A bond is a debt instrument that helps a company or the government raise capital. But bonds are not new for investors. Did you know that bonds were used as early as 4,420 years ago in Iraq?

Centuries ago, a bond used to look like this beautifully carved stone. It was used as a guarantee against future payments. Today, bonds are the primary source of funding for government and corporations. But exactly what are bonds? Are they safe? Should you invest in bonds? These are a few questions that we will cover in this article on what are bonds. Additionally, we will also cover:

- What are bonds?

- Types of bonds

- Key terms for understanding bonds

- What is yield to maturity (YTM)?

- How price fluctuations affect the purchase price of bond in the secondary markets?

- What is accrued interest?

- Advantages of bonds

- Disadvantages of bonds

- Tax implications on bonds

- Alternatives to investing in bonds

- Who should invest in bonds?

What are Bonds?

A bond is a form of debt or a loan which is given by the public to corporations or the government. In exchange, the borrower or bond issuer agrees to pay a fixed rate of interest and return the borrowed capital on maturity.

Since the issuer has an obligation to repay the principal on maturity, bonds are considered as a safe haven. A bond is usually backed by a collateral. A key reason for bond’s popularity is that the bondholder gets the first right on the company’s assets if the company goes bankrupt. Even while distributing profits, bond holders are given preference over equity shareholders.

Watch this video to understand what are bonds

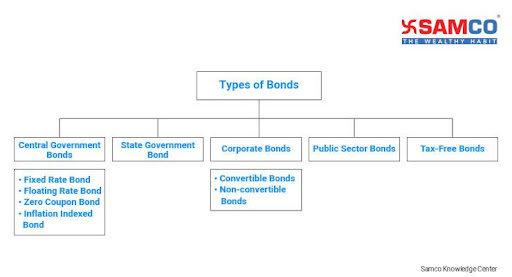

Now that you have understood what are bonds, let us look at the different types of bonds in India. The different types of bonds are segregated based on the following:

- Type of borrower or issuer

- Type of coupon rates

- Type of options

- Type of Tax Benefits

Types of Bonds Based on Borrower (Issuer)

1. Central Government Bonds

Government bonds have been in existence since the early 1,100s. Back then Venice used to issue government bonds to fund its wars. Today this same practice of issuing bonds is followed by central banks across the globe. In India, these bonds are issued by the Reserve Bank of India (RBI) on behalf of the central government. They come with a maturity period of more than 10 years.

As they are issued by the government, central government bonds carry the sovereign guarantee. This makes them one of the safest types of bonds. However, these bonds are exposed to inflation rate risk due to the long maturity period. This means that there is a possibility that the inflation rate might outpace the returns delivered by your bond in the future.

Central government bonds are usually purchased by institutional investors like debt mutual funds, insurance companies etc. But even retail investors can invest in central government bonds using National Stock Exchange’s platform GoBid.

The table below shows a few of the central government bonds currently in circulation.

Central Government Bonds | Coupon Rate | Issue Date | Maturity Date |

10.18 % GOI BOND 2026 | 10.18% | 11-09-2021 | 11-09-2026 |

8.35 % GOI BOND 2022 | 8.35% | 14-05-2002 | 14-05-2022 |

7.95 % GOI BOND 2032 | 7.95% | 28-08-2002 | 28-08-2032 |

2. State Government Bonds

State Government bonds are also known as state development loans (SDLs). They are issued by state governments to fund infrastructural developments in the state or during liquidity crunch etc. The table below shows a few state governments bonds in circulation –

State Government Bonds | Issued by | Coupon Rate | Issue Date | Maturity Date |

8.31% West Bengal SDL 2025 | West Bengal Government | 8.31% | 29-07-2015 | 29-07-2025 |

8.61% Uttar Pradesh SPL Bond 2028 | Uttar Pradesh Government | 8.61% | 04-10-2014 | 04-10-2028 |

8.27% Tamil Nadu SDL 2025 | Tamil Nadu Government | 8.27% | 11-08-2015 | 12-08-2025 |

