The final trading day of 2023 comes to an end. Despite multiple global and domestic challenges, the Indian markets remained resilient in the CY2023. On a weekly basis, after a minor correction last week, the Nifty exhibited resilience by climbing 1.8%. All major indices wrapped up the week positively, with notable sectors such as Auto, Metals, Telecom, and FMCG witnessing impressive gains.

December proved to be a remarkable month for the Nifty, registering a significant surge of 7.94%. This marked it as the most fruitful month for the Index throughout 2023, surpassing November's growth of 5.52%. In the span from 30th December 2022 to 29th December 2023, the Nifty amassed a cumulative growth of 20.03%. Notably, for the past nine weeks, the Nifty has consistently demonstrated a pattern of higher highs and higher lows.

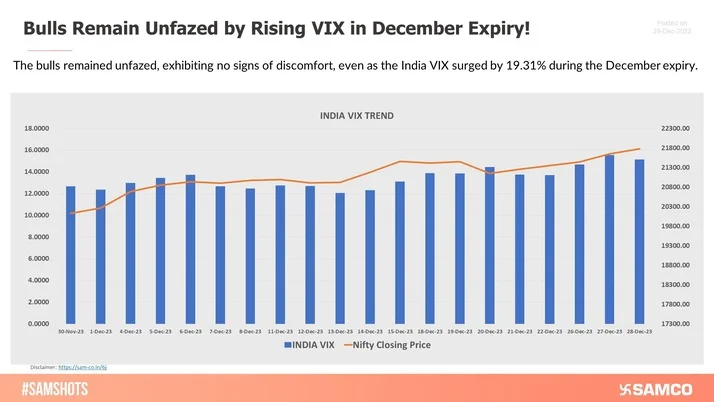

During December, the Nifty encountered robust resistance levels, notably around 21,000 on 12th December and approximately 21,600 on 20th December. Despite these challenges, any selling pressure observed was fleeting, with the Nifty rebounding energetically each time. Interestingly, even as the India VIX escalated by 19.31% during December's expiry, bullish sentiments persisted undeterred.

In summary, the market's recent performance underscores its strength and resilience. Based on current trends and patterns, it appears that this momentum is poised to continue, indicating a promising outlook for the start of the new year.

Scroll down to understand more of such market news and perspectives for the week gone by in easily understandable charts.

MegaCap Stocks Trading Below Their Historical Valuations!

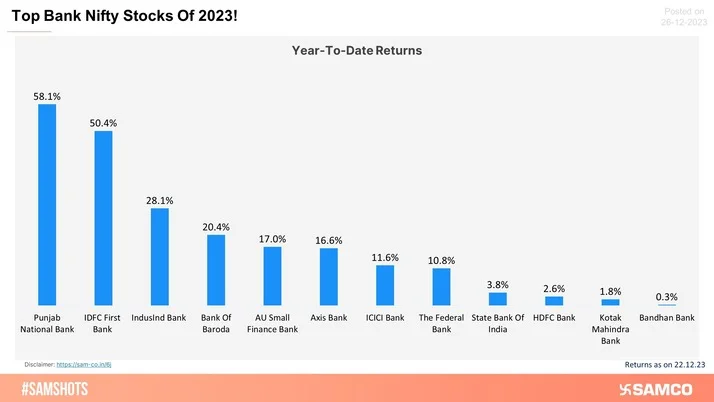

All Bank Nifty Stocks Reports A Positive Return in CY23 - Who's At The Top?

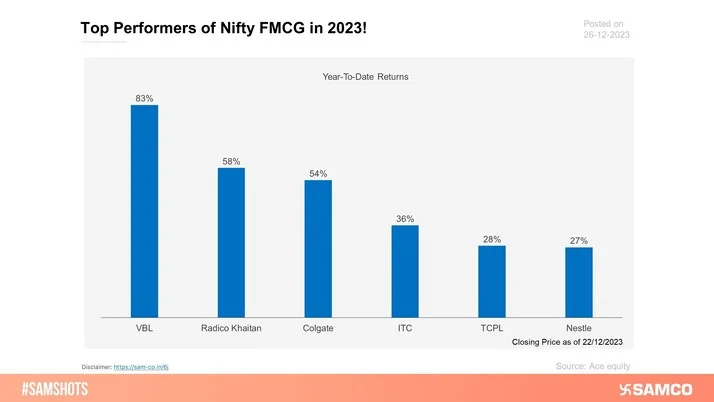

Here’s the YTD performance of FMCG Giants:

