- Home

- Stock Plus

Trade with ZERO balance

Using margin against your shares with StockPlus

Pledge your Shares + Mutual Fund Holdings

Where can you use Margin Against Shares?

Future & Options

It covers Cover Orders, Bracket Orders, MIS Orders, NRML orders

Equity Intraday - Cash Segment

Now place order using Bracket Orders, and Cover Orders

How to Use Margin Against Share?

Stockplus Leverage Calculator

The following tables explain how enhanced zero balance trading is with the StockPlus subscription.

Select type

Select stock

Value of Holdings

0.00

Margin Post Haircut

0.00

StockPlus leverage wise margin table

| S/No | Stock | ISIN | Haircut% | Action |

|---|

| S/No | Stock | ISIN | Haircut% | Action |

|---|

Recent Blogs

FAQ's

In order to put these to use, Samco StockPlus allows traders to use these shares as margins after pledging for carry forward trades in the NSE F&O & NSE CDS Segments. No fresh funds need to be locked up for initiating overnight positions. Clients can initiate these positions without any funds, only utilising margins against shares.

You need not have cash in their Trading Account to meet the Exchange SPAN & Exposure Margins. Stocks pledged under the StockPlus facility can be used for Margins.

Illustration: Say you wish to go long 1 Lot of NIFTY, & the margin required to initiate the position with the NRML Product type is Rs.48,000. Currently you would need to have to the entire Rs.48,000 in your Samco Trading Account as a cash balance.

With StockPlus, even if your Samco Trading Account balance is NIL, you can initiate this position if the value of your pledged shares exceeds Rs.48,000.

The Highlights of the StockPlus Product -

- Trade with Margin against shares with Zero Cash Balance in the Equity Derivatives and Currency derivatives segments (Both Intraday and Positional Trades) and also in the Cash Market segment (via Bracket Order and Cover Orders)

- No requirement to maintain 50-50 cash collateral ratios while initiating trades

- You can initiate trades in Options too with margin against shares (both long and short options for intraday and positional basis)

- You can sell your pledged holdings in real time by placing a real time sale request. You don’t need to un-pledge holdings the previous day to sell them.

The StockPlus product is effectively free for all Samco customers! You only need to pay a lifetime subscription fee of Re. 1 and get it activated from Samco Star Back Office.

Additionally, there is a charge of Rs.30 plus GST to pledge or unpledge shares regardless of the number of shares pledged or unpledged.

In case clients wish to place instant sale requests for unpledged stocks, they would be charged Rs. 60 plus GST for each request.

You can get margins upto 100% on the Value of your Holdings which includes Stocks & ETF’s. Your holdings will be subject to deduction of Haircut, which you can refer from the Samco StockPlus Margin Calculator.

You can pledge over 1200+ Stocks & ETF’s as Collateral to get trading Limits.

Haircut is the amount by which the value of your stock is deducted for the purposes of calculating the exact value of collateral holdings/limits. It is often quoted in percentage terms %. So for instance if the Value of holdings is Rs. 1,00,000 and the haircut percentage applicable is 10%, then the value of the collateral/margins available for trading purposes shall be Rs. 1,00,000 – Rs. 10,000 (10% of Rs. 1,00,000) = Rs. 90,000 (Holdings Value post haircut).

The haircut is different for different securities and is based on the volatility of the security, liquidity of the security amongst other factors.

With StockPlus, you can trade in the NSE F&O & CDS Segments along with Cover Orders & Bracket Orders on the NSE Cash, NSE F&O & NSE CDS Segments.

Additional Margin against shares under StockPlus will be available for the following:

| Exchange Segment | Buy/Long | Sell/Write |

|---|---|---|

| BSE – EQ / NSE - EQ – Cover Orders | ||

| BSE – EQ / NSE - EQ – MIS Orders | ||

| BSE – EQ / NSE - EQ – CNC Orders | ||

| BSE – EQ / NSE - EQ – NRML Orders | ||

| NSE – EQ – Bracket Order | ||

| NSE Equity Derivatives – Futures – MIS orders | ||

| NSE Equity Derivatives – Futures – Bracket orders and Cover Orders | ||

| NSE Equity Derivatives – Options – NRML orders | ||

| NSE Equity Derivatives – Options – MIS orders | ||

| NSE Currency Derivatives – Futures – NRML orders | ||

| NSE Currency Derivatives – Futures – MIS orders | ||

| NSE Currency Derivatives – Futures – Bracket orders and Cover Orders | ||

| NSE Currency Derivatives – Options – NRML orders | ||

| NSE Currency Derivatives – Options – MIS orders |

Note – Clients subscribing to StockPlus alone will not be able to place NRML orders in the Cash Markets. Clients who are subscribers to MTF and StockPlus both will be able to place NRML orders however additional margin against shares will not be available for Cash NRML orders.

Clients are communicated about margin shortfalls through SMS & E-Mails. Clients may also be restricted from entering fresh orders in depending on the quantum of margin

shortfalls. Clients should meet these margin shortfalls immediately, else margin calls will be generated which will lead to Square Off of Open Positions and Collateral.

In case you are unable to meet margin shortfalls on time, your open positions & collateral (pledged stocks) will be squared off & your accounts will be settled accordingly.

Margins will be provided against 1200+ scripts & ETF’s. You can view the full list on the StockPlus Margin Calculator.

You can check your StockPlus pledged holdings in the Samco Trader in the “View Collateral/ISIN Holding” Window in the “Withheld Quantity” Column. You’re pledged stocks will appear with a minus sign.