8.26% Maharashtra SDL 2025 | Maharashtra Government | 8.26% | 12-08-2015 | 12-08-2025 |

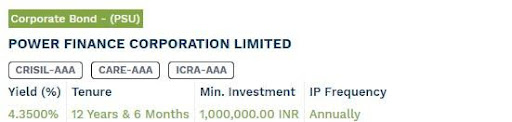

3. Public Sector Bonds

Like central and state governments, even public sector units (PSUs) can raise funds from the general public by issuing bonds known as Public Sector Bonds. These bonds are mostly issued by top public sector companies or institutions to fund their growth and expansion needs. They are relatively less risky than corporate bonds.

The table below shows some of the public sector bonds currently in circulation –

Public Sector Bonds | Issuing Entity | Coupon Rate | Face Value | Credit rating |

Power Grid Corporation of India Ltd 8.84% | 8.84% | Rs 12.50 lakhs | AAA | |

National Highway Authority of India Ltd 7.04% | National Highway Authority of India Ltd | 7.04% | Rs 1,000 | AAA |

Indian Railways Finance Corporation 8.65% | 8.65% | Rs 10 lakhs | AAA | |

Himachal Pradesh State Electricity Board Ltd. 10.39% | Himachal Pradesh State Electricity Board Ltd | 10.39% | Rs 10 lakhs | Sovereign |

4. Corporate Bonds

Corporate bonds are issued by private companies. They represent a large portion of the bond market in India. By issuing corporate bonds, companies can raise capital at a low cost. This is better than issuing fresh shares as there is no dilution of equity capital. Since they carry higher risk of default, corporate bonds generally pay higher coupon compared to government bonds. In addition to credit risk, corporate bonds also carry inflation risk and reinvestment risk.

The table below shows a few corporate bonds currently in circulation.

Corporate Bond | Issuing Company | Coupon Rate | Credit Rating |

Fullerton India Credit Company Ltd 10.50% | Fullerton India Credit Company Ltd | 10.50% | AAA |

Coastal Gujarat Power Ltd 9.70% | Coastal Gujarat Power Ltd | 9.70% | AA |

Torrent Power Ltd 8.95% | 8.95% | AA- |

Corporate bonds are further divided into:

- Convertible bonds: These bonds can be converted into equity shares in a certain ratio. For example, if a bond has a conversion ratio of 2:1, then you will get two equity shares in exchange for one bond on maturity

- Non-convertible bonds: These bonds cannot be converted into equity shares. On maturity, the principal is paid back to the bondholder and the transaction is complete.

Types of Bonds Based on Coupon or Interest

a. Fixed rate bond: These bonds pay fixed coupon rates throughout their tenure.

b. Floating rate bond: These bonds have fluctuating coupon rates and the interest income changes at regular intervals.

c. Zero coupon bond: Zero coupon bonds do not pay coupon (interest). Instead, they are issued at a discount to their face value and redeemed at par. The difference between the two prices is the investors profit. For example, a bond is issued at Rs 80 and redeemed at Rs 100. The difference of Rs 20 is the bondholder’s profit.

d. Inflation indexed bond: These bonds are the ones in which the principal amount and the interest payment is linked to inflation in the economy. They help you earn positive real rate of return.

Types of Bonds Based on Call and Put Options

- Callable Bonds: These bonds have a clause wherein the issuer can repurchase the bond from the investor before the maturity date. This is usually done by the borrower to refinance high debt.

- Puttable Bonds: In these bonds, the investors can sell or surrender their bonds to the borrower before the maturity date. This is usually done when an investor is unable to sell the bond in the secondary market.

Types of Bonds Based on Taxation

a. Tax-free bonds: These are issued by government entities to raise funds for an upcoming project. Some of the popular tax-free bonds are issued by:

- National Highways Association of India (NHAI)

- Indian Railways Finance Corporation (IRFC)

- Rural Electrification Corporation (REC)

The interest earned on tax-free bonds is exempt per section 10 of the Income Tax Act of India, 1961.

b. RBI Bonds (Floating Rate Saving Bonds): These are issued by the Reserve Bank of India (RBI) and are also known as RBI taxable bonds. They come with a maturity period of seven years and interest rate keeps fluctuating every six months. You can invest in these bonds with as low as Rs 1,000 and there is no maximum limit on investments. Interest received from these bonds will be taxed as per your income slab.

