Will Metal Stocks Finally Shine in 2022?

The metal sector plays a crucial role in the Indian economy. We use different types of metals in our day to day lives. What is the first thing you do in the morning? You plug in your phone for charging. What metal does your charger contain? Aluminium. The train that takes you to work every day is made from stainless steel. The bridges we travel on, our fridge, and even your car is made up of iron, another metal. So, it’s safe to say that we are surrounded by metals. And that metals make up a large chunk of our universe. But do metals also make up your investment universe? I bet not. How many of us have thought of investing in metal stocks? My guess is, very few. But why? Isn’t it the simplest investment idea ever? I mean, think about it… the demand for metal will never go down. And what does this mean for investors like you? Infinite wealth creation in metal stocks.

In this article, we will cover

- The Metal Sector in India

- Video on the 22 month cycle in base metals

- List of Metal Stocks – Iron & Steel

- List of Metal Stocks – Non-Ferrous Metals – Aluminium & Coal

- List of Metal Stocks – Mining & Mineral Products

Now you must be wondering, but which are the best metal stocks in India? Which metal stock will hit the bull’s eye in 2022? Which metal stocks will drive home the maximum wealth in 2022? Don’t worry we will answer all these questions in this article on the best metal stocks in 2022. But like always, we first need to understand the history of the metal sector in India.

The Metal Sector in India

India literally sits on a golden throne when it comes to metals and their mining. Did you know that there are around 1,229 mines in India? Yes, of these, 545 are metallic mines. The remaining 684 are non-metallic mines, which is mostly used to mine coal. The Asian sub-continent is blessed with an abundance of metals. This makes India a force to reckon with in the metal sector. And India seems to have used this geographical advantage to the best of its abilities. India is a market leader in producing most of the metals in the world. We are the –

- Fourth largest producer of iron ore and chromium in the world.

- Fifth largest producer of bauxite, graphite, and zinc across the globe.

- Seventh largest producer of lead and sulphur.

- 11th largest producer of titanium and uranium in the world.

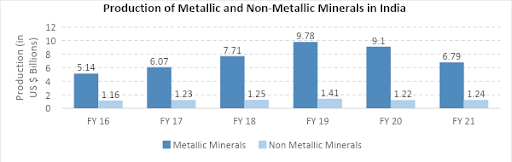

The list of our accomplishments in the metal sector is endless. Trust us, we are not exaggerating. Our iron ore exports are expected to reach US$ 2.23 Billion by FY 2022. This means a y-o-y growth of 21.80%! Wait, don’t get excited just yet. Did you know that India is the second-largest producer of crude steel in the world?! Yes. The production of crude steel registered a growth of 46.90% (y-o-y) in FY 21. Even the production of steel in India is expected to grow at 18% to reach 9.2 million tonnes by FY 22. The graph below shows the growth in the production of both metals and non-metals in India.

| Metals | Y-O-Y Increase |

| Lithium | 265.82% |

| Magnesium | 155.38% |

| Nickel | 105.54% |

| Aluminium | 60.19% |

| Zinc | 49.73% |

| Lead | 24.17% |

| Copper | 18.16% |

| Steel | 4.55% |

Now it doesn’t take a genius to realise who will benefit the most from the global rally in metals. But of course, metal stocks. Now there are more than 50-60 metal stocks in India. Each metal stock is further subdivided in segments like steel, iron, aluminium etc. Now there are two ways in which you can invest in metal stocks. You can either invest in individual metal stocks. But there are nearly 50 metal stocks listed on Indian stock exchanges. Which of these do you invest in? It would not be financially possible to invest in all these 50 metal stocks. At least not if you plan to hold substantial number of shares. The next option is to invest in Nifty Metal Index, which is a collection of 15 of the biggest metal stocks in India. Check out this video on the 22 month cycle in base metals and understand how fear and greed work in metal stocks.

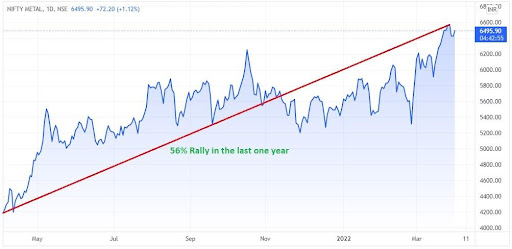

The below graph shows the performance of Nifty Metal Index. The index has given an absolute return of 56% in the last one year (as of March 31, 2022). Let us now take a closer look at the top metal stocks in India in 2022. For your ease, we have divided the list of metal stocks in three sections.

