In this Article, we will discuss:

- The SEBI Report: A Data-Driven Perspective

- Decoding the Data From SEBI’s Report

- Exploring the Reasons for Losses in F&O Trading

- The Role of Advanced Trading Tools

- Options Greeks: An Essential Advanced Tool for F&O Traders

- A Deep-Dive Into Options Delta

- Become a Better F&O Trader by Factoring in Options Delta on the Samco Trading App

- Become a Profitable Options Trader by Using Options Delta on the Samco Trading App

Futures and options (F&O) trading in India is one of the most dynamic segments of the country’s financial markets. In the period from January 2020 and March 2022, the F&O trading volumes on the NSE, India’s foremost options trading platform, grew by a whopping 737%, with the average daily F&O volumes breaching the ₹140 lakh crore mark by the end of this period.

Clearly, the F&O segment is a dynamic and integral part of the financial markets. However, despite being replete with both opportunities and risks — trading in this segment via options trading platforms presents a paradoxical scenario. While it offers potential high returns, the reality for most traders in this domain is quite the opposite. A majority of F&O traders consistently lose money on options trading platforms. This troubling trend is not just anecdotal but is backed by hard data, particularly highlighted in the Securities and Exchange Board of India (SEBI)'s comprehensive report.

The SEBI Report: A Data-Driven Perspective

The SEBI report sheds light on a startling reality: a vast majority of individual F&O traders are on the losing side of their trades. The report reveals that in the financial year 2021-22, 89% of individual derivative traders suffered losses, averaging around Rs 1.1 lakh per trader. This statistic is a glaring indication of the high-risk nature of F&O trading. The gravity of this situation is further accentuated when you consider that the number of F&O traders increased by over 500% in just three years.

Decoding the Data From SEBI’s Report

Several inferences can be drawn from the findings in SEBI’s report. Firstly, the allure of high returns in F&O trading attracts numerous individual investors, but the complexity and risk associated with these instruments are often underestimated. Secondly, the high percentage of traders incurring losses on options trading platforms suggests that the risks associated with F&O trading are perhaps not adequately understood or managed by the majority.

In addition to this, the substantial average loss per trader indicates that not only are many traders losing, but they are losing significant amounts, pointing towards a possible lack of effective risk management strategies. Lastly, the vast increase in the number of F&O traders, by over 500% in three years, suggests that despite the high risks, the allure of these markets remains strong.

Exploring the Reasons for Losses in F&O Trading

A closer look at the F&O trading segment gives us reliable insights into the possible reasons driving such tremendous losses in the F&O market. They include:

Over-Reliance on Tips and Advisory Services

Many traders, especially novices, rely heavily on tips and advice from unverified sources. This approach lacks a methodological and analytical basis and leads to ill-informed decisions.

Poor Risk Management

Effective risk management is crucial in F&O trading. However, many traders disregard risk management principles in the pursuit of quick recovery from losses, leading to significant losses.

Overtrading

The SEBI report found that loss-making traders incurred additional costs due to frequent trading. Overtrading, driven by unrealistic expectations and facilitated by mobile trading apps and accessible futures and options trading platforms, inevitably compounds losses.

Part-Time Trading

F&O trading requires dedicated attention. Many individuals attempt to trade part-time alongside their primary occupation. This leads to a lack of focus and insufficient analysis. The unavailability of advanced trading tools in futures and options trading platforms further adds to the problem.

The Role of Advanced Trading Tools

A significant and often overlooked reason for the losses incurred by many F&O traders is the unavailability or underutilization of advanced trading tools. These tools, which range from sophisticated analytical software to risk management algorithms, play a crucial role in informing traders about market trends, potential risks and opportunities.

The absence of or lack of access to such tools in futures and options trading platforms can lead to decisions based on incomplete information or mere speculation. Advanced tools also aid in automating certain aspects of trading, thus reducing the likelihood of emotional or impulsive trading decisions.

Options Greeks: An Essential Advanced Tool for F&O Traders

Advanced trading tools like options Greeks play a pivotal role in enhancing the decision-making process for options traders. They provide a mathematical framework to measure and analyse different dimensions of risk and potential in options trading. Among these, delta, gamma, theta and vega are particularly crucial.

