Would you rather keep your valuables in a digital locker or a rusty old metal safe? Most people today choose the former. That’s because it is safer. And just like cloud storage replaced physical filing cabinets, the stock market has moved away from cumbersome paper share certificates. Today, a demat account in India acts as the digital vault for traders. It helps protect equity shares and other securities in electronic form. This has made investing simpler, faster and far more secure.

As India pushes toward a fully digital financial ecosystem, regulatory bodies like SEBI have made it mandatory to hold shares in a dematerialised format. This makes trading more convenient, increases transparency and speed and reduces risks. In fact, SEBI’s strong stance has made more people look into what a demat account is and try to understand the markets. With investors ranging from students to senior citizens, it is imperative that everyone understands the benefits of demat account usage today.

In this article, we explore the meaning of a demat account, its types, how to open a demat account and more.

What is a Demat Account?

A demat account is short for a dematerialised account. It is a digital account that allows you to store and manage your financial securities electronically. Just like a savings account holds your cash, a demat account in India holds your shares, bonds, mutual funds and other investments in a paperless format. The concept of what a demat account is becomes especially important for new investors who want to buy or sell securities without dealing with paperwork or delays.

Before demat accounts existed, investors received physical share certificates. These were easily misplaced, damaged or forged. The manual processes involved also made trading slow and prone to errors. Today, demat accounts in India have revolutionised investing by making transactions instant, secure and trackable. Unlike physical shares that need to be couriered and verified, electronic holdings eliminate risk and improve efficiency. Knowing the meaning of a demat account and opening one is the first step toward participating in modern financial markets with confidence.

How Does a Demat Account Work?

Understanding how a demat account works is necessary if you want to comprehend the trading process.

A demat account works like an electronic repository where financial securities like shares, ETFs and bonds can be held in digital form. When you buy stocks through a broker, they get credited to your demat account, and when you sell them, they get debited. This seamless process eliminates the need for any physical certificates.

The actual storage of these securities is managed by two government-regulated entities: NSDL (National Securities Depository Limited) and CDSL (Central Depository Services Limited). These depositories are responsible for maintaining your holdings in a secure and centralised system. However, in the case of demat accounts in India, you cannot directly open an account with them. Instead, you must go through an authorised intermediary called a Depository Participant (DP). Brokerage partners like Samco Securities act as these DPs.

While a demat account holds your securities, you also need a trading account to buy or sell them on the stock exchange. The trading account executes the order, and the demat account reflects the change in ownership.

Types of Demat Accounts in India

Now that you know what a demat account is, let us look into the different types of demat accounts you can open in India.

- Regular Demat Account

If you're just getting started learning about what a demat account is, this is the most common type you'll come across. This is meant for Indian residents who want to invest and trade in equities and other securities. It holds all your investments in digital format and makes transactions quick and paperless. - Non-Repatriable Demat Account

Also for NRIs, this type does not allow fund repatriation outside India. It must be connected with an NRO (Non-Resident Ordinary) bank account. It may limit fund transfers abroad, but it supports investing in India-based securities. This makes it a key category among demat accounts in India for those with domestic financial commitments.

Why is a Demat Account Important?

A demat account is important for various reasons. If you want to open a demat account in India, here is why it could be necessary.

- Safe and Secure Storage

Misplacing paper share certificates worth lakhs of rupees is a real and tragic possibility. With a demat account, that risk disappears. Your securities are stored digitally and protected from theft, loss and damage. You get peace of mind in your investing journey, especially as demat accounts in India have become the norm. - Easy Transfer of Shares

Say you want to offer some shares to your child or spouse as a gift. With a demat account, you can transfer securities in a few clicks, without paperwork or delays. This quick and simple process eliminates the long waiting times associated with physical share transfers, making it a true upgrade from the old-school method. - Faster Settlement Cycles

Buying shares on Monday and receiving them by Tuesday? That’s how the T+1 settlement works today. Thanks to your demat account, transactions are processed quickly and efficiently. It ensures you don’t miss out on time-sensitive market opportunities, which is a big plus for active investors who value speed and clarity. - Paperless and Convenient

