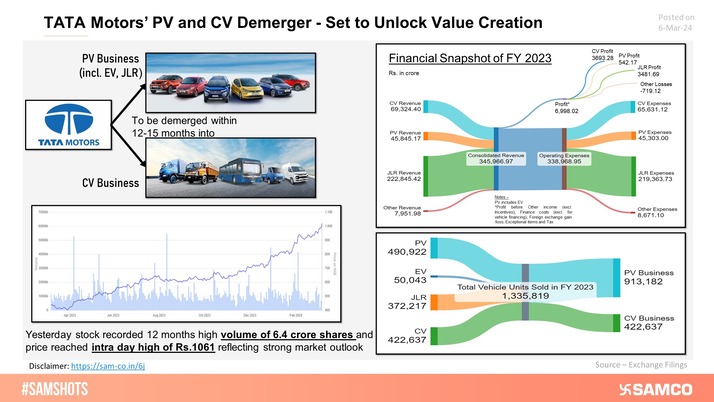

This week’s market landscape witnessed significant volatility with notable announcements and shifts in market sentiments. The week commenced with Tata Motor’s demerger announcement, capturing investor’s attention as the Nifty Auto index hit an all-time high for the sixth consecutive week!

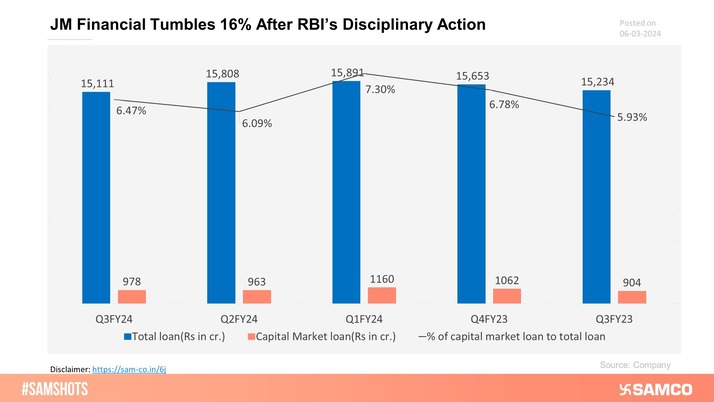

However, it’s not all smooth sailing. The RBI’s crackdown on JM Financial sent ripples through the market, affecting recently listed mainboard and SME stocks, given the company’s pivotal role in IPO-related funding. NBFCs felt the heat too, with share prices taking a hit midweek.

Despite the ups and downs, the Nifty 50 and Bank Nifty closed the week positively, while the Nifty SmallCap 100 and Nifty Midcap 100 indices ended the week on a negative note. This trend suggests a gradual tilt towards large-caps outperforming mid-small cap companies in the coming period.

Nifty ended the week 0.51% higher at 22,494. Nifty PSU Bank and Nifty PSE surged the most during the week with a gain of 3.10% and 2.33% respectively.

Scroll down to understand more of such market news and perspectives for the week gone by in easily understandable charts.

A value-unlocking move announced in TATA Motors!

The regulator barred JM Financials from loans against IPOs and NCDs.

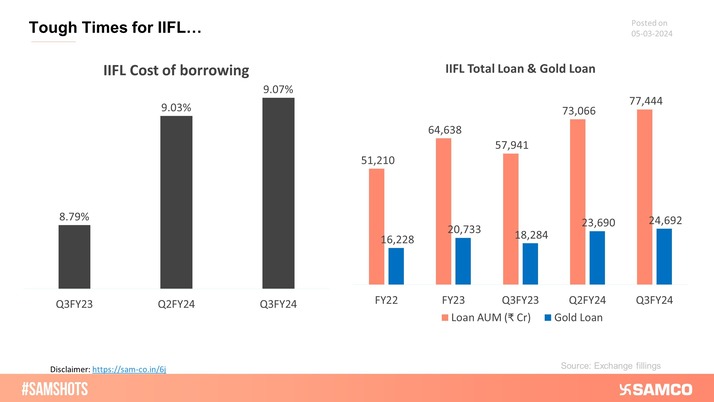

RBI found irregularities in IIFL gold loans which created difficult times for the company.

