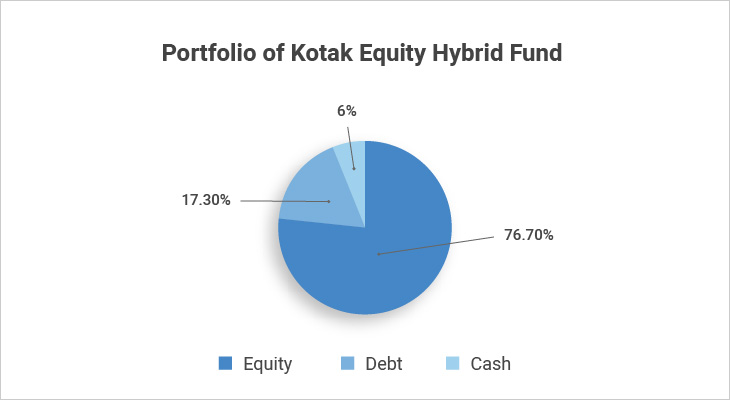

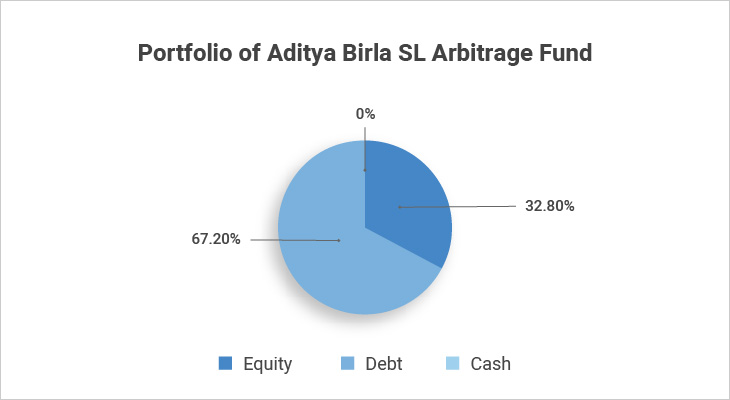

Hybrid mutual funds have been a blessing for mutual fund investors. Earlier, investors were forced to choose between high-risk equity funds and debt mutual funds providing low returns. But now they have a choice – hybrid mutual funds. What are hybrid mutual funds? Well, it’s all in the name. A hybrid is a mix or a combination of something. So, a hybrid mutual fund is a mutual fund scheme that invests in both equity shares and debt instruments. This combination of equity and debt puts hybrid mutual funds in a sweet spot. They enjoy the capital appreciation from equity mutual funds. But that’s not all. They also get to enjoy the fixed income generated by debt instruments such as bonds and debentures. Hybrid mutual funds are conveniently placed to handle both the bear and the bull market cycles. This is because there is a negative correlation between equity and debt asset classes. So, the appreciation from the debt portion of a hybrid mutual fund will compensate against the loss faced by the equity portfolio during a bear market. You will be in a much better position to understand what a hybrid fund is, once you look at the portfolio of a hybrid mutual fund. The pie chart below shows the portfolio of Canara Robeco Equity Hybrid Fund

- In the equity portion, the fund invests in roughly 51 stocks which includes ICICI Bank, Reliance Industries Ltd, Larsen & Toubro Ltd

- In the debt portion, the fund holds government securities, debentures issued by Reliance Industries Ltd., LIC Housing FinanceNCDs etc.

- In the cash portion, it holds Triparty Repo Systems (TREPs) which include special bonds issued by the government like oil marketing bonds etc.

In our opinion, a hybrid mutual fund is like a low-cost portfolio management service. Think about it…

- Without hybrid funds, who would be responsible for creating a balance between equity and debt in your portfolio?