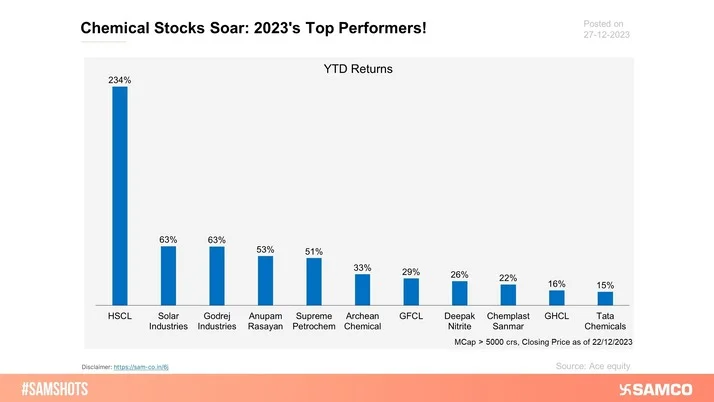

Here’s the YTD performance of Chemical companies.

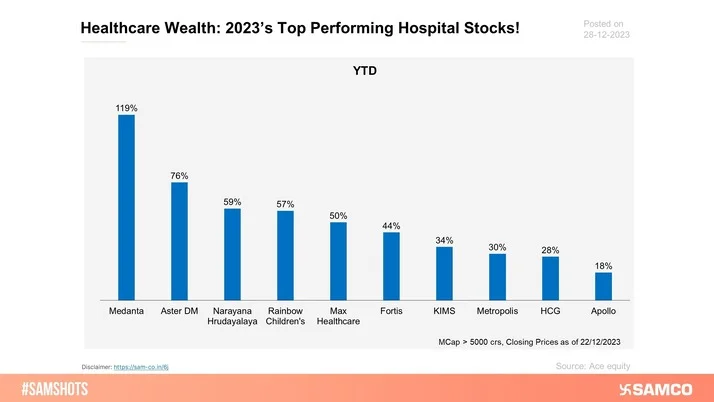

The below chart represents the wealth created by Hospital stocks on a YTD basis.

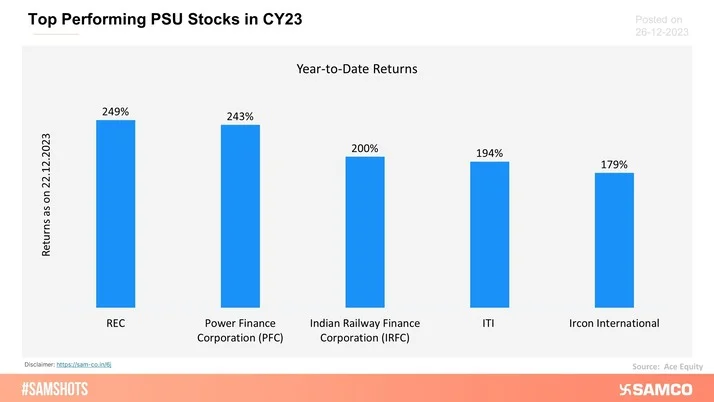

The chart below showcases the best performing PSU stocks in 2023.

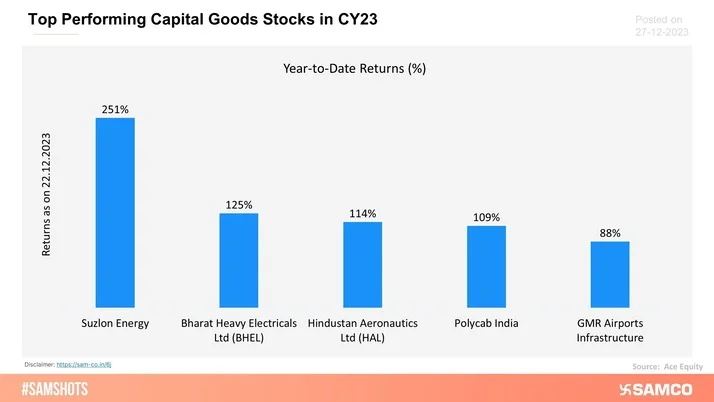

The chart shows the top 5 gainers from the BSE Capital Goods Index in the Calendar Year 2023.

