The Indian economy has experienced significant growth in recent years, with the financial sector playing a vital role in this expansion. Financial instruments such as derivatives have become increasingly popular in India, especially after liberalization and globalization. Derivatives are financial instruments that derive their value from an underlying asset. They play a crucial role in managing financial risks, speculating on asset prices, and facilitating trading in financial markets.

Derivatives in India have come a long way since their introduction in the early 2000s. The country's regulatory framework for various types of derivatives has evolved over the years, with the Securities and Exchange Board of India (SEBI) playing a significant role in regulating the derivatives market. Today, the derivatives market in India is one of the fastest-growing and most dynamic in the world, with a wide range of instruments available to investors. Investors can use various Types of Derivatives to manage financial risk and speculate on future price movements.

Types of Derivatives

Derivatives allow investors to manage their financial risk exposure by betting on the price movements of underlying assets. There are three main types of derivatives -

1. Futures

Futures are a type of derivative contract that obligates the buyer to purchase an underlying asset (such as stocks, indices, commodities, or currencies) at a predetermined price on a specified date in the future. Futures contracts are standardized and traded on exchanges, with the exchange acting as an intermediary between the buyer and the seller.

Futures contracts have several features and characteristics that make them unique.

- Futures are marked-to-market daily, meaning the contract's profits and losses are settled daily.

- Futures contracts have a margin requirement, a percentage of the contract value the buyer must deposit as collateral. This margin requirement ensures the buyer has sufficient funds to cover potential losses in adverse price movements.

- Futures contracts expire, after which the contract is settled in cash or through physical delivery of the underlying asset.

Futures contracts expire, after which the contract is settled in cash or through physical delivery of the underlying asset.

Advantages

- Provide an opportunity to hedge against prospective losses in the underlying asset.

- Allow investors to take leveraged positions, meaning they can control a large amount of the underlying asset with a relatively small investment.

- They are highly liquid, meaning they can be bought and sold easily in the market.

Disadvantages

- Complex financial instruments require a high understanding and expertise to trade successfully.

- Carry a high degree of risk due to the leverage involved, which means that losses can be substantial if the market moves against the investor.

- Have a fixed expiration date, which means that investors must either settle the contract in cash or take physical delivery of the underlying asset.

2. Options

Options are a type of derivative contract that gives the buyer the right to buy or sell an asset, but not the obligation (such as stocks, indices, currencies, or commodities) at a predetermined price on or before a specified date in the future. Options contracts are traded on exchanges and over-the-counter (OTC) markets. Unlike futures, options are not an obligation but rather the right to do so.

Options contracts have several features and characteristics that make them unique.

- Options expire, after which the contract is no longer valid.

- Options have a strike price. It is the price at which the asset can be bought or sold.

- Options can be of two types: call options and put options.

Call Options: A call option gives the buyer the right to buy an asset at the strike price on or before the expiration date. The seller of the call option is obligated to sell the asset if the buyer decides to exercise the option.

Put Options: A put option gives the buyer the right to sell an asset at the strike price on or before the expiration date. The seller of the put option is obligated to buy the asset if the buyer decides to exercise the option.

In India, options contracts are traded on various exchanges, including the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE). The underlying assets for options contracts can include equity indices, individual stocks, currencies, and commodities like gold, silver, and crude oil.

Advantages

- Provide an opportunity to hedge against prospective losses in the asset by buying put options.

- Allow investors to take leveraged positions, meaning they can control a large amount of the underlying asset with a relatively small investment.

- Provide flexibility to investors, as they can choose to exercise or not exercise the option depending on market conditions.

Disadvantages

- They are complex financial instruments that require a high level of understanding and expertise to trade successfully.

- Options are highly risky, as the option's value can decrease rapidly if the market moves against the investor.

- Options contracts have a fixed expiration date, which means that investors must either exercise the option or let it expire worthless.

3. Swaps

Different types of derivatives are available to investors for managing financial risk, and swaps are one of them. Swaps are derivative contracts that allow two parties to exchange financial instruments or cash flows with each other. The exchange is usually based on a predetermined formula or interest rate. Swaps are not traded on exchanges but rather are privately negotiated between parties.

Swaps have several characteristics that make them unique.

- They involve the exchange of cash flows or financial instruments rather than the exchange of the underlying asset itself.

- Swaps are customized to suit the parties' needs, meaning they are not standardized contracts.

- Swaps can be of various types, including interest rate swaps, currency swaps, and commodity swaps.

Interest Rate Swaps: Interest rate swaps involve the exchange of fixed-rate and floating-rate cash flows based on a notional principal amount. These swaps are commonly used to manage interest rate risk.