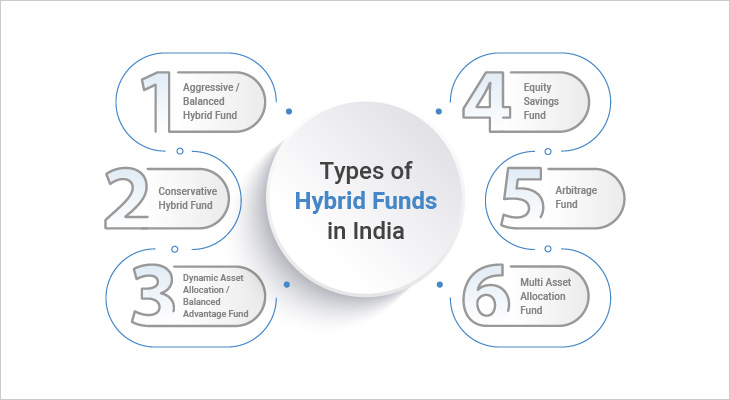

The onus of rebalancing your portfolio as per market valuations would fall upon you. God forbid, if you analysed the market incorrectly and lost out on handsome gains. This is the advantage of investing in hybrid mutual funds. Here, an expert fund manager does all the balancing and rebalancing. Plus, he has a bigger canvas to play with in terms of assets under management. So, you end up truly diversifying your portfolio and having the best balance between equity and debt asset classes. But if only things were this simple. You see, there are six different types of hybrid mutual funds in India. And each of these hybrid mutual funds has a distinct characteristic. So, investors have their work cut out for them. But you’re in luck. The experts at RankMF have shortlisted the six best hybrid mutual funds in India from a basket of over 35 hybrid funds. We have scanned their portfolios and selected six best hybrid funds, one from each category. Now we will reveal this list of best hybrid funds for 2022 shortly. But before that we first need to understand each of the six different types of hybrid funds. Don’t get overwhelmed, this is easier than it looks. You see, the premise of all six types of hybrid funds remains the same…only the percentage of equity and debt changes.

Types of Hybrid Funds in India

1. Aggressive Hybrid or Balanced Hybrid Fund:

Now there is a catch here. A mutual fund house can either offer an aggressive hybrid fund or a balanced hybrid fund but not both.

- An aggressive hybrid fund invests 65-80% of its assets in equity and the balance 20-35% in debt instruments.

- A balanced hybrid fund invests 40-60% of its total assets in equity and the remaining 40-60% in debt instruments.

Let us see how this works in real life. Kotak Equity Hybrid Fund is an aggressive hybrid fund. It is also one of the best hybrid mutual funds in 2025. This is its portfolio as on January 31, 2022.

Here are the five best aggressive hybrid funds in 2025

Aggressive Hybrid Fund Category | 1-Year | 3-Years | 5-Years |

| Aditya Birla Sun Life Equity Hybrid 95 Fund Growth | 18.23% | 15.54% | 10.59% |

| Kotak Equity Hybrid Fund - Regular Plan Growth | 16.55% | 20.47% | 12.71% |

| Union Hybrid Equity Fund - Regular Plan - Growth | 14.35% | 0.00% | 0.00% |

| Sundaram Aggressive Hybrid Fund - Regular Plan Growth | 13.95% | 14.47% | 12.94% |