Let us now take a closer look at the top metal stocks in India in 2022. For your ease, we have divided the list of metal stocks in three sections. - List of Metal Stocks – Iron & Steel

- List of Metal Stocks – Non-Ferrous Metals – Aluminium & Coal

- List of Metal Stocks – Mining & Mineral Products

List of Metal Stocks – Iron & Steel

| Name | Current Price(In Rs) | Market Capitalization(Rs in Crore) | Price to Earnings Ratio | Return on Equity (%) | Debt to Equity Ratio |

|---|---|---|---|---|---|

| JSW Steel | 741.85 | 1,79,321.46 | 8.33 | 18.97 | 1.16 |

| Tata Steel | 1,321.85 | 1,61,438.07 | 4.29 | 10.85 | 0.85 |

| Jindal Steel | 530.80 | 54,146.28 | 8.45 | 14.9 | 0.5 |

| S A I L | 100.45 | 41,491.13 | 3.04 | 9.51 | 0.47 |

| APL Apollo Tubes | 935.00 | 23,401.22 | 45.57 | 23.61 | 0.28 |

| Ratnamani Metals | 2,608.50 | 12,188.96 | 38.03 | 14.93 | 0.08 |

| Jindal Stain. | 205.00 | 10,337.59 | 7.42 | 12.16 | 0.78 |

| Shyam Metalics | 366.50 | 9,348.71 | 5.56 | 26.08 | 0.06 |

| Jindal Stain. Hi | 395.35 | 9,327.68 | 5.51 | 25.35 | 0.4 |

| Godawari Power | 391.50 | 5,518.04 | 4 | 37.38 | 0.18 |

| Apollo Tricoat | 866.45 | 5,267.98 | 36.8 | 41.69 | 0.14 |

| Lloyds Metals | 138.75 | 5,115.97 | 166.93 | 0.08 | 0.2 |

| Welspun Corp | 177.40 | 4,629.25 | 9.97 | 16.07 | 0.33 |

| Sarda Energy | 1,150.00 | 4,145.68 | 5.67 | 18.29 | 0.58 |

| Usha Martin | 131.45 | 4,005.80 | 15.99 | 11.33 | 0.3 |

| Mah. Seamless | 562.80 | 3,770.77 | 9.91 | 6.07 | 0.23 |

| Tata Steel Long | 732.60 | 3,304.02 | 3.18 | 24.64 | 0.55 |

| Mishra Dhatu Nig | 169.95 | 3,183.83 | 18.72 | 16.37 | 0.14 |

| Kirl. Ferrous | 221.10 | 3,066.99 | 6.45 | 35.09 | 0.17 |

| Jindal Saw | 92.20 | 2,948.12 | 6.29 | 4.64 | 0.78 |

| Rajratan Global | 544.00 | 2,761.97 | 24.99 | 26.56 | 0.7 |

| Technocraf.Inds. | 1,032.25 | 2,525.06 | 11.15 | 12.12 | 0.36 |

| Tata Metaliks | 792.20 | 2,501.52 | 9.61 | 20.32 | 0.11 |

| Surya Roshni | 424.10 | 2,307.47 | 12.76 | 12.02 | 0.48 |

| Mukand | 145.80 | 2,061.68 | 30.13 | -161.64 | 3.21 |

| JSW Ispat Speci. | 33.30 | 1,563.58 | 17.1 | 16.41 | 2.05 |

| ISMT | 51.80 | 1,556.60 | - | - | - |

| Gallantt Ispat | 50.85 | 1,435.80 | 14.92 | 11.85 | 0.36 |

| JTL Infra | 234.75 | 1,394.24 | 31.03 | 28.15 | 0.43 |

| Prakash Industri | 77.50 | 1,387.90 | 8.28 | 3.28 | 0.18 |

| Kalyani Steels | 303.65 | 1,325.72 | 5.3 | 17.97 | 0.18 |

| Lloyds Steels | 14.68 | 1,319.35 | 382.41 | 0.44 | 0 |