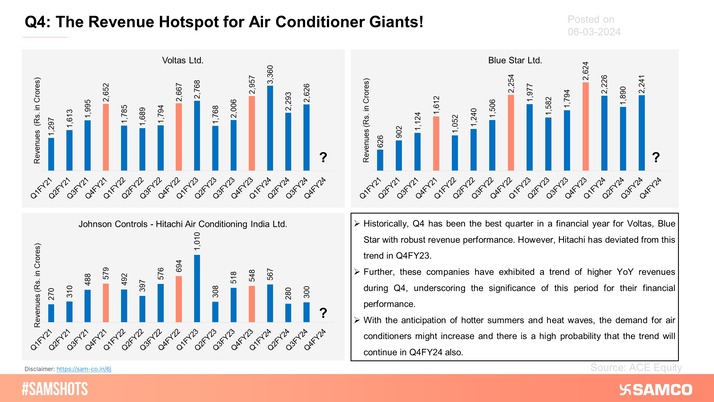

The below chart depicts the revenue performance of leading air conditioner companies across quarters. Q4 is generally the best in a financial year.

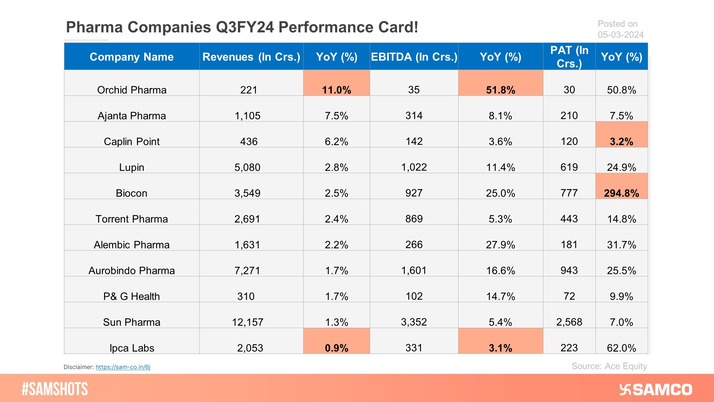

Here are the leaders and laggards of the Pharma Industry for Q3FY24! P.S: We recently closed a recommendation in Orchid Pharma with gains of 47%. Do check it out on the Samco Trading App.

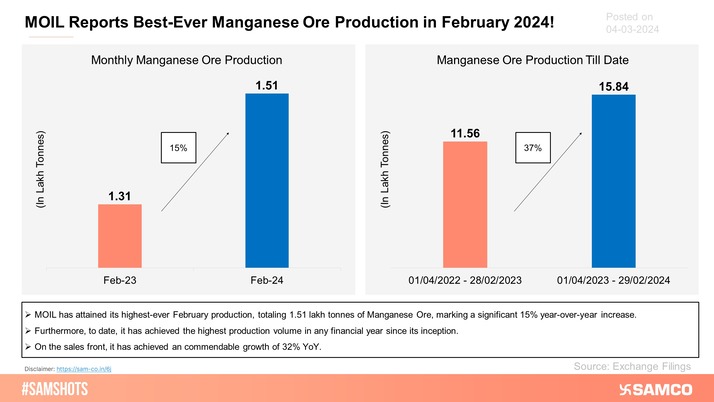

The below chart indicates the consistent performance displayed by MOIL.

Here are the 14 Companies that have shown a 5x surge in volumes!

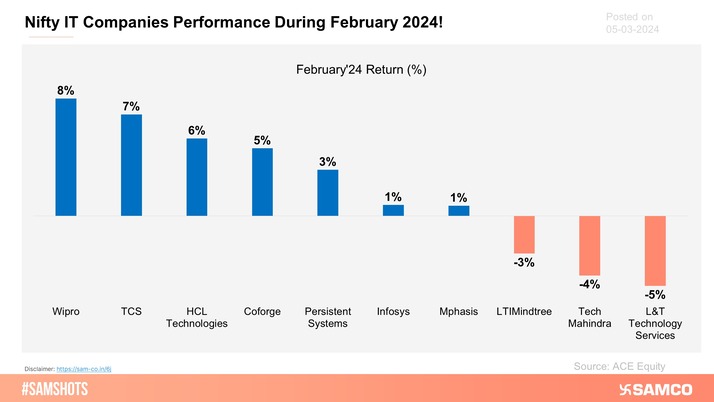

Here’s How Nifty IT Companies Fared During February 2024!

