In this article, we will discuss:

- Options BRO is a Game Changer: Here’s Why

- The Role of Market Insights in Creating Winning Options Trading Strategies

- Choose Samco to Build a Winning Options Strategy with Current Market Insights Easily

Are you one among the millions of options traders in India? In that case, how do you go about choosing the options strategies for your trades? If you’re like most retail participants in the F&O segment, you may be relying on simple (and often highly risky) strategies like writing naked calls — where the potential for losses is unlimited.

Needless to say, with such risky strategies, you may be making more losses than profits. Inadequate risk management is, in fact, one of the top reasons over 90% of F&O traders suffer losses in the markets.

So, how do you go about identifying winning options buying strategies or options selling strategies in a market that is constantly changing? At Samco Securities, we’ve created the answer for you. Say hello to Options BRO — our proprietary options strategy builder that’s integrated into the Samco trading app.

Options BRO is a Game Changer: Here’s Why

To identify the winning options buying strategy or options selling strategy at any given point of entry in the market, you need to evaluate various market insights like implied volatility, technical indicators, risk-reward ratios and return on investment (ROI). In addition to this, you need to analyse the options Greeks for the contracts you wish to trade in — like delta, gamma, theta and vega.

While these seem simple enough on paper, it’s practically impossible to manually analyse each of these insights in real-time — especially in a market segment that is often highly volatile. Here’s where Options BRO from the Samco trading platform is a game-changing new addition.

All you need to do is submit inputs about three key details:

- The scrip you want to trade in

- The expiry of that scrip, and

- Your market outlook, which may be bullish, bearish, neutral or volatile

Using these inputs, our options strategy builder does the humanly impossible in the span of one second and:

- Performs over 1.5 lakh mathematical computations

- Evaluates more than 2,000 options contracts

- Analyses over 1,000 options trading strategies

You then get recommendations for the top three strategies that align with your market view for the scrip you wish to trade in. But wait, there’s more! This comprehensive evaluation is also accompanied by strategy analysis, where the Options BRO feature in the Samco trading app rates and ranks each strategy on the basis of a wide range of current market insights.

Let’s take a closer look at why such market insights matter and how they can help you build a winning options trading strategy.

The Role of Market Insights in Creating Winning Options Trading Strategies

To build a winning options buying strategy or options selling strategy, it’s not enough to simply choose the scrip you want to trade in and pick a strategy that you found on the internet. Instead, it’s vital to assess a combination of factors — all of which are typically constantly changing.

Options BRO performs such manually impossible analysis automatically, leaving you free to focus on simply submitting your inputs as clearly as you can. The strategy builder in the Samco trading app then rates each potential strategy based on the following insights, which can make the difference between winning and losing trades in the F&O segment.

-

Implied Volatility

The Implied Volatility (IV) tells you how much the market expects the price of the underlying asset to move or fluctuate over the life of an options contract. This insight is important to identify winning options trading strategies because it affects the pricing of options, the risks associated with a position and the potential rewards. If the IV is high, it reflects that the market expects significant price swings in the underlying asset. This, in turn, leads to high options premiums.

The Samco strategy builder uses this information to choose the optimal options buying strategy. For instance, in the lead-up to a company's earnings announcement, if the implied volatility of an option is unusually high, it indicates possibly increasing volatility. So, Options BRO may suggest a long straddle strategy — aiming to help you profit from the expected volatility.