| Sunflag Iron | 65.40 | 1,178.62 | 4.6 | 9.64 | 0.35 |

| Vardhman Special | 234.45 | 950.97 | 9.7 | 10.64 | 0.6 |

| Welspun Special. | 16.40 | 869.34 | - | -71.33 | 13.61 |

| Beekay Steel Ind | 423.05 | 806.82 | 5.31 | 15.34 | 0.22 |

| Goodluck India | 284.70 | 740.38 | 12.58 | 8.28 | 1.14 |

| Kamdhenu | 234.00 | 630.30 | 19.71 | 11.88 | 0.46 |

| Salasar Techno | 218.60 | 624.54 | 18.6 | 12.8 | 0.78 |

| Raghav Product. | 560.00 | 609.09 | 34.81 | 17.19 | 0.06 |

| BMW Industries | 27.00 | 607.73 | - | -28.96 | 0.49 |

| Hi-Tech Pipes | 505.80 | 594.13 | 16.68 | 12.18 | 1.34 |

| Man Industries | 101.75 | 580.98 | 5.75 | 12.65 | 0.09 |

| Rama Steel Tubes | 316.75 | 531.96 | 19.25 | 13.19 | 0.91 |

| Pennar Industrie | 35.90 | 510.37 | 11.68 | -1.64 | 0.89 |

| Jai Balaji Inds. | 45.55 | 503.14 | 8.23 | - | - |

| Gallantt Metal | 61.35 | 498.91 | 5.36 | 11.7 | 0.07 |

| Supershakti Met. | 405.00 | 466.77 | 35.88 | 10.91 | 0.16 |

| D P Wires | 331.00 | 449.09 | 14.79 | 21.76 | 0.15 |

| Bharat Wire | 69.15 | 437.36 | 12.75 | -6.99 | 0.63 |

| MSP Steel & Pow. | 11.16 | 430.10 | 19.14 | 1.59 | 1.21 |

| Gandhi Spl. Tube | 349.50 | 424.72 | 9.9 | 22.56 | 0 |

| Bajaj Steel Inds | 634.95 | 330.16 | 5.98 | 44.59 | 0.3 |

| Manaksia Steels | 44.20 | 289.66 | 8.86 | 12.52 | 0.18 |

| Panchmahal Steel | 147.70 | 281.80 | 5.14 | 8.47 | 0.39 |

| Natl. Gen. Inds. | 505.80 | 279.72 | 52.28 | -3.45 | 0.09 |

| Alliance Integ. | 20.10 | 233.41 | - | - | - |

| Bedmutha Indus. | 69.90 | 225.51 | 0.89 | - | 3.1 |

| Sh. Bajrang All. | 242.90 | 218.62 | 3.48 | 22.69 | 0.14 |

| Shah Alloys | 105.55 | 208.99 | 3.22 | - | 12.83 |

| Visa Steel | 15.65 | 181.22 | - | - | - |

| Manaksia Coated | 27.30 | 178.92 | 26.74 | 6.04 | 1.41 |

| Guj.Nat.Resour. | 22.05 | 176.94 | - | -4.47 | 0.16 |

| Scan Steels | 32.40 | 169.61 | 3.42 | 9.51 | 0.34 |

| Electrotherm(I) | 115.05 | 146.61 | 2.73 | - | - |

| India Steel | 3.59 | 142.90 | - | -11.74 | 1.03 |

| Mideast Int. Stl | 10.05 | 138.56 | - | -74.82 | 4.86 |

| Ahlada Engineers | 103.75 | 134.04 | 16.76 | 8.91 | 0.3 |

| Ankit Met.Power | 9.48 | 133.76 | - | - | - |

| Suraj Products | 114.75 | 130.82 | 5.97 | 18.23 | 0.71 |

| Suraj | 62.85 | 121.05 | 41.03 | 1.48 | 0.64 |

| Mahamaya Steel | 71.20 | 105.17 | 20.02 | 0.77 | 0.51 |

| Kanishk Steel | 36.10 | 102.66 | 4.57 | 10.1 | 0.13 |

| Incredible Indus | 21.55 | 100.77 | 42.52 | 3.12 | 0.41 |

| Bihar Sponge | 11.10 | 100.13 | 13.59 | - | - |

