In this article we will cover

- What is option trading

- Options jargons you must understand

- Put option vs Call option

- Why deal with option trading

- The risk involved while trading options

- Moneyness of an option

- Factors affecting option value

- Understanding Option Greeks

- Options Trading Strategies

- End Note

Options are possibly the most debatable financial instrument ever. At first glance, they seem to be complicated and overwhelming. But once you understand the basics of options trading then there is no end to how much wealth you can create.

If I ask you who is the most popular and successful investor in the world, which name will strike your mind?

Are you picturing Warren Buffett – The chairman and CEO of Berkshire Hathaway?

His investment style is quite simple and popular. He built a wealth of over US $100.6 billion (as of April 2021) by patiently letting his investments compound. His investment strategy to invest in value stocks and focusing on fundamentals is now talked about by every new investor.

But while most people think it was only the value investing strategy that helped him get rich, they couldn’t be more wrong.

People rarely associate The Oracle of Omaha with options trading.

In 2002 annual letter Warren Buffett said –

‘In our view… derivatives are financial weapons of mass destruction, carrying dangers that are potentially lethal.’

But, in the same letter, Buffett also said –

‘I sometimes engage in large-scale derivatives transactions to facilitate certain investment strategies.’

So, while he acknowledges the risk associated with derivatives … he does not discard the fact that they come with huge profit-making potential.

We all want to create wealth to live a life we wish and dream of. There is no shortcut but nor is it impossible. While opinions starkly vary, there is no denying that options remain one of the most popular financial instruments ever.

And if you want to understand everything a novice must know about options trading, then you are at the right place.

What are Options Trading?

Investor portfolios include several asset classes. These may be stocks, mutual funds, bonds, ETFs, etc.

Similarly, options are a type of asset class. If dealt with them smartly, options have the potential to offer advantages that trading stocks alone cannot.

Options belong to the larger group of securities known as derivatives. Forwards, Futures, Options and Swaps are the four most common types of derivatives.

A derivative is a contract between two or more parties that derives its value from its underlying asset. These underlying assets can be stocks, bonds, commodities, or an index.

The buyer of the options contract has the right but not an obligation to buy or sell the underlying asset. You can buy options just like you buy shares from your Demat account.

Options Jargons you must Understand

Before we go any further, it is important to understand these seven options concepts –

1. Strike price or exercise price

It refers to the price at which an option can be exercised or executed. The strike price is the fixed price which is agreed upon before you buy or sell an option contract. Selecting the strike price is one of the important decisions investors must make while selecting a particular option.

