Day by day Mutual Fund Investment and Systematic Investment Plan (SIP) are becoming popular in India. So it becomes necessary for retail investors and new investors to understand the types of mutual fund schemes running in India.

Through this article you will get to know:

- Classification of Mutual Funds

- Different Types of Mutual Funds in India in each classification

Classification of Mutual Funds:

| Classification of Mutual Funds | Mutual Fund Structure | Asset Class | Investment Objectives | Speciality | Risk |

| Elements in Each Class | Open Ended Funds | Equity Funds | Growth Funds | Sector Funds | Low Risk Funds |

| Close Ended Funds | Debt Funds | Income Funds | Index Funds | Medium Risk Funds | |

| Interval Funds | Money Market Funds | Liquid Funds | Fund of Funds | High Risk Funds | |

| Balanced or Hybrid Funds | Tax Saving Funds | Emerging Market Funds | |||

| Capital Protection Funds | International Funds | ||||

| Pension Funds | Global Funds | ||||

| Real Estate Funds | |||||

| Commodity focussed Stock Funds | |||||

| Market Neutral Funds | |||||

| Leverage Funds | |||||

| Asset allocation Funds | |||||

| Gift Funds | |||||

| Exchange traded Funds |

Types of Mutual Funds in India Based on Fund Structure:

- Open Ended Funds: These are the funds available for investors for investment and redemption throughout the year, meaning any investor can buy or sell the fund at the prevailing NAVs. This fund allows investor to take action based on his will. There is no limit on the purchase and sell of the fund by the investor. The fund is usually active and therefore usually a Fund Manager to take care of the fund and its movement. There is also a fee associated with the fund.

- Close Ended Funds: As the name suggests, these funds are close ended in nature meaning investors can buy the mutual fund only in a specific period and units can be redeemed at maturity of the investment. These funds are usually listed on exchanges and usually these funds are sold through exchanges at the prevailing price.

- Interval Funds: Interval funds have features and characteristics of both open-ended funds and close ended funds. Interval funds are available for purchase at different intervals during the tenure.

Types of Mutual Funds in India Based on Asset Class:

- Equity Funds: These funds are meant to invest in equities of companies. Return of the fund is highly correlated to market equity movement in general

- Debt Funds: These funds invest in debt instruments such as bonds, debentures, zero coupon bonds, government securities etc. Due to the nature of their investments, debts are safer than equity funds and are known to provide stable returns.

- Money Market Funds: These funds invest in liquid instruments like treasury bills, CPs etc. These funds are also considered safe as these funds invests in money market which is not directly linked to equity markets

- Balanced or hybrid Funds: These funds are a mixture of different asset class funds. Depending on the liking of fund houses.

Types of Mutual Funds in India Based on Investment Objectives:

- Growth Funds: These are the funds which invests in equities which have good growth potentials. Such stocks give good capital appreciation.

- Income Funds: Such funds invests in Fixed income instruments like bonds, debentures with a purpose of giving good returns to investors with zero to less risk

- Liquid Funds: In this funds , investments are done in liquid funds to get returns in the short term

- Tax saving Funds (ELSS): Such funds invests in stocks which satisfy the requirements set by Income tax department. Investors usually invest in to get the tax benefit in the form of tax exemption

- Capital Protection Fund: The purpose of this fund is to provide protection to the capital invested. This is done by partly investing fixed income instruments and equity markets. The funds ensure that the principal is protected against uncertainties

- Fixed Maturity Funds: In this, money is invested in money market and the debt instruments and one significant feature is that the maturity date is either the same as that of the fund or before the maturity of the fund.

- Pension Funds: Pension funds usually have a goal of investing money for longer term with an objective getting good returns. The fund usually have both risky as well as capital protection nature.

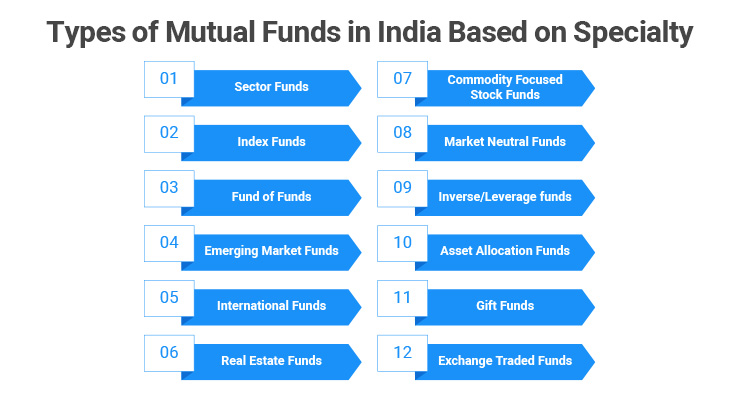

Types of Mutual Funds in India Based on Specialty:

- Sector Funds: These are sector specific funds meaning fund is invested in a particular sector so auto sector fund will invest in instruments related to auto sector

- Index Funds: This kind of fund is usually invested in index on an exchange, The purpose is to leverage on the movement of the indices which are a bit easy to predict.

- Fund of Funds: These funds invests in other mutual funds and the return is dependent on the performance of the fund in which the money is invested in. Sometimes this is referred as the multi manager fund as multiple managers are connected to performance of the fund of funds.

- Emerging Market Funds: These funds usually invest in emerging market after assessing the future growth opportunities. These investments could be risky in nature as the political and economic situation may not be stable over there.

- International Funds: These funds usually invest in companies which are located internationally meaning that the fund won’t invest in companies which are located in investor’s own country

- Real Estate Funds: These are the funds that invest in companies which are in the real estate sector. Funds can invest in realtors, builders, project management companies and even in loan providers.

- Commodity Focused Stock Funds:

- Market Neutral Funds: Funds invest in treasury bills, ETFs and securities and try to target a fixed and steady growth meaning the funds don’t invest directly in the markets.

- Inverse/Leverage funds: These funds are 180 degree opposite of what a traditional Mutual Funds are, These funds earn when the market is in red and these funds incur losses when the market is up.

- Asset Allocation Funds: There are two type of Asset allocation funds, the target date funds and the target allocation funds. In these funds, managers vary the proportion of investment to achieve the result.

- Gift Funds:

- Exchange Traded Funds: These are the funds that have the exposure of both the open and close ended mutual funds and are traded on the stock exchanges. These funds generally have a lot of liquidity

Types of Mutual Funds in India Based on Risk:

- Low Risk: The fund possess low risk and therefore people who like to have low return and want to take less risk tend to invest in such funds. The time frame of investment is usually long term. Such Funds prefer debt market instruments and Government securities. Typical gift funds can come under it

- Medium Risk: Funds which offer moderate risk and moderate returns come under this category. Such Funds generate wealth for investor over a longer period of time.

- High Risk: These are those funds which offer higher return for the higher risk exposure. Wealth creation is opportunities always exists for investors but these tend to be a bit risky in nature. Inverse funds qualify for such funds.

Easy & quick

Easy & quick

Leave A Comment?