In this article, we will discuss

- What is a Put Option?

- What is a Long Put Strategy?

- What is the Payoff Of A Long Put Strategy?

- Who can Deploy A Long Put Strategy?

- When Should A Long Put Strategy Be Deployed?

- Understanding Strategy Greeks

- Things to Keep In Mind

- Conclusion

What is a Put Option?

A put option is a contract that gives the buyer the right, but not the obligation, to sell an underlying asset at a predetermined price (called the strike price) on a certain date (called the expiration date). The seller of the put option, on the other hand, has the obligation to buy the underlying asset from the buyer at the strike price if the buyer exercises the option.

What is a Long Put Strategy?

A long put strategy is a single-leg option strategy that consists of buying one put option. The put option can be in the money (ITM), at the money (ATM), or out of the money (OTM), depending on the relationship between the strike price and the current price of the underlying asset.

- An ITM put option has a strike price higher than the current price of the underlying asset. It has intrinsic value, which is the difference between the strike price and the current price, and some time value, which is the premium minus the intrinsic value.

- An ATM put option has a strike price equal to or very close to the current price of the underlying asset. It has no intrinsic value, and its premium is entirely composed of time value.

- An OTM put option has a strike price lower than the current price of the underlying asset. It has no intrinsic value, and its premium is entirely composed of time value.

The choice of the strike price depends on the trader's expectation of the price movement of the underlying asset, the risk tolerance, and the budget.

What is the Payoff Of A Long Put Strategy?

The payoff of a long put strategy depends on the price of the underlying asset at expiration. The maximum loss is limited to the premium paid for buying the put option, which occurs when the underlying asset closes above or at the strike price at expiration. The breakeven point is the strike price minus the premium paid. The profit increases as the underlying asset closes below the breakeven point at expiration. Theoretically, the profit potential is unlimited if the underlying asset drops to zero.

Who can Deploy A Long Put Strategy?

A long put strategy can be deployed by traders who have a low capital and a bearish outlook on the underlying asset. Although this is a low capital strategy, the probability of losing the capital is very high, as the underlying asset has to fall significantly before the expiration date to make a profit. This is a high risk, high reward strategy.

When Should A Long Put Strategy Be Deployed?

A long put strategy should be deployed when the trader expects the price of the underlying asset to move downwards immediately and sharply. It's essential for the trader to establish a precise exit strategy, whether by setting a target price, implementing a stop-loss threshold, or closing the position prior to expiration. If the trader wants to increase the risk-reward ratio of this strategy, they can consider buying an OTM put option, which has a lower premium. However, this also reduces the probability of profit, as the underlying asset has to fall more to reach the breakeven point.

Understanding Strategy Greeks

The Option greeks are measures of the sensitivity of an option's price to various factors, such as the price of the underlying asset, the time to expiration, the volatility of the underlying asset, and the interest rate. The main greeks that affect a long put strategy are delta, theta, and vega.

- Delta measures the change in the option's price for a unit change in the underlying asset's price. A long put option has a negative delta, which means that the option's price decreases as the underlying asset's price increases, and vice versa. The delta of a long put option ranges from -1 to 0, depending on how far the option is from the money. The more ITM the option is, the closer the delta is to -1, and the more OTM the option is, the closer the delta is to 0.

- Theta measures the change in the option's price for a unit change in time. A long put option has a negative theta, which means that the option's price decreases as time passes, all else being equal. This is because the option loses time value as it approaches expiration. The theta of a long put option is higher for ATM and OTM options than for ITM options, as they have more time value to lose.

- Vega measures the change in the option's price for a unit change in the underlying asset's volatility. A long put option has a positive vega, which means that the option's price increases as the underlying asset's volatility increases, and vice versa. This is because higher volatility implies higher uncertainty and higher probability of large price movements, which increase the value of the option. The vega of a long put option is higher for ATM and OTM options than for ITM options, as they are more sensitive to volatility changes.

Things to Keep In Mind

A long put strategy is a simple but risky way to bet on a bearish scenario for a stock or an index. Here are some things to keep in mind before deploying this strategy:

- If this strategy is entered when the implied volatility (IV) of the option is very high, the probability of making a profit would be significantly low. This is because high IV implies high option premiums, which increase the breakeven point and the maximum loss. Moreover, if the IV drops suddenly after the strategy is deployed, the option's price would also drop, resulting in a loss. Therefore, it is advisable to enter this strategy when the IV is low or moderate, and to monitor the IV changes closely.

- The trader should maintain strict stop losses for this strategy, as the option's price can decline rapidly due to time decay or adverse price movements of the underlying asset. The trader should also be prepared to close the position before expiration if the target price is reached or if the outlook changes.

- If the trader wants to deploy this strategy and hold it for a long period, they should buy an ITM put option, as it has a lower theta and a higher delta, which reduce the time decay and increase the sensitivity to the underlying asset's price movements, respectively. However, this also requires a higher capital and a lower risk-reward ratio.

