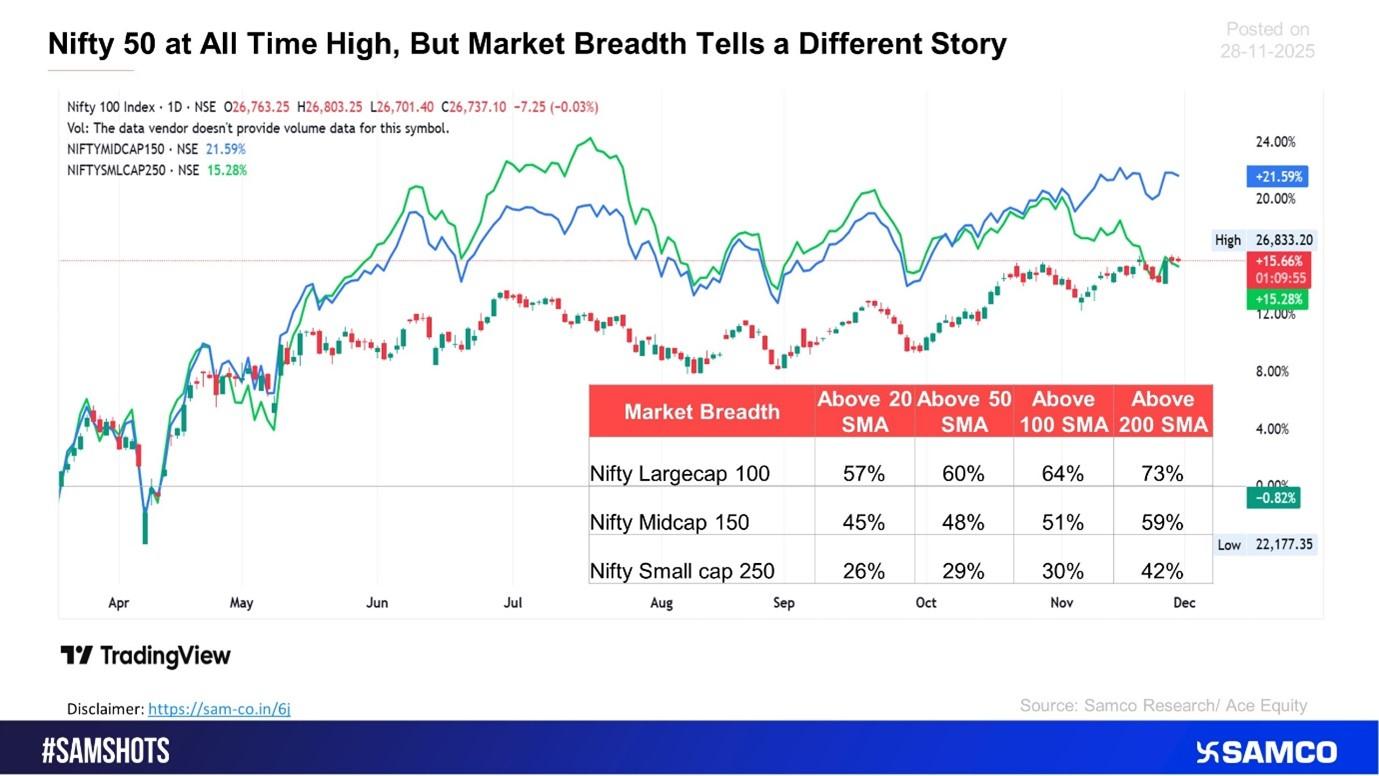

The Nifty 50 climbed to a fresh all-time high (ATH) of 26,310.45 on 27 November 2025, surpassing its previous peak of 26,277.35 from September 2024. After 426 days, the index finally broke out, but the excitement hasn’t translated to investor portfolios.

Many retail investors are wondering:

“If the Nifty is at ATH, why is my portfolio still in loss?”

The answer lies in market breadth, which reveals what’s happening beneath the headline index.

What Is Market Breadth and Why Does It Matter

Market breadth measures how many stocks are participating in a market move.

- Strong breadth → most stocks are rising

- Weak breadth → only a few stocks are pulling the index up

Even if the Nifty 50 hits record highs, a narrow rally means the gains come from only a handful of heavyweight stocks. This is precisely what the current market is showing.

Market Breadth Breakdown: Large Caps vs Midcaps vs Small Caps

Based on the chart data, here’s the percentage of stocks trading above key Simple Moving Averages (SMA) across three major indices:

Index | Above 20 SMA | Above 50 SMA | Above 100 SMA | Above 200 SMA |

Nifty Largecap 100 | 57% | 60% | 64% | 73% |

Nifty Midcap 150 | 45% | 48% | 51% | 59% |

Nifty Smallcap 250 | 26% | 29% | 30% | 42% |

Key Takeaways:

- Large caps are leading the rally with strong momentum.

- Midcaps show moderate strength but are not fully aligned with the Nifty 50.

- Small caps are significantly lagging, with less than one-third of stocks above major moving averages.

Why Retail Portfolios Are Not Matching the Nifty 50 Rally

Most retail investors hold a higher percentage of midcap and small-cap stocks.

But the Nifty Smallcap 250 is still 10% below its previous all-time high, signaling clear underperformance.

This divergence explains:

- Portfolios appear flat or negative

- Nifty 50 is rising, but the broader market isn’t

- Only select sectors and heavyweight stocks are pushing the index higher

Conclusion: Nifty’s Highs Don’t Reflect Broad Market Strength

While the Nifty 50 touching an all-time high is a positive signal, the rally is narrow and uneven.

Market breadth clearly shows that the broader market is yet to fully participate. Until midcaps and small caps recover, many retail portfolios will continue to trail the benchmark index.

Easy & quick

Easy & quick

Leave A Comment?