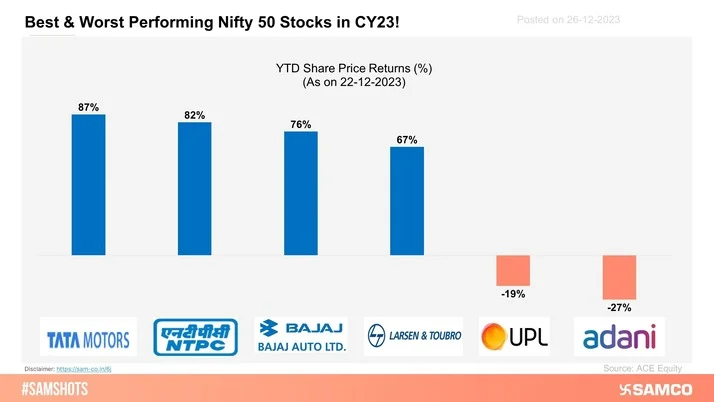

The chart indicates returns delivered by key Nifty 50 stocks between January 01, 2023 and December 22, 2023.

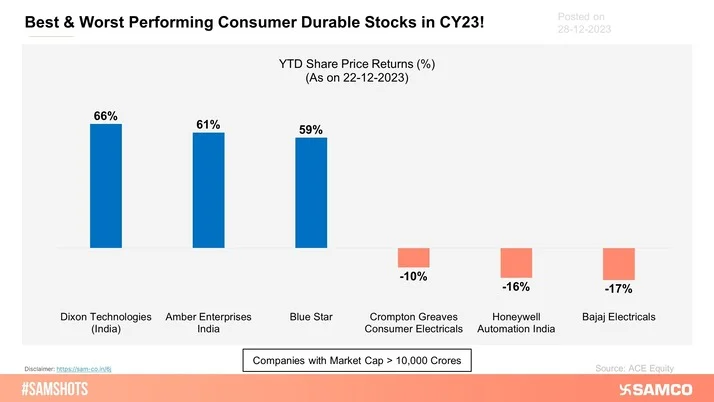

Here are the best and worst performing consumer durable stocks in CY23!

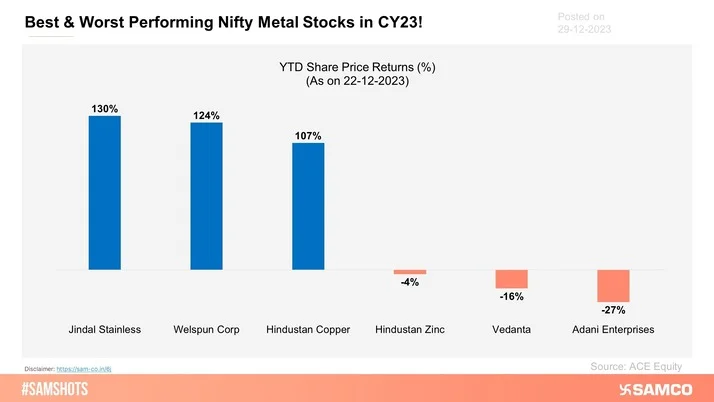

The chart displays the best and worst performing Nifty Metal stocks from January 01, 2023 to December 22, 2023.

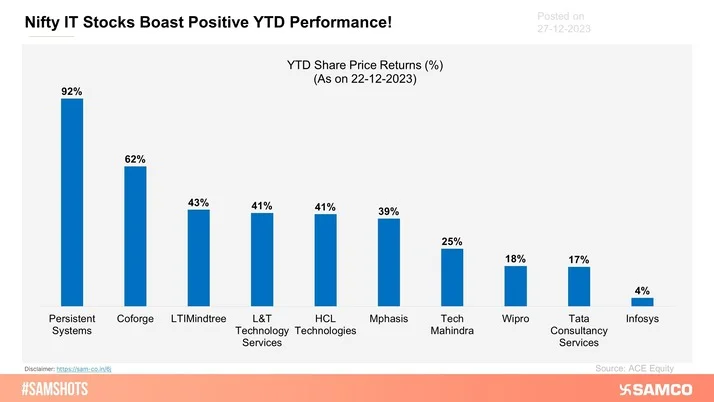

Every stock within the Nifty IT index has demonstrated positive year-to-date (YTD) returns.

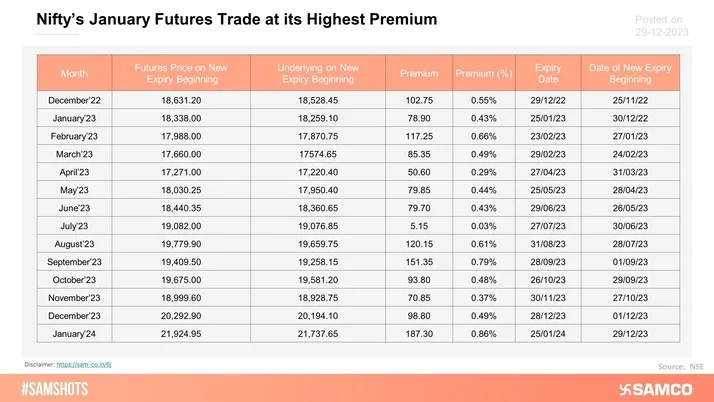

The table shows the premium of futures over their spot prices for new monthly expiry. Nifty’s January futures are trading at its highest premium.