| HDFC Hybrid Equity Fund - Regular Plan - Growth | 13.86% | 16.39% | 11.14% |

Data as of 2022

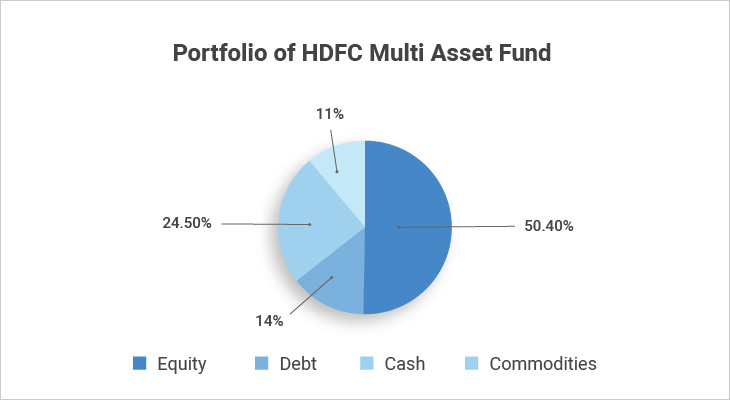

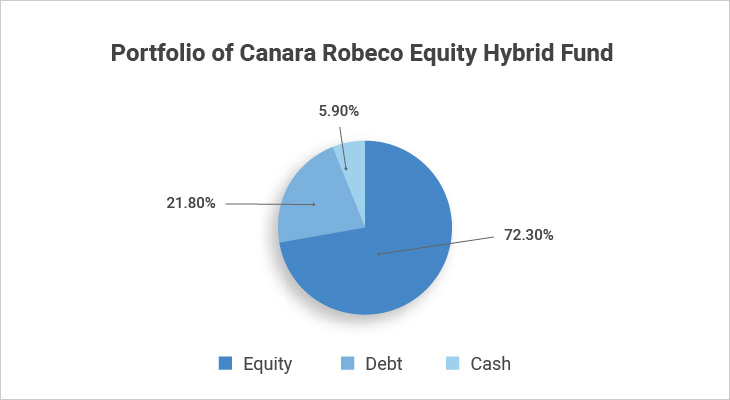

2. Conservative Hybrid Funds:

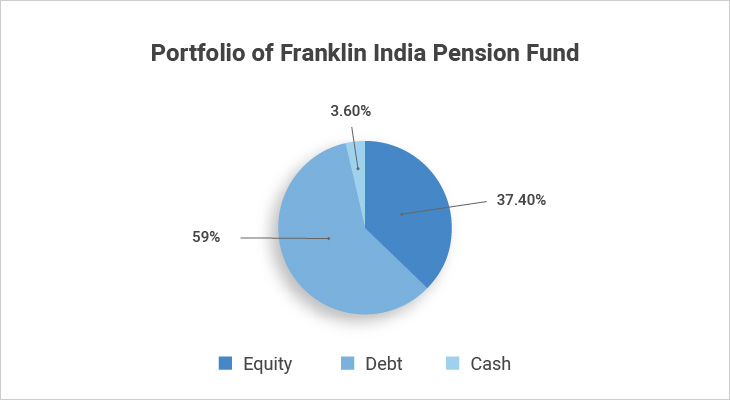

This type of hybrid fund focuses on debt investments. The equity portion acts as a natural sweetener. Conservative hybrid funds invest only 10-25% of their assets in equity. The remaining 75-90% is invested in debt instruments like bonds and debentures. This is a step above pure debt funds. By investing the bare minimum in equity, conservative hybrid funds are giving investors a taste of equity markets. Conservative hybrid funds are ideal during bear markets as they are less affected due to the 10-25% equity allocation. The graph below shows the portfolio of Canara Robeco Conservative Hybrid Fund, one of the best hybrid funds in 2025. The fund invests 68.30% in debt, 22.80% in equities and the balance 8.90% is held in cash. Conservative investors with a short-term investment horizon of say two to four years can invest in the fund.

