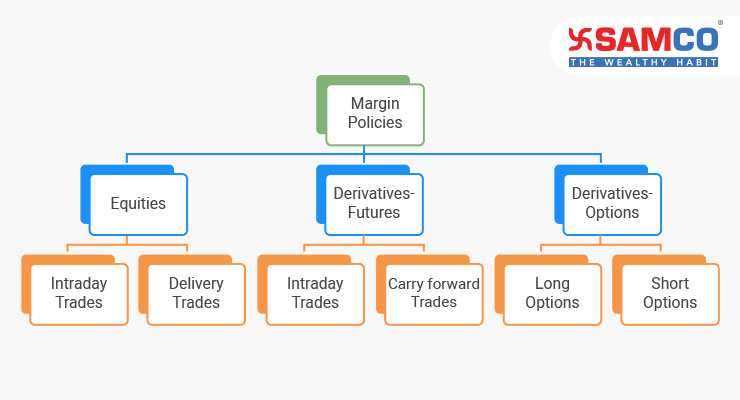

Margin Limits and Policies are a very critical point for consideration for every Trader and Investor in the markets. We at Samco in this post have tried to detail the margin policies that shall be available under different product categories. We have tried to be transparent and upfront in our risk management approach however Mr. Markets may require us to change our policies based on its mood swings. Broadly, the entire risk management policy is designed for 3 types of trading patterns and segments

- Equities

- Derivatives – Futures

- Derivatives – Options

1. Trading in Equities i.e. Shares Listed on NSE/BSE

All market participants can trade in the Equities or Cash Market Segment on the NSE/BSE using the following Product Types with Samco

a. For Intra-day Trades

Intraday traders can trade using 2 product types

1. MIS – (Margin Intraday Square-off)

In this MIS product type, additional leverage is available for intraday trades since there is lower risk to positions, especially since positions are not carried forward and therefore there is no overnight market risk. Clients will be required to chose MIS as a product type while placing their orders in the Samco Trader. By selecting MIS as a product type, leverage from 3x – 15x will be available depending on the liquidity of the stock. A total of 700+ stocks are available for trading in the MIS product type. However, one thing to remember is that all orders in the MIS product type should be compulsorily squared off before 3.14 pm failing to do which will require the Samco RMS to square-off positions at 3.15 pm. To see the full list of eligible stocks and their corresponding multipliers, check the Samco Margin Calculator on our website.

2. CO – (Cover Orders)

For traders requiring even more intraday leverage than provided by the MIS product, a unique feature available with the Samco Trader is Cover Orders. When you select the Cover Orders as a product, you will be compulsorily required to enter a stop loss for your trade. In simple terms, a cover order is an order with a stop loss. This enables us to calculate the maximum risk to your positions and accordingly charge lower margins for intraday trades. More often than not, the margin levied in cover orders shall be [(Trade Price – Stop Loss Price) * Quantity]. A point to remember is that these orders too will be required to be squared up before 3.15 pm failing which they will be squared up by the Samco RMS Team.

b. Delivery Trades

CNC – (Cash & Carry) :

To execute delivery trades with Samco, you will need to use the product type – CNC i.e. Cash and Carry. As the name suggests, you will need to completely pay up the margin for delivery trades upfront prior to executing a trade. In case you have Rs. 50,000 in your account, you will be able to buy the delivery of only Rs. 50,000 by using the CNC product type. Also, whilst selling in the CNC product type, you will be required to have the stock either in your Samco DP account or the Samco Client Beneficiary Account. You will not be permitted to sell stock which is not a part of the Samco ecosystem.

This is to ensure stocks are sold only when stocks are available to be delivered to the exchanges as an obligation.Why do CNC trades require 100% Margin upfront? When stocks are purchased and carried forward, the price risk due to overnight events is extremely high. We have often seen stocks reacting to news events with 20% gap up/ gap down movements. In such cases, it's best to have un-leveraged positions that require a 100% margin.An important point to note is that positions can be converted from MIS to CNC and vice versa at any point in time subject to margin availability. For instance, if you had purchased 1,000 shares of Reliance @ Rs. 900/share in MIS product and blocked Rs. 1,80,000 in the margin (say 20%) and decided at 3 pm that you wanted to carry forward this as a CNC trade, all you’ll need to do is go to the Samco trader and convert your position from MIS to CNC.

However, this conversion would be permitted only if you had Rs. 7,20,000 (CNC Margin difference of 80%) available in your account as a free balance.