-

Option Greeks

Options Greeks measure how sensitive an option’s price is to different factors like the underlying asset’s price, time to expiry and more. The primary options Greeks that Options BRO evaluates include the following:

-

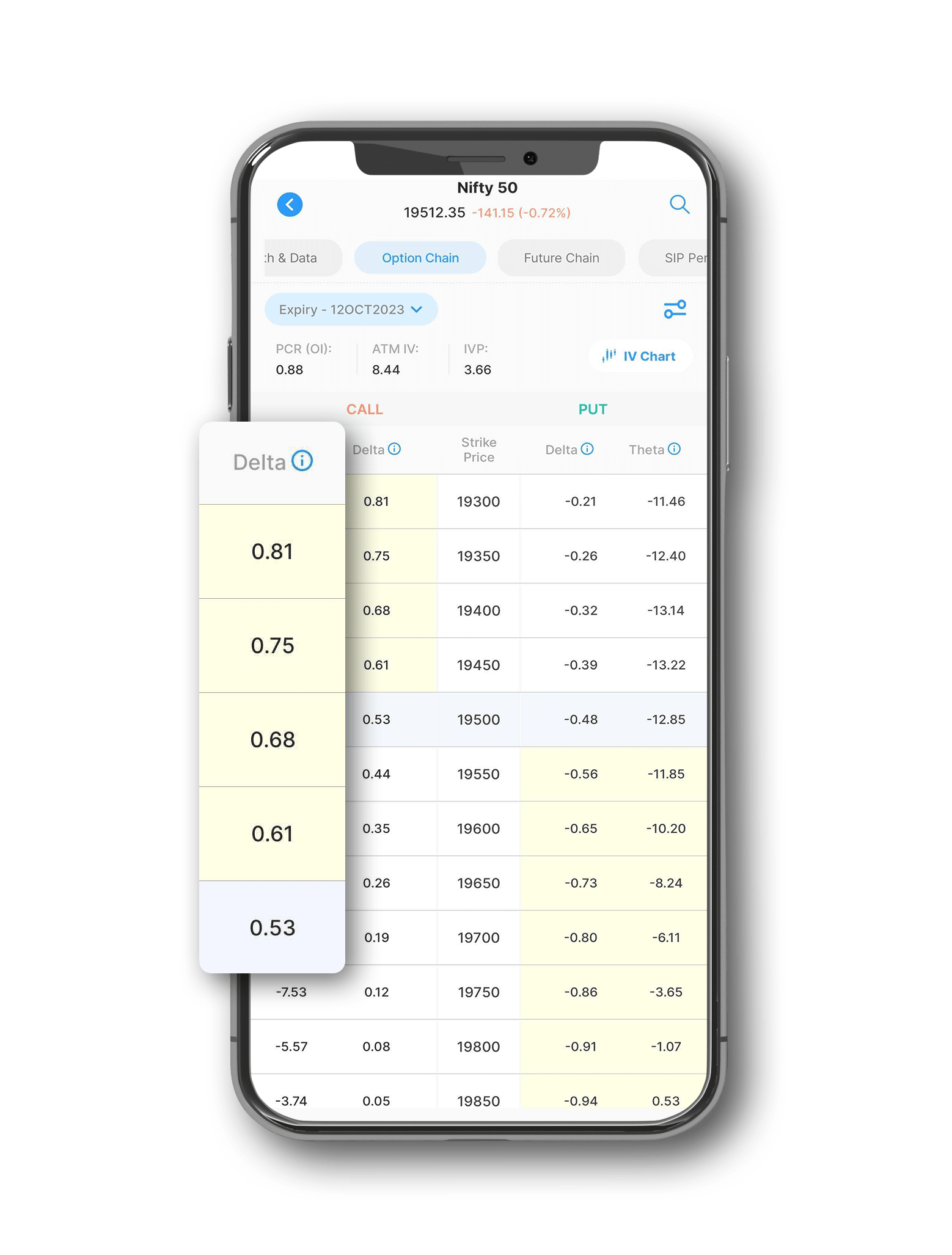

Delta

It measures how sensitive an option's price is to changes in the price of the underlying asset.