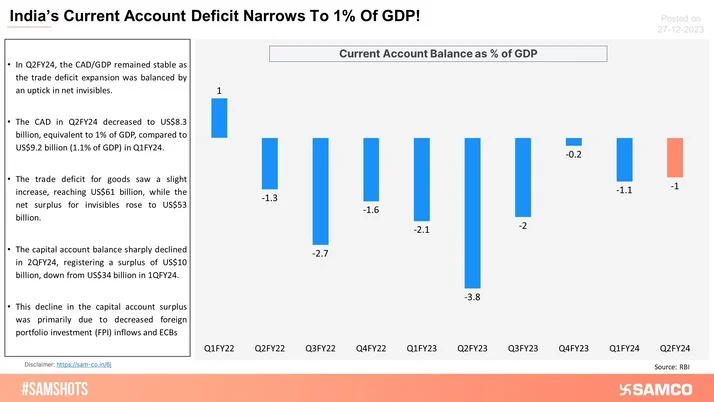

Current Account Deficit Narrows To 1% in Q2!

Bad Loans at Multi-Year Low: RBI Financial Stability Report Key Highlights!

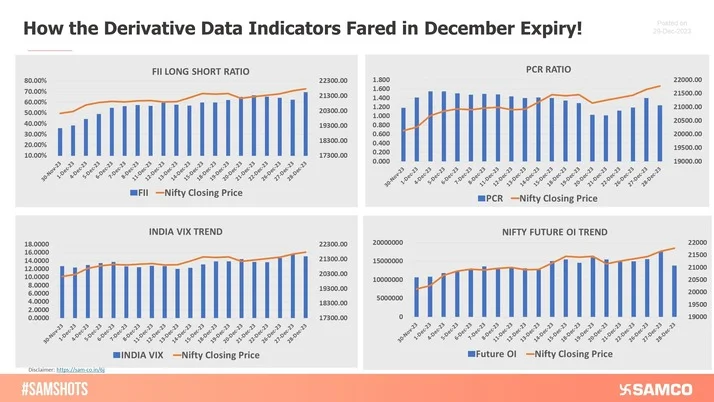

December Delight: Market Records Soar, Riding High on the Peak of Optimism!

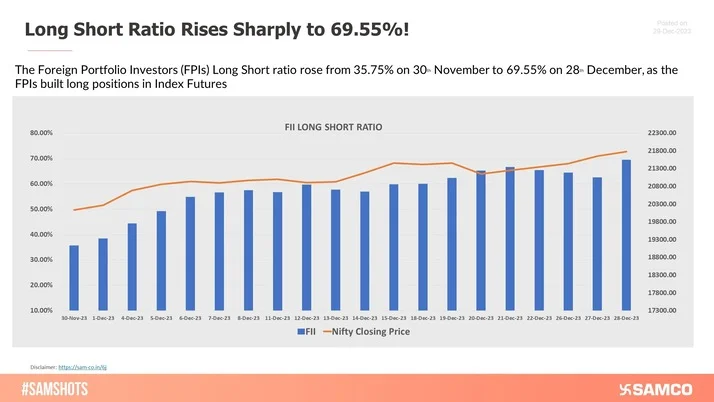

The Foreign Portfolio Investors (FPIs) Long Short ratio rose from 35.75% on 30th November to 69.55% on 28th December, as the FPIs built long positions in Index Futures

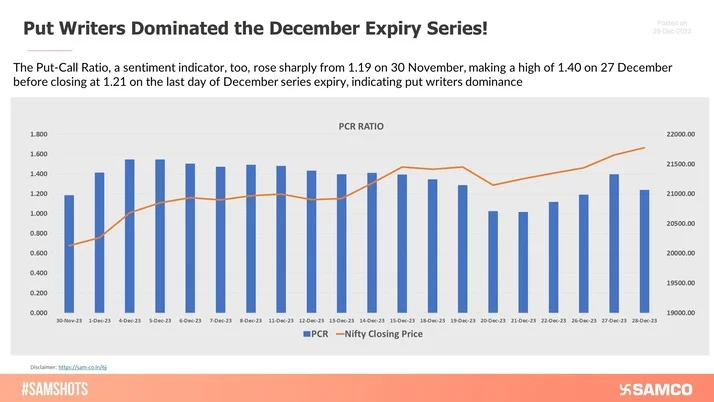

The Put-Call Ratio, a sentiment indicator, too, rose sharply from 1.19 on 30 November, making a high of 1.40 on 27 December before closing at 1.21 on the last day of December series expiry, indicating put writers dominance

