| Risk Disclosures on derivatives |

|---|

|

Source:

SEBI study dated January 25, 2023 on “Analysis of Profit and Loss of Individual Traders dealing in equity Futures and Options (F&O) Segment”, wherein Aggregate Level findings are based on annual Proft/Loss incurred by individual traders in equity F&O during FY 2021-22.

To follow highest standards of ethics and compilances while facilitating the trading by clients in securities in a fair and transparent manner, so as to contribute in creation of wealth for investors.

| S.No. | Activities | Expected Timelines |

|---|---|---|

| 1. | KYC entered into KRA System and CKYCR | 10 days of account opening |

| 2. | Client Onboarding | Immediate, but not later than one week |

| 3. | Order execution | Immediate on receipt of order, but not later than the same day |

| 4. | Allocation of Unique Client Code | Before trading |

| 5. | Copy of duly completed Client Registration Documents to clients | 7 days from the date of upload of Unique Client Code to the Exchange by the trading member |

| 6. | Issuance of contract notes | 24 hours of execution of trades |

| 7. | Collection of upfront margin from client | Before initiation of trade |

| 8. | Issuance of intimations regarding other margin due payments | At the end of the T day |

| 9. | Settlement of client funds | 30 days / 90 days for running account settlement (RAS) as per the preferenceof client. If consent not given for RAS - within 24 hours of pay-out |

| 10. | ‘Statement of Accounts’ for Funds, Securities and Commodities | Weekly basis (Within four trading days of Securities and Commodities following week) |

| 11. | Issuance of retention statement of funds/commodities | 5 days from the date of settlement |

| 12. | Issuance of Annual Global Statement | 30 days from the end of the financial year |

| 13. | Investor grievances redressal | 30 days from the receipt of the complaint |

| S.No. | DOs | DON’Ts |

|---|---|---|

| 1. | Read all documents and conditions being agreed before signing the account opening Form. | Do not deal with unregistered stockbroker. |

| 2. | Receive a copy of KYC, copy of account opening documents and Unique Client Code. | Do not forget to strike off blanks in your account opening and KYC. |

| 3. | Read the product / operational framework / timelines related to various Trading and Clearing & Settlement processes. | Do not submit an incomplete account opening and KYC form. |

| 4. | Receive all information about brokerage, fees and other charges levied. | Do not forget to inform any change in information linked to trading account and obtain confirmation of updation in the system. |

| 5. | Register your mobile number and email ID in your trading, demat and bank accounts to get regular alerts on your transactions. | Do not transfer funds, for the purposes of trading to anyone other than a stock broker. No payment should be made in name of employee of stock broker. |

| 6. | If executed, receive a copy of Power of Attorney. However, Power of Attorney is not a mandatory requirement as per SEBI / Stock Exchanges. Before granting Power of Attorney, carefully examine the scope and implications of powers being granted. | Do not ignore any emails / SMSs received with regards to trades done, from the Stock Exchange and raise a concern, if discrepancy is observed. |

| 7. | Receive contract notes for trades executed, showing transaction price, brokerage, GST and STT etc. as applicable, separately, within 24 hours of execution of trades. | Do not opt for digital contracts, if not familiar with computers. |

| 8. | Receive funds and securities / commodities on time within 24 hours from pay-out. | Do not share trading password. |

| 9. | Verify details of trades, contract notes and statement of account and approach relevant authority for any discrepancies. Verify trade details on the Exchange websites from the trade verification facility provided by the Exchanges. | Do not fall prey to fixed / guaranteed returns schemes. |

| 10. | Receive statement of accounts periodically. If opted for running account settlement, account has to be settled by the stock broker as per the option given by the client (30 or 90days). | Do not fall prey to fraudsters sending emails and SMSs luring to trade in stocks / securities promising huge profits. |

| 11. | In case of any grievances, approach stock broker or Stock Exchange or SEBI for getting the same resolved within prescribed timelines. | Do not follow herd mentality for investments. Seek expert and professional advice for your investments. |

Level 1 – Approach the Stock Broker at the designated Investor Grievance e-mail ID of the stock broker. The Stock Broker will strive to redress the grievance immediately, but not later than 30 days of the receipt of the grievance.

Level 2 – Approach the Stock Exchange using the grievance mechanism mentioned at the website of the respective exchange.