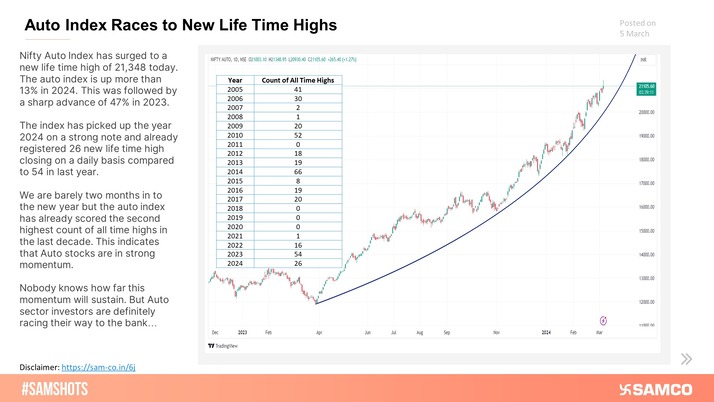

The below chart indicates Auto Stocks have begun 2024 with strong momentum.

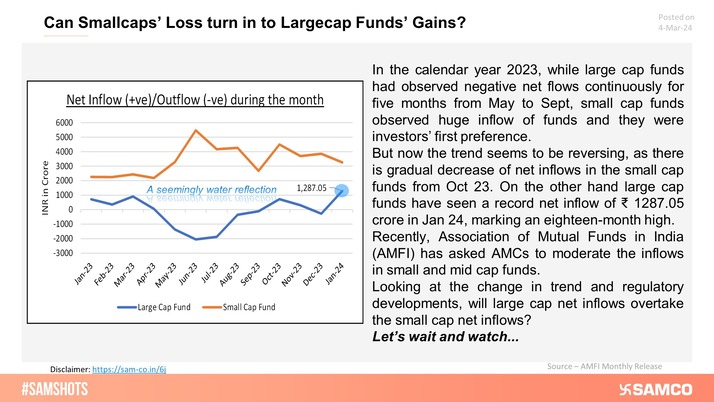

Here’s a water-reflection of how large-cap and small-cap funds’ net inflows contrast each other.

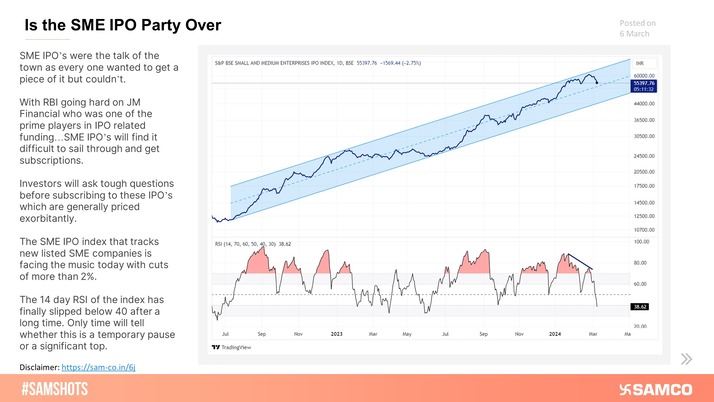

The below chart indicates why it is time to be cautious in newly listed stocks.

Here’s why caution should be exercised before investing in SME IPOs now!

