The first index fund in India was launched in 1999. In the same decade, world’s first index fund, Vanguard 500 Index fund reached an Assets Under Management (AUM) of $1 Billion Dollars!

It’s been 22 years since and Indian index fund AUM stands at a disappointing Rs 16,867 crores! While the AUM of Vanguard 500 Index Fund reached $6 Trillion Dollars!

The reason behind such disappointing numbers is lack of awareness around index mutual funds. Majority of investors don’t understand the basics of index funds like index, benchmark, expense ratio etc.

This article aims to change that. In this article, we will take a detailed look at Index funds –

The first index fund in India was launched in 1999. In the same decade, world’s first index fund, Vanguard 500 Index fund reached an Assets Under Management (AUM) of $1 Billion Dollars!

It’s been 22 years since and Indian index fund AUM stands at a disappointing Rs 16,867 crores! While the AUM of Vanguard 500 Index Fund reached $6 Trillion Dollars!

The reason behind such disappointing numbers is lack of awareness around index mutual funds. Majority of investors don’t understand the basics of index funds like index, benchmark, expense ratio etc.

This article aims to change that. In this article, we will take a detailed look at Index funds –

- What is an Index Fund?

- What is Benchmark Index?

- How Index Funds Work?

- Index Funds vs Actively Managed Mutual Funds

- Active Approach

- Passive Approach

But Exactly What is a Benchmark?

A benchmark is a standard against which you measure your performance. Here are some daily life examples of benchmark:- Your friend does 20 push-ups while you can manage only 10. Your gym instructor says, ‘seekho kuch isse’. This person is your benchmark!

- You decide to make your mom’s special Biryani. You follow the recipe exactly. While tasting, your dad says it needs a little bit of spice to be as yummy as your moms. Your mom’s Biryani is your benchmark.

- You score 80% in a math test while the topper scores 98%! He is your benchmark!

- If a mutual fund beats its benchmark, (outperformance) then it is a good fund.

- If a mutual fund does not beat its benchmark (underperformance), then it is a bad fund.

What is an Index Mutual Fund?

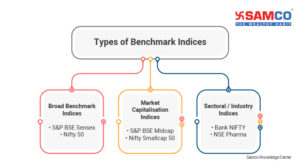

As per the Securities and Exchange Board of India (SEBI), ‘An index fund is a mutual fund scheme which invests 95% of its assets in a particular index (which is being replicated/tracked)’. In India, majority of index funds are equity-oriented index funds. We do not have a debt oriented index fund yet. Every index fund has its own benchmark index. An index fund manager collects money from various investors. This collected money is then invested in exact same proportion as the benchmark index.Types of Benchmark Indices

How Does an Index Mutual Fund Work?

Suppose an index fund wants to invest Rs 100. Its benchmark is ABC Benchmark. ABC benchmark has the following allocations –| Stock | Allocation |

| Reliance Industries | 30% |

| HDFC Bank | 15% |

| Infosys Ltd | 25% |

| TATA Steel Ltd | 10% |

| Mahindra & Mahindra | 20% |

| Stock | Investment |

| Reliance Industries | Rs 30 |

| HDFC Bank | Rs 15 |

| Infosys Ltd | Rs 25 |

| TATA Steel Ltd | Rs 10 |

| Mahindra & Mahindra | Rs 20 |

- If you invest in a NIFTY 50 index, your fund manager will invest in the 50 stocks of NIFTY in the exact same proportion!

- If you invest in S&P BSE Sensex index, your fund manager will invest in 30 stocks of SENSEX in the exact same proportion!

Index Mutual Funds Vs Actively Managed Mutual Funds

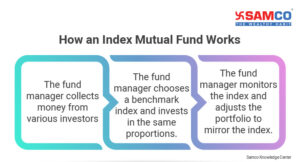

1. Fund Manager’s Control: The main difference between active mutual funds and index funds is the fund manager. In an actively managed mutual fund, the fund manager is in total control of the fund’s investments. He can decide which stocks to buy and which to avoid. This freedom is not available with an index fund manager. The below flow chart will help you understand the difference between an index fund and an actively managed fund.How an Actively Managed Fund Works

How an Index Mutual Fund Works

As you can see, an index fund manager does not research which stocks to buy or when to book profits.

As you can see, an index fund manager does not research which stocks to buy or when to book profits.

- He will buy a particular stock when it is added to the benchmark index.

- He will sell a particular stock when it is removed from the benchmark index.

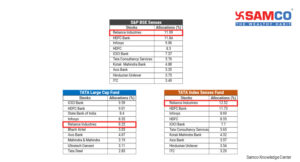

In the above image, note the allocations of S&P BSE Sensex (benchmark), TATA Index Sensex Fund & TATA Large-cap Fund.

In the above image, note the allocations of S&P BSE Sensex (benchmark), TATA Index Sensex Fund & TATA Large-cap Fund.

- The allocation of Reliance Industries in the benchmark index is 11.99%. TATA Index Sensex Fund maintains almost same allocation at 12.52%. But TATA Large cap fund reduces the allocation to 8.25%.