Five best conservative hybrid funds in 2025

| Conservative Hybrid Fund Category | 1-Year | 3-Years | 5-Years |

| UTI Regular Savings Fund - Growth Plan | 11.58% | 8.62% | 7.74% |

| SBI Conservative Hybrid Fund | 10.86% | 11.80% | 8.26% |

| HDFC Hybrid Debt Fund - Growth Option | 10.70% | 10.78% | 8.03% |

| Nippon India Hybrid Bond Fund - Growth Plan | 9.38% | 1.16% | 3.22% |

| ICICI Prudential Regular Savings Fund - Growth | 8.34% | 10.29% | 9.22% |

Data as of 2022

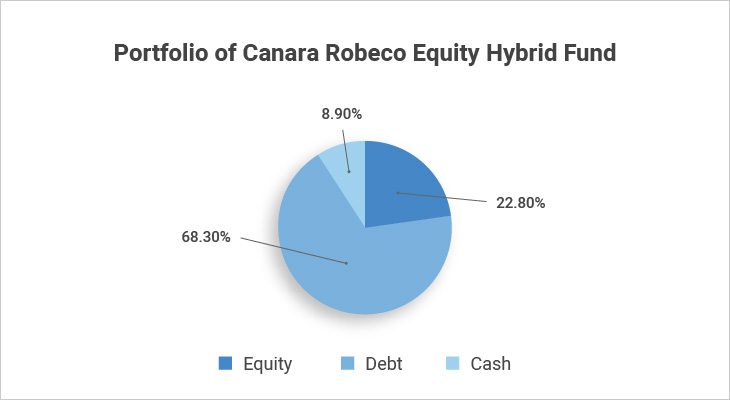

3. Multi-Asset Allocation Fund:

This hybrid fund must invest a minimum of 10% in each asset class – equity, debt, cash and commodities. This is perfect for investors who want a taste of commodities in their portfolio but don’t know where or how to start. The biggest advantage of multi-asset allocation fund is its negative correlation between equity and commodities market. The pie chart below shows the portfolio of HDFC Multi Asset Fund.

Five best multi asset allocation hybrid funds in 2025

| Multi-Asset Allocation Fund Category | 1-Year | 3-Years | 5-Years |

| SBI Multi Asset Allocation Fund Regular Growth | 11.38% | 13.05% | 9.36% |

| Axis Triple Advantage Fund - Regular Growth - Growth | 14.40% | 18.19% | 12.83% |

| ICICI Prudential Multi-Asset Fund - Growth | 28.77% | 20.61% | 14.02% |

| HDFC Multi-asset Fund - Regular Plan - Growth | 13.19% | 16.15% | 10.58% |

| Navi 3 In 1 Fund - Growth | 13.36% | 13.75% | 9.48% |

Data as of 2022

4. Dynamic Asset Allocation Fund or Balanced Advantage Fund:

Now this is a risky hybrid fund. As the name suggests, these funds can shift from 100% equity to 100% debt as per the prevailing market conditions. For example – the fund will invest more in equities when the market is moving up. Whereas in a falling market, the fund switches 100% to debt instruments. Now it is possible that two dynamic asset allocation funds have different views on the market. So, they might follow different investment structures. Consider the case of Motilal Oswal Dynamic Fund and Franklin India Dynamic Asset Allocation FoF.

| Equity | Debt | Cash | |

| Motilal Oswal Dynamic Fund | 57.00% | 23.30% | 19.70% |

| Franklin India Dynamic Asset Allocation FoF | 44.20% | 1.20% | 54.70% |

t is evident from the above table that Motilal Oswal Dynamic Fund is a slightly more aggressive fund. This is because it has a higher exposure (57%) to equities. Hence, investors must be cautious while investing in a dynamic asset allocation fund and should check the funds’ underlying portfolio before investing. Now in a dynamic, ever changing world, here’s a list of the best dynamic asset allocation hybrid funds in 2022 to give you some stability.

Best Dynamic asset allocation hybrid funds in 2025

| Dynamic Asset Allocation Fund Category | 1-Year | 3-Years | 5-Years |

| Edelweiss Balanced Advantage Fund - Growth Option | 10.62% | 16.68% | 12.79% |

| Baroda Dynamic Equity Fund - Regular Growth | 10.10% | 16.91% | 0.00% |

| Sundaram Balanced Advantage Fund - Regular Plan Growth | 7.77% | 7.22% | 6.57% |

Data as of 2022

5. Arbitrage Funds:

In the case of arbitrage funds, the fund manager invests a minimum of 65% of its assets in equities. The only catch is the fund manager must follow arbitrage strategy. What does this mean? Well, arbitrage is the simultaneous buying and selling of an asset in two different markets. It is usually done in cash and futures and options (F&O) markets. This way, the fund’s net position in equities is always nil. The pie chart below shows the portfolio of Aditya Birla SL Arbitrage Fund.

