Retirement accounts were lost. Their home values crashed. Housing prices fell by approximate 31%. The banks started going bankrupt.

The stock market wiped out almost US $8 trillion in United States alone from late 2007 to 2009. Millions of people lost their jobs. By October 2009, unemployment went up to 10%.

Economists failed to predict the crisis. And what happens when the world’s strongest economy collapses?

The global economy collapses.

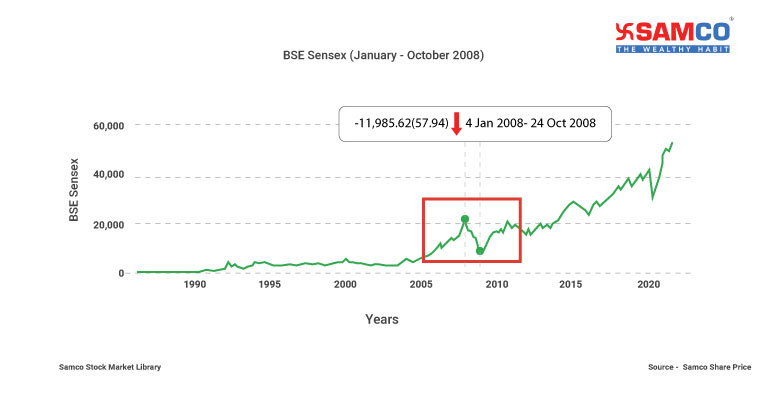

There was a ripple effect. The Indian stock market saw a fall of over 50% in the year 2008-09. On 3 March 2008, the Sensex fell by 900 points and settled at 16,677.

Retirement accounts were lost. Their home values crashed. Housing prices fell by approximate 31%. The banks started going bankrupt.

The stock market wiped out almost US $8 trillion in United States alone from late 2007 to 2009. Millions of people lost their jobs. By October 2009, unemployment went up to 10%.

Economists failed to predict the crisis. And what happens when the world’s strongest economy collapses?

The global economy collapses.

There was a ripple effect. The Indian stock market saw a fall of over 50% in the year 2008-09. On 3 March 2008, the Sensex fell by 900 points and settled at 16,677.

On 24 October 2008, the BSE Sensex fell to 8701. It was a fall of 1070 points in a single day. The National Stock Exchange’s Nifty ended at 2,557.25, down 13.11 per cent or 386 points. The BSE Midcap closed 8.38 per cent lower and BSE Smallcap Index ended 7.66 percent down.

But what led to the world economy collapsing this badly? What triggered this? Let’s find that out!

In this article:

On 24 October 2008, the BSE Sensex fell to 8701. It was a fall of 1070 points in a single day. The National Stock Exchange’s Nifty ended at 2,557.25, down 13.11 per cent or 386 points. The BSE Midcap closed 8.38 per cent lower and BSE Smallcap Index ended 7.66 percent down.

But what led to the world economy collapsing this badly? What triggered this? Let’s find that out!

In this article:

- Brief about the 2008 financial crisis

- The banks, CDOs, and the risk associated with loans

- The role of Credit Default Swaps (CDS)

- The Credit Rating Agencies and the insurance companies

- Beginning of the debacle

- Did anyone make profits out of this fiasco?

- The big short – Book & documentary

- Four books based on 2008 financial crisis

- Timeline to 2008 financial crisis

- How to identify and avoid stock bubble?

Brief about the 2008 financial crisis

The 2008 financial crash involved –- Investment banks

- Insurance companies

- Credit rating agencies

- US Federal Banks

- Investors and the people of the USA

This is where things started to tumble.

The US equity market was not giving good returns compared to debt instruments.

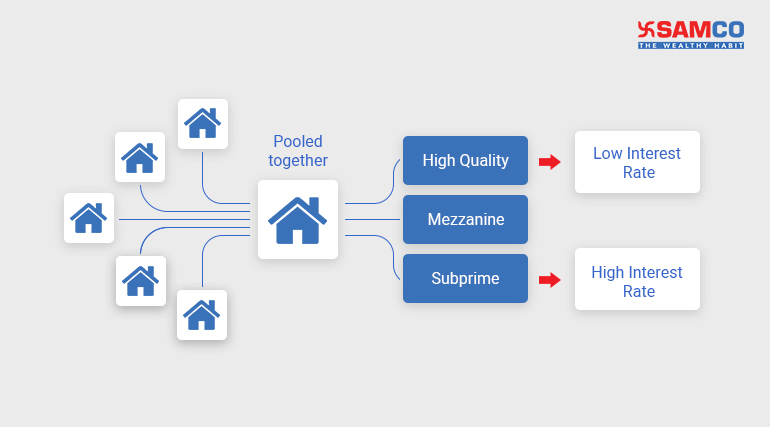

Whereas, CDOs were not only giving good returns but they were also safer. The credit rating agencies like Moody’s and Standard and Poor’s (S&P) rated them AAA.

