In this article on Gold Bees

- What are BeEs?

- What are Gold BeEs?

- Gold as an investment

- Gold returns Vs. Equity returns

- Ways of investing in Gold

- Gold BeES Vs Sovereign Gold Bonds

- Tax treatment for Gold BeES

- Why invest in Gold BeES?

- Gold BeEs

- Sovereign gold bonds.

- Gold Exchange Traded Funds (ETF)

- E-Gold etc.

What are BeES?

BeES stands for Benchmark Exchange Traded Schemes. It is a collection of stocks which are actively traded on the stock exchange.- Nifty BeES is a collection of 50 stocks that are a part of the Nifty 50 index.

- Liquid BeES invest in liquid instruments like collateralised borrowing and lending obligation (CBLO), repurchase agreements (REPO) and reverse REPO instruments.

- Bank BeEs is a collection of ten biggest banks in India.

Watch this video to know what are exchange traded funds and how they work

What are Gold BeES?

Gold BeEs is an open-ended exchange traded fund. Its primary objective is to mirror the price movement of physical gold. The underlying asset of gold BeEs is physical gold bullions. Gold BeEs is an efficient and cost-effective way of investing in gold. Gold BeEs is an excellent portfolio diversifier as it helps you hedge equity risk and maximise portfolio returns. Before we discuss if you should invest in Gold BeEs, let us first understand if you should invest in gold as an asset class.Why should you invest in Gold?

Gold is a beloved asset class because it provides a hedge against inflation. But how does gold do this? Let’s find out…- Depreciation of rupee is one of the major factors for exceptional gold returns in India.

| 2011 | 2021 | Returns | |

| Gold Prices | Rs. 26,000 | Rs. 49,000 | 88.46% |

| Rupee Value against USD | Rs. 46 | Rs. 76 | 1.6X |

In the past 10 years gold prices increased from USD 1,550 to USD 1,750. Gold returns in India doubled while in the US gold price rose only 10%. Hence, we can say that deprecation of Indian rupee is factored in Indian gold returns. This is why we consider gold to be a perfect hedge against inflation.

Gold has also been a great investment option due to its quality of providing immediate liquidity and store of value. Gold is considered to be a long-term investment at low risk because of these qualities.

In the past 10 years gold prices increased from USD 1,550 to USD 1,750. Gold returns in India doubled while in the US gold price rose only 10%. Hence, we can say that deprecation of Indian rupee is factored in Indian gold returns. This is why we consider gold to be a perfect hedge against inflation.

Gold has also been a great investment option due to its quality of providing immediate liquidity and store of value. Gold is considered to be a long-term investment at low risk because of these qualities.

Gold Returns Vs. Equity Returns

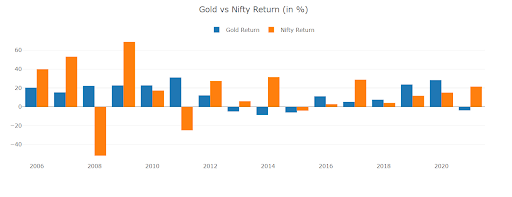

Gold also seems to be a good investment avenue during emergencies like the one we were in 2020. But is it the best long-term choice for wealth creation? (source: www.tradingview.com)

Red = Gold prices; Blue = Sensex

If we take a look at the chart above, in the last 10 years, Gold has generated a compound annual growth rate (CAGR) of 9.4% which is 145% on an absolute basis. Whereas Sensex has generated a CAGR of 6.22% which is an absolute return of 82% (as on March 2020).

(source: www.tradingview.com)

Red = Gold prices; Blue = Sensex

If we take a look at the chart above, in the last 10 years, Gold has generated a compound annual growth rate (CAGR) of 9.4% which is 145% on an absolute basis. Whereas Sensex has generated a CAGR of 6.22% which is an absolute return of 82% (as on March 2020).

Source: equityfriend.com

Gold is a proper hedge against crisis as its price jumps when fear runs high. In the great recession of 2008, the prices of gold drove to new highs over a very short time period. And since COVID-19 pandemic began the prices of gold has been steadily rising.

Gold is perfect to beat inflation because the government has relatively the same amount of gold reserves even when it increases the supply of currency.

The fact that gold’s value doesn’t effectively corelate with the movement of stock market, makes it a unique proposition in the investment world. Owning different kinds of investment relatively reduces the overall market risk. According to financial experts, 10-15% of your portfolio should be allocated towards gold.

But we are back to the same question… which type of gold should you own? Let us answer this as we look at the different ways to invest in gold.