| Arbitrage Funds Category | 1-Year | 3-Years | 5-Years |

| JM Arbitrage Fund - Growth Option | 3.17% | 3.50% | 4.18% |

| Sundaram Arbitrage Fund - Regular Plan Growth | 2.53% | 2.73% | 2.42% |

| BOI AXA Arbitrage Fund- Regular Plan - Growth | 2.53% | 3.49% | 0.00% |

| Indiabulls Arbitrage Fund - Regular Plan - Growth | 2.65% | 3.69% | 4.46% |

6. Equity Savings Fund:

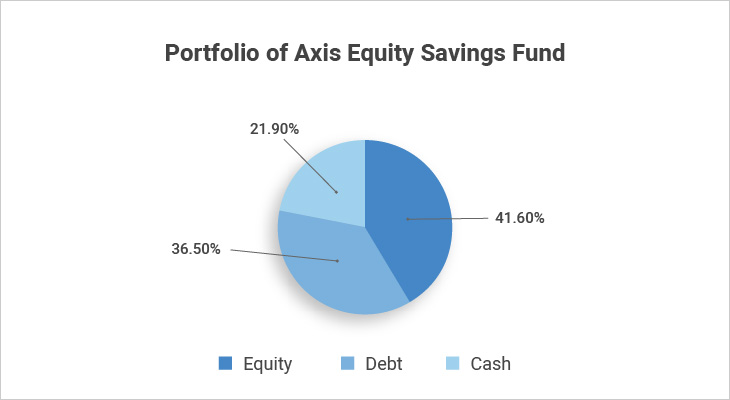

This final type of hybrid equity fund invests a minimum 65% in equity, 10% in debt and also uses derivatives to hedge its positions. The fund is a hybrid fund but uses the minimum 65% equity allocation to qualify for equity taxation. Equity savings fund uses derivatives to hedge equity positions to generate risk free profits. The pie chart below shows the portfolio of Axis Equity Savings Fund.

Here’s a list of the best equity savings fund in 2025.

| Equity Savings Fund Category | 1-Year | 3-Years | 5-Years |

| Tata Equity Savings Fund Regular Plan Growth | 6.43% | 9.27% | 6.84% |

| Union Equity Savings Fund Regular Plan - Growth | 5.43% | 8.98% | 0.00% |

| Invesco India Equity Savings Fund - Regular Growth | 6.49% | 0.00% | 0.00% |

| IDBI Equity Savings Fund- Growth | 5.69% | 9.63% | 6.20% |

Data as of 2022

Let us now look at the 5 key advantages of hybrid mutual funds.

Advantages of Hybrid Mutual Funds

1. Multiple asset classes under one roof:

Imagine for a second that hybrid mutual funds do not exist. How do you invest in equity, debt, cash and commodities? You will have to buy four different mutual funds and track them diligently. Doesn’t this sound like tedious work? Luckily, you don’t have to do this. With hybrid mutual funds, you get to diversify your portfolio across these four asset classes with a single fund. This helps you save up on the headache of tracking these funds. Even the overall cost in terms of expense ratio comes down drastically. So, one of the biggest advantages of hybrid funds is that you get to diversify across four asset classes with a single fund.

2. Hybrid funds benefit from the negative correlation between equity and commodities:

Multi-Asset Allocation Funds invest in both equities and commodities. Do you know that there is a negative correlation between these two asset classes? Yes, historically, when equity markets are flourishing, the commodity market is down and vice-a-versa. Now how many of us invest in commodities market to hedge against our equity portfolio? I would say very few, if any. There are many reasons for this but lack of knowledge and limited capital are the key reasons why retail investors shy away from the commodities market. This is also why they miss out on potential portfolio gains. But multi-asset allocation funds have solved this. Here, the expert fund manager invests in both the asset classes in such a way that you get to benefit from this negative correlation.