2. Trading in Derivatives – Futures (Equity Derivatives, Currency derivatives, Commodity derivatives and Interest Rate Futures Derivatives)

a. For Intra-day Trades

Intraday traders can trade using 2 product types

MIS – (Margin Intraday Square-off) :

In this MIS product type, additional leverage is available for intraday trades since there is lower risk to positions, especially since positions are not carried forward and therefore there is no overnight market risk. Clients will be required to chose MIS as a product type while placing their orders in the Samco Trader. However, one thing to remember is that all orders in the MIS product type should be compulsorily squared off before cut-off time failing to do which will require the Samco RMS to square-off positions. The stipulated cut-off time for the different exchange segments are as follows:

- Equity Derivatives (NSE-F&O, BSE F&O) – 3.15 pm

- Currency Derivatives (NSE-CDS, BSE-CDS, MCXSX-CDS) – 4.45 pm

- Commodity Derivatives (MCX) – 30 Minutes prior to market close.

2. CO – (Cover Orders) : For traders requiring even more intraday leverage than provided by the MIS product, a unique feature available with the Samco Trader is Cover Orders. When you select the Cover Orders as a product, you will be compulsorily required to enter a stop loss for your trade. In simple terms, a cover order is an order with a stop loss. This enables us to calculate the maximum risk to your positions and accordingly charge lower margins for intraday trades. More often than not, the margin levied in cover orders shall be [(Trade Price – Stop Loss Price) * Quantity]. The leverage available in a Cover order is higher than in MIS and NRML products. Cover orders are available for all the segments i.e. equity, currency and commodity derivatives however the margin applicable varies across segments.

b. Carry Forward Trades

To execute carry forward trades with Samco i.e. trades that you’d like to carry overnight, you will need to use the product type – NRML i.e. Normal. As the name suggests, you will need to completely pay up the normal margin as required by the exchanges (SPAN + Exposure margin) for carrying forward trade upfront prior to executing a trade. In case you have Rs. 50,000 in your account and you want to execute a trade to buy 100 units of NIFTY Futures @ 8,500 and the applicable normal margin is 5%, then Rs. 42,500 (5% * 8,50,000) from your account will get blocked once your trade is executed. When you execute a trade using the NRML product type, you will be permitted to carry your positions till the expiry of the contract. To calculate the margin applicable to your positions, you can visit the F&O Margin calculator on the Samco Website.

3. Trading in Derivatives – Options (Equity & Index Options and Currency Options)

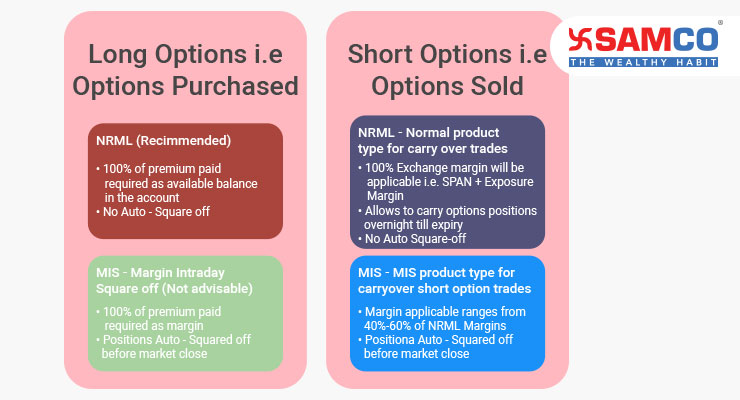

a. Forgoing Long options i.e. Purchasing Options

When you buy options, Samco provides no additional leverage. So if you are buying calls or puts of any contract, the premium required to buy them has to be available in your account with Samco. You can trade options either with product type as NRML or MIS, but since there is no additional leverage provided if you use product type as MIS, it is recommended to use the NRML product type which will allow you to carry the positions overnight and not MIS since all MIS positions would get squared off before the close of markets.

b. Forgoing Short options i.e. Selling Options

Selling options require margin to be blocked and the premium received from the short options is credited to your trading account. You can short option either using the product type as NRML or MIS. To calculate the margin applicable on your positions, you can visit the F&O Margin calculator on the Samco Website. The margins displayed in the margin calculators are for information purposes only and are only indicative in nature and do not constitute the final margin as would be levied by the exchanges. Clients should maintain some extra margins in their accounts to manage initial margins and marked to market losses if any.

Samco reserves the right to square off all client positions in case of margin shortfall and in case of erosion of more than 80% of balance available due to mark to market losses without any prior notice. In case of more than 80% erosion of balance by way of mark to market losses due to price fluctuation, Samco also reserves the right to restrict additional exposure and can place the client's account in square off mode only. We hope this post clearly solves all your questions on Samco’s margin policies.

Easy & quick

Easy & quick

Leave A Comment?