The recently unveiled Interim Budget for the fiscal year 2024-25 signals a departure from traditional pre-election patterns. Instead of populist measures, the budget demonstrates a professional and forward-looking approach, showcasing the government's confidence in the upcoming elections and the overall economic landscape. Noteworthy features include an unexpected Fiscal Deficit target of 5.1% of GDP, positively impacting the market by reducing government borrowing and lowering bond yields.

The budget also emphasizes capital expenditure, with an 11.1% increase, reaching Rs 11.1 trillion, reflecting the government's commitment to public investment-led growth and sustainable economic development.

Nifty ended the week 2.35% higher at 21,854. Nifty PSU Bank and Nifty Oil & Gas surged the most during the week with a gain of 11.47% and 9.11% respectively.

Scroll down to understand more of such market news and perspectives for the week gone by in easily understandable charts.

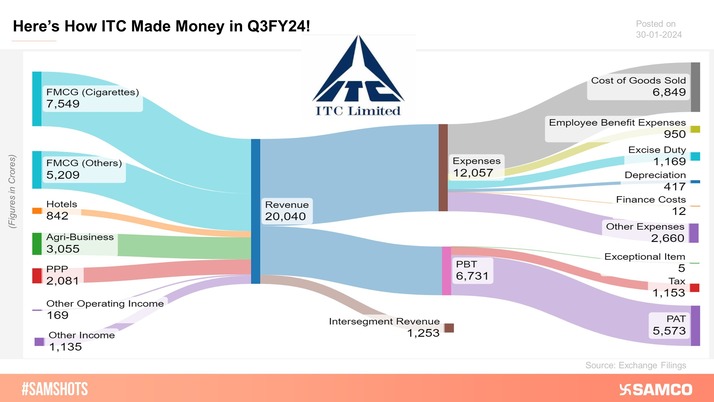

Here’s how ITC made money in Q3FY24.

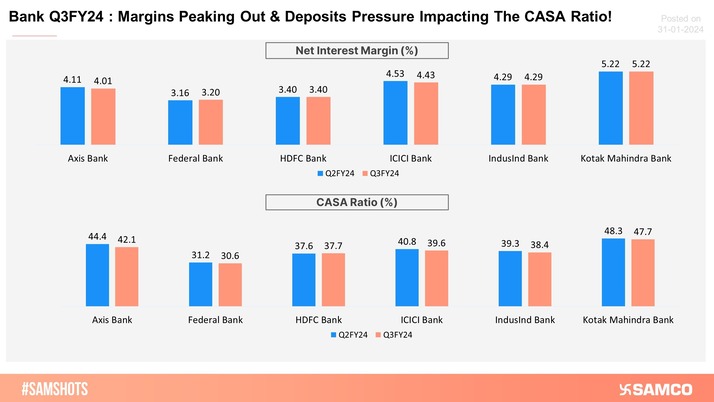

Banks Q3FY24: A Quick Look at NIMs and CASA Ratio!

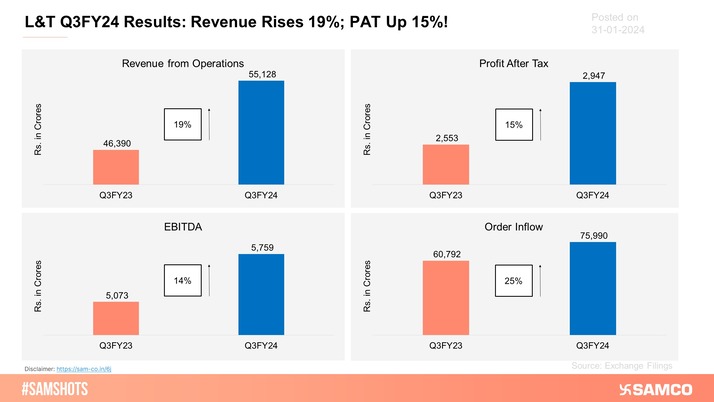

Here’s how L&T performed during Q3FY24!

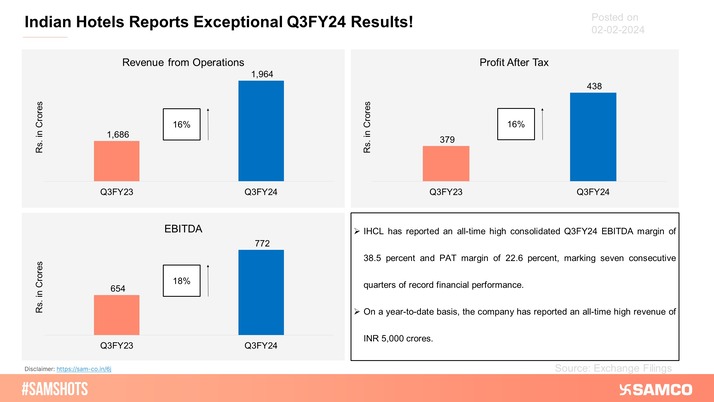

The below chart shows how Indian Hotels Co. Ltd. performed during Q3FY24.