CDO was a new concept and the market was largely unregulated. One can trade them over the counter or between the banks but not on exchanges.

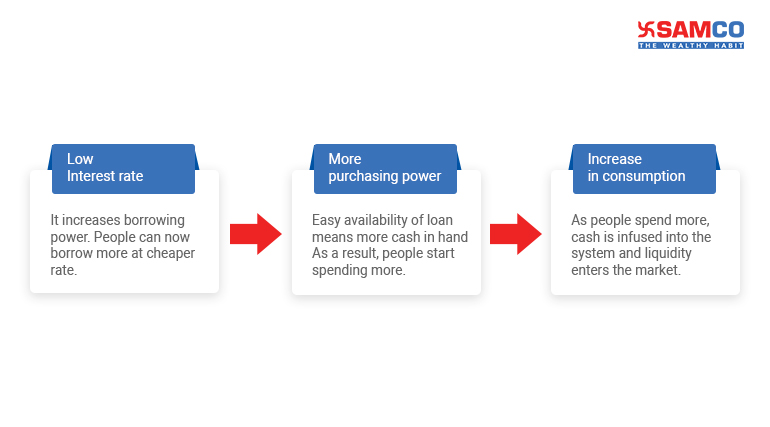

The chairman of the Federal Reserve cut the target federal funds rate to 1% in 2003. The rates were at a high of 6.5% in 2001.

The availability of easy credit motivated banks to increase lending. They started providing housing loans to borrowers. Their careless mistake was that they loaned money to those who would not qualify for these loans.

These products were immensely profitable for banks.

On the other end, the housing prices were on a rise. This resulted in the growth of mortgage-backed derivatives around the world.

This is where things started to tumble.

The US equity market was not giving good returns compared to debt instruments.

Whereas, CDOs were not only giving good returns but they were also safer. The credit rating agencies like Moody’s and Standard and Poor’s (S&P) rated them AAA.

CDO was a new concept and the market was largely unregulated. One can trade them over the counter or between the banks but not on exchanges.

The chairman of the Federal Reserve cut the target federal funds rate to 1% in 2003. The rates were at a high of 6.5% in 2001.

The availability of easy credit motivated banks to increase lending. They started providing housing loans to borrowers. Their careless mistake was that they loaned money to those who would not qualify for these loans.

These products were immensely profitable for banks.

On the other end, the housing prices were on a rise. This resulted in the growth of mortgage-backed derivatives around the world.

The Credit Rating Agencies and the insurance companies

The American International Group (AIG) speculated with the CDOs. AIG is the biggest Insurance company in the USA. They provided insurance to investment banks if the instruments were to default. People started acknowledging the fact that these products are insured by AIG. Consecutively, credit rating agencies like Moody’s and S&P continued rating them as high as AAA. Other players like Lehman Brothers, Morgan Stanley, Bear Stearns, Citi Group, Goldman Sachs all jumped into the CDO market. They started selling more and more of these products. The housing prices kept rising. But now, they reached a point of saturation. The house buyers with good credit scores and history were fewer. Eventually, the profits started to decrease. This is when the bankers became puppets of their greed. They began issuing loans to those who didn’t have a reliable credit history. The probability of them not being able to repay the loan money was high. In hindsight, people were being robbed without a gun by the dream of a house with easy loan money. Now you may be thinking that rating agencies must have downgraded the ratings of these CDOs. But sadly, that was not the case. The underlying loans were given at very high interest rates. But people kept taking such loans. Since the housing prices were increasing more than the interest rate on these home loans. Records show that the riskiest loans originated in 2004–2007. Over the years, the proof of assets and income were de-emphasized. In the beginning, loans required full documentation. Eventually, it led to low documentation and finally to no documentation at all. A mortgage product that gained wide recognition was the no income, no job, no asset verification required (NINJA) mortgage. These loans are also referred to as liar loans. The ultimate result was loans being disbursed to people with poor credit rating. By 2006, 60% of the mortgages purchased by Citigroup were defective. By 2007 these defective mortgages increased to over 80%. Between January 2006 to June 2007, over 9,00,000 mortgages issued revealed that only 54% of the loans met their originators’ underwriting standards. The analysis additionally showed that 28% of the sampled loans did not meet the minimal standards of any issuer. This was on behalf of 23 investment and commercial banks, including seven too big to fail banks.Beginning of the Fiasco

