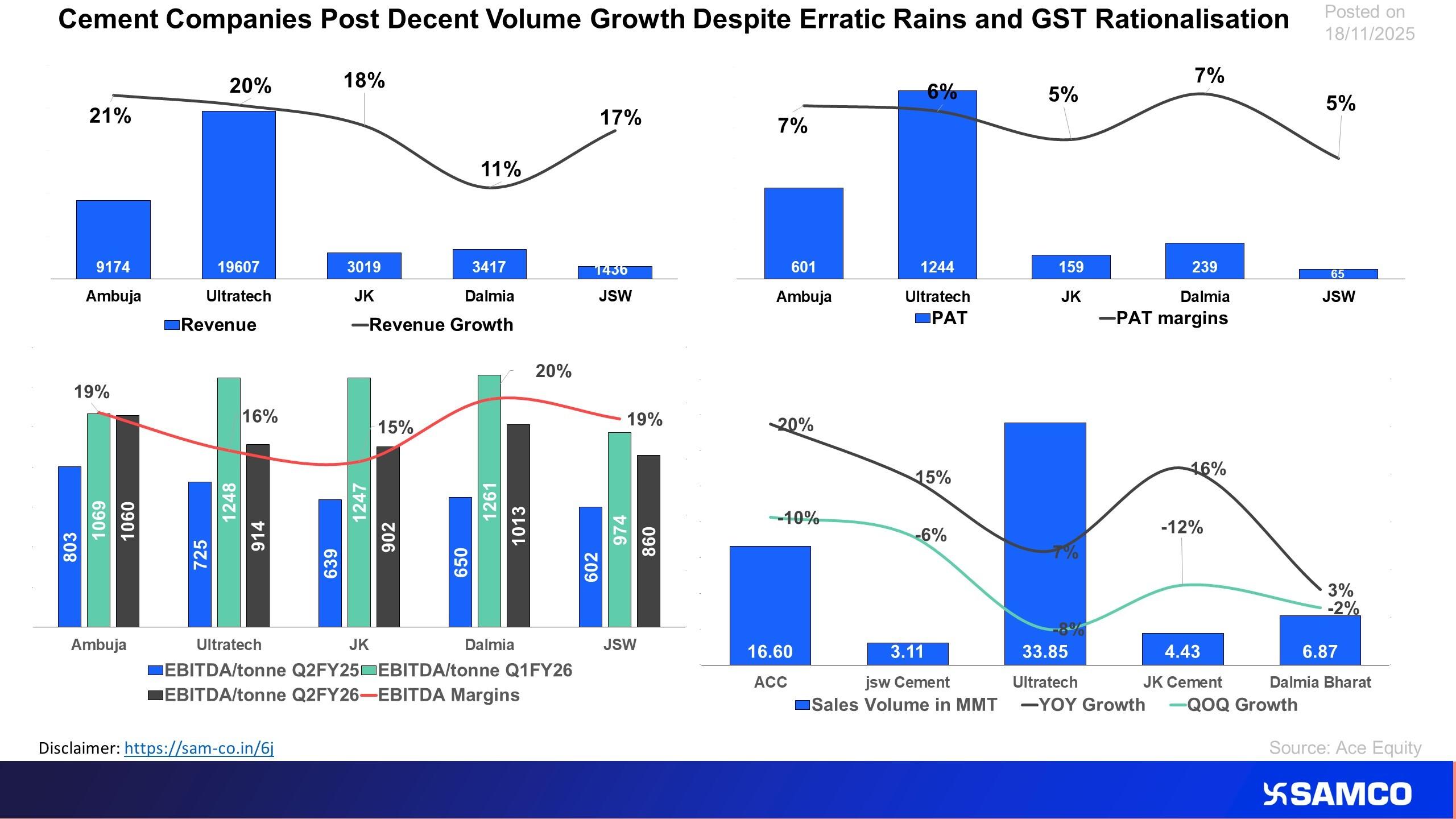

The cement sector delivered steady performance despite multiple near-term challenges, including unseasonal rains, softening cement prices, and the deferral of purchases ahead of GST rate rationalisation. While price moderation impacted quarterly realisations, companies still posted meaningful year-on-year (YoY) volume growth, signalling healthy underlying demand.

Cement Prices Ease After Q1 Surge

After witnessing a sharp surge in Q1FY26, cement prices softened across India as regional rates stabilised. This price correction, combined with buyers postponing purchases in anticipation of GST changes, led to muted QoQ realisations for most companies.

However, despite the temporary slowdown, pan-India demand remained intact, cushioned by infrastructure activity and pre-festive construction momentum.

Volume Growth Resilient Despite Rains

Unseasonal and erratic rains impacted construction activity in several states, which typically dampens near-term cement demand.

Even so, the sector managed to deliver positive YoY sales volume growth, as illustrated in the chart. UltraTech, Dalmia Bharat, ACC, and certain regional players posted strong YoY volume performance driven by:

- Demand recovery in rural and tier-II/III markets

- Pre-emptive restocking by dealers

- Steady infrastructure and housing activity

EBITDA/Tonne Softens QoQ but Improves YoY

The sector’s EBITDA/tonne metrics reflected the effect of stabilising cement prices:

- QoQ EBITDA/tonne declined for most companies due to lower realisations.

- YoY EBITDA/tonne improved, supported by higher volumes, better cost efficiencies, and lower fuel costs compared to the previous year.

Despite a QoQ decline in profitability, companies reported YoY EBITDA growth, indicating stronger operational leverage and improved cost structures compared with last year.

Capacity Expansion Continues at a Robust Pace

Capacity addition remains a major theme in the cement industry. Leading players, including UltraTech, JK Cement, Dalmia Bharat, and JSW, are aggressively expanding capacity to capture long-term demand from:

- Government infrastructure projects

- Affordable housing push

- Commercial real estate revival

Most listed cement manufacturers have outlined multi-year expansion plans, aiming for significant capacity increases over the next three years.

Overall Sector View

Despite short-term headwinds from rains and price stabilisation, the cement sector continues to exhibit:

- Healthy YoY volume growth

- Recovering margins on a YoY basis

- Strong capex and expansion momentum

- Stable long-term demand drivers

The near-term weakness in realisations appears temporary, while the sector's overall structural outlook remains constructive.

Easy & quick

Easy & quick

Leave A Comment?