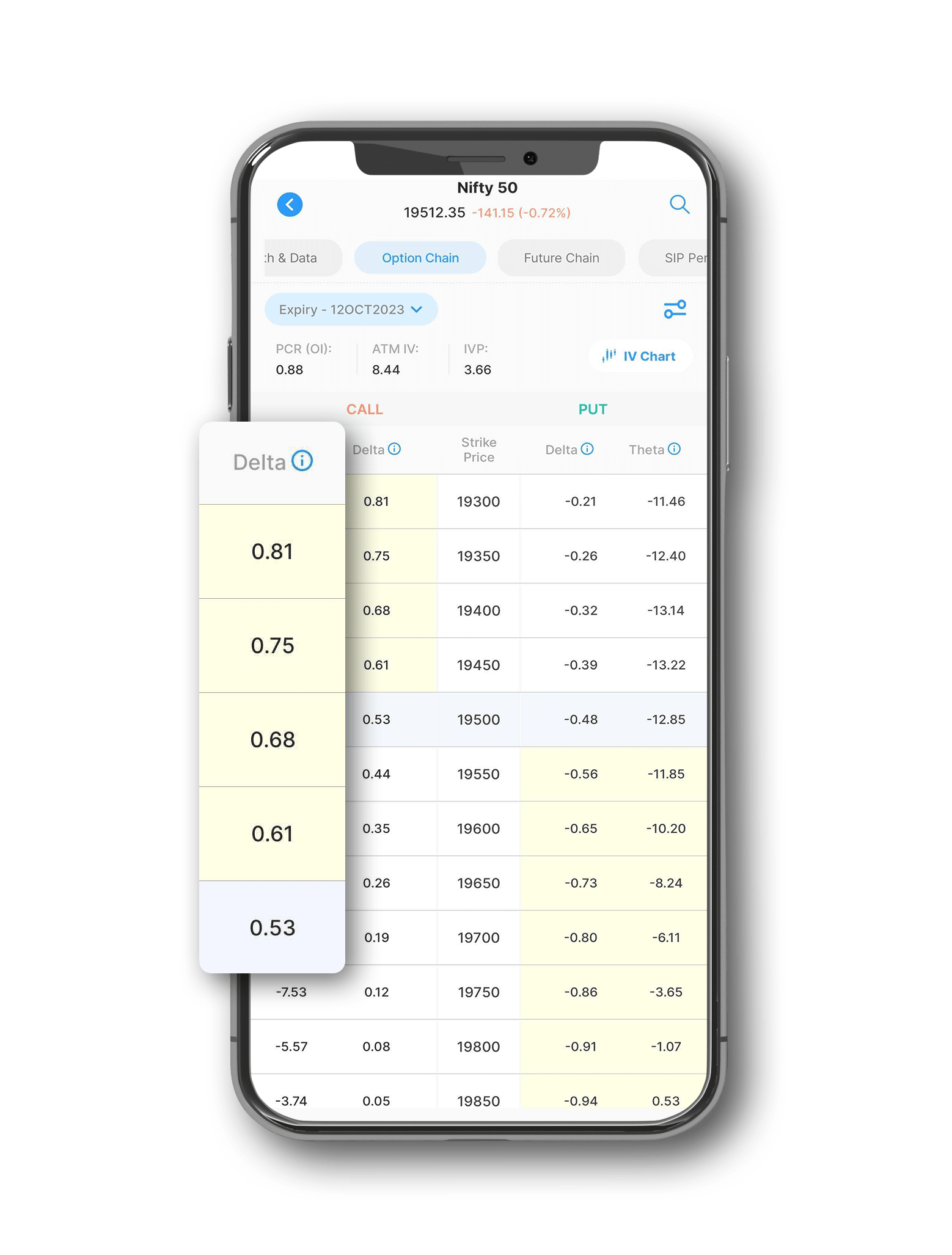

Delta measures the rate of change in an option's price for each point of movement in the underlying asset's price. It essentially predicts how much the price of an option will change when the stock price fluctuates. This is crucial to estimate how much you can expect to gain or lose when the price of the underlying stock moves.