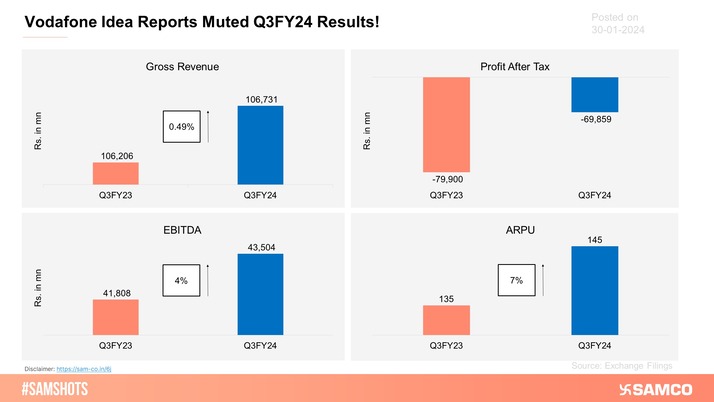

Vodafone Idea reported muted Q3FY24 results!

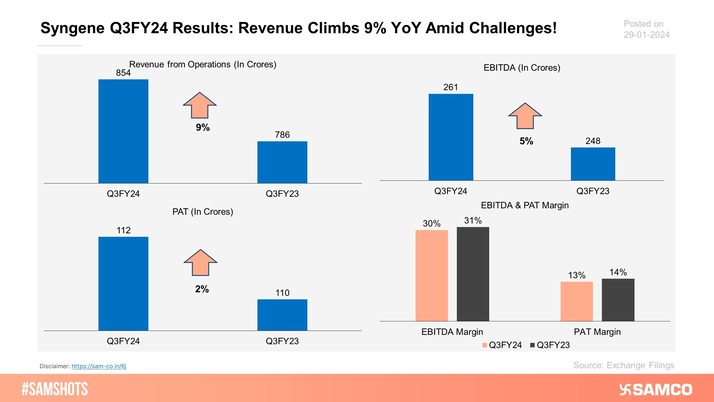

Here’s how Syngene performed during Q3FY24.

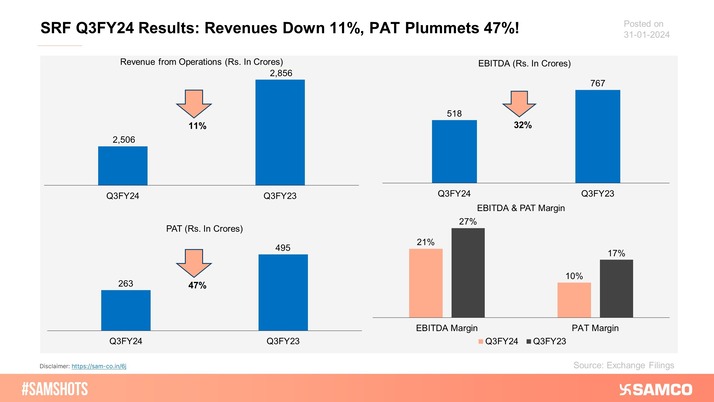

Summary of SRF Ltd’s Q3FY24 performance.

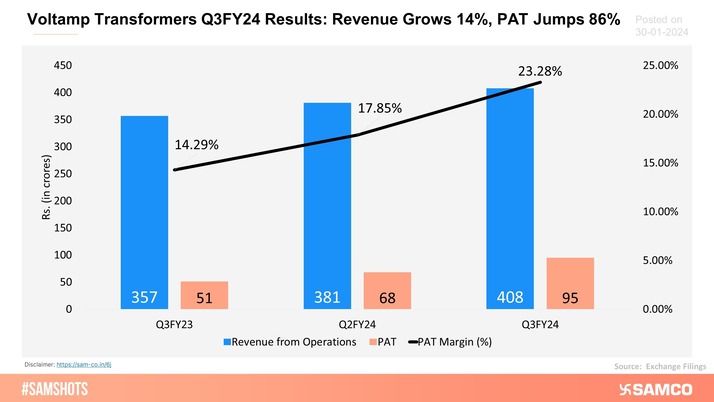

The chart below shows the Q3FY24 results of Voltamp Transformers.

