Hilton Metal Forging Ltd-RE Price Performance

- Day's Low

- ₹0

- Day's High

- ₹0

₹ 0.11

- 52-w low

- ₹0

- 52-w high

- ₹0

0.11

- Day's open

₹0 - Previous close

₹0 - VWAP

₹0 - Lower price band

₹0 - Upper price band

₹0

Today's Market Action

Its last traded stock price on BSE was 0.11 down by %. The total volume of shares on NSE and BSE combined was 0 shares. Its total combined turnover was Rs 0.00 crores.

Hilton Metal Forging Ltd-RE Medium and Long Term Market Action

The stock price of Hilton Metal Forging Ltd-RE is down by 0% over the last one month. Don't forget to check the full stock price history in the table below.

Hilton Metal Forging Ltd-RE Fundamentals

-

Market Cap (Cr):

-

Book Value (₹):

-

Stock P/E:

-

Revenue (Cr):

-

Total Debt (Cr):

-

Face Value (₹):

-

Roce (%):

-

ROE (%):

-

Earnings (Cr):

-

Promoter’s Holdings (%):

-

EPS (₹):

-

Debt to Equity:

-

Dividend Yield (%):

-

Cash (Cr):

Hilton Metal Forging Ltd-RE Mutual fund holdings and trends

| FUND NAME | Quantity | Monthly Change (Qty) |

|---|

Similar Stocks

| Company | Price | Market Cap (Cr) | P/E |

|---|

About Hilton Metal Forging Ltd-RE

Data not available.

Hilton Metal Forging Ltd-RE FAQ's

What is Share Price of Hilton Metal Forging Ltd-RE?

What is the Market Cap of Hilton Metal Forging Ltd-RE?

What is PE Ratio of Hilton Metal Forging Ltd-RE?

What is PB Ratio of Hilton Metal Forging Ltd-RE?

What is the CAGR of Hilton Metal Forging Ltd-RE?

How to Buy Hilton Metal Forging Ltd-RE Share?

Can I buy Hilton Metal Forging Ltd-RE from Samco?

How do I buy Hilton Metal Forging Ltd-RE from Samco?

Financials

(*All values are in Rs. Cr)

(*All values are in Rs. Cr)

(*All values are in Rs. Cr)

(*All values are in Rs. Cr)

(*All values are in Rs. Cr)

Consolidated Financial Performace In Graph(Net Profit)

Standalone Financial Performace In Graph(Net Profit)

(*All values are in Rs. Cr)

Consolidated Financial Performace In Graph(Net Profit)

Standalone Financial Performace In Graph(Net Profit)

(*All values are in Rs. Cr)

Consolidated Financial Performace In Graph(Cash Flow)

Standalone Financial Performace In Graph(Cash Flow)

News

Review

Pros

Pros

- No Data Available

Cons

Cons

- No Data Available

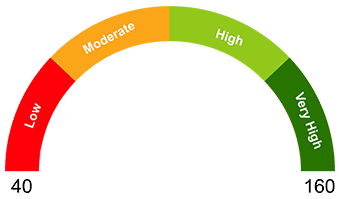

Valuation Analysis

Margin of safety

(11/03/2026)

(11/03/2026)

0

0%

0%0% People are bullish about Hilton Metal Forging Ltd-RE

0%

0%0 % People are bearish about Hilton Metal Forging Ltd-RE

What is your opinion about this Stock?

Historical Data

Hilton Metal Forging Ltd-RE

₹

0.11

0

(0%)

Brokerage & Taxes at Samco

Brokerage & Taxes at Other traditional broker

Potential Brokerage Savings with Samco ₹ 49.62()

Top Gainers (NIFTY 50)

Stock Name Change %

Top Losers (NIFTY 50)

Stock Name Change %