Currency Swaps: These involve exchanging cash flows denominated in different currencies based on a notional principal amount. These swaps are commonly used to hedge currency risk.

Commodity Swaps: Commodity swaps involve the exchange of cash flows based on the price of a commodity. These swaps are commonly used to manage commodity price risk.

Swaps are commonly used by financial institutions, corporations, and investors to manage their financial risk exposure. The underlying assets for swap contracts include interest rates, currencies, and commodities like oil, gold, and agricultural products.

Advantages

- They provide an opportunity to manage financial risk exposure by exchanging cash flows or financial instruments with another party.

- Swaps allow investors to customize the terms of the contract to suit their specific needs.

- Swaps are flexible, which means they can be structured in various ways to suit the needs of the parties involved.

Disadvantages

- They are complex financial instruments that require a high level of understanding and expertise to trade successfully.

- Swaps carry a high degree of counterparty risk, as the counterparty's creditworthiness is critical to the performance of the contract.

- Swaps contracts are not standardized, which means that the terms of the contract can be difficult to value.

4. Forward Contracts

A forward contract is an agreement between two parties to buy or sell an asset at a predetermined price and date in the future. It is a non-standardized contract, meaning that the terms of the agreement are negotiated between the two parties. The asset underlying a forward contract can be anything, such as commodities, currencies, stocks, or bonds.

Forward contracts differ from futures contracts because they are not traded on exchanges. Instead, they are traded over the counter (OTC), meaning that the two parties negotiate the terms of the agreement directly with each other. This lack of standardized terms in forward contracts gives them more flexibility and customization options than futures contracts.

Examples of underlying assets in forward contracts include agricultural products like wheat and corn, currencies like euros and yen, and commodities like gold and oil.

Advantages

- Forward contracts can be tailored to meet the two parties' specific needs. This allows for flexibility regarding the underlying asset, quantity, and settlement date.

- Unlike futures contracts, forward contracts do not require margin calls. This means that the parties do not need to make additional payments to maintain their position in the contract.

- Forward contracts are traded directly between the two parties involved, which can reduce transaction costs.

Disadvantages

- Because forward contracts are OTC contracts, there is a risk that one party may default on the contract. This can lead to financial losses for the other party.

- Forward contracts are not traded on exchanges, making them illiquid and difficult to sell.

Investors can use different types of derivatives, such as forward contracts to hedge against market volatility and manage financial risk. Forward contracts are commonly used by businesses to manage financial risk. For example, a farmer might enter into a forward contract to sell a certain quantity of wheat at a fixed price to a buyer in the future. By doing so, the farmer can lock in a price for their crop and avoid the risk of price fluctuations. Similarly, a company that needs to make a foreign currency payment in the future might enter into a forward contract to buy the necessary currency at a fixed rate.

Investors can also use forward contracts to speculate on future price movements. For example, an investor might enter into a forward contract to buy a certain quantity of gold at a fixed price in the future, hoping that the price will rise and they can sell the gold for a profit.

Conclusion

Derivatives are financial contracts that allow investors to manage their financial risk exposure by betting on the price movements of underlying assets. There are three main types of derivatives - futures, options, and swaps - each with unique characteristics and applications. While futures contracts offer the potential for high returns, they also carry a high degree of risk. On the other hand, options offer the potential for high returns with limited downside risk but also carry the risk of losing the premium paid for the contract. Swaps offer a more customized risk management approach but carry counterparty risk.

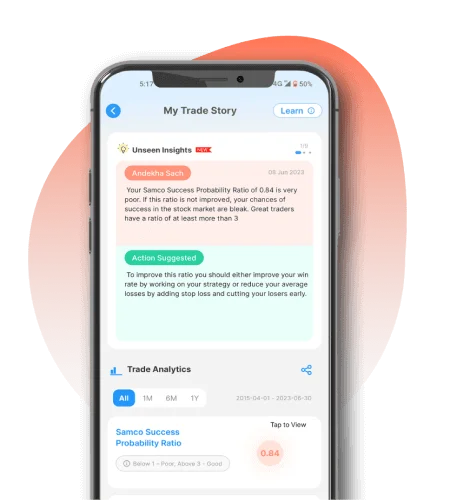

If you are interested in trading various types of derivatives, consider using Samco - a leading discount broker in India that offers a user-friendly online platform for trading futures, options, and other derivatives. With low brokerage rates, advanced trading tools, and excellent customer support, Samco can help you execute your trading strategy with confidence and ease. Sign up today to start trading derivatives with Samco.

Easy & quick

Easy & quick