Very true. Back in the 1990s, a movie ticket would barely cost you Rs 30. While today you need to pay Rs 500 to Rs 700 or sometimes even Rs 1,000 per ticket. That is an insane rise in prices.

But have you ever wondered what makes the prices of goods and services rise?

Well, this is the effect of inflation.

In this article:

Very true. Back in the 1990s, a movie ticket would barely cost you Rs 30. While today you need to pay Rs 500 to Rs 700 or sometimes even Rs 1,000 per ticket. That is an insane rise in prices.

But have you ever wondered what makes the prices of goods and services rise?

Well, this is the effect of inflation.

In this article:

- What is inflation?

- What causes inflation?

- How is inflation measured?

- Effect of inflation on your investment

- What are real returns?

- Which investment option can help you earn inflation-beating returns?

What Is Inflation?

Inflation is the increase in the prices of goods and services over a period of time. It is commonly referred to as mehangai in Hindi. As prices of goods rise, you have to spend more to buy the same goods. For example,- The cost of 1 Litre petrol was Rs 9.84 in 1990. Today, it is Rs 99.14.

- 1 kg of wheat grains used to cost Rs 2.35 in 1990. It costs Rs 40 in 2021.

- 1 kg toor dal would cost Rs 8 in 1990. It costs Rs 150 in 2021.

What Causes Inflation?

1. Increased money supply

Let's take the example of the famous oil-rich country Venezuela. Almost 90% of the country’s income was generated by exporting oil. But oil prices crashed in 2014. The country found itself in the midst of an economic crises. Bolivar which is Venezuela’s currency became worthless. As the government was falling short of cash, they started printing more money. Bolivar fell rapidly due to increase in its supply. This caused the prices of goods and services to increase further. This caused hyperinflation.2. National Debt

If the country has more debt, then inflation is likely to occur. In case of Venezuela's economy, the country’s government kept printing more notes to pay off their debt. This continuous printing led to hyperinflation and the cost of goods rose by 6,500% every year.3. Cost-Push Inflation

Cost-push inflation only occurs when input or raw materials costs rise. This increases the cost of production. This happens when the company is spending more on buying raw materials. In order to preserve their profitability, they pass the increased production cost to the customer in the form of the increased prices. This is one of the most visible inflationary forces.4. Demand-Pull Inflation

Demand-pull inflation occurs when there is high demand but less supply of goods in an economy. It leads to a quick rise in prices. An example of this is the soaring prices of onions and toor dal a few years ago.How Is Inflation Measured?

In India, inflation is measured by two main indices.- Wholesale Price Index (WPI)

- Consumer Price Index (CPI)

| Food Items | Non-Food Items | Manufactured Goods |

| Cereals, Pulses, Vegetables, Fruits, Milk, Eggs, Meat & Fish, etc. | Oil Seeds, Minerals and Crude Petroleum | Textiles, Apparels, Paper, Chemicals, Plastic, Cement, Metals, and more. |

Effect of Inflation on Your Investment

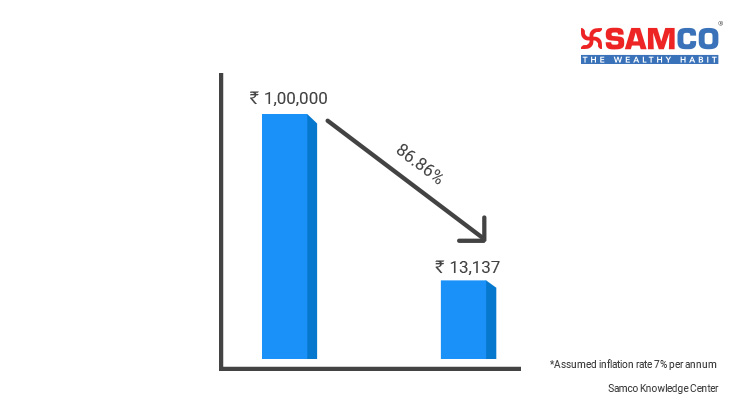

You must have heard a lot about how power of compounding works. But have you heard of decompound interest? If not, let’s explore more about it. Decompound interest is the opposite of compound interest. In compound interest, your money compounds every year over the previous year’s returns. Similarly, inflation occurs every year on top of the previous year’s inflation. It means that the effect of inflation on investment is just like compounding. So what you earn from compounding your investment, inflation takes it away. This is the effect of decompounding. Let’s take a simple example. Suppose you have invested Rs 1 lakh for 10 years in an investment option which provides 7% returns annually. At the same time, the inflation rate of the economy is also 7% per annum. Here, the amount you earn every year is equal to the inflation rate. So, even if your investment corpus increases, it doesn’t add value. It simply means that the things you could buy today for Rs 1,00,000 will cost you Rs 1,97,000 after 10 years. So, practically you haven’t become any richer. Now let’s take another example. Suppose you don’t believe in investing. And you have Rs 1 lakh in your locker. Let’s see how inflation erodes the value of your money in the upcoming years if the inflation rate is 7%.| Year | Amount |

| Start | Rs 1,00,000 |

| 10 | Rs 50,835 |

| 20 | Rs 25,842 |

| 30 | Rs 13,137 |

You can notice your Rs 1 lakh will be worth only Rs 13,137 after 30 years. That means your money is losing value every minute. Hence, there is a need to invest in assets which can provide inflation beating returns.