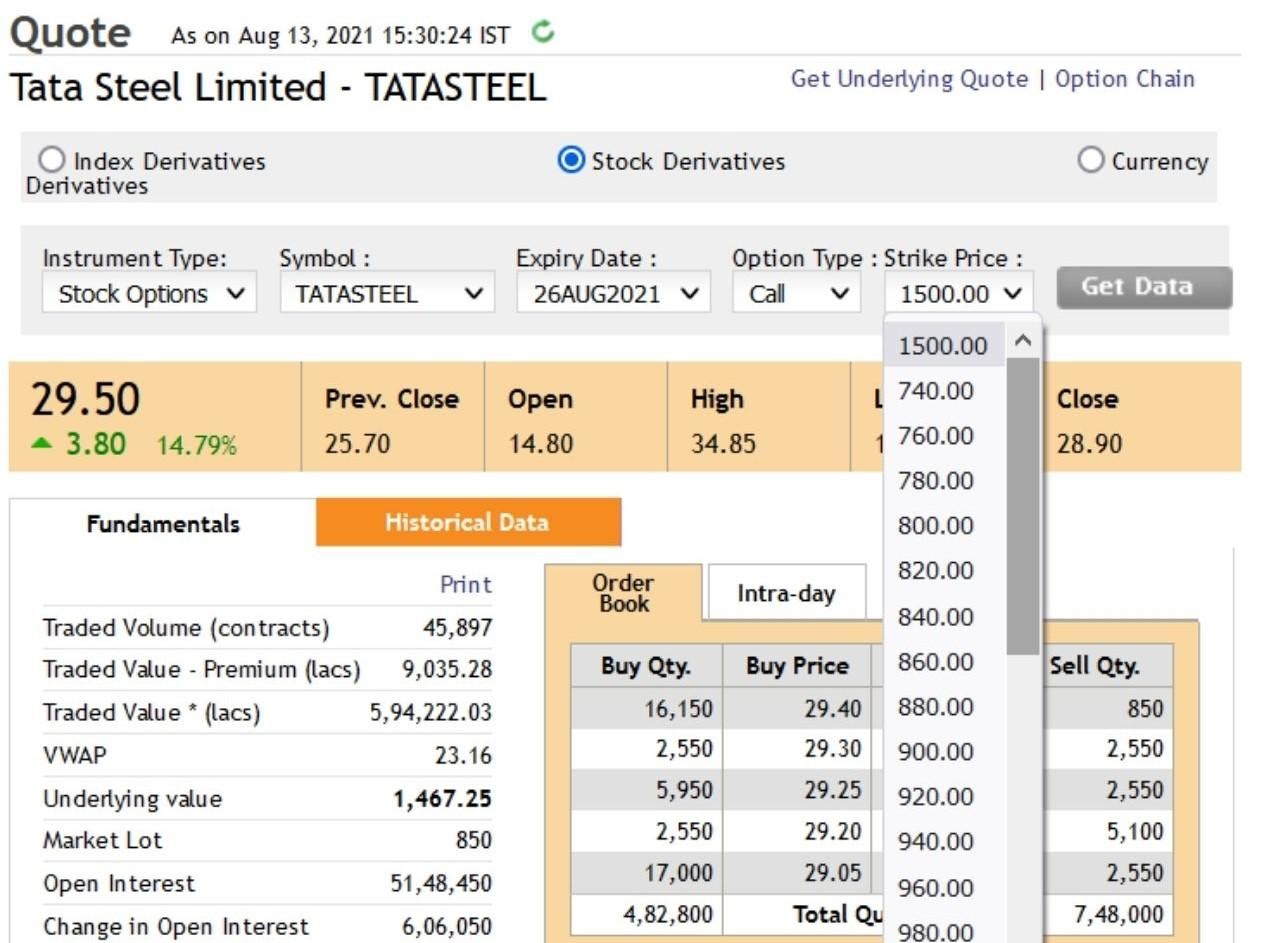

For example, you can buy Tata Steel Limited’s option contract at a strike price of Rs. 1,500. Refer the image below –

Source: National Stock Exchange of India (NSE)

2. Expiration date or the end date

It is the date on which an options contract expires or ceases to exit. At any given point, an options contract will have three maturities:

- Near month (maturing after 1 month)

- Middle Month (maturing after 2 months)

- Far Month (maturing after 3 months)

Before an option expires, the option buyer has three choices –

- Choose to exercise the option

- Close the position to realize profit or loss

- Let the contract expire worthlessly .

3. Option premium

It is the current market price of an options contract. The option writer (seller) receives the option premium from the buyer.

4. Lot size

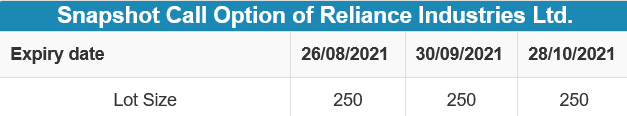

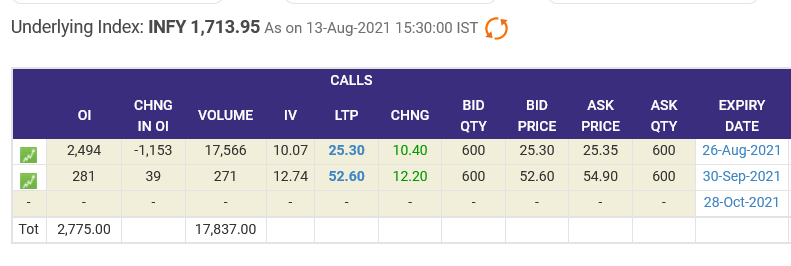

It is the total number of underlying assets under a single options contract. The standard lot size is different for each asset. The exchange on which the stock is traded decides the lot size. For example, one option contract of Reliance Industries Ltd. consist of 250 shares. Whereas, the lot size for one Infosys options contract consists of 600 Infosys shares. The exchange revises the lot sizes on a regular basis.