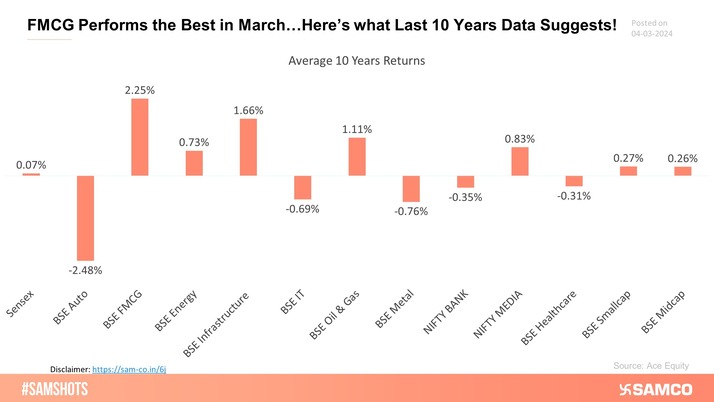

Indices 10 years average returns suggest FMCG yields the best returns in March

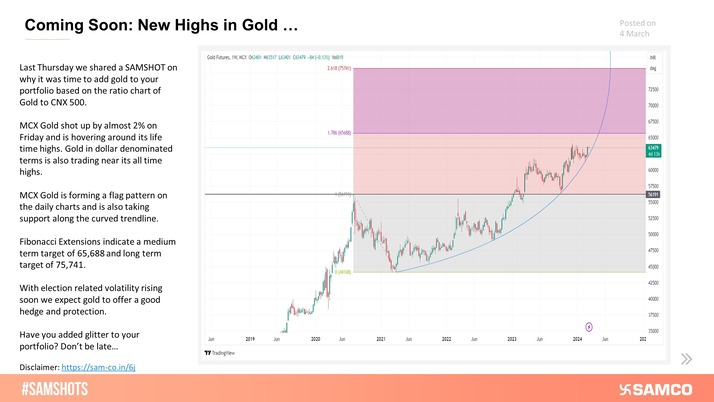

Here’s How Gold Can Add Glitter to Your Portfolio!

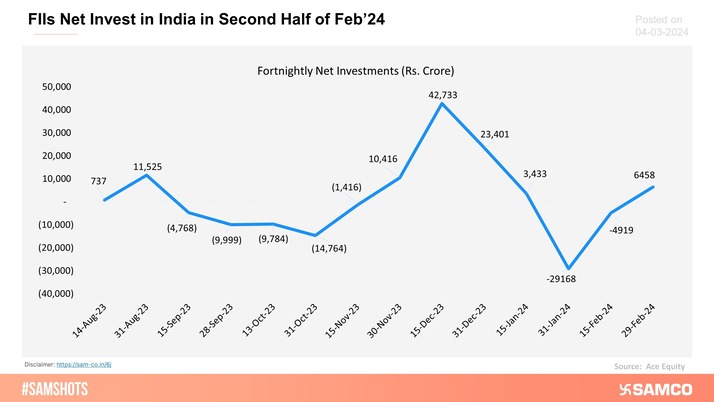

After 2 successive fortnightly withdrawals from the Indian markets, Foreign Institutional Investors (FIIs) net invested Rs. 6458 in the second half of February’24.

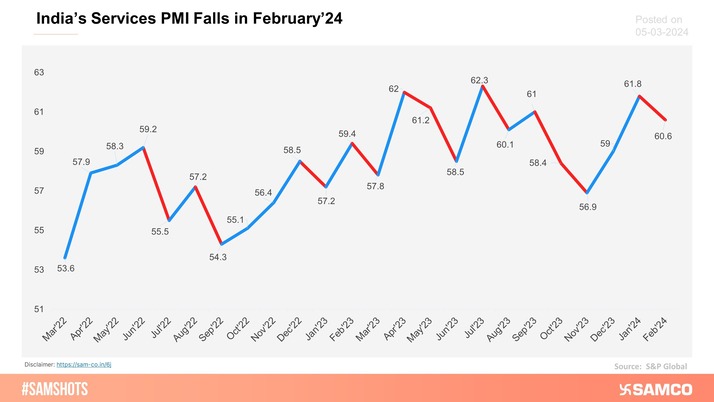

India’s Services Purchasing Manager’s Index (PMI) fell Month-on-Month (MoM) in February’24.

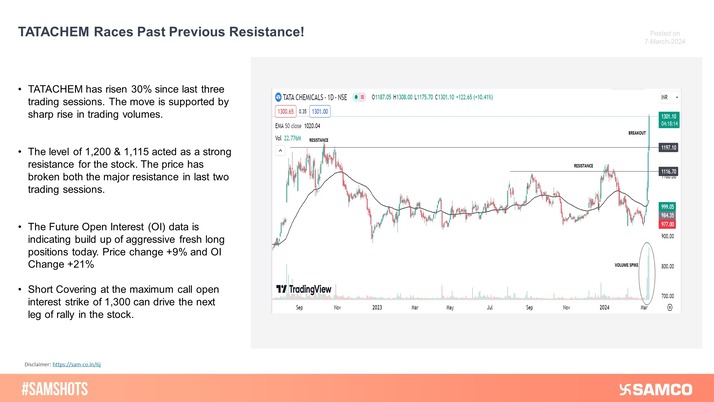

TATACHEM has risen 30% since the last three trading sessions. The price has zoomed past the previous resistance of 1,115 & 1,200 levels respectively.

