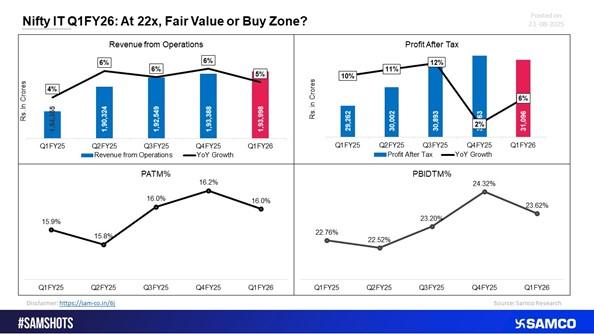

The Nifty IT index opened FY26 on a weaker footing, with Q1 earnings up just 4.33% YoY, lagging its historical growth trend. Persistent global headwinds—slower tech spending, delayed project rollouts, and tighter budgets—continue to weigh on the sector’s performance.

Company Highlights

[caption id="attachment_53458" align="alignnone" width="594"] Nifty IT Q1FY26: At 22x, Fair Value or Buy Zone?[/caption]

Nifty IT Q1FY26: At 22x, Fair Value or Buy Zone?[/caption]- Wipro: Revenue rose a modest 0.8% YoY to ₹22,135 crore, though profits improved 9.8% due to cost efficiencies.

- LTIMindtree: Outperformed peers with 12.6% USD revenue growth and $1.63 billion in deal wins, positioning itself as a standout player.

- TCS: Reported muted deal flow and subdued client activity, reflecting broader demand weakness.

Broader Context

The IT sector’s slowdown mirrors the Nifty 50, where aggregate Q1FY26 earnings rose just 3% YoY, triggering concerns about possible earnings downgrades. Roughly 60% of Nifty companies may miss FY25 EPS guidance, pressured by:

- US Fed rate pause, leading to restrained discretionary IT spend.

- US banks shifting IT work in-house via Global Capability Centres.

- New tariff measures affecting exports.

Valuation Check

At ~22x FY26 earnings, Nifty valuations remain elevated, making investors cautious. While IT firms see flat-to-modest growth (±1–3%) in Q2, cost discipline and selective deal wins may provide stability.

Silver Linings Beyond IT

Not all sectors are struggling. Consumer goods companies delivered strong Q1 results, buoyed by urban tax relief and monsoon-driven rural demand. Additionally, a potential GST rationalisation could add ₹12,000–18,000 crore annually to household disposable income, boosting consumption-led sectors.

Outlook

The IT sector faces a challenging near-term outlook, with muted growth and margin pressures. However, structural strengths—digital transformation, cloud adoption, and selective deal flows—remain intact. For investors, the 22x multiple may reflect fair value rather than a deep buy zone, keeping attention on earnings recovery trends in the coming quarters.

Easy & quick

Easy & quick

Leave A Comment?