Another popular type of bond in India is Sovereign Gold Bond (SGBs). They are issued by the central government of India for those who wish to invest in gold. The bond pays fixed 2.5% annual interest and comes with a maturity period of eight years.

[Read More: Sovereign Gold Bonds Scheme – A Complete Guide]

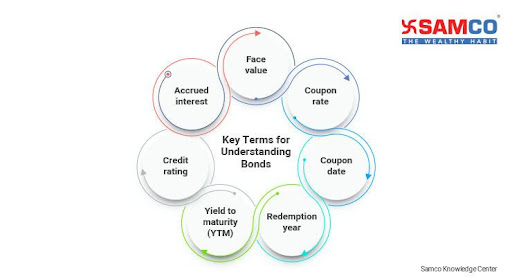

Important Terms to Understand Bonds

1. Face value: This is the price of a bond at the time of issue on which interest is calculated. The face value of a bond can vary between Rs 1,000 to Rs 1 crore.

Bond | Face Value |

Mahindra & Mahindra Financial Services Ltd 7.95% Bond | Rs 1,000 |

Sp. Jammu Udhampur Highway Ltd 9.15% Bond | Rs 10 lakhs. |

2. Coupon rate: It is the rate of interest paid on the bond’s face value. It can be paid annually or semi-annually.

3. Coupon date: This is the date on which investors receive coupon payments.

4. Redemption year: It is the maturity year of the bond. On maturity, bonds can be redeemed on par or premium.

a. Redemption at par: When the redemption price is equal to the face value, the bond is said to be redeemed at par.

b. Redemption at premium: When the redemption price is more than the face value, the bond is said to be redeemed at a premium. For example, if a Rs 100 bond is redeemed for Rs 115, then Rs 15 is the premium.

5. Yield to maturity (YTM): It is the total expected return for an investor if the bond is held till maturity. The YTM of a bond keeps on changing as per your purchase price in the secondary markets. How? Let’s understand this with an example.

Formula to calculate yield: YTM = Coupon rate / Bond price

Suppose there is a bond with a face value of Rs 1,000 and the coupon rate is 10%. How much coupon will you earn on this bond? The answer is Rs 100 (10% of Rs 1,000).

Scenario 1: The bond is trading at a discount in the secondary market.

Assume that the price of the bond in the secondary market is Rs 800. So, the bond is trading at a discount of Rs 200 to its face value.

Note: The coupon rate remains constant and is always calculated on the face value of the bond. So, no matter at what price the bond is trading at, the coupon will remain Rs 100.

So now how much yield will the bond provide?

YTM = Coupon rate / Bond price

= Rs 100 / Rs 800)

= 12.50%

Scenario 2: The bond is trading at a premium in the secondary market

Now assume that the price of the bond went from Rs 800 to Rs 1,200. We can now say that the bond is trading at a premium of Rs 200 to its face value. How much yield will the bond provide now?

YTM = Coupon amount / Bond price

= Rs 100 / Rs 1200

=8.33%

This brings us to the relationship between bond yields and bond prices.

- When the price of a bond increases, bond yield falls.

- When the price of a bond decreases, bond yield rises.

So, the YTM keeps fluctuating depending on the price at which you have purchased the bond.

Let’s take a real-life example. The below bond is of Hindustan Petroleum Corporation Limited (HPCL) – Mittal Energy Ltd. It was issued in February 2020 at a coupon rate of 9.18%.

Today this same bond is trading at a premium and hence the yield is 8.33% and not the original 9.18

Source: thefixedincome.com

5. Credit rating

All bonds receive ratings from independent credit rating agencies. The ratings are based on factors such as –

- creditworthiness of the borrower

- present and expected cash flow

- borrowing and repayment history of the issuer

- performance of the business etc.