| Prakash Steelage | 5.25 | 91.89 | 2.03 | - | - |

| S.A.L Steel | 10.45 | 88.77 | 4.02 | 56.71 | 4.13 |

| Rudra Global | 34.75 | 87.17 | 4.74 | -33.15 | 0.67 |

| Bansal Roofing | 62.05 | 81.79 | 36.19 | 14.77 | 0.13 |

| Uttam Galva Stee | 5.00 | 71.12 | - | - | - |

| Hisar Met.Inds. | 128.75 | 69.53 | 7.07 | 18.1 | 1.41 |

| Supreme Engg. | 2.55 | 63.74 | 245.16 | -9.9 | 2.2 |

| Vaswani Industri | 20.40 | 61.20 | 22.33 | 4.06 | 0.51 |

| Gyscoal Alloys | 3.70 | 58.57 | - | - | - |

| Unison Metals | 35.35 | 56.63 | 16.88 | 8.84 | 1.49 |

| Rathi Bars | 29.95 | 48.92 | 17.27 | 2.76 | 0.63 |

| Gujarat Intrux | 123.70 | 42.49 | 16.16 | 7.75 | 0.03 |

| Remi Edelstahl | 38.55 | 42.34 | 18.33 | 0.38 | 0.42 |

| Oil Country | 9.50 | 42.08 | - | - | - |

| Aanchal Ispat | 19.40 | 40.46 | - | -10.13 | 1.59 |

| Surani Steel Tub | 47.45 | 39.31 | 10.1 | 18.73 | 0.8 |

| Bombay Wire | 65.90 | 35.19 | - | -0.95 | 0 |

| Zenith Steel | 2.47 | 35.15 | 11.06 | - | - |

| Bonlon Industrie | 24.50 | 34.75 | 17.73 | 2.94 | 0.05 |

| Chennai Ferrous | 95.80 | 34.51 | 1.7 | - | - |

| Modern Steels | 24.90 | 34.27 | - | - | - |

| Sharda Ispat | 66.80 | 33.94 | 8.2 | 10.55 | 0.29 |

| Metal Coatings | 44.30 | 32.47 | 8.94 | 8.5 | 0.09 |

| Nova Iron &Steel | 8.27 | 29.89 | - | - | - |

| Riddhi Steel | 31.35 | 25.99 | 19.84 | 2.85 | 2.29 |

| Ashirwad Steels | 15.90 | 19.87 | - | 1.68 | 0 |

| Natl. Steel&Agro | 4.25 | 18.91 | - | - | - |

| Ashiana Ispat | 21.00 | 16.73 | 15.63 | 3.56 | 2.38 |

| Garg Furnace | 37.60 | 15.08 | 9.48 | -14.75 | 0.98 |

| Sathavaha. Ispat | 2.85 | 14.51 | - | - | - |

| Pact Industries | 2.55 | 14.13 | 1413 | 2.88 | 1.13 |

| Grand Foundry | 4.20 | 12.78 | - | - | - |

| Rish.Digh.Steel | 23.10 | 12.68 | - | -3.29 | 0.06 |

| Rajas. Tube Mfg | 21.85 | 9.85 | 17.91 | 7.22 | 2.29 |

| Narayani Steels | 8.54 | 9.32 | - | - | - |

| Umiya Tubes | 8.41 | 8.42 | 76.55 | 0.16 | 0.2 |

| Ahm. Steelcraft | 19.50 | 7.98 | - | -0.91 | 0 |

| Mukat Pipes | 6.69 | 7.91 | - | - | - |

| Sh. Steel Wire | 23.75 | 7.86 | 262.16 | 7.12 | 0 |

| Aditya Ispat | 10.35 | 5.54 | 11.54 | 4.06 | 2.49 |

| P.M. Telelinnks | 5.33 | 5.37 | - | 0.78 | 0 |

| Real Strips | 8.60 | 5.14 | - | - | - |

| Mahalaxmi Seam. | 9.55 | 5.04 | 9.17 | - | - |

| T N Steel Tubes | 9.40 | 4.82 | - | -7.97 | 1.23 |

| Aryavan Enter. | 10.97 | 4.22 | - | -3.89 | 0.15 |

| Gopal Iron Stl. | 7.62 | 3.77 | - | -88 | 0.66 |