-

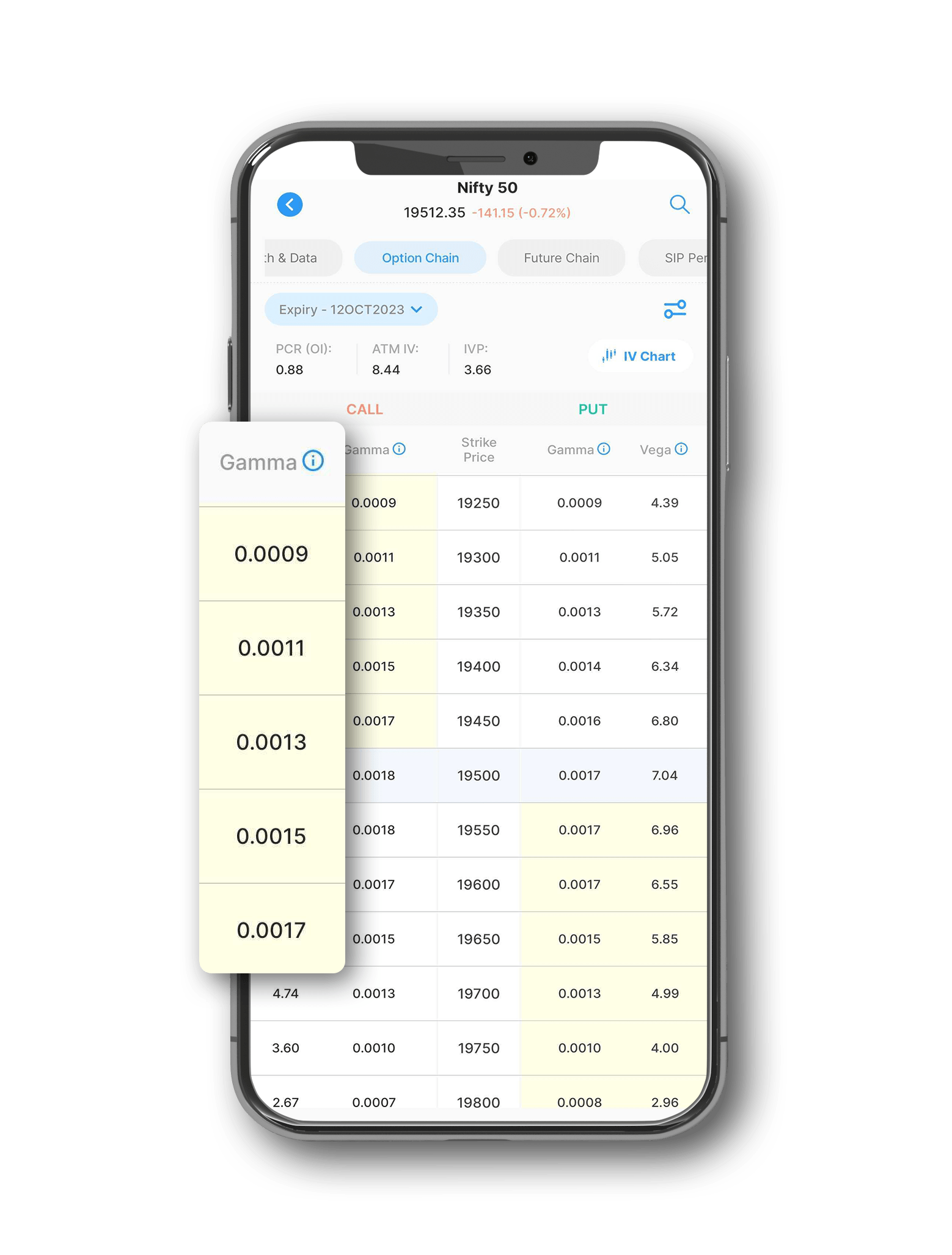

Gamma:

It measures how much the delta of an option changes over time as the underlying asset price changes.