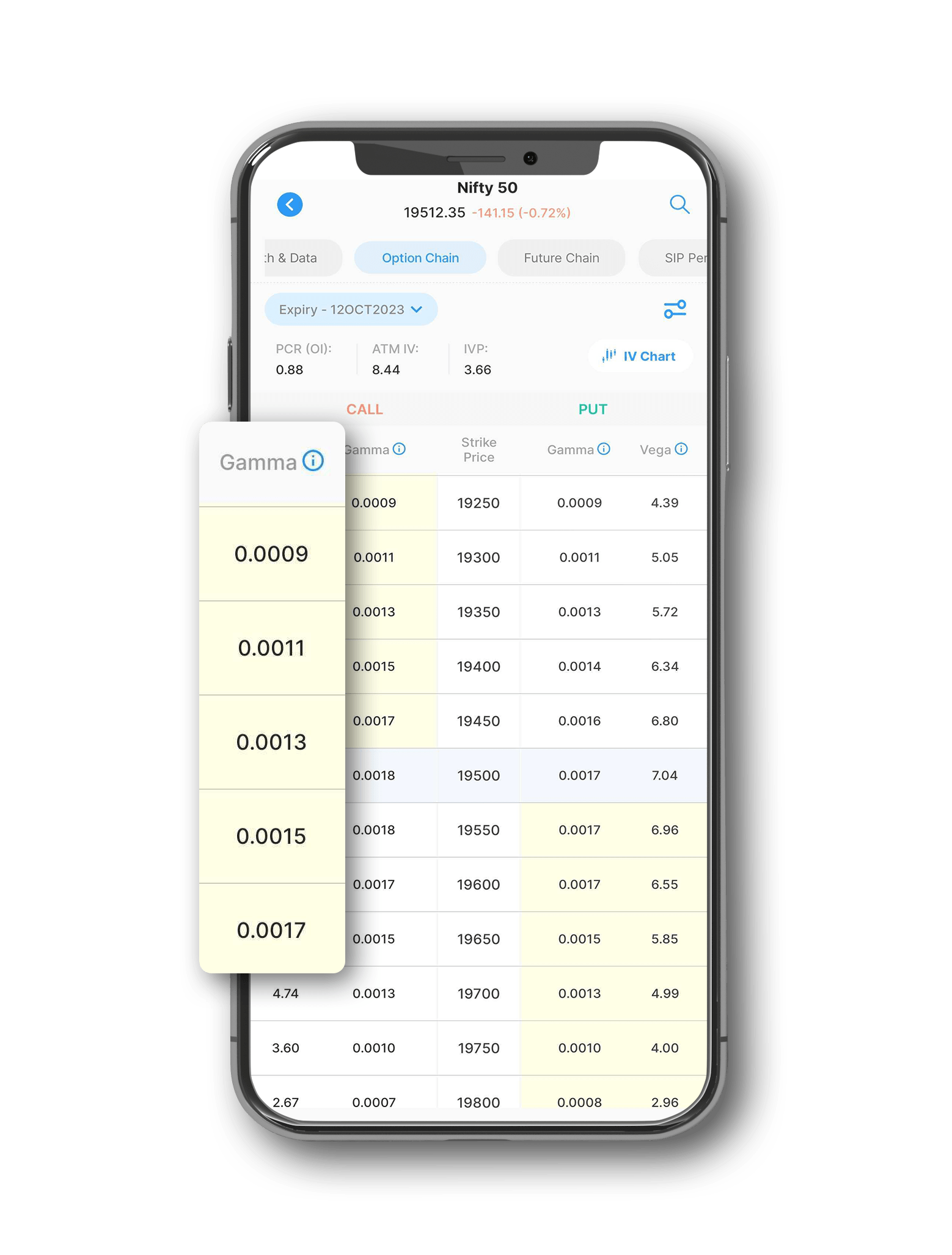

Gamma is related to delta. It measures the rate of change of the delta itself, so you can assess how likely it is that an option ends up as an in-the-money security. High gamma values suggest that the delta may change rapidly and react dynamically to even small movements in the underlying asset’s price. Studying this tool is essential for managing risk in dynamic market conditions.