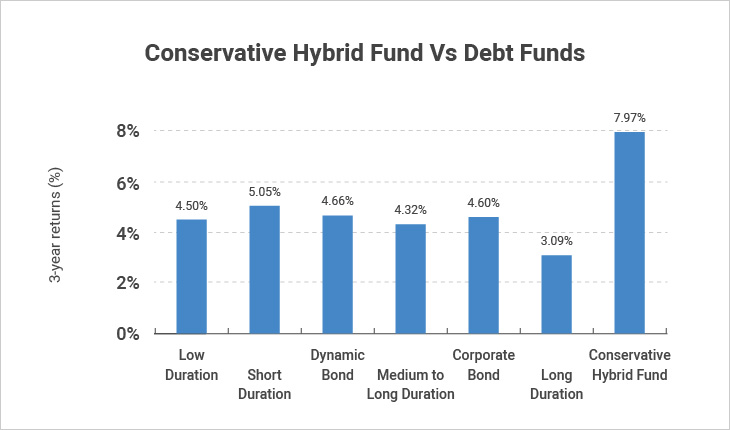

3. Higher Returns than Debt Funds:

A conservative hybrid fund invests 75-90% of its assets in debt instruments. Whereas only a tiny portion of say, 10-25% is invested in equities. This helps the fund generate better returns than pure debt mutual funds. So, investors end up generating better returns than a pure debt fund by taking very little risk. The graph below shows the performance of conservative hybrid funds against different types of debt funds.

4. A tax-efficient alternative to liquid funds:

Equity savings fund is a type of hybrid fund that invests 65% of its corpus in equities. But the fund uses derivatives and arbitrage to hedge its positions. This way, the fund has already squared-off its positions and ends up making risk-free profits. Now investors often turn to liquid funds or ultra-short duration funds for storing their emergency cash. The logic is simple… liquid or ultra-short duration funds invest in risk-free liquid and money market instruments. But then so does your equity savings fund! This is why investors can also store a portion of your emergency fund in equity savings fund and earn higher returns.

- The average return generated by equity savings fund in the last one year is 8.26%.

- On the other hand, liquid funds have generated a return of 3.22% during the same time period.

But that’s not all. In the case of liquid funds, you need to hold them for a minimum of three years to qualify for tax benefits. Whereas you only need to hold equity savings fund for 12 months to qualify for long term capital gains taxation. Hence, an equity savings fund is a tax efficient alternative to liquid funds.

Taxation of Hybrid Mutual Funds

Before we conclude, let us quickly take a look at the taxation of hybrid mutual funds. Now different types of hybrid funds follow different taxation. But roughly, you can divide hybrid funds into three sets for the purpose of taxation

- Equity-oriented hybrid funds– Aggressive hybrid, equity savings, multi-asset allocation funds,

- Debt-oriented hybrid funds – Balanced hybrid,arbitrage funds

- Dynamic hybrid funds – Dynamic asset allocation

Taxation for Equity-oriented Hybrid Funds: Aggressive hybrid, equity savings, multi-asset allocation fund

- If redeemed within 12 months a 15% short term capital gains tax is applicable

- If redeemed after 12 months, a 10% long term capital gains tax above Rs 1 lakh is applicable.

Taxation for Debt-oriented Hybrid Funds: Balanced hybrid, arbitrage funds

- If redeemed within 36 months, the gains will be added to your tax slab and taxed accordingly.

- If redeemed after 36 months, taxed at 20% with indexation.

Note: The taxation for Dynamic hybrid funds depends on its equity and debt allocation during the year of redemption. This concludes our discussion on the best hybrid mutual funds in 2025. Remember, don’t invest in any of these best hybrid mutual funds blindly. First understand your financial goals and risk appetite. A conservative investor with a short-term financial goal, should avoid aggressive hybrid funds at all costs. So, while hybrid mutual funds are a boon for retail investors, it can easily become a bane for them if you ignore your risk appetite. Simply open an investment account with RankMF and start investing in the best hybrid funds in 2025 with just a few clicks.

Easy & quick

Easy & quick

Leave A Comment?