-

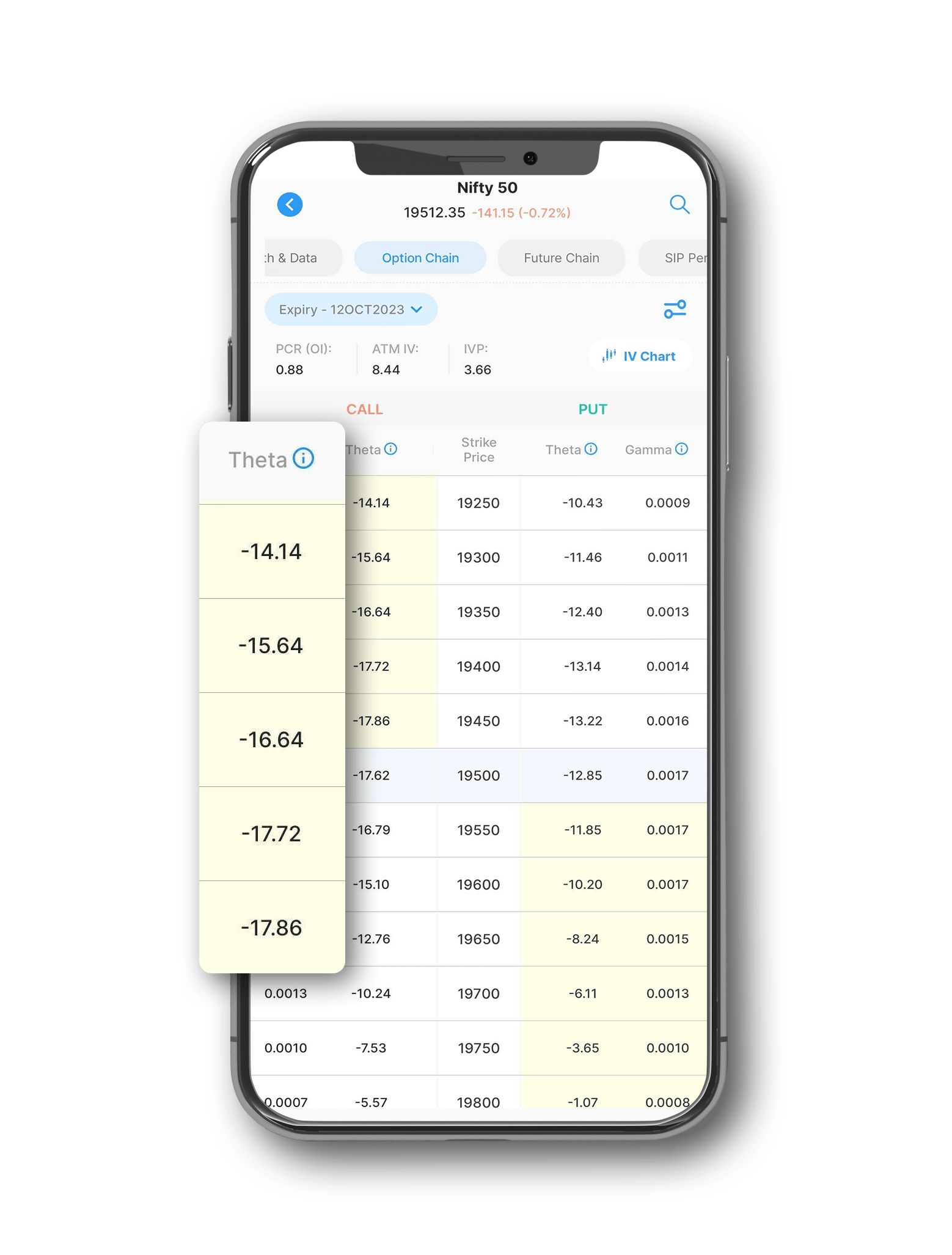

Theta

It represents the rate of time decay of an option's price and quantifies how much an option's value reduces as the expiry approaches.