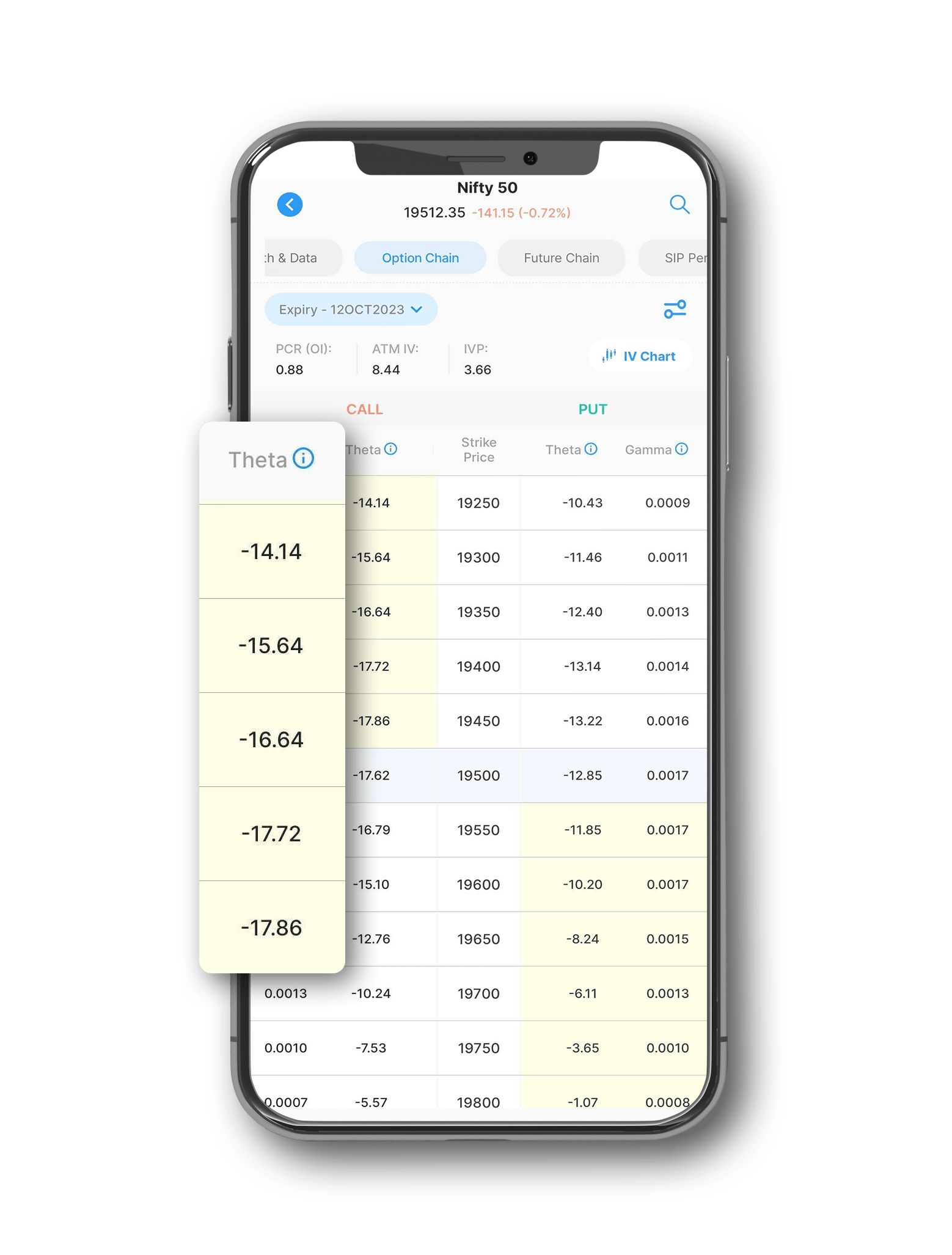

Theta quantifies the rate at which an option's value decreases over time. This is known as time decay. It's particularly important for option sellers who benefit from the erosion of the option's time value as expiration approaches. Understanding theta helps you strategize trades based on how much time value an option is likely to lose each day.