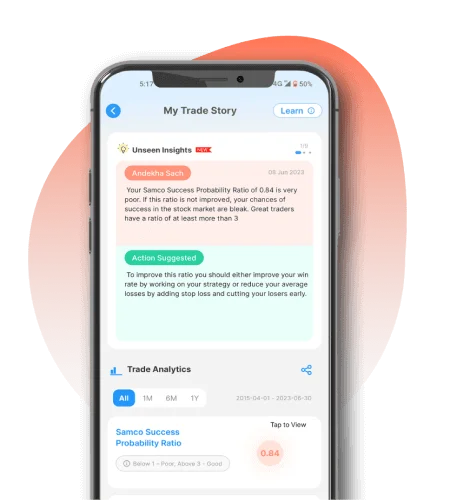

No more couriering of documents or standing in long queues. Whether you’re buying mutual funds or applying for an IPO, your demat account makes the process 100% digital. If you're wondering why and how a demat account works so seamlessly, it’s because it eliminates physical paperwork and speeds up transactions. - Access to IPOs and Corporate Actions

With a demat account in India that is linked to a trading account, you get access to trading apps. These apps give you alerts for dividends, rights issues and IPO allotments. For instance, applying for a popular IPO is possible with just a few taps. With such features, you can stay informed, act quicker and not miss opportunities, all of which are benefits of a demat account. - Non-Repatriable Demat Account

Also for NRIs, this type does not allow fund repatriation outside India. It must be connected with an NRO (Non-Resident Ordinary) bank account. It may limit fund transfers abroad, but it supports investing in India-based securities. This makes it a key category among demat accounts in India for those with domestic financial commitments.

Benefits of Having a Demat Account

The benefits of a demat account include the following:

- Lower Costs: A demat account helps reduce your overall investment costs because it eliminates the need for physical share handling and courier charges, among other fees.

- Easy Access: You can view and manage your securities anytime, anywhere through your broker’s trading platform or app.

- Quick Loan Approvals: Shares held in your demat account can be pledged as collateral for any eligible loan.

- Portfolio Diversification: You can easily invest across stocks, ETFs, mutual funds and bonds through a single digital account.

- Real-Time Tracking: You can also monitor your investments in real time and make informed decisions using up-to-date market data and holdings.

How to Open a Demat Account in India?

Want to know how to open a demat account in India? Broadly, you simply need to follow these steps:

Step 1: Choose a Depository Participant (DP) Start by selecting a trusted DP like Samco Securities. We offer a user-friendly and seamless demat account opening process with zero paperwork.

Step 2: Fill in the KYC Form Complete the Know Your Customer (KYC) form using your basic personal and financial details.

Step 3: Submit Required Documents Upload scanned copies of your PAN card, Aadhaar and a cancelled cheque or bank statement.

Step 4: Complete e-KYC Verification Verify your identity through an OTP-based Aadhaar verification or a quick in-person video check.

Step 5: Account Activation Once verified, your demat account will be activated, usually within 24 to 48 hours.

Ready to get started? Open your demat and trading account with Samco Securities today and take your first step toward digital investing.

Documents Required to Open a Demat Account

A major part of learning how to open a demat account is to know which documents are required for a demat account opening. Here is a quick look at the paperwork generally needed for this purpose.

- PAN card

- Aadhaar card

- Bank statement

- A passport-sized photo

- A cancelled cheque

Demat vs Trading Account: What’s the Difference?

Here is how a trading account and a demat account in India compared with one another.

| Particulars | Demat Account | Trading Account |

|---|---|---|

| Purpose | To store securities in an electronic format | To buy and sell securities on the stock exchanges |

| Function | Acts as a digital locker for your investments | Facilitates trading transactions on the stock exchanges |

| Usage | Used for holding shares, bonds, ETFs and mutual funds | Used for placing buy/sell orders in the market |

| Requirement | Required when you want to hold shares and other securities | Required when you want to actively trade in the markets |

| Regulatory Link | Connected to depositories like the NSDL and CDSL | Linked to stock exchanges like the NSE and BSE |

| Type of Account | Non-transactional storage account | Transactional execution account |

Conclusion

Ultimately, a demat account is your entry point to safe and easy investing in the modern markets. It simplifies how you store, track and manage your securities. It also offers other benefits like added convenience and reduced costs. With Samco Securities, opening a demat account is quick and hassle-free. Start your stock market journey with Samco today.

Easy & quick

Easy & quick