These details are available on National Stock Exchange (NSE) website.

5. Open Interest

It refers to the total number of outstanding positions of a particular options contract. It covers all participants in the market at any given point of time. Once the contract passes its expiration date, the open interest becomes nil.

To check the open interest data at the end of the trading session, visit National Stock Exchange (NSE) website.

6. Types of option contracts –

There are two types of option contracts –

- American Options

- European Options

American options can be exercised any time before the expiry date. But European options can be exercised on the expiry date only, not before. To exercise an option means to execute the right to either buy or sell an options contract. You put into effect the rights you are entitled to in the options contract. In simple words, you ask your broker that you wish to exercise the option in your contract.

7. Implied volatility

Investors use implied volatility to project option contracts’ range of future moves.. I It is often used to price an options contract. Predicting volatility is vital for option traders. It helps in assessing the risk involved while purchasing a particular contract. Note that implied volatility does not predict which direction will the price of a contract move. It only helps predict a range on how much it is likely to move in any direction. One can gauge the potential risk and reward in an option trade with it.

Call Option vs Put Option

Let us understand what call and put options mean.

-

Call Option

Think of a call option as a down payment for a future purchase. For example, you decide to buy a brand new car. While signing the contract, you make a down payment to book the car. This implies that the car is now reserved for you and you have the right but not an obligation to buy the car. But of course, the seller of the car won’t wait forever for you to make the full and final payment. Hence, there will be a fixed date until which you must make the full payment or else the deal will lapse and you won’t get your refund of the initial down-payment.

Let’s relate this scenario with call option contract. The owner of a call option has the right but not the obligation to purchase the underlying asset at a specific price on a specified date. You become the option buyer by paying a premium to the option writer (seller of the call option). You buy a call option, when you expect the price of the underlying asset to increase in the future. If the stock price goes up as expected, you must exercise the call option. On the other hand, if the stock price goes down, exercising the call option would lead to losses. Here, you have the option to not exercise the option and let it expire worthless. Remember, you do not have the obligation to buy. However, you will have to bear the loss of the premium you paid while purchasing the call option.

Recommended Video: Learn the basics of Call Options-

Put Option

A put option gives the holder the right to sell an asset, at a specified price and date to the buyer of the put. When you buy a put option, you bet against the market. It means, that you will profit if the price of the underlying asset falls below the strike price that you have agreed upon. In simple words, you interpret a negative movement of the future value of the underlying stock. Continuing with the same example, say that you buy the brand-new car. What would you do next? You will want to insure your car and your life from accidents. You buy an insurance policy to save you from incurring huge expenses in case of any accidents. Similarly, you buy a put option to save your from falling prices. Watch the following video where our Chief Markets Editor Apurva Sheth explains how Put Options are similar to Insurance Policy along with many important concepts.

Quick Reference Table –

| Call Option | Put Option | |

| Buyer | Has the right to buy the underlying asset at a specific price on a predetermined date. | Has the right to sell the underlying asset at a specific price on a pre-decided date. |

| Seller | Has the obligation to sell the underlying asset at a specific price and date. | Has the obligation to buy the underlying asset at a specific price and date. |

You might be thinking, what is the use of understanding these complex terms if you can simply trade and invest in stocks. Well, here are three main reasons why traders prefer options to create wealth in short amount of time.

Benefits of Options Trading –

Investors use options to speculate or to hedge against risks in existing investments. This gives them an opportunity to earn profits under any market scenario – bullish, bearish or sideways.

