There are 2 types of stop loss orders i.e. a stop loss market order and a stop loss limit order.

Stop Loss Market Order Meaning

A stop loss market order or simply stop loss order is a type of stop loss order where the final order generated after the trigger price is a market order. While entering the stop loss market order, since the order to be traded is a market order one needs to enter only the trigger price. The order price will be a non editable field and once the trigger is activated, the order will get traded at the market price i.e. the best available price.

Stop Loss Order Example

In a stop loss order which is also referred to as market if touched order, as soon as the trigger price is reached, a market order is generated and executed at the market rate immediately.

In case of a Stop Loss Buy Order, the quantity gets filled at the market prices as soon as the prevailing rates move above the trigger price.

In case of a Stop Loss Sell Order, the quantity gets filled at the market prices as soon as the prevailing rates move below the trigger price.

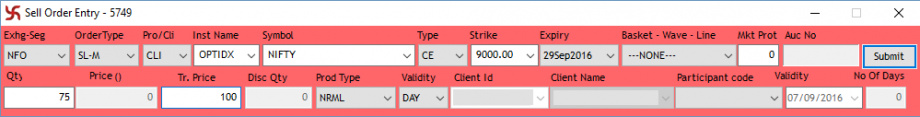

The above image is a stop loss order example for a sell order. First select the order type as “SL-M”, Enter the required quantity and the trigger price. The Price option would be “0” and non editable. What this implies is that as soon as the market price falls till Rs. 100 and stock trades at Rs. 100, immediately a market sell order will be generated and executed.

After this, once the trigger is activated, the order will get traded at the best available price. Stop Loss Market Order is a better type of stop loss order as the probability of the orders remaining pending is lower than in case of stop loss limit orders.

What is the difference between stop loss order vs limit order?

The primary function of a stop loss order is to STOP a loss or protect the rupee amount of loss from increasing. So the fundamental point under consideration in a stop loss order is the TRIGGER PRICE whereas in case of a limit order, it is simply the desired execution price. A Stop Loss Limit order is just an extension of a simple stop loss order, where along with the trigger price, a limit execution price is also selected.

Additional Reference Links

Easy & quick

Easy & quick

Leave A Comment?