| Vallabh Steels | 6.68 | 3.31 | - | -192.41 | - |

| Heera Ispat | 3.55 | 2.09 | - | -48.8 | - |

| Indian Bright St | 20.40 | 2.04 | - | -20.51 | 0.27 |

List of Metal Stocks – Non-Ferrous Metals

| Name | Current Price (In Rs) | Market Capitalization (Rs in Crore) | Price to Earnings Ratio | Return on Equity (%) | Debt to Equity Ratio |

| Hindustan Zinc | 317.6 | 134196.2 | 14.51 | 21.26 | 0.13 |

| Hindalco Industries. | 567.1 | 127437.2 | 11.37 | 5.33 | 0.96 |

| National Aluminium Company Ltd. | 121.55 | 22324.24 | 7.78 | 12.57 | 0.01 |

| Hindustan Copper | 116 | 11217.5 | 45.23 | 10.73 | 0.54 |

| Tinplate Co. | 414.5 | 4338.59 | 14.73 | 12.25 | 0.01 |

| Gravita India | 309 | 2133.28 | 17.9 | 21.24 | 0.98 |

| Prec. Wires (I) | 80.15 | 926.82 | 15.1 | 13.12 | 0.09 |

| Manaksia | 75.35 | 493.95 | 4.23 | 5.56 | 0.08 |

| MMP Industries | 193 | 490.3 | 23.09 | 8.44 | 0.23 |

| Ram Ratna Wires | 202 | 444.4 | 9.78 | 7.87 | 1.36 |

| PG Foils | 322 | 292.79 | 5.79 | 8.9 | 1.05 |

| Euro Panel | 114.9 | 281.52 | 77.98 | 11.36 | 0.79 |

| Arfin India | 165 | 262.23 | 33.97 | 4.58 | 1.42 |

| Maan Aluminium | 134.15 | 181.38 | 9.52 | 25.92 | 0.88 |

| NILE | 566 | 169.8 | 6.83 | 9.33 | 0.33 |

| Manaksia Alumi. | 24.6 | 161.21 | 19.4 | -2.88 | 0.92 |

| Century Extrus. | 10.6 | 84.8 | 14.1 | 4.22 | 0.78 |

| Sagardeep Alloys | 39.2 | 66.84 | 43.39 | 0.54 | 0.47 |

| Sacheta Metals | 23.5 | 44.94 | 19.69 | 6.67 | 0.39 |

| Shalimar Wires | 10.28 | 43.96 | - | -47.81 | 4.44 |

| Cubex Tubings | 23.05 | 33.01 | 15.51 | 2.26 | 0.07 |

| Amco India | 70 | 28.77 | 8.12 | 5.01 | 0.51 |

| Maitri Enterp. | 60.2 | 26.48 | 331.06 | 3.49 | 0.03 |

| Hind Aluminium | 41.9 | 26.39 | - | -19.12 | 0.4 |

| RCI Industries | 6.81 | 10.68 | - | -525.21 | - |

| Bothra Metals | 5.41 | 10.02 | - | -6.41 | 2.85 |

| Golkonda Alumin. | 18.5 | 9.75 | 10.04 | -3.83 | 0 |

| Bhoruka Alum. | 1.54 | 8.46 | - | -0.86 | 0.23 |

| Synthiko Foils | 39.7 | 6.91 | 6.18 | 8.39 | 0 |

| Mewat Zinc | 16.32 | 6.53 | - | 0.28 | 0 |

| N D Metal Inds. | 26.25 | 6.51 | - | -7.83 | 1.17 |

| Sturdy Industrie | 0.38 | 5.75 | - | - | - |

| Sudal Industries | 5.51 | 4.06 | - | - | - |

| Galada Power | 4.49 | 3.36 | - | - | - |

| Globus Corp. | 0.36 | 2.3 | - | - | - |

List of Metal Stocks – Mining & Mineral Products

| Name | Current Price (In Rs) | Market Capitalization (Rs in Crore) | Price to Earnings Ratio | Return on Equity (%) | Debt to Equity Ratio |