Conclusion

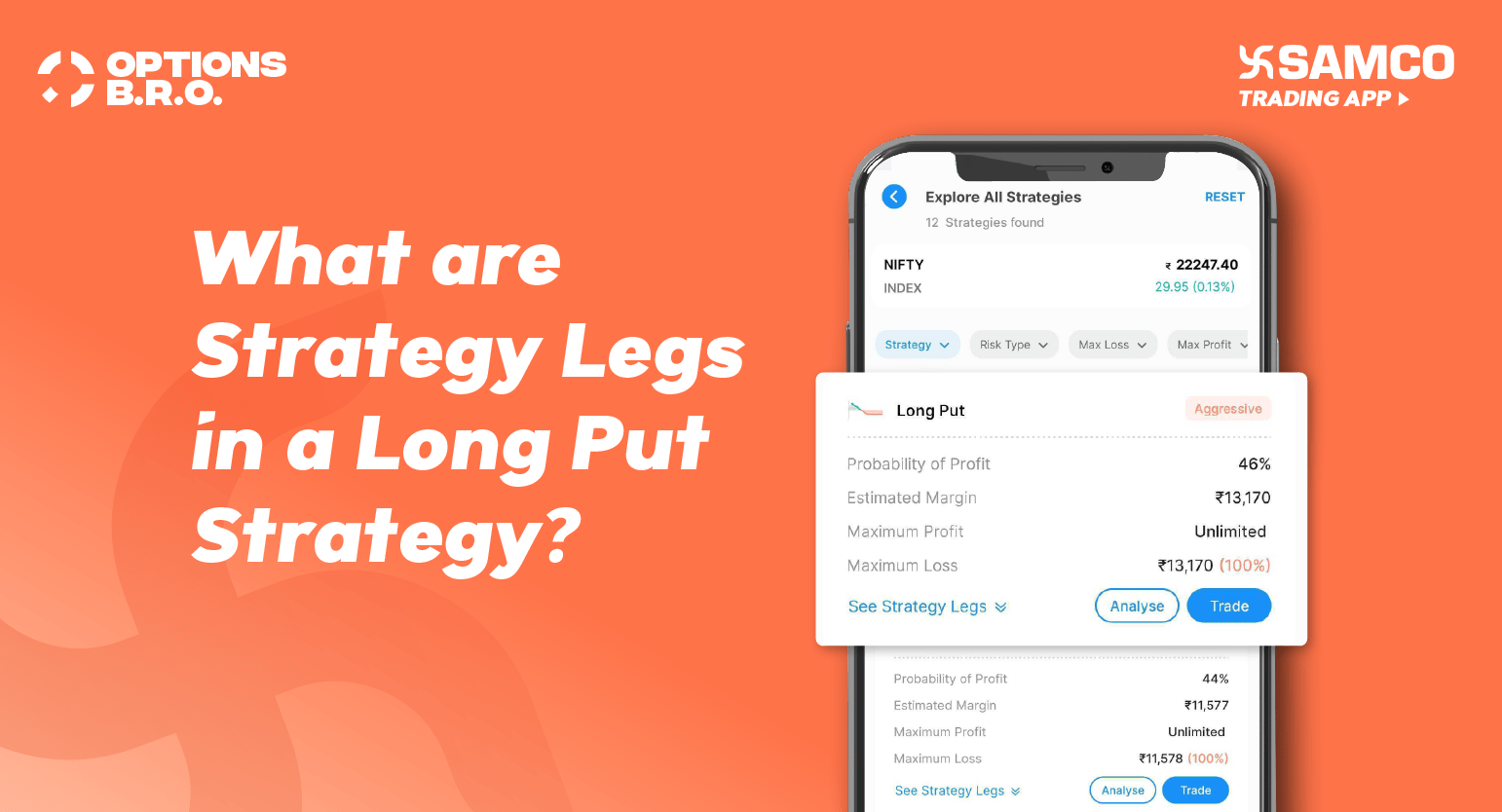

Want to earn profit from a bearish outlook on a stock using long put strategy? Try Options B.R.O. . Options BRO is a proprietary options strategy builder that is integrated into the Samco trading app. It helps traders to identify the best options strategies based on their market outlook, risk appetite, and return expectations. Options B.R.O. performs complex mathematical computations, evaluates thousands of options contracts and strategies, and provides recommendations for the top three strategies that suit the trader’s needs. It also analyses various market insights and Options Greeks to rate and rank each strategy. Don't hesitate any longer—dive into stock and derivatives trading today, exclusively with Samco Securities.

Disclaimer: INVESTMENT IN SECURITIES MARKET ARE SUBJECT TO MARKET RISKS, READ ALL THE RELATED DOCUMENTS CAREFULLY BEFORE INVESTING. The asset classes and securities quoted in the film are exemplary and are not recommendatory. SAMCO Securities Limited (Formerly known as Samruddhi Stock Brokers Limited): BSE: 935 | NSE: 12135 | MSEI- 31600 | SEBI Reg. No.: INZ000002535 | AMFI Reg. No. 120121 | Depository Participant: CDSL: IN-DP-CDSL-443-2008 CIN No.: U67120MH2004PLC146183 | SAMCO Commodities Limited (Formerly known as Samruddhi Tradecom India Limited) | MCX- 55190 | SEBI Reg. No.: INZ000013932 Registered Address: Samco Securities Limited, 1004 - A, 10th Floor, Naman Midtown - A Wing, Senapati Bapat Marg, Prabhadevi, Mumbai - 400 013, Maharashtra, India. For any complaints Email - grievances@samco.in Research Analysts -SEBI Reg.No.-INHO0O0005847.

Easy & quick

Easy & quick

Leave A Comment?