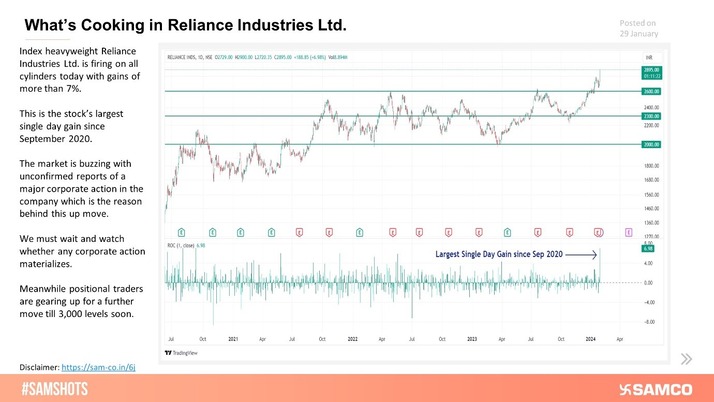

Reliance Industries witnessed biggest single day jump since September 2020.

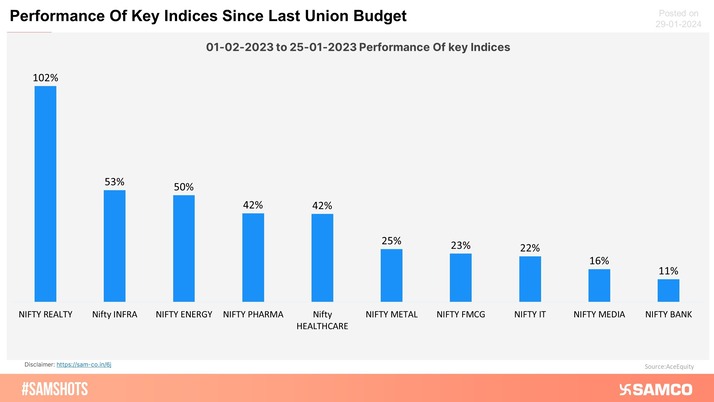

Which Index Outperformed Others Since The Last Union Budget?

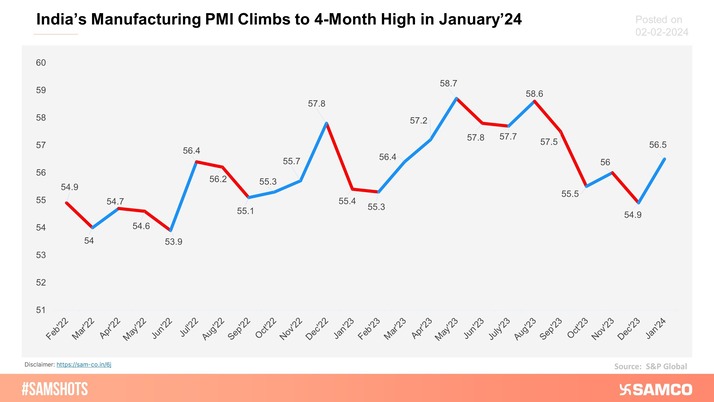

India’s Manufacturing Purchasing Manager’s Index (PMI) rose to a 4-month high in January’24 after slipping to an 18-month low in December’23.

LICHSGFIN has given a range breakout on the daily chart. The price was consolidating in the 555-590 range for a month.

NATIONALUM broke out of its key resistance level of 140 on the daily chart. Short covering at the maximum call open interest strike of 145 can drive a fresh leg of rally in the stock.

UTIAMC Surges Beyond its Previous Resistance

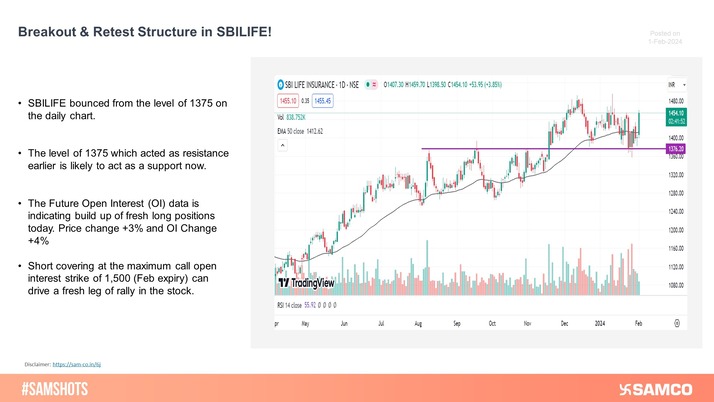

The level of 1375 which acted as a strong resistance for SBILIFE earlier is likely to act as a support going forward.

Image Source: Markets Mojo