The FMCG/NIFTY ratio has once again moved into focus, as it retests a historically significant support zone. This development is drawing attention from market participants seeking sectoral rotation amid a consolidating broader market. With technical signals aligning alongside improving fundamentals, the setup suggests that FMCG stocks could be poised for relative outperformance against the Nifty 50 in the coming quarters.

Understanding the FMCG/NIFTY Ratio

The FMCG/NIFTY ratio compares the performance of the CNX FMCG Index against the NIFTY 50, offering insight into whether FMCG stocks are outperforming or underperforming the broader market.

- A rising ratio indicates FMCG outperformance.ce

- A falling ratio reflects relative underperformance.

Institutional investors widely track this ratio to identify mean reversion opportunities and defensive sector leadership.

Key Technical Observations

Retest of a Major Long-Term Support

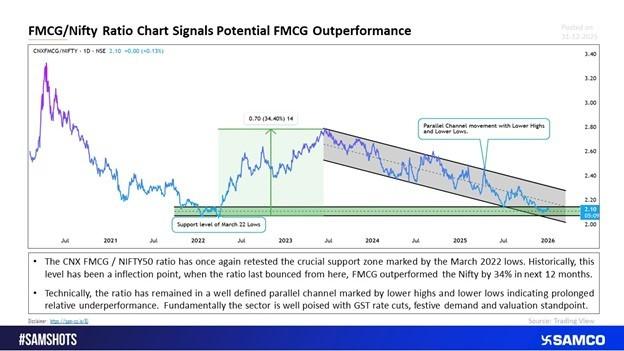

The FMCG/NIFTY ratio has once again approached the March 2022 low, a level that has historically acted as a strong inflexion point. When the ratio last rebounded from this zone, FMCG stocks outperformed the Nifty by nearly 34% over the following 12 months, highlighting the importance of this support area.

Prolonged Underperformance Signals Mean Reversion Potential

Technically, the ratio has been trading within a well-defined parallel channel, marked by lower highs and lower lows. This structure reflects an extended phase of relative underperformance by FMCG stocks. Such prolonged deviations often increase the probability of mean reversion, where leadership begins to rotate back toward the lagging sector.

The recent test of the lower boundary of this channel post mid-2025 strengthens the case for a potential trend reversal or at least a phase of relative stabilisation.

Fundamental Tailwinds Supporting FMCG Stocks

Valuations Have Normalised

After years of underperformance, FMCG valuations have moderated, making the sector more attractive on a risk-reward basis. Premium multiples that once capped upside have eased, creating room for re-rating if earnings growth improves.

GST Rationalisation Could Boost Consumption

Proposed GST rationalisation could act as a meaningful catalyst for the sector. Lower or simplified tax structures tend to:

- Improve affordability

- Stimulate demand in mass consumption categories

- Support volume-led growth

This is particularly beneficial for staples, where pricing sensitivity is high.

Early Signs of Volume Recovery

Recent data points indicate gradual improvement in volume growth, suggesting that demand conditions are stabilising after a prolonged slowdown. With rural demand showing tentative recovery and urban consumption holding steady, FMCG companies may benefit from operating leverage going forward.

Seasonal and Festive Demand Tailwinds

Historically, the second half of the year tends to favour FMCG earnings due to festive demand. Higher consumption during this period often translates into:

- Better revenue visibility

- Margin stability

- Improved earnings momentum

These seasonal factors further strengthen the case for FMCG outperformance.

What This Means for Investors?

From a sector rotation perspective, the current setup presents a compelling case for FMCG stocks:

- Technically, the ratio is at a long-term support zone

- Fundamentally, valuations and demand indicators are improving

- Macro and policy developments may act as additional catalysts

While the broader market remains range-bound, FMCG could emerge as a relative outperformer, especially during periods of heightened volatility or consolidation in cyclical sectors.

Risks to Monitor

Despite the constructive setup, investors should remain mindful of:

- Prolonged weakness in rural demand

- Unexpected input cost inflation

- Delays in policy implementation

A sustained breakdown below the historical support zone would weaken the outperformance thesis.

Conclusion

The FMCG/NIFTY ratio is once again at a critical juncture, where historical patterns, technical structure, and improving fundamentals are aligning. While this does not guarantee immediate outperformance, it significantly raises the probability of a relative recovery in FMCG stocks over the medium term.

For investors seeking stability, defensive positioning, and potential mean reversion gains, FMCG deserves close attention in the current market environment.

Easy & quick

Easy & quick

Leave A Comment?