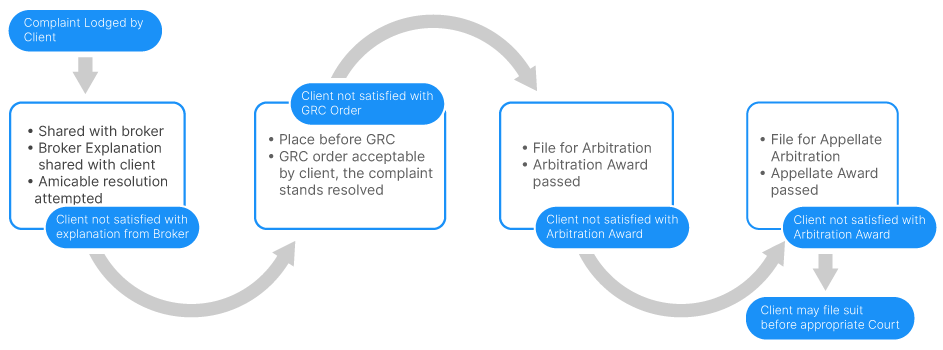

Complaints Resolution Process at Stock Exchange explained graphically:

| S.No. | Type of Activity | Timelines for activity |

|---|---|---|

| 1. | Receipt of Complaint | Day of complaint (C Day). |

| 2. | Additional information sought from the investor, if any, and provisionally forwarded to stock broker. | C + 7 Working days. |

| 3. | Registration of the complaint and forwarding to the stock broker. | C+8 Working Days i.e. T day. |

| 4. | Amicable Resolution | T+15 Working Days. |

| 5. | Refer to Grievance Redressal Committee (GRC), in case of no amicable resolution. | T+16 Working Days. |

| 6. | Complete resolution process post GRC. | T + 30 Working Days. |

| 7. | In case where the GRC Member requires additional information, GRC order shall be completed within. | T + 45 Working Days. |

| 8. | Implementation of GRC Order. | On receipt of GRC Order, if the order is in favour of the investor, debit the funds of the stock broker. Order for debit is issued immediately or as per the directions given in GRC order. |

| 9. | In case the stock broker is aggrieved by the GRC order, will provide intention to avail arbitration | Within 7 days from receipt of order |

| 10. | If intention from stock broker is received and the GRC order amount is upto Rs.20 lakhs | Investor is eligible for interim relief from Investor Protection Fund (IPF).The interim relief will be 50% of the GRC order amount or Rs.2 lakhs whichever is less. The same shall be provided after obtaining and Undertaking from the investor. |

| 11. | Stock Broker shall file for arbitration | Within 6 months from the date of GRC recommendation |

| 12. | In case the stock broker does not file for arbitration within 6 months | The GRC order amount shall be released to the investor after adjusting the amount released as interim relief, if any. |

Default of TM/CM

Following steps are carried out by Stock Exchange for benefit of investor, in case stockbroker defaults:

Following information is available on Stock Exchange website for information of investors:

Level 3 – The complaint not redressed at Stock Broker / Stock Exchange level, may be lodged with SEBI on SCORES (a web based centralized grievance redressal systemof SEBI) @ https://scores.sebi.gov.in/

Towards making Indian Securities Market - Transparent, Efficient, & Investor friendly by providing safe, reliable, transparent and trusted record keeping platform for investors to hold and transfer securities in dematerialized form.

A Depository is an organization which holds securities of investors in electronic form. Depositories provide services to various market participants - Exchanges, Clearing Corporations, Depository Participants (DPs), Issuers and Investors in both primary as well as secondary markets. The depository carries out its activities through its agents which are known as Depository Participants (DP). Details available on the link.

| Sr. no. | Brief about the Activity / Service | Expected Timelines for processing by the DP after receipt of proper documents |

|---|---|---|

| 1. | Dematerialization of securities | 7 days |

| 2. | Rematerialization of securities | 7 days |

| 3. | Mutual Fund Conversion / Destatementization | 5 days |

| 4. | Re-conversion / Restatementisation of Mutual fund units | 7 days |

| 5. | Transmission of securities | 7 days |

| 6. | Registering pledge request | 15 days |

| 7. | Closure of demat account | 30 days |

| 8. | Settlement Instruction | Depositories to accept physical DIS for pay-in of securities up to 4 p.m. and DIS in electronic form up to 6 p.m. on T+1 day |

| Sr. no. | Type of Activity / Service | Brief about the Activity / Service |

|---|---|---|

| 1. | Value Added Services | Depositories also provide value added services such as a. Basic Services Demat Account (BSDA) b. TPIN facility to authorise debits c. Transposition cum dematerialization link d. Distribution of cash and non-cash corporate benefits (Bonus, Rights, IPOs etc.), stock lending, demat of NSC / KVP, demat of warehouse receipts etc. |

| 2. | Consolidated Account statement (CAS) | CAS is issued 10 days from the end of the month (if there were transactions in the previous month) or half yearly (if no transactions). |

| 3. | Digitalization of services provided by the depositories | Depositories offer below technology solutions and e-facilities to their demat account holders through DPs: a. E-account opening: Details available on the link b. Online instructions for execution: Details available on the link - Easiest c. e-DIS / Demat Gateway: Details available on the link d. e-CAS facility: Details available on the link |