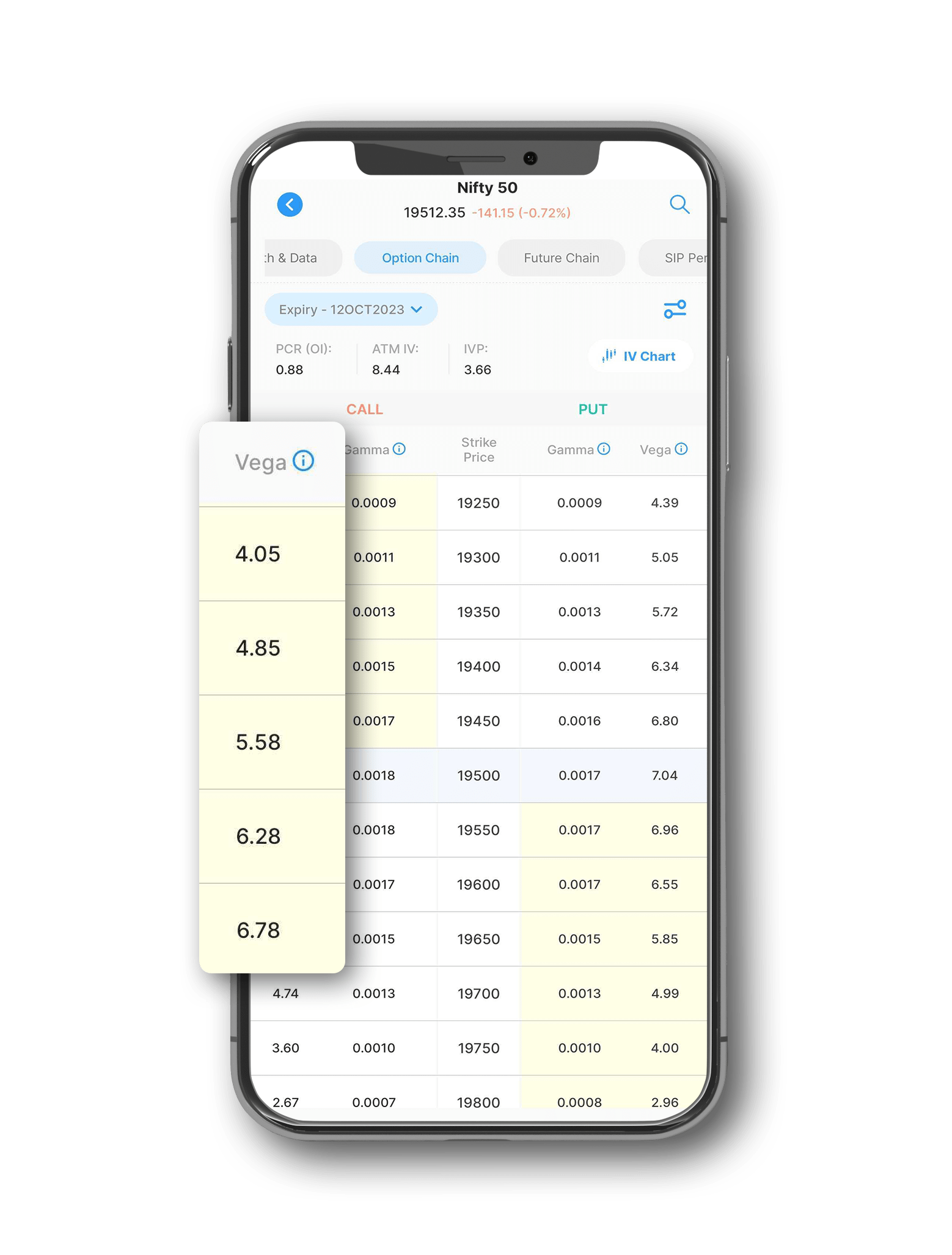

Vega measures an option's sensitivity to changes in the volatility of the underlying asset. It indicates the amount by which the price of an option would increase or decrease based on a 1% change in the asset's volatility. This helps you understand and capitalise on market sentiment and anticipated price swings.

A Deep-Dive Into Options Delta

Understanding the range of delta for both call options and put options is crucial for refining your F&O trading strategies and decision-making processes. For call options, the delta ranges from 0 to 1. A delta near 0 indicates the option is likely out-of-the-money, and a delta close to 1 suggests it's in-the-money. For put options, the delta ranges from -1 to 0. A delta near -1 indicates a deep-in-the-money put, while a delta closer to 0 suggests an out-of-the-money put.

Strategic Use of Delta in Bullish and Bearish Markets

The value of delta offers a wealth of strategic insights. In a bullish market, traders might look for call options with a higher delta as these options will have a stronger correlation with the underlying stock. This high delta indicates a higher likelihood of the option being in-the-money at expiration and also points to a greater sensitivity to the underlying stock's price movements.

Conversely, in bearish market conditions, traders might focus on put options with a delta closer to -1 for similar reasons. These options would move inversely but closely with the underlying stock, thus providing a hedge against downward movements or an opportunity to profit from them.

Delta Strategies in Neutral Markets

In neutral market conditions or when the trader’s directional bias is less strong, options with a delta closer to 0.5 (for calls) or -0.5 (for puts) could be more appealing. These options strike a balance between potential profits and limited risks because they are less sensitive to price movements of the underlying asset.

Interpreting the Rate of Change in the Delta for Trade Timing

The rate of change in the delta also offers strategic cues. For instance, an option with a delta that is rapidly approaching 1 or -1 as the expiration nears, especially in the context of the underlying asset’s price movement, might signal an opportune time for trade execution. This change in the delta can indicate an increasing probability of the option expiring as an in-the-money security, which might prompt a trader to either take a position or adjust an existing one.

