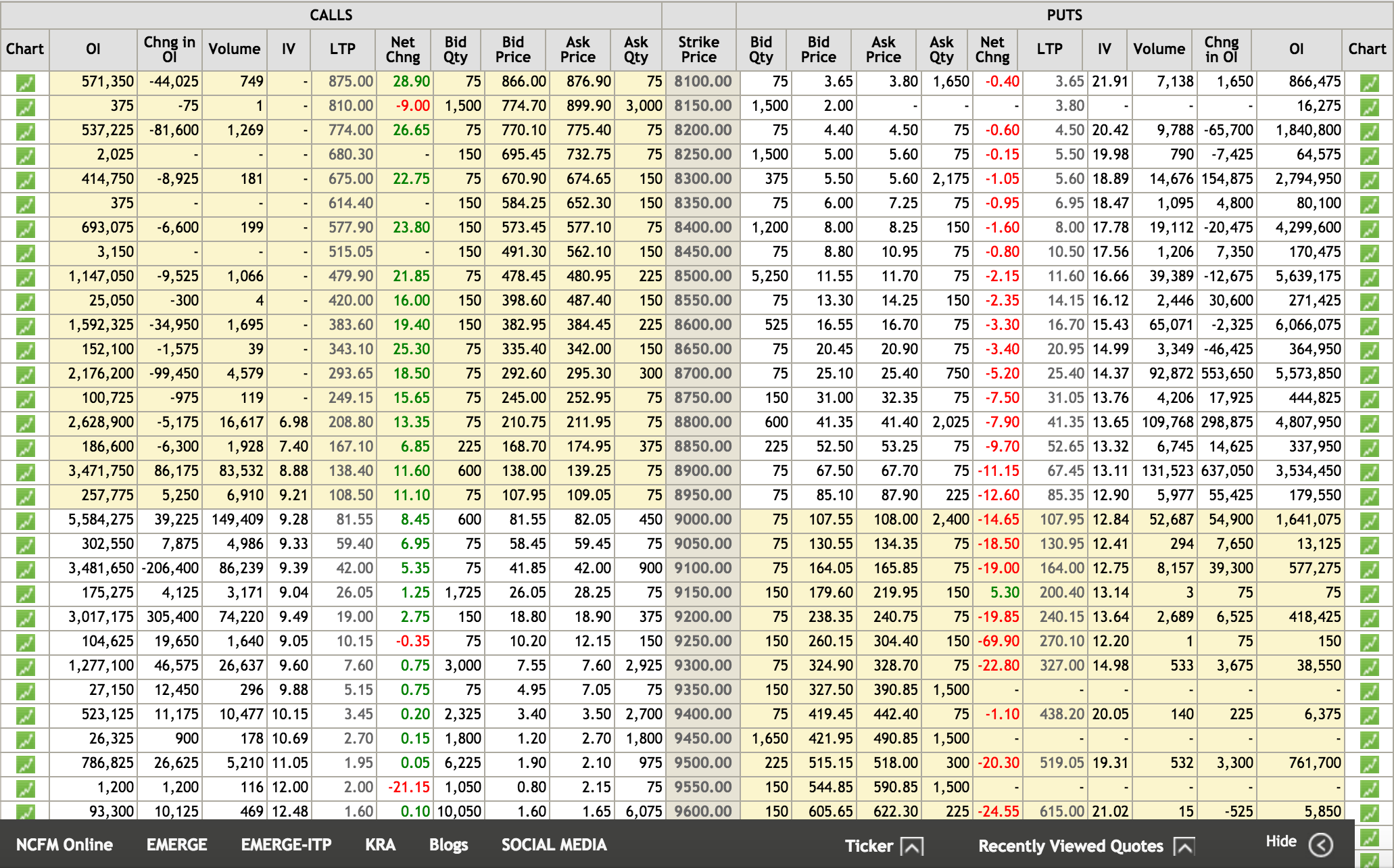

To check the IV's for a variety of contracts of the same underlying, you can check the same on the Option chain available on the NIFTY Website.

Quick Link also available on the SAMCO Option Price Calculator - http://goo.gl/G2I86A.

As we can see above, the IV's for each and every contract are different based on the expected consensus movement of the underlying based on expectations of all different market participants.

In a nutshell – Option IV or Implied volatility is determined by numerous factors but above all it’s a psychological phenomenon. IV is the short term sentiment about the given stock that drives the option prices. It is seen that a surge in stock price results in exponential gain in option price which is not necessarily linear in nature and is result of implied volatility of the stock.

Trader’s takeaway - Buy options when IV is relatively low and sell options when IV is relatively high.

Leave A Comment?