The credit rating given to bonds ranges from AAA (highest safety) to D (junk bonds). Here is the Investment Information and Credit Rating Agency of India (ICRAs) long term rating scale.

Ratings | Risk |

AAA | Low credit risk and highest degree of safety |

AA | Low credit risk and a high degree of safety |

A | Low credit risk and adequate degree of safety |

BBB | Moderate credit risk and a moderate degree of safety |

BB | Moderate risk of default |

B | High risk of default |

C | Very high risk of default |

D | The security has already defaulted or is expected to default soon |

Please note: Credit rating agencies use modifiers such as + (plus) or – (minus). It indicates their relative position within the rating categories. Thus, the rating of AA+ is one notch higher than AA, while AA- is one notch lower than AA.

The credit rating of a bond largely affects its coupon rate. If the issuer of the bond has a low credit rating, then the default risk is high. Hence, these bonds pay higher coupon rate to compensate investors for the high risk. If the issuer of the bond has a AAA credit rating, then the default risk is low. Hence, these bonds pay lower coupons.

These are some of the basics of bonds that you must know. Let us now move ahead and understand the effect of price fluctuations and how to invest in bonds through the secondary market.

How Price Fluctuations Affect the Purchase Price of Bonds in The Secondary Markets

Example of Primary Markets

Let’s say that on 18th February 2021, Mr Roy invests Rs. 1 Lakh in a 10-year bond that pays him 12% coupon annually. This means that he will get Rs 12,000 per year for 10 years until maturity. Now Mr Roy has directly bought this bond from the issuer.

But what if Mr Roy couldn’t buy this bond from the issuer? Can he still invest in this bond? The answer is yes. Like shares, even bonds are traded in the secondary market.

Example of Secondary Market

On 24th April 2021, Mr Roy invests in the same bond through the secondary market. Here are the bond details:

- Bond Issue Date: 18 Feb 2021

- Bond Maturity Date: 18 Feb 2030

- Bond Face Value (Value of one bond): Rs 1,00,000

- Coupon Rate: 12.00% (Interest will be paid on 18th February annually till maturity)

Scenario 1: The price of the bond in the secondary market is Rs 1,00,500.

Since the bond is trading at a premium, its YTM will fall from 12% to 11.94% (12,000/1,00,500). Now, Mr Roy has to pay the principal amount plus accrued interest of Rs 2,169 (calculation shown below). This accrued interest is the holding period interest payable to the seller of the bond. So, the total amount payable to the seller is Rs 1,02,669 (Principal value plus accrued interest).

Scenario 2: The price of the bond in the secondary market is Rs 99,500.

As the bond is trading at a discount, its YTM will increase from 12% to 12.06% (12,000/99,500). Now, Mr Roy has to pay the principal amount plus accrued interest of Rs 2,169 to the seller. So, the total amount payable to the seller is Rs 1,01,669. (Principal value plus accrued interest).

In both primary and secondary market, Mr Roy will get an annual interest payment of Rs. 12,000 every year on 18th February till the maturity of the bond. On maturity, he will get back his principal of Rs 1,00,000 along with that year’s interest. The only difference in buying bonds from the secondary market is the addition of accrued interest.

What is Accrued Interest?

If a bondholder sells his bond in the secondary market before the next interest payment, then the buyer has to pay the estimated interest amount to the seller. This amount is called accrued interest. The bond issuer is not involved in this process. The accrued interest is added to the market price of the bond. Hence, a bond will always cost more than the quoted price in the secondary market.

Why Does the Buyer Pay Accrued Interest?

This is because only the bondholder on record will receive the next interest payment. But the former bondholder had held the bond for a certain period. Hence, he needs to be compensated for his original ownership. The buyer of the bond will pay the accrued interest to the seller on top of the price of the bond during the sale. The buyer is then reimbursed at the next coupon date as he will receive a full interest payment even though he had only held the bond for a small period of time.

How is Accrued Interest Calculated?

