These Terms of Use govern the usage of services of the GTT Feature. By agreeing to use this GTT Feature terms, you agree to have read and understood these clauses, conditions, the modalities of how the GTT Feature clearly works, and Samco Securities’ policies, procedures and risk disclosure documents.

Definitions

1.1 “Good Till Trigger Feature” or “GTT Feature” shall be defined as per Clause 2.

1.2 “Last Traded Price” or “LTP” is the last traded price at which a stock/scrip was traded on the Exchange.

1.3 “Limit Order” or limit order shall be defined as per the NSE “Order Conditions” which can be found here. As per NSE, a Limit Order shall mean “an order that allows the price to be specified while entering the order into the system.”

1.4 “RMS” or “Risk Management System” is the system in place at Samco Securities which monitors all positions of Samco Securities clients on a real time basis and sees to it that clients maintain margins with respect to all positions/positional trades & that Samco Securities maintains margins at a broker/trading member level with the clearing houses. The RMS also constantly vets each order, on a pre-trade basis, placed by a client towards the exchanges to see whether the order is as per Samco Securities’ risk management policies and procedures, and whether the client has placed such order with sufficient cash balances, holdings and as per the rules set by Samco Securities and the Exchanges. The RMS continuously enforces Samco Securities’ terms, policies & procedures, by enforcing limits of margins/squaring off positions with respect to each client, as per the risk management policies followed by Samco Securities. You, as a client, are required to always be updated with Samco Securities’ risk management policies, terms, and procedures.

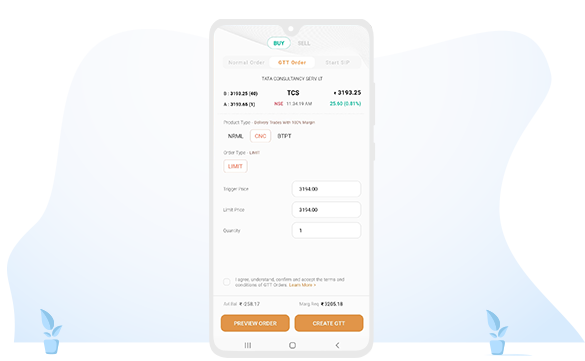

1.5 “Trigger Condition” shall mean the criteria and conditions entered by You, which if met, the corresponding limit order entered by you will be placed on the exchange. The below set of conditions, not being limited to, are required to be selected by You:

A Trigger Price (defined as per Clause 1.6)

A Limit Price: the price selected by you, which places a limit order at the price selected by you after the Trigger Price is met or breached.

Type of order: You will be able to select only limit order as a type of order for your using the GTT Feature.

1.6 “Trigger Price” shall mean the price entered by you to trigger a limit order and place it on the exchange while using the GTT feature. This price selected by You may either be:

- The price used to trigger a buy order in case it is being placed for stock/scrips that are not in Your current existing holdings;

- The price used to trigger a selling/target order in case it is being placed at a higher price than the current market price, for stock/scrips that are already existing in your current holdings;

- The price used to trigger a selling/stop-loss order in case it is being placed at a lower price than the current market price, for stock/scrips that already exist in your current holdings.

- All prices entered by You for Your Trigger Price shall be tracked against the Last Traded Price (LTP) of the stock/scrip.

1.7 “You” or “Your” or “Yourself” shall mean you, the client, having a trading and demat account i.e. a Client ID, with Samco Securities and using the GTT Feature placement services from your trading account terminal through either StockNote Web or the StockNote Mobile Application.

Read more

Easy & quick

Easy & quick