-

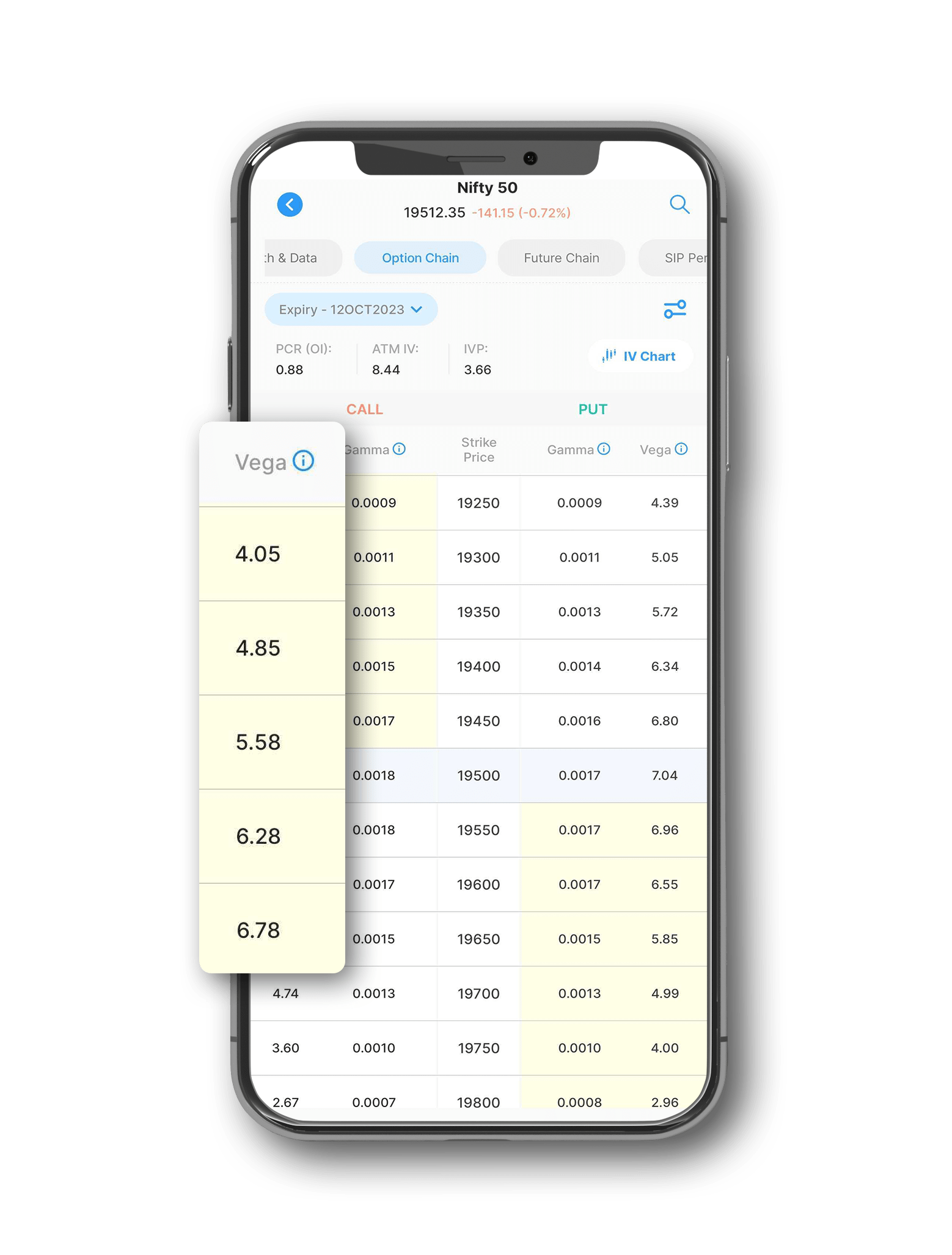

Vega

It measures the sensitivity of an option to changes in the IV of the underlying asset.