Source: equityfriend.com

Gold is a proper hedge against crisis as its price jumps when fear runs high. In the great recession of 2008, the prices of gold drove to new highs over a very short time period. And since COVID-19 pandemic began the prices of gold has been steadily rising.

Gold is perfect to beat inflation because the government has relatively the same amount of gold reserves even when it increases the supply of currency.

The fact that gold’s value doesn’t effectively corelate with the movement of stock market, makes it a unique proposition in the investment world. Owning different kinds of investment relatively reduces the overall market risk. According to financial experts, 10-15% of your portfolio should be allocated towards gold.

But we are back to the same question… which type of gold should you own? Let us answer this as we look at the different ways to invest in gold.

Ways to Invest in Gold

1. Physical Gold

Buying physical gold is no longer ideal due to the huge mark-up costs. Physical gold involves high making charges, GST, storage cost, insurance and impurities. These added costs are impossible to recover while selling gold. So, the only winner when you buy physical gold is the jeweller, not the investor.2. Electronic Gold or E-Gold

E-Gold is a unique product which can be bought and sold through stock exchanges just like shares. A demat account is compulsory if you want to buy E-gold. One unit of E-gold is equal to one gram of gold. However, E-gold does suffer from risk of hacking.3. Sovereign Gold Bonds (SGBs)

Sovereign Gold Bonds are tax-efficient bonds denominated in gold backed by the government. Apart from the capital appreciation, SGBs also provide a guaranteed interest rate of his dematerialised asset doesn’t just rest, it regularly yields 2.5% on investment amount. % annually (paid out semi-annually). However, SGBs have a lock-in period of eight years and are comparatively less liquid than gold ETFs or gold BeEs. [Read More: What are Sovereign Gold Bonds? – Features & Advantages of Sovereign Gold Bonds]Comparison between Sovereign Gold Bonds (SGB) and Gold BeES

- Quantity

- When to enter the investment

- Redemption

- Returns

- Sovereign Guarantee

4. Gold ETF

Gold ETFs are more efficient than physical gold. Nonetheless they carry a small hit of ETF fees for the entire life of investment and mild tracking errors. The table below shows all the Gold ETFs available in India in 2021.| Company Name | Last Price | % Change | 52-week | 52-week | Market Capitalisation |

| High | Low | (Rs. Cr) | |||

| Nippon ETF Gold | 41.39 | 0.51 | 45.2 | 38.17 | 6,327.8 |

| SBI Gold ETF | 4257.06 | 0.72 | 4712 | 3930 | 325.2 |

| Invesco G-ETF | 4360 | 1.75 | 4745 | 3989.5 | 49.83 |

| HDFC Gold ETF | 42.57 | 0.71 | 50 | 38.7 | 6.55 |

| UTI - Gold | 41.37 | 0.32 | 46.75 | 39.21 | 5.74 |

| Axis Gold ETF | 41.5 | 0.27 | 44.99 | 38.36 | 3.18 |

| IPRU Gold ETF | 42.42 | 0.12 | 46.5 | 39.05 | 1.99 |

| Kotak MF-GETF | 41.81 | -0.02 | 45.29 | 36.81 | 1.67 |

5. Gold BeES

Gold BeES are focused on providing returns close to physical gold. It invests purely in finest gold of 99.5% purity. Gold BeES are open-ended funds that are traded on exchanges. These funds are tracked to provide returns to its benchmark – domestic gold prices. The underlying portfolio composition of a Gold BeEs includes physical gold and money market instruments like treasury bills, certificate of deposits etc. Gold BeES Composition - Gold 995 1kilogram bars amounts for 97% of the Gold BeEs. The rest 3% includes cash and cash receivables.Tax Treatment for Gold BeES

- If you sell Gold BeEs before three years from the date of purchase, then a short-term capital gains tax as per your tax slab is applicable.

- If you sell Gold BeEs after 3 years from the date of purchase, then a long-term capital gains tax is applicable. LTCG on gold BeEs is 20% of profit with indexation or 10% of profits without indexation, whichever is lower.

Why Invest in Gold BeES?

- Lowest cost - Buying Gold BeES involves minimal brokerage charges only. While buying physical gold includes paying huge markup and losing on GST claim.

- Secured - Gold BeES are secured in electronic mode. These are stored in your demat account. Unlike physical gold no storage charges, insurance or fear of theft or misplacement arises.

- Trading margin – Gold BeES investment is accepted as trading margin. It is a collateral for trading on stock exchanges.

- Invest in smallest quantity – Gold BeES can be bought in multiples of 0.01 gram. Unlike gold bonds where the minimum buying quantity is one gram. Hence, one can buy Gold BeES on their trading terminal starting from 0.01 gram.

Easy & quick

Easy & quick

Leave A Comment?