How does all of these affect your investment?

You can notice your Rs 1 lakh will be worth only Rs 13,137 after 30 years. That means your money is losing value every minute. Hence, there is a need to invest in assets which can provide inflation beating returns.

How does all of these affect your investment?

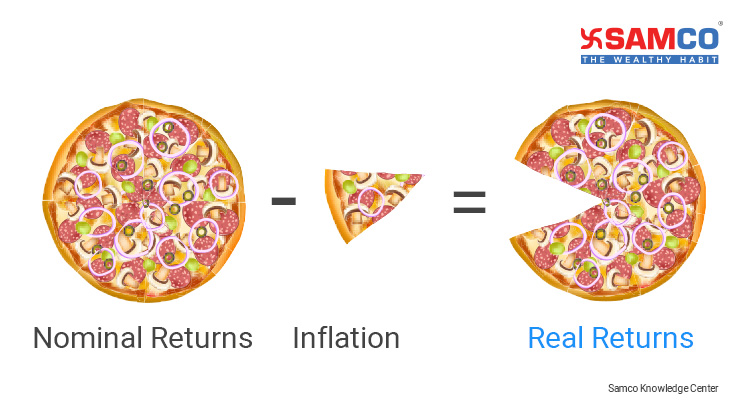

Let’s say you order a pizza. When the delivery man delivers it you notice that there’s a missing slice. This slice could be called inflation. It reduces your real returns.

So, the interest you expect to receive is your nominal return. Then inflation takes a bite from it and the leftover pizza is the real return that you will get.

Let’s say you are planning to retire in the next 30 years and your goal is to have an investment with a value of Rs 1 crore then you must plan with a bigger amount, say Rs 5 crore. Because in the next 30 years, the value of Rs 1 crore will be Rs 13 lakhs only assuming a conservative 7% inflation. Even the value of Rs 5 crores will be a mere 65 Lakhs!

Now you know why considering inflation is important for your investment.

But the question still remains - which is the investment option that can help you earn inflation beating returns?

Let’s say you order a pizza. When the delivery man delivers it you notice that there’s a missing slice. This slice could be called inflation. It reduces your real returns.

So, the interest you expect to receive is your nominal return. Then inflation takes a bite from it and the leftover pizza is the real return that you will get.

Let’s say you are planning to retire in the next 30 years and your goal is to have an investment with a value of Rs 1 crore then you must plan with a bigger amount, say Rs 5 crore. Because in the next 30 years, the value of Rs 1 crore will be Rs 13 lakhs only assuming a conservative 7% inflation. Even the value of Rs 5 crores will be a mere 65 Lakhs!

Now you know why considering inflation is important for your investment.

But the question still remains - which is the investment option that can help you earn inflation beating returns?

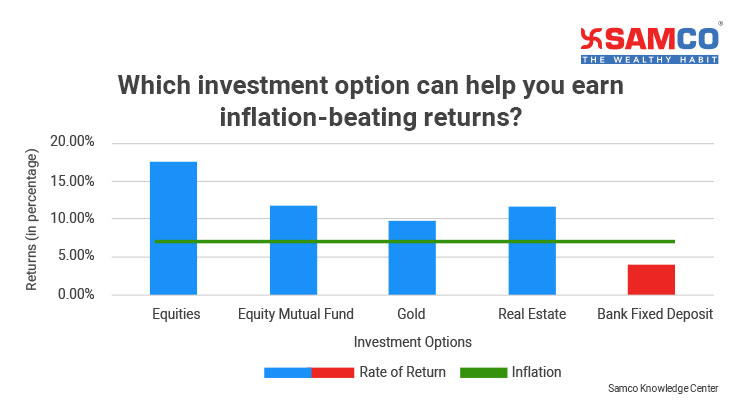

Which Investment Option Can Help You Earn Inflation-Beating Returns?

Sources: RBI website and NSE website

Sources: RBI website and NSE website

1. Equities

| Liquidity | High |

| Tenure | Long- term |

| Risk | High |

| Who can invest | If you want to invest for the long term and wish to earn high returns. |

| Risk-Reward ratio | High |

2. Equity Mutual Funds

| Liquidity | High |

| Tenure | Long term |

| Risk | Moderate |

| Who can invest | If you are looking for a long term investment option with moderate risk. |

| Risk-Reward ratio | High |

3. Gold

| Liquidity | High |

| Tenure | Long term |

| Risk | Low |

| Who can invest | If you wish to diversify your investment and want to hedge against inflation. |

| Risk-Reward ratio | High |

4. Real estate

| Liquidity | Low |

| Tenure | Long term |

| Risk | Moderate |

| Who can invest | Investors who invest with the view of future appreciation of the property. |

| Risk-Reward ratio | Depends on the location of the property. |

5. Bank Fixed Deposit

| Liquidity | High |

| Tenure | 7 days to 10 years (premature) |

| Risk | Low |

| Who can invest | If you have a lump sum amount to invest for a fixed period. |

| Risk/reward | Low |

Easy & quick

Easy & quick

Leave A Comment?