The strategy builder in the Samco trading platform analyses each Greek to pinpoint the winning options selling strategy or options buying strategy based on how the delta, gamma, theta and vega are positioned.

For instance, say you wish to trade in an option with the following metrics:

- A delta of 0.6, which indicates a strong correlation with the underlying stock's price movement

- A theta of -0.05, which shows how much value it loses each day

- A gamma of 0.1, which suggests the delta's low sensitivity to changes in the stock's price

In this scenario, Options BRO may suggest a calendar spread, which involves selling a short-term option with a high theta (to benefit from rapid time decay) and buying a longer-term option with a lower theta but higher gamma (to benefit from adjustments in the delta as the stock price moves).

Technical indicators use historical price and volume data to predict future price movements. Some common technical indicators include the Relative Strength Index (RSI), Bollinger bands, Moving Average Convergence Divergence (MACD), moving averages like SMA and EMA and more.

They are crucial for identifying opportune entry and exit points for each options selling strategy or options buying strategy you execute. Samco’s strategy builder analyses technical indicators as well before choosing and rating ideal winning strategies for your trade. Here’s how.

Say a stock’s RSI dips below 30, clearly indicating an oversold condition, and its MACD shows a bullish crossover. Together, these technical indicators may point to an upcoming upward price movement. So, Options BRO may recommend a suitable strategy like a bullish vertical call — where you buy a call option at a lower strike price and simultaneously sell a call option at a higher strike price to capitalise on the expected price rise while limiting your maximum loss to the premium paid.

This ratio compares the risks in a trading position with the potential returns it could offer. The ideal risk-reward ratio varies from one trader to another, depending on their risk tolerance. Aggressive traders may be more comfortable with higher risk-reward ratios than conservative traders.

The new options strategy builder in the Samco trading app evaluates the potential risks and rewards for different strategies and pinpoints the top options selling strategy or options buying strategy for traders with aggressive, moderate and conservative risk profiles.

Choose Samco to Build a Winning Options Strategy with Current Market Insights Easily

If you’ve had trouble pinpointing the winning options trading strategy for your trades lately, Samco’s integrated options strategy builder can turn things around for you. In addition to comprehensive and quick analysis as outlined above, Options BRO in the Samco trading app also supports one-click trading — so you will never miss out on an opportunity in the markets again.

The best part? Samco does not levy any fee whatsoever for using these pioneering features. If you choose to become a member of the Samco trading community, you need not pay any extra fees aside from the standard Samco brokerage charges. The Samco account opening process is also quick and easy, so you can switch to Samco Securities even if you already have a trading account. This way, you can leverage all our proprietary solutions via the Samco trading app and become a more successful options trader.

Disclaimer: INVESTMENT IN SECURITIES MARKET ARE SUBJECT TO MARKET RISKS, READ ALL THE RELATED DOCUMENTS CAREFULLY BEFORE INVESTING. The asset classes and securities quoted in the film are exemplary and are not recommendatory. SAMCO Securities Limited (Formerly known as Samruddhi Stock Brokers Limited): BSE: 935 | NSE: 12135 | MSEI- 31600 | SEBI Reg. No.: INZ000002535 | AMFI Reg. No. 120121 | Depository Participant: CDSL: IN-DP-CDSL-443-2008 CIN No.: U67120MH2004PLC146183 | SAMCO Commodities Limited (Formerly known as Samruddhi Tradecom India Limited) | MCX- 55190 | SEBI Reg. No.: INZ000013932 Registered Address: Samco Securities Limited, 1004 - A, 10th Floor, Naman Midtown - A Wing, Senapati Bapat Marg, Prabhadevi, Mumbai - 400 013, Maharashtra, India. For any complaints Email - grievances@samco.in Research Analysts -SEBI Reg.No.-INHO0O0005847

Easy & quick

Easy & quick

Leave A Comment?