The bulls remained unfazed, exhibiting no signs of discomfort, even as the India VIX surged by 19.31% during the December expiry

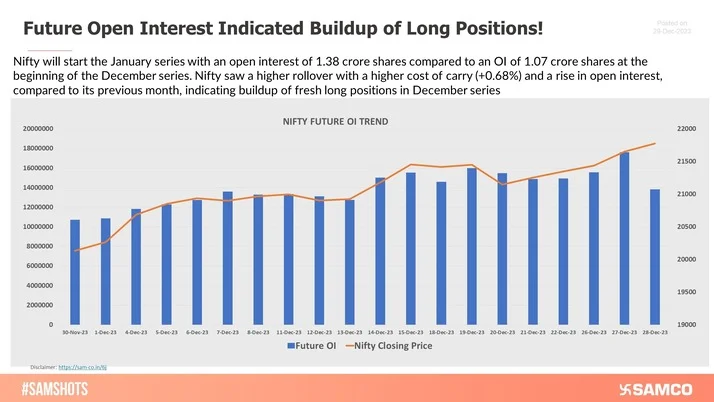

Nifty saw a higher rollover with rise in open interest, indicating buildup of fresh long positions in December series.

HDFCBANK has faced multiple resistance around the 1700 levels since October 2021. Short covering at 1700 Strike can fuel a fresh leg of rally in the stock

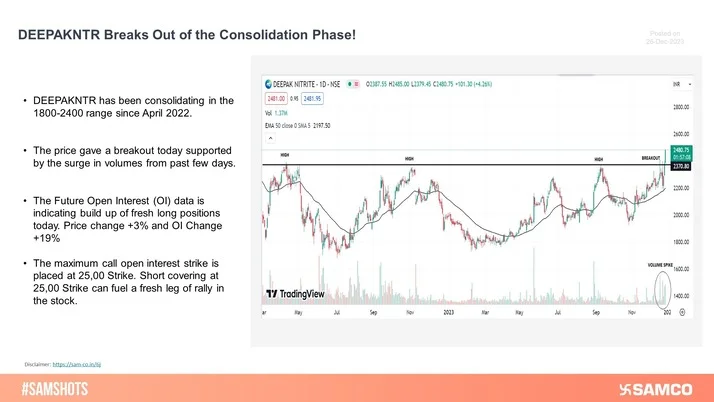

DEEPAKNTR has broken out of the consolidation phase today supported by a surge in volumes since past few days. Short covering at 2,500 Strike can fuel further rally.

VEDL exhibits a bullish trend rebounding from a double-bottom pattern with a series of higher highs and higher lows.

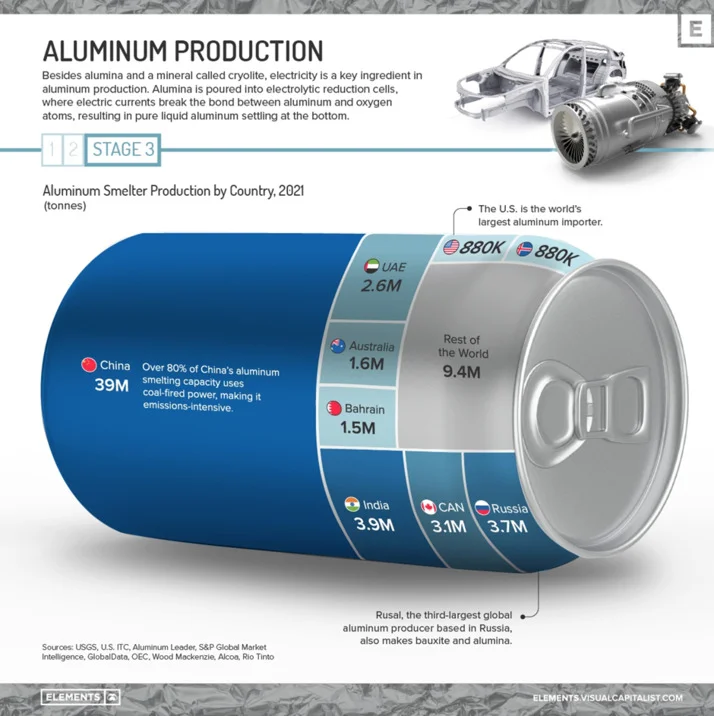

Image Source: Elements