Number of days = 24 April 2021 – 18 February 2021

= 66 days

Now, calculate interest on principal value:

= (Face value* coupon rate/100) *(No. of days/365)

= (1,00,000*12.00/100)*(66/365)

= Rs 2,169

Advantages of Investing in Bonds – Why Should you Invest in Bonds?

Advantages of Bonds to Investors (bond holders)

- Investors receive regular fixed income.

- The interest paid on bonds is higher than fixed deposits.

- Bonds are less volatile compared to stocks.

- As bonds are liquid, you can easily sell them in the secondary markets.

- Bond holders are creditors of the company. Hence, they will be paid before equity shareholders and debenture holders.

- Selected bonds provide tax-free returns to bondholders.

Advantages of Bonds to the Issuing Company (Borrower)

- Bonds are a cheaper source of finance compared to bank loans. Companies end up paying as high as 12-14% on bank loans. But by issuing bonds, companies can raise finance at 8-9%.

- Bondholders do not get voting rights. Hence, it does not dilute the control of the management.

Disadvantages of Investing in Bonds

Disadvantages of Bonds to Investors

- If you buy a bond from the secondary market at a premium, then your YTM will be less.

- If the financial condition of the company is not good, then finding buyers for the bond in the secondary markets is difficult.

- Bonds are less liquid compared to stocks.

Disadvantages of Bonds to the Issuing Company

- Repayment of principal amount and coupon are legal obligations of a company. Hence, a bond is a financial burden on the company.

- The credit rating of the company is highly affected if the company defaults on its payments.

- Bonds are issued against collateral such as factory building or any other asset. So, the asset is mortgaged till the principal amount is repaid. Hence, it restricts the company from selling the mortgaged asset.

Now that you understand the advantages and disadvantages of bonds, let us look at the risks in bonds.

Risks in Bonds

Contrary to popular beliefs, bonds are not risk-free. The six main types of risks in bonds is –

- Credit or Default risk

- Interest rate risk

- Reinvestment risk

- Inflation risk

- Call Risk

- Liquidity risk

Credit risk is when the issuer of the bond (the borrower) is unable to repay the principal amount or make coupon payments. There is a direct relationship between credit risk and coupon rates. A bond with high credit risk will generally pay higher coupon rate to attract investors. Generally, privately-issued corporate bonds carry high credit risk while government bonds have very low credit risk.

Interest rate risk is an in-built aspect of investing in bonds. Bond prices and interest rates have an inverse relationship. When interest rates are high, bond prices fall as newer, higher interest paying bonds become more attractive. The best way to manage interest rate risk is by investing in floating rate funds.

Reinvestment risk happens when the interest rates in the market are lower than the bond’s coupon rate. For example, suppose a bond pays a coupon of 6%. You decide to reinvest this coupon in a bank deposit. But the bank is offering you 5% interest rate. This loss of 1% interest is known as reinvestment risk.

Inflation risk is when the purchasing power of a bond falls. So, the income you derive from the bond via coupon will buy fewer goods than before. This risk can be diversified by investing in inflation-indexed bonds or equity instruments.

Call risk is when the bond issuer buys back or calls the bond before the maturity date. This is usually done when interest rates fall. For example, suppose ABC Ltd issued 8% bond for 10 years. After 6 years, the interest rate in the market falls to 6%. In case of a callable bond, ABC Ltd. will call (buy back) this bond as it can issue cheaper bonds in the market.

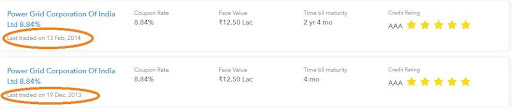

Liquidity risk is when you are unable to sell your bond in the secondary market without a loss in value. Bonds like Power Grid Corporation of India Ltd pay high coupon rates but these bonds haven’t been traded in the last six-seven years. So, exiting such bonds is difficult for retail investors due to low liquidity.

How are Bonds Taxed? – Taxation of Bonds

Bonds provide you both interest income and capital appreciation. However, both these incomes have different tax implications.

