There’s a strange disconnect in the Indian stock market — one that’s both ironic and revealing. Every day, millions of us use Airtel for our daily needs — data, calls, streaming. We pay a premium for good service and ditch providers that don’t deliver. But when it comes to investing, that logic vanishes.

Instead, many investors flock to Vodafone Idea (VI) — a company struggling to survive — while ignoring Airtel, the telecom leader posting strong financial and operational metrics.

Let’s unpack this contradiction.

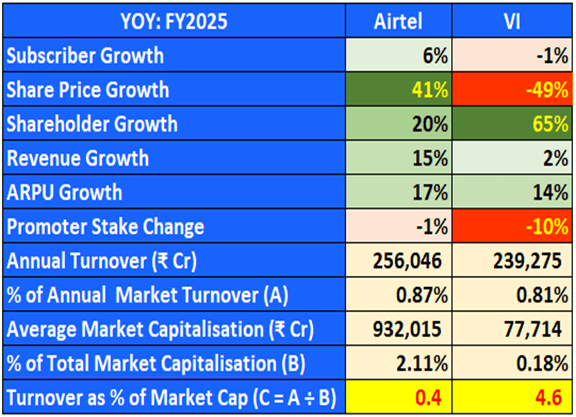

Airtel vs Vodafone Idea (VI): FY2025 Comparison

Metric | Airtel | Vodafone Idea (VI) |

Subscriber Growth | +6% | -1% |

Share Price Growth | +41% | -49% |

Shareholder Growth | +20% | +65% |

Revenue Growth | +15% | +2% |

ARPU Growth | +17% | +14% |

Promoter Stake Change | -1% | -10% |

Annual Turnover (₹ Cr) | ₹2,56,046 | ₹2,39,275 Cr |

% of Annual Market Turnover (A) | 0.87% | 0.81% |

Average Market Capitalisation (₹ Cr) | ₹9,32,015 | ₹77,714 Cr |

% of Total Market Capitalisation (B) | 2.11% | 0.18% |

Turnover as % of Market Cap (C = A ÷ B) | 0.4 | 4.6% |

Vodafone Idea’s share price fell 49% in FY2025, but still gained 65% more shareholders.

This isn’t optimism — it’s market theatre.

The Visual Proof: One Stock Soars, One Sinks

This chart says it all:

- Airtel is up over 100% since early 2024.

- VI is down more than 46% in the same period.

And yet, retail investors keep chasing VI like it’s a turnaround waiting to happen. Except, it’s not.

Cheap Doesn’t Mean Undervalued

Let’s be honest: Many are buying VI not because it’s a great business, but because:

- It’s cheap

- It’s trending

- It might turn around someday

But markets don’t reward hope. They reward performance.

Airtel’s financials are improving, its user base is growing, and its ARPU (Average Revenue Per User) is rising. VI, on the other hand, is bleeding cash, losing users, and watching promoters reduce their stake.

Still, investors line up to buy VI shares. Why?

Because in the market, hype often wins over homework.

Retail Investors: It's Time for a Reality Check

We wouldn’t trust a weak network with a phone call. But we’re ready to trust it with our money?

That’s not logic. That’s irony.

It’s time we flipped the script. Instead of following the crowd, it’s time to follow the data. Stop confusing price with value. Stop buying hope. Start buying strength.

Conclusion: Buy Service, But Also Buy Sense

You use Airtel because it works. Maybe it’s time to invest the same way. Not based on what’s cheapest or noisiest — but based on what’s strongest.Because hype doesn’t build wealth.

Research does.

Easy & quick

Easy & quick

Leave A Comment?