Few experts saw the bubble coming. But nobody believed them. People were not ready to accept the idea that the housing prices can ever go down. It was a truth too harsh to accept. Initially, the default rate was around 4%. As the default rate kept rising and reached 8%, the MBS system collapsed. The crisis started with the fall in housing prices. More and more people became fearful. And with that, the default rate in these loans skyrocketed. Eventually, the CDOs failed to return investors their money. The case of Bear Sterns, Lehman Brothers, Merrill Lynch & AIG

Did no one see this coming?

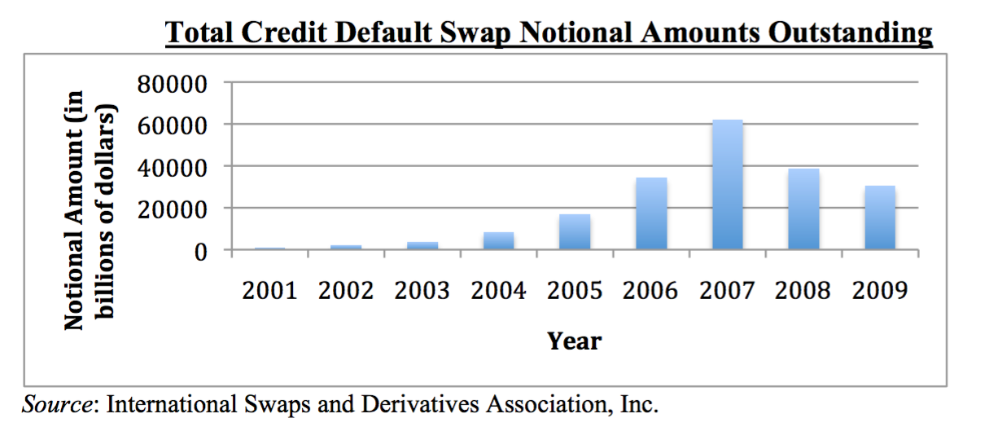

Some people did. In the mid-2000s, a few finance experts observed the instability in the US housing market. They predicted the collapse. They discovered the flaws and corruption in the system. In early 2000, Michael Burry realized that many subprime home loans were in a danger of defaulting. Burry started betting against the housing market. He invested more than US $1 billion of his investors’ money into CDS. His actions attracted the attention of a few more bankers and other opportunists. They tried to warn everyone, but like always, no one believed in what they claimed. Infact, people mocked them to bet against the housing market. These men made a fortune by taking full advantage of the imminent economic collapse. A book was written on the same events of how they predicted the economic fall. The Big Short: Inside the Doomsday Machine – A Book by Michael Lewis

Four notable books other than The Big Short

There are many books and movies describing the housing bubble of 2008. The Big Short is indeed a great book. But here are four more books which will help you understand the 2008 financial crash from various perspective. 1. Too Big To Fail by Andrew Ross Sorkin Originally Published On: September 2010

