- Introduction to Demat

- Process of Converting Shares into Demat

- Documents Required to Open a Demat

- FAQs

What is Dematerialisation?

It is the process of converting physical securities into electronic form. Shares can be held physically as share certificates. However, to transfer or sell them we need to convert them into demat. As per the Securities Exchange Board of India (SEBI) only shares in electronic form can be sold or transferred.How to convert physical shares into demat form? – The process

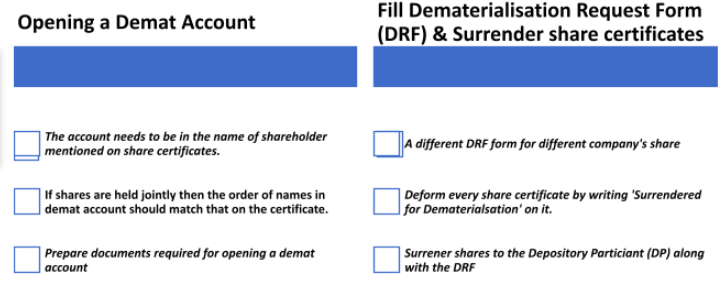

Here’s a quick checklist for converting physical shares into demat form

1. Opening a demat account

Opening a demat has become easier than ever with paperless and online account opening facilities. Here are points to keep in mind before account opening for converting physical shares into demat form:- Demat account should be in the name of the shareholder

- The order of holding remains same as physical shares

- PAN card – This is mandatory for every investor.

- Unique Identification Number (UIN) – Aadhaar card or Passport or Election card.

- Ration card with address

- Water bill in your name

- Telephone bill in your name

- Electricity bill in your name

- Bank statement

- Personalized cancelled cheque

- Bank account statements - past six months

- Passbook

- Salary slip

- Personalized cancelled cheque

- Bank account statements - past six months

- Passbook

- a company is not delisted from the stock exchange.

- The company is performing fairly well.

2. Filling form & surrendering share certificates

Moving on to the conversion process. Now that you know which share certificates are worth converting into demat form. Place a request for conversion of physical shares into demat form by submitting:-

- Filling DRF - Dematerialisation Request Form

- Defacing physical share certificates - surrendered for dematerialization.

Note that every company needs a different DRF. Therefore, use separate forms for share certificates of different companies.

- Defacing every share certificate by writing surrendered for dematerialization is equally important.

- An acknowledgment slip is received for the surrendered shares. These physical shares are then dismissed. Demat account then gets credited with electronic shares. Now the securities can easily be sold and transferred.

FAQs

- What are the benefits of demat account?

- No risk of misplacement or theft.

- Minimal paperwork as compared to physical shares.

- Quick and easy execution for sale, purchase and transfer of securities.

- Is there a process to reconvert securities into paper form?

- Does dematerialisation of physical share cause any change in rights of a shareholder?

- What should one do incase their share certificate has got torn or worn out?

- What are the instruments that can be converted into demat form?

- equity shares,

- preference share,

- partly paid-up share,

- bonds,

- debentures,

- commercial paper,

- government securities.

Easy & quick

Easy & quick

Leave A Comment?