For Instance, if you’ve pledged 50 shares of Infosys, your pledged holdings will appear as -50 in the withheld quantity column.

Brokerage continues to remain the same at lower of Rs.20 per executed Order or 0.05%. Call-N-Trade charges will continue to be Rs.20 + GST per order.

You can view the StockPlus margins available to you in the RMS Limits under Adhoc Margin.

Most brokers require a client to un-pledge their holdings and thereafter stocks are available for sale only the next day. However, that is not the case with Samco StockPlus where you can sell your shares even if you’ve not unpledged them the previous day.

You can sell your pledged holdings by placing an instant sale request from you Samco STAR Dashboard. Once you place a sale request, your stock shall be unpledged and sold at the market rates as a market order. Requests for instant sale will usually be processed in 30 minutes during market hours.

Instant sale requests for pledged holdings will be charged at Rs. 60 per request plus GST irrespective of the amount of shares pledged.

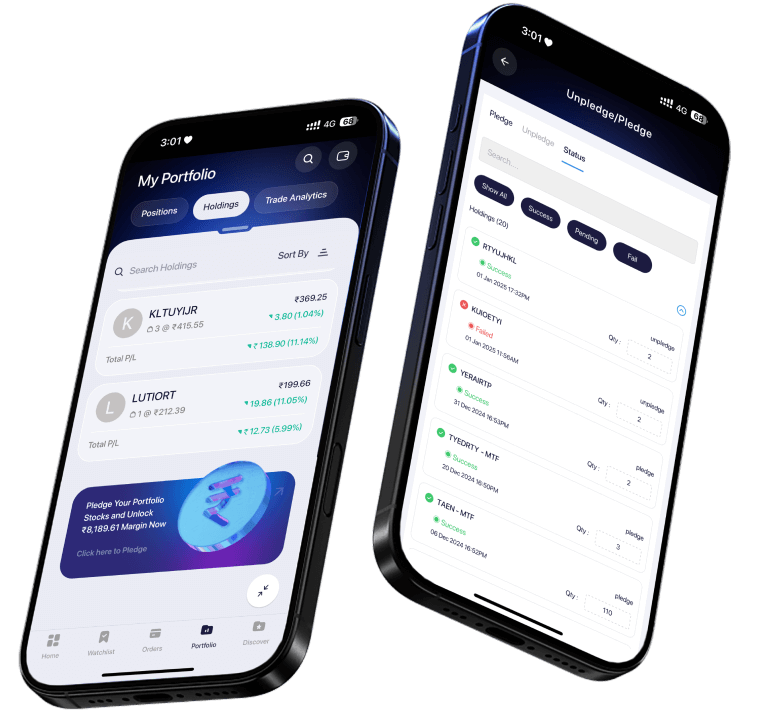

You can place pledge & unpledged requests from Samco Star throughout the day except from the Block window from 4 PM to 7 PM. All requests received till 4 PM shall be processed on the same day and the limits against the same shall be available on the next trading day. All requests entered after 7 PM shall be processed on the following day and the limits shall be available the day after. To place pledge and un-pledge requests, go to Samco STAR -> Holdings -> Pledge/Unpledge.

No! While most brokers require that Cash & Collateral be maintained at a ratio of 50:50, with Samco, clients can initiate positions only utilizing the collateral. There is no requirement of maintaining a 50:50 Cash collateral ratio.

Interest will have to be paid on outstanding ledger debits. A rebate will be given to traders up to (50% of exchange margins, higher of Peak or EOD margin) or collateral value, whichever is lower.

Let us illustrate with an Example:

Ledger Debit: Rs.50,000

Margin utilized in F&O Segment: Rs.25,000

Collateral Value: Rs.10,000

In this, the collateral value i.e. Rs.10,000 will be taken as Rebate & interest will be charged on the Rs.40,000 at 0.05% per day.

You shall not be able to place unpledge requests in case your ledger balance is debit or in case of instant sale of pledged shares (this is to avoid double unpledging). Also, In case the security is not available is list of eligible securities, you shall not be able to place a pledge request.

Please note that if you are utilising your collateral for your margin obligations, then you’re unpledge requests may be rejected. In such cases, the Status of requests in the Samco STAR will carry a remark “Utilising Collateral”.

In case of any further queries, please raise a ticket on the Support Helpdesk in the Technical Department section.

No, StockPlus margins can be availed only against free & unencumbered holdings. Note that margins will not be available against MTF holdings even if the client has a ledger credit.

Yes. You will be able trade options for intraday and positional with margin against shares in StockPlus. You can even initiate buy options trades with margin against shares however in case you do not have adequate cash margin, there may be margin shortfalls/margin calls which could lead liquidation of your collateral and/or positions.

Disclaimer - Use of StockPlus involves the use of financial leverage. Margin against shares carries a high degree of risk and it puts one’s share holdings to risk. By availing the facility of margin against shares, the client understands that in case of shortfalls/losses/extreme volatility, their holdings are bound to be liquidated which may result in a loss of capital. Trading on Margin can expose the client's capital to substantial risk and in certain cases; a client may sustain a total loss of capital. A client should be apprised of the risks of financial leverage and should consult their financial advisor to ensure that the use of the same is appropriate and in accordance with the client's risk appetite and financial position.

| ISIN | Haircut [%] | Value of Holdings | Margin Post Haircut |

|---|---|---|---|

Easy & quick

Easy & quick