- The same thing is repeated for HDFC Bank. Its allocation in the benchmark index is 11.84%. Its allocation in index fund is 11.73%. But its allocation in large-cap fund is only 9.01%.

- The expense ratio of TATA Index Sensex Fund is 1%.

- The expense ratio of TATA Large Cap Fund is 2.43%.

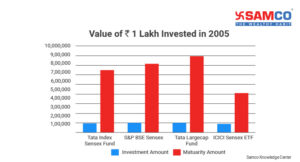

- Tata Index Sensex Fund

- Tata Large cap Fund

- S&P BSE Sensex index

- ICICI Prudential Sensex ETF (Since TATA fund house does not have a Sensex ETF)

As you can see, you would have made highest money in TATA Large cap fund – an actively managed equity fund. The difference between the returns generated by TATA Large cap fund and S&P BSE Sensex is a whopping 11.06%!

By investing in TATA Large Cap fund, you’ve earned a Compounded Annual Growth Rate of (CAGR) of 14.56% between 2005 and 2021. Whereas TATA Index Sensex fund generated a CAGR of 13.15%.

Surprisingly, lowest returns were generated by ICICI Prudential Sensex ETF. The difference between TATA Large cap fund and ICICI Prudential Sensex ETF is a whopping 94%!

This proves that actively managed funds have beaten passively managed funds by a huge margin.

Even after accounting for a higher expense ratio, your actively managed fund has beaten index fund returns by 1.42%!

4. Risk: Investors often believe that index funds face only market risk, like every other mutual fund. However this is not true. Index funds face a much bigger risk – risk of fund manager turning a blind eye to market information.

An index is creating by clubbing companies with highest market capitalisation. Whether these companies are ‘fundamentally good’ is another question.

For example: In 2009, Satyam Computers was removed from all major indices – Sensex, Nifty, NSE’s CNX 100, CNX 500 Indices etc. This was following the discovery of a major fraud – bigger than Enron!

Sensex fell by 6% as the scandal broke. Active fund managers held lower allocations to Satyam Computers. But passive fund managers had no control on the allocations. They had to mirror their benchmark index.

I agree that Satyam Computers was a one-off case. But this is exactly why active fund managers are crucial. When your fund manager decides to invest in a stock, they go and meet the company’s management. They run hundreds of analysis before investing in a stock. Due to this, chances are higher that you hold fundamentally and ethically sound companies.

This might not be the case for index funds. So you might be holding onto ethically weak stocks. And your index fund manager cannot do anything about it. This is a serious risk!

This is precisely why actively managed mutual funds are better than index funds. But this does not mean that index funds should be avoided. Index funds or passive investments can form 10-15% of your overall portfolio. In this way, you can benefit from both active and passive investment approaches. But which index funds have generated superior returns? Sensex index funds or Nifty index funds? To find out the best index funds in India, open a FREE RankMF account today and start investing!

As you can see, you would have made highest money in TATA Large cap fund – an actively managed equity fund. The difference between the returns generated by TATA Large cap fund and S&P BSE Sensex is a whopping 11.06%!

By investing in TATA Large Cap fund, you’ve earned a Compounded Annual Growth Rate of (CAGR) of 14.56% between 2005 and 2021. Whereas TATA Index Sensex fund generated a CAGR of 13.15%.

Surprisingly, lowest returns were generated by ICICI Prudential Sensex ETF. The difference between TATA Large cap fund and ICICI Prudential Sensex ETF is a whopping 94%!

This proves that actively managed funds have beaten passively managed funds by a huge margin.

Even after accounting for a higher expense ratio, your actively managed fund has beaten index fund returns by 1.42%!

4. Risk: Investors often believe that index funds face only market risk, like every other mutual fund. However this is not true. Index funds face a much bigger risk – risk of fund manager turning a blind eye to market information.

An index is creating by clubbing companies with highest market capitalisation. Whether these companies are ‘fundamentally good’ is another question.

For example: In 2009, Satyam Computers was removed from all major indices – Sensex, Nifty, NSE’s CNX 100, CNX 500 Indices etc. This was following the discovery of a major fraud – bigger than Enron!

Sensex fell by 6% as the scandal broke. Active fund managers held lower allocations to Satyam Computers. But passive fund managers had no control on the allocations. They had to mirror their benchmark index.

I agree that Satyam Computers was a one-off case. But this is exactly why active fund managers are crucial. When your fund manager decides to invest in a stock, they go and meet the company’s management. They run hundreds of analysis before investing in a stock. Due to this, chances are higher that you hold fundamentally and ethically sound companies.

This might not be the case for index funds. So you might be holding onto ethically weak stocks. And your index fund manager cannot do anything about it. This is a serious risk!

This is precisely why actively managed mutual funds are better than index funds. But this does not mean that index funds should be avoided. Index funds or passive investments can form 10-15% of your overall portfolio. In this way, you can benefit from both active and passive investment approaches. But which index funds have generated superior returns? Sensex index funds or Nifty index funds? To find out the best index funds in India, open a FREE RankMF account today and start investing!

Easy & quick

Easy & quick

Leave A Comment?