Integrating Delta in Multi-leg Trading Strategies

In multi-leg strategies, understanding the combined delta of different options in a spread or a straddle becomes critical. For example, in a delta-neutral strategy, the goal is to balance the positive and negative delta values to reduce directional risk. You can adjust these positions in response to changes in the underlying asset's price to maintain this balance and thus manage your overall portfolio risk.

Become a Better F&O Trader by Factoring in Options Delta on the Samco Trading App

Navigating the F&O market successfully requires more than just intuition; it demands advanced tools and analytics. The high rate of losses in the F&O segment, as highlighted by SEBI's report, indicates the necessity and the corresponding lack of such tools among India’s retail traders.

One critical tool that every trader needs in options trading platforms is the understanding and application of options Greeks, particularly options delta. Unfortunately, in the broader market, these advanced analytics are not easily available in most options trading platforms. Even if they are, accessing them often comes at a significant cost, leading to a barrier for many traders.

This is where the new-gen trading app from Samco Securities steps in as the game changer. Recognising the need for powerful yet accessible trading tools, we at Samco Securities offer a wide range of options Greeks, including Delta, for all the users on our options trading platform. This democratisation of advanced trading analytics empowers traders at all levels and offers them a chance to make informed and data-driven decisions in the volatile F&O market.

The best part is that these analytics and tools are available free of charge in a market where traders otherwise find it challenging to access them without incurring significant expenses or subscribing to premium services. Let us delve deeper into how you can use the options delta, available in the Samco trading app, to enhance your F&O trading strategies.

Position Management with Delta

By understanding the implications of the options delta, you can adjust your portfolio to maintain the desired level of exposure to the underlying asset. For instance, say you hold an options contract that has a delta of 0.5. What this essentially means is that for every one point that the price of the underlying asset moves, the price of the option may move by half a point.

Delta Hedging for Risk Reduction

Delta hedging is another strategy that can be employed to mitigate risk. This involves creating a delta-neutral position, where the overall delta of a portfolio of options and the underlying asset is zero. In such a setup, small movements in the price of the underlying asset have minimal impact on the overall value of the portfolio, thus reducing risk.

Market Sentiment and Delta

Delta can also serve as an indicator of market sentiment. Options with a high delta are typically in-the-money, and their price movements are more closely tied to the underlying asset. This can suggest that traders strongly believe in the direction of the asset's price movement.

Delta in Multi-leg Strategies

If you frequently employ multi-leg strategies like spreads or straddles, understanding how the delta varies across different legs of the trade is crucial. The combined delta of these positions can offer insights into the net directional exposure of the strategy and how you may need to adjust in response to market movements.

Become a Profitable Options Trader by Using Options Delta on the Samco Trading App

Factoring in the options delta in your F&O trading strategies can be incredibly beneficial. You can improve the chances of trading success and become a profitable options trader. By providing these tools free of charge on the Samco trading app, we aim to help our community of traders understand and mitigate risks better, make strategic choices based on market sentiment and effectively manage their positions.

This accessibility in our options trading platform levels the playing field and equips you with the insights needed to navigate the complex F&O market. Ultimately, it enhances your trading decisions and potentially boosts your success without the burden of additional costs.

Disclaimer: INVESTMENT IN SECURITIES MARKET ARE SUBJECT TO MARKET RISKS, READ ALL THE RELATED DOCUMENTS CAREFULLY BEFORE INVESTING. The asset classes and securities quoted in the film are exemplary and are not recommendatory. SAMCO Securities Limited (Formerly known as Samruddhi Stock Brokers Limited): BSE: 935 | NSE: 12135 | MSEI- 31600 | SEBI Reg. No.: INZ000002535 | AMFI Reg. No. 120121 | Depository Participant: CDSL: IN-DP-CDSL-443-2008 CIN No.: U67120MH2004PLC146183 | SAMCO Commodities Limited (Formerly known as Samruddhi Tradecom India Limited) | MCX- 55190 | SEBI Reg. No.: INZ000013932 Registered Address: Samco Securities Limited, 1004 - A, 10th Floor, Naman Midtown - A Wing, Senapati Bapat Marg, Prabhadevi, Mumbai - 400 013, Maharashtra, India. For any complaints Email - grievances@samco.in Research Analysts -SEBI Reg.No.-INHO0O0005847

Easy & quick

Easy & quick

Leave A Comment?