2008 Financial Crisis Timeline:

Here is a detailed timeline of the US Housing Bubble – 2005 Fund manager Michael Burry closed a CDS against subprime mortgage bonds on 19th May 2005. The deal valuing US $60 million was sealed with Deutsche Bank. He predicted they would become volatile within two years. 2006 Housing prices peaked and the default on mortgage loans went up. This was the start leading to the United States housing bubble. February 2007 Reports of decline in house prices following the defaults started hitting the market. Stock prices in China and the U.S. fell by the most since 2003. Freddie Mac stopped investing in subprime loans because of the increase in the default rates. April 2007 New Century, a real estate investment trust filed for bankruptcy protection. They specialised in Subprime lending and securitization. This originated the subprime mortgage crisis. June 2007 Bear Stearns bailed out two of its hedge funds. They had $20 billion of exposure to CDOs, including subprime mortgages. July 2007 Bear Stearns liquidated their two hedge funds. August 2007 American Home Mortgage filed for bankruptcy. BNP Paribas blocked withdrawals from three of its hedge funds. They had over $2.2 billion in assets under management (AUM). There was hardly any liquidity left in the market. It was apparent that the banks were refusing to do business with each other. September 2007 NetBank filed for bankruptcy due to exposure to home loans. October 2007 The Dow Jones Industrial Average (DJIA) hit its peak closing price of 14,164.53. December 2007 Delta Financial Corporation filed for bankruptcy after failing to securitize subprime loans. January 2008 The credit rating of Ambac, a bond insurance company was downgraded. Stock markets fell to a yearly low. U.S. stocks kept hitting low over concerns about the exposure of companies that issue bond insurance. March 5, 2008 Bear Stearns faced bankruptcy. A week earlier to the bankruptcy, the stock was trading at $60/share. September 2008 After Bear Stearns, the Lehman Brothers filed for bankruptcy. This led to a 504-point drop in the Dow Jones Industrial Average (DJIA). It was its worst decline in seven years. Lehman had been in talks to be sold to either Bank of America or Barclays. Sadly, no bank wanted to acquire the entire company. To avoid bankruptcy, Merrill Lynch was acquired by Bank of America for $50 billion. Investors withdrew $144 billion from U.S. money market funds. They were invested in commercial paper. These papers were issued by corporations to fund their operations and payrolls. The withdrawal caused short-term lending market to freeze. The withdrawal compared to $7.1 billion in withdrawals the week prior. This interrupted the ability of corporations to rollover their short-term debt. Washington Mutual went bankrupt and was seized by the Federal Deposit Insurance Corporation. The panicked depositors withdrew $16.7 billion in 10 days. The DJIA dropped 777.68 points, or 7%, its largest point drop in history. The S&P 500 Index fell 8.8% and the Nasdaq Composite fell 9.1%. Several stock market indices worldwide fell 10%. October 2008 The U.S. Senate passed the Emergency Economic Stabilization Act of 2008. Stock market indices fell 4%. The DJIA fell over 1,874 points. The S&P 500 fell more than 20%. The Icelandic stock market trading was suspended for three successive trading days. November 2008 The IMF predicted a worldwide recession of −0.3% for 2009. Iceland obtained an emergency loan from the International Monetary Fund. January 6, 2009 The 2009 Icelandic financial crisis protests intensified and the Icelandic government collapsed. Early March 2009 The drop in stock prices was compared to that of the Great Depression. Obama stated that “Buying stocks is a potentially good deal if you’ve got a long-term perspective on it”. The Dow Jones hit its lowest level of 6,443.27, a drop of 54% from its peak of 14,164 on October 9, 2007. Wrapping up the 2008 Financial Crisis Several interrelated factors triggered the meltdown. The financial institutions were operating with too much leverage. The low interest rates fuelled a housing price bubble. The low lending regulations and standards gave it a further push. This encouraged people to borrow beyond what they could afford to repay. Despite the downgrade in the quality of advances, banks kept selling their mortgages. The financial companies who bought these mortgages repackaged them in tranches. They were then being resold to investors as mortgage-backed securities. Buyers and investors found themselves holding worthless paper when mortgage loans started defaulting. One thing led to another and within a matter of days, the global economy started to collapse.Financial Crisis 2008 in brief:

Bubbles occur all the time in the financial world. The stock price of a company or any commodity can inflate beyond its intrinsic value. Usually, the over-enthusiastic buyers are the ones who suffers massive losses. However, the 2008 housing bubble was different. It grew big enough that when it burst, it damaged the entire world economy. Every person was affected in one way or the other. In 2011, the Financial Crisis Inquiry Commission reviewed the crash. They reported that the 2008 financial crisis was avoidable. It was caused by –- Widespread failures in financial regulation and supervision.

- Dramatic failures of corporate governance and risk management.

- Combination of excessive borrowing, risky investments, and lack of transparency by financial institutions.

- Ill preparation and inconsistent action by government and key policymakers.

- A systemic breakdown in accountability and ethics at all levels.

- Collapsing mortgage-lending standards.

- Deregulation of over-the-counter derivatives, especially credit default swaps.

- The failures of credit rating agencies to correctly price risk.

Leave A Comment?