(1) The Process of investor grievance redressal

| Sr. no. | Type of Activity / Service | Brief about the Activity / Service |

|---|---|---|

| 1. | Investor Complaint/Grievances | Investor can lodge complaint/ grievance against the Depository/DP in the following ways: a. Electronic mode - (i) SCORES (a web based centralized grievance redressal system of SEBI) (ii) Respective Depository’s web portal dedicated for the filing of compliant [link] (iii) Emails to designated email IDs of Depository [link] b. Offline mode The complaints/ grievances lodged directly with the Depository shall be resolved within 30 days. |

| 2. | Online Dispute Resolution (ODR) platform for online Conciliation and Arbitration | If the Investor is not satisfied with the resolution provided by DP or other Market Participants, then the Investor has the option to file the complaint/ grievance on SMARTODR platform for its resolution through by online conciliation or arbitration. ODR Portal |

| 3. | Steps to be followed in ODR for Review, Conciliation and Arbitration |

- Investor to approach Market Participant for redressal of complaint - If investor is not satisfied with response of Market Participant, he/she can escalate the complaint on SEBI SCORES portal. - Alternatively, the investor may also file a complaint on SMARTODR portal for its resolution through online conciliation and arbitration. - Upon receipt of complaint on SMARTODR portal, the relevant MII will review the matter and endeavour to resolve the matter between the Market Participant and investor within 21 days. - If the matter could not be amicably resolved, then the Investor may request the MII to refer the matter case for conciliation. - During the conciliation process, the conciliator will endeavor for amicable settlement of the dispute within 21 days, which may be extended with 10 days by the conciliator. - If the conciliation is unsuccessful, then the investor may request to refer the matter for arbitration. - The arbitration process to be concluded by arbitrator(s) within 30 days, which is extendable by 30 days. |

| 4. | Investor Grievance Redressal Committee of Depository | If no amicable resolution is arrived, then the Investor has the option to refer the complaint/ grievance to the Grievance Redressal Committee (GRC) of the Depository. Upon receipt of reference, the GRC will endeavor to resolve the complaint/ grievance by hearing the parties and examining the necessary information and documents. |

| 5. | Arbitration proceedings | The Investor may also avail the arbitration mechanism set out in the Byelaws and Business Rules/Operating Instructions of the Depository in relation to any grievance, or dispute relating to depository services. The arbitration reference shall be concluded by way of issue of an arbitral award within 4 months from the date of appointment of arbitrator(s). |

(2) For the Multi-level complaint resolution mechanism available at the Depositories please refer to [link]

| Sr. no. | Type of special circumstances | Timelines for the Activity/ Service |

|---|---|---|

| 1. | ▪ Depositories to terminate the participation in case a participant no longer meets the eligibility criteria and/or any other grounds as mentioned in the bye laws like suspension of trading member by the Stock Exchanges. ▪ Participant surrenders the participation by its own wish. |

Client will have a right to transfer all its securities to any other Participant of its choice without any charges for the transfer within 30 days from the date of intimation by way of letter/email. |

For Do’s and Don’ts please refer to the link

For rights, please refer to the link

For responsibilities, please refer to the link

Invest with knowledge & safety.

Every investor should be able to invest in right investment products based on their needs, manage and monitor them to meet their goals, access reports and enjoy financial wellness.

In case of any grievance / complaint, an investor should approach the concerned research analyst and shall ensure that the grievance is resolved within 30 days.

If the investor’s complaint is not redressed satisfactorily, one may lodge a complaint with SEBI on SEBI’s SCORES portal which is a centralized web based complaints redressal system. SEBI takes up the complaints registered via SCORES with the concerned intermediary for timely redressal. SCORES facilitates tracking the status of the complaint.

With regard to physical complaints, investors may send their complaints to: Office of Investor Assistance and Education, Securities and Exchange Board of India, SEBI Bhavan. Plot No. C4-A, ‘G’ Block, Bandra-Kurla Complex, Bandra (E), Mumbai - 400 051.

| Do’s | Don’ts |

|---|---|

| Always deal with SEBI registered Research Analyst. | Do not provide funds for investment to the Research Analyst. |

| Ensure that the Research Analyst has a valid registration certificate. | Don’t fall prey to luring advertisements or market rumours. |

| Check for SEBI registration number. | Do not get attracted to limited period discount or other incentive, gifts, etc. offered by Research Analyst. |

| Please refer to the list of all SEBI registered Research Analysts which is available on SEBI website in the following link: (https://www.sebi.gov.in/sebiweb/other/OtherAction.do?doRecognisedFpi=yes &intmId=14) | Do not get attracted to limited period discount or other incentive, gifts, etc. offered by Research Analyst. |

| Always pay attention towards disclosures made in the research reports before investing. | |

| Pay your Research Analyst through banking channels only and maintain duly signed receipts mentioning the details of your payments. | |

| Before buying securities or applying in public offer, check for the research recommendation provided by your research Analyst. | |

| Ask all relevant questions and clear your doubts with your Research Analyst before acting on the recommendation. | |

| Inform SEBI about Research Analyst offering assured or guaranteed returns. |