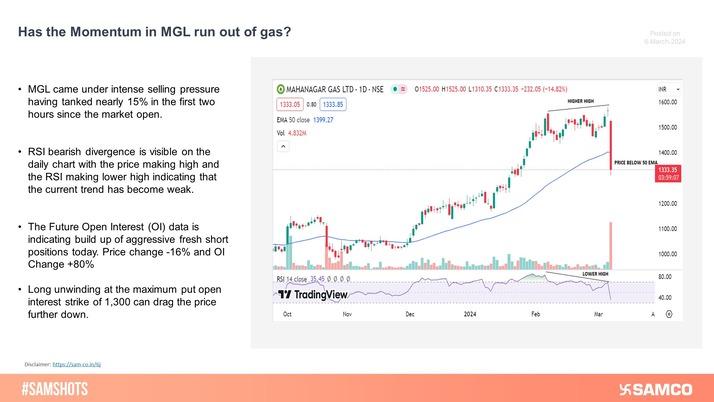

RSI bearish divergence is visible on the daily chart of MGL indicating the current trend is losing strength

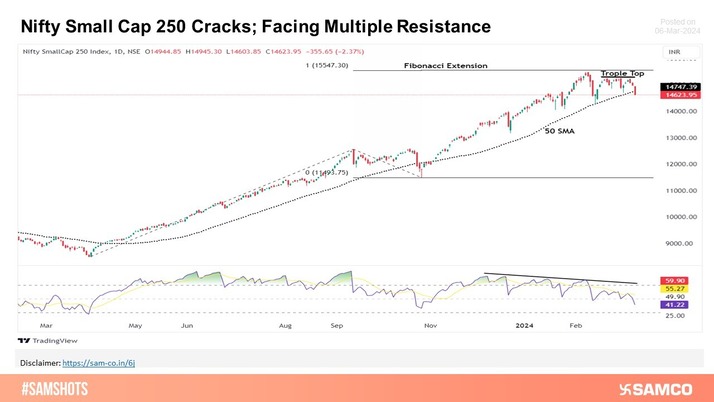

Weakness in Nifty Small Cap 250

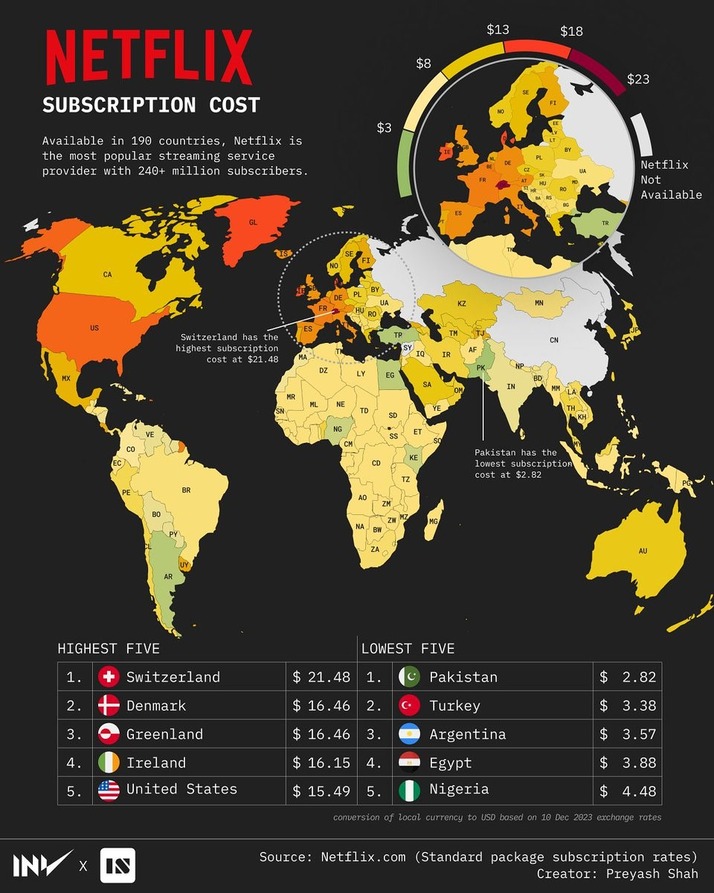

Image Source: @VisualCap (Twitter)