| Vedanta | 407.9 | 151624.4 | 7.53 | 20.42 | 0.8 |

| Coal India | 185.9 | 114565.1 | 7.55 | 36.99 | 0.08 |

| NMDC | 165.4 | 48472.2 | 4.66 | 21.81 | 0 |

| KIOCL | 222.5 | 13522.46 | 43.13 | 15.36 | 0.05 |

| G M D C | 193.15 | 6142.17 | 13.84 | 8.24 | 0 |

| Maithan Alloys | 1355 | 3944.62 | 5.95 | 16.41 | 0.01 |

| MOIL | 186.95 | 3804.14 | 10.5 | 7.43 | 0 |

| Sandur Manganese | 3512 | 3161.46 | 6.22 | 16.8 | 0.26 |

| Indian Metals | 437.3 | 2359.43 | 5.46 | 13.67 | 0.45 |

| Orissa Minerals | 2923.45 | 1754.07 | - | -123.06 | 18.21 |

| Ashapura Minech. | 130.95 | 1198 | 11.11 | 17.51 | 1.12 |

| South West Pinn. | 198.85 | 554.83 | 53.2 | 10.48 | 0.48 |

| Shyam Century | 23.6 | 524.33 | 10.46 | 17.15 | 0 |

| Rohit Ferro Tech | 29.2 | 332.23 | - | - | - |

| Dec.Gold Mines | 32 | 298.63 | - | -6.93 | 0 |

| Indsil Hydro | 98.95 | 274.98 | 11.09 | -6.36 | 0.95 |

| 20 Microns | 77.4 | 273.09 | 8.53 | 11.54 | 0.53 |

| Bhagyanagar Ind | 45.85 | 146.7 | 18.45 | 2.79 | 1.05 |

| Facor Alloys | 7.35 | 143.74 | 10.68 | -4.8 | 0.09 |

| Sarthak Metals | 98.65 | 135.05 | 17 | 15.96 | 0.58 |

| Asi Industries | 14.05 | 126.56 | 168.75 | 3.81 | 0.64 |

| Madhav Copper | 30.1 | 81.69 | - | 9.86 | 0.17 |

| VBC Ferro Alloys | 43.7 | 71.63 | - | -47.31 | 0.16 |

| Nagpur Power | 53.95 | 70.67 | 11.74 | 2.56 | 0.16 |

| Baroda Extrusion | 4.45 | 66.32 | 114.35 | - | - |

| Shilp Gravures | 91.95 | 56.54 | 6.63 | 12.29 | 0.03 |

| HG Industries | 98.6 | 45.69 | - | -2.31 | 0 |

| Elegant Marbles | 110.55 | 40.46 | 20.43 | -1.86 | 0 |

| Impex Ferro Tech | 2.7 | 23.75 | 4.56 | - | - |

| Kachchh Minerals | 22.55 | 11.96 | - | 11.16 | 0.41 |

| Starlit Power | 10.05 | 10.12 | - | - | - |

| Rajdarshan Inds | 31.55 | 9.8 | 20.88 | 4.23 | 0 |

| MFS Intercorp | 20.7 | 8.95 | 20.33 | -3.28 | 0.6 |

| South. Magnesium | 28.05 | 8.43 | 11.23 | -3.59 | 0.57 |

| Monind | 20.4 | 7.51 | - | - | - |

| Elango Industrie | 11.8 | 4.5 | 225.18 | 0.85 | 0 |

| Shiva Granito | 2.9 | 3.83 | - | 0 | 0.39 |

India is on the fast track of economic development. Billions of rupees are being pumped to upgrade our infrastructure sector. What does this mean? Simply that the demand for steel, iron, aluminium and other metals will continue to grow. Even the demand for metals like Aluminium will go up as the Electric Vehicle sector picks up. Now it doesn’t take a genius to realise that the future is metal! So, it wouldn’t be the worst idea to invest in metal stocks. But which metal stocks should you invest in? The answer lies with Samco Stock Ratings. Check out unbiased rating of every metal stock in India with Samco Stock Rating. Open a FREE Demat account with India’s best stockbroker Samco Securities and invest in the best metal stocks always! Related Articles: EV stocks Auto stocks

Leave A Comment?