Indian Renewable Energy Development Agency Ltd. (IREDA) saw a sharp 5% decline in its stock price following the announcement of its Q1FY26 results. While the company delivered substantial revenue and net worth growth, concerns surrounding asset quality and rising NPAs weighed heavily on investor sentiment.

Q1FY26 Performance Highlights

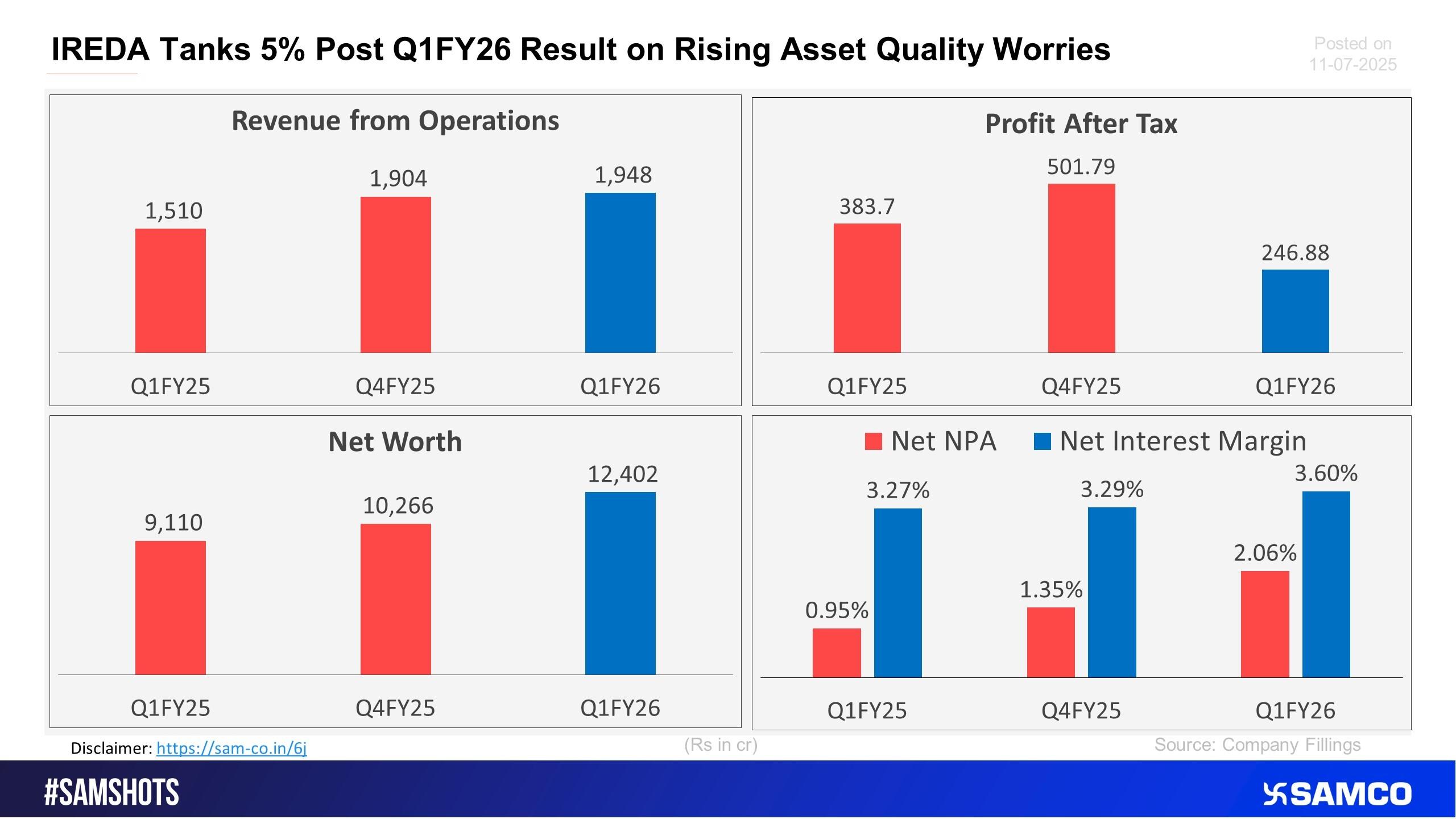

Financial Metric | Q1FY25 | Q4FY25 | Q1FY26 |

Revenue from Operations | ₹1,510 Cr | ₹1,904 Cr | ₹1,948 Cr |

Profit After Tax (PAT) | ₹383.7 Cr | ₹501.79 Cr | ₹246.88 Cr |

Net Worth | ₹9,110 Cr | ₹10,266 Cr | ₹12,402 Cr |

Net NPA | 0.95% | 1.35% | 2.06% |

Net Interest Margin (NIM) | 3.27% | 3.29% | 3.60% |

Strong Revenue & Net Worth Growth

IREDA's revenue rose to ₹1,948 Crore in Q1FY26, up 2.28% sequentially and 28.96% YoY. This growth signals continued expansion in the renewable energy lending space. The company's Net Worth also surged to ₹12,402 Crore, representing a YoY increase of 36.14% and a 20.81% rise over the previous quarter. This reflects a strong capital position and balance sheet resilience.

PAT Slumps on Asset Quality Pressure

Despite strong top-line growth, Profit After Tax fell sharply by 50.8% QoQ and 35.66% YoY, landing at ₹246.88 Crore. This was mainly attributed to elevated provisioning and impairment losses arising from the downgrade of key borrower accounts, specifically M/s GEL and M/s Gensol EV Lease Pvt. Ltd.—into the NPA bucket.

Net NPA Doubles, Raising Red Flags

One of the most pressing concerns is the steep rise in the Net NPA ratio, which jumped from 0.95% to 2.06% YoY. This deterioration in asset quality has shaken investor confidence, especially as the lending book expands. Although the Net Interest Margin (NIM) improved to 3.60%, indicating robust income generation, the rising NPAs could erode profitability if left unchecked.

Cost of Funds Improves, But Risk Lingers

On a positive note, IREDA's cost of borrowing decreased to 7.4% in Q1 FY26 from 7.61% a year ago, reflecting improved funding efficiency. This, along with stable spreads, helped sustain a healthy NIM even amid credit pressure.

Outlook: Focus on Asset Quality Is Key

IREDA's Q1FY26 performance tells a mixed story:

- ✅ Revenue growth and NIM strength remain promising.

- ❌ Asset quality and declining profitability are rising concerns.

In the future, IREDA will need to tighten borrower monitoring and enhance credit risk frameworks to restore investor confidence. While top-line growth reflects business momentum, long-term success will hinge on managing delinquencies and protecting margins.

Bottom Line:

The Q1 FY26 result reaffirms IREDA's operational scalability, but the sharp drop in profits and rising NPAs make it clear that the road ahead will demand strong risk management and sharper underwriting discipline.

Easy & quick

Easy & quick

Leave A Comment?