- The interest you earn from bonds is credited to your bank account and is considered as income from other sources. So, tax is applicable as per your income tax slab.

- On the other hand, the growth in the price of bonds is considered as capital gains.

- If you sell the bond after a year but before maturity, then you are eligible to pay long term capital gains (LTCG) at 20% with indexation.

- If you sell the bond before a year in the secondary market, then you have to pay short term capital gains (STCG) is as per your tax slab.

- Tax free bonds are exempt from tax.

Alternatives to Investing in Bonds – Debt Mutual Funds

While the Indian debt market is open to retail investors, investing in bonds is not that simple. There are various hurdles like –

- The secondary bond market is fairly illiquid. Some bonds go without a single trade for months. For example, Power Grid Corporation of India Ltd 8.84% bond was issued on 29th March 2010. But liquidity in the bond is so low that it was last traded on 13th February 2014, which is nearly seven years ago! Hence, liquidity or trading in bonds is restricted compared to shares.

- Another problem is affordability of the bonds. A majority of the bonds issued by corporations or the government have very high face value. For example, the face value of Himachal Pradesh State Electricity Board Ltd. 10.39% bond is Rs 10 Lakhs. A retail investor might not have such high capital to invest and will have to forego a 10.39% coupon.

But there is a one-stop-solution to all these hurdles – Debt mutual fund. A debt mutual fund is a mutual fund scheme that invests 65% of its corpus in fixed income instruments such as corporate, government bonds, money market instruments etc. With debt mutual funds retail investors get benefits like –

- In case of a debt mutual fund, investors do not have to worry about liquidity. The fund will buy back units whenever the unitholder wants to redeem them.

- In a debt mutual fund, you do not need a huge capital to start. You can start with as little as Rs 500-Rs 1,000 via a systematic investment plan.

- Debt mutual funds are managed by expert fund managers who monitor and adjust the portfolio in line with the interest rate cycle. For example, when interest rates are falling, your fund manager will shift to long-term bonds.

- And finally, you get ample diversification when you invest in debt mutual funds. This is because your fund manager will not invest 100% in just one bond. He will spread the corpus to reduce interest rate risks and increase overall returns.

Here’s a list of the best debt funds in 2021.

List of Best Debt Funds for 2021

Fund | Star rating | 1-Year Return | 3-Year Return | 5-Year Return | Expense Ratio |

4 Star | 4.47% | 8.25% | 7.05% | 1.16% | |

IDFC Government Securities Fund – Constant Maturity Plan -regular Plan-growth | 5 Star | 3.35% | 11.85% | 9.63% | 0.62% |

4 Star | 4.01% | 4.38% | 5.09% | 0.43% | |

Nippon India Banking and PSU Debt Fund – Growth Plan-growth Option | 3 Star | 4.79% | 9.14% | 7.64% | 0.79% |

3 Star | 6.74% | 8.58% | 7.19% | 1.31% | |

4 Star | 5.66% | 9.83% | 6.85% | 0.80% | |

5 Star | 1.18% | 9.34% | 7.01% | 2.00% |

*This is simply a list of best debt funds. This is not an investment advice. *Data as on 11th October 2021

Who Should Invest in Bonds?

Bonds are not just for risk averse investors or retired individuals. Every investor must invest in good quality bonds. This will help them offset the high risk of equities. However, the allocation of bonds in the portfolio should be based on your risk profile and time horizon. Investors could also use the 100 minus your age rule to figure out their equity-bond allocation.

- Retirees or senior citizens can hold 50% of their portfolio in bonds.

- Investors in the 25-40 age group, can invest 20%-30% in bonds and the balance in equities.

To invest in bonds with India’s best discount broker, open a FREE Samco Demat account today. If you want to diversify your investment and prefer debt mutual funds, then RankMF is your ideal partner. Samco’s RankMF rates and ranks all mutual funds in India and gives the most honest answer to Kaunsa mutual fund sahi hai! So, open a FREE Samco Demat account and get free access to RankMF and invest in the best debt funds in 2021.

Easy & quick

Easy & quick

Leave A Comment?