From the days of open outcry systems on physical trading floors to fully digitised platforms, share trading in India has evolved significantly. The rise of smartphones and internet penetration has helped enhance the speed, transparency and convenience of online share trading in India.

With just a few taps on your smartphone, you can buy and sell shares and other financial securities in seconds. The democratisation of financial markets has made trading and investment popular avenues for wealth creation among retail investors.

In this comprehensive guide, we will explore online share trading in India, its benefits and a few associated drawbacks. Furthermore, we will also look into how to start online trading quickly and effortlessly.

What is Online Share Trading?

Online share trading involves buying and selling equity shares through electronic, internet-based platforms. To purchase or sell shares, you need to place an order through a stockbroker’s trading platform or smartphone app. The order is then sent to the stock exchange, where it is processed.

Online share trading platforms not only facilitate the exchange of shares, but they also allow you to monitor markets in real-time, track your investments and manage your portfolio from anywhere in the world.

This is in stark contrast to traditional trading, which often involved physical paperwork and face-to-face interactions with brokers or retail traders. Additionally, it lacked transparency and demanded more time and effort. Online trading, meanwhile, is faster, more accessible and cost-effective as it gives you direct control over your investments with instant execution capabilities and regular updates.

Benefits of Online Share Trading

Understanding the benefits of online trading helps you trade with confidence and make better decisions from the very beginning. Here is a quick overview of the key advantages.

- Convenience and Accessibility

With online share trading platforms, you can buy and sell financial securities anytime and from anywhere. Furthermore, these platforms have features that allow you to conduct thorough market analysis. - Cost-Effectiveness

One of the key benefits of online trading is the lower costs. Online trading reduces many of the expenses linked to traditional methods. Brokerage fees, which are often the biggest expense associated with trading, are far lower with online trading. - Real-Time Monitoring and Control

Online share trading platforms show real-time prices, charts and news. You can watch the market live and act instantly. With timely updates, you stay in control and can adjust your strategies as the market moves. - Access to a Wide Range of Financial Instruments

Online trading gives you access to more than just equity shares. You can trade in other financial securities like derivative contracts, mutual funds, bonds and more. Access to a wider range of investments lets you diversify your portfolio better. - Educational Resources and Tools

Most platforms offering online share trading in India provide free learning materials, webinars and tutorials. These educational resources help you understand how things work before you invest real money. As you learn, you gain the confidence to make better choices and avoid costly mistakes.

Risks Involved and How to Mitigate Them

While the benefits of online trading are many, it is equally important to be aware of the risks. Knowing what these risks are and how to manage them helps you stay prepared and protects you from losses.

- Market Volatility

Sudden market movements can lead to prices rising and falling unexpectedly. This can lead to losses, especially if the market moves against your position. Fortunately, you can reduce the impact of market volatility by setting a clear entry and exit plan. - Technical Issues

Online share trading in India depends on stable internet and software. System crashes can affect your ability to trade at the right time. To stay safe, ensure your device is updated and your connection is strong. Sometimes, the trading platform can develop technical issues. In such cases, it is advisable to have the broker’s support contact handy so you can act quickly if problems arise. - Inadequate Market Research

Making trading decisions based on guesswork can be risky and lead to losses. Therefore, instead of acting on tips or rumours without checking facts, make sure to always do your own research. Staying informed helps you make smarter, more confident investment decisions. - Risk Management

With online share trading in India, there is always an element of risk. However, you can manage the risks wisely by using strategies like diversification, stop-loss orders, take-profit orders and position sizing.

Step-by-Step Guide to Start Online Share Trading

If you are a beginner, you may not know how to start online trading. Fortunately, the process is simple. Here is a step-by-step guide to help you get started.

- Step 1: Choosing a reliable brokerage platform

A brokerage platform facilitates the purchase and sale of financial securities on stock exchanges. It is essential to choose a reliable platform that is easy to use, secure and offers good customer support. A trusted brokerage platform like Samco Securities can make your trading experience smooth and hassle-free. - Step 2: Opening a demat and trading account

Once you have chosen a brokerage platform, the next step is to open a demat and trading account, which is necessary to buy and hold shares electronically. Online trading platforms like Samco Securities let you open a demat and trading account online through a paperless process. - Step 3: Understanding market basics and conducting research

Once your demat and trading account are activated, the next step is to learn how the markets work. A strong base of knowledge helps you make informed decisions. Follow reliable news, official company reports and market trends. You can also use platform tools to study charts and price data. - Step 4: Placing your first trade

Select the stock you wish to invest in from your broker’s trading platform. Then, enter the quantity, set your desired price and confirm the order. Your order will be forwarded to the stock exchange, where it will be processed and executed. - Step 5: Monitoring and managing your investments

Once you have invested in a stock, you must track its performance regularly. Monitoring your investments and staying updated with market news helps you stay on course and protect your capital.

Why Choose Samco for Online Share Trading?

With so many platforms offering online share trading in India, choosing the right one matters. Here are some reasons why Samco Securities is the right option for you.

- Unique Features and Offerings

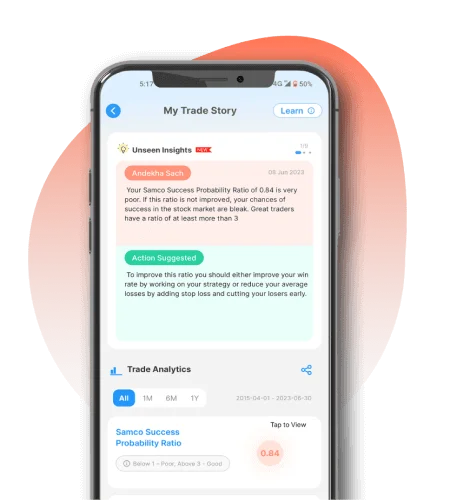

Samco offers a user-friendly platform with fast trade execution capabilities. Additionally, you also get unique trading features like Margin Trading Facility (MTF), TradingView charts and margin against shares. You also get access to insightful reports and smart recommendations designed to help you trade with greater confidence and precision. - Strong Customer Support and Educational Resources

Samco’s multi-channel customer support is highly responsive and can be accessed whenever you need it. You also get access to education resources in the form of free tutorials, webinars and guides to help you learn and trade better. - Competitive Pricing and Tools

With low brokerage charges and access to premium tools, Samco keeps trading cost-effective. You can use tools like margin calculators and leverage advanced analytics to plan trades smartly.

Conclusion

Online share trading in India has made investing easier, faster and more accessible. Now that you understand the benefits and risks involved, you can trade with confidence. With Samco Securities, you get the tools and support needed to begin your journey on the right foot. Open a demat and trading account with Samco today and enjoy trading at a low cost.

Easy & quick

Easy & quick