-

Cost-Efficiency

You can hold an options position like any stock position at fraction of the cost.

For example, the share price of Infosys Ltd is Rs. 1,713 on 13 th August 2021. To buy 600 Infosys shares, you will have to pay Rs. 10,27,800.

But when you buy a call option of Infosys with an expiry date of 26 th August 2021, you get exposure to 600 shares at just Rs. 15,210. (600 shares x Bid Price of Rs. 25.30)

The investor will no longer have to block Rs. 10 lakhs to buy 600 shares of Infosys Limited. He can take exposure by buying one call option with a premium amount of Rs. 15,210. The amount can earn interest in your bank account or invest in other assets to diversify your portfolio.

-

Hedging – Higher Potential Returns

Hedging is a risk management strategy employed to offset losses on investments. To hedge risk, the investor takes an opposite position in same or related asset.

Hedging with options help reduce risk at a reasonable cost.

Consider options as a form of an insurance policy. Just as you insure your car, options can insure your investments against a downturn.

For example –

Imagine you buy 250 shares of Infosys at Rs. 1,700 per share in the spot market. This requires you to invest Rs. 4,25,000.

The quarterly results are to be declared by the company shortly.

You worry that Infosys may not announce a favourable report as per the market expectations. You fear the stock price may decline considerably. But you don’t want to sell your stock. How can you avoid making losses on your holdings?

Simple… hedging.

In order to hedge the position in spot, you must simply enter a counter position in the options market. You can buy a put option of Infosys with a strike price of 1,700.

You only pay the premium amount to the put option seller. If the stock falls below 1,700 then your put options will set off the losses on your holding in spot market.

-

Speculation

Speculation is a bet on future price trends. If a speculator (the trader) might think the price of a stock will go up based on his research, he can buy the stock or buy a call option on the stock.

If you buy a call option, your total risk is limited to the premium you pay to buy the option. While, your potential profit is unlimited. It is calculated by how far the market price will exceed the option’s exercise price.

Whereas if the speculator holds a negative n view on the underlying, he must buy a put option.

If the market price of the underlying security falls, the put buyer profits to the extent the market price declines below the option strike price. If the investor was wrong and prices don’t fall, the investor only loses the option premium.

Watch this video to understand when must one buy or sell option contacts –

But wait, as much as options trading helps you create wealth, there have been instances where traders bore huge losses. The primary reason being the lack of understanding and the greed of quick wealth.

-

Options can be used in a non-trending market

A trader only makes money if the stock is trending upwards or downwards. But options allows you to make money in sideways market too.

When a stock is trading sideways options can help you make money with straddle strategy. Here you sell calls and puts to earn premium.

You can use this strategy when you do not expect a major move in share prices. We will explain this strategy in detail along with many more option strategies in this article further. Stay tuned…

Risks and Disadvantages involved in Options Trading

Trading options is becoming increasingly popular among investors. It’s no longer just for professionals. Novice investors and people working from home are also taking advantage of options trading. You might be wondering… if trading in options has so many benefits, why do investors shy away from investing in it? Like every investment, trading in options has its share of risks.

-

Options trading is complex

Looking at the higher gains with small investments, many investors jump into options trading. But options are complicated to understand. It is not as easy as buying a call option if the market is rising. Knowing which strike price to buy, studying the implied volatility (IV) determines success in options trading.

Retail investors spend majority of their time forecasting prices. Instead, their focus must be on managing trades. If you become greedy and start trading options looking others then you might end up losing all your money.

-

Highly Risky

Options are short-term investment instruments. So, the probabilities of losing wealth are as high as earning profits.

A small change in the underlying stock price can cause a sharp movement in the options pricing. Plus, a short time horizon gives less time for price recovery.

-

Options are not available for all stocks

Over 4,000 stocks trade in the Indian stock market. But only about 165 stocks and three indices are available in the futures and options (F&O) segment.

This limits the underlying contracts where you can trade options.

-

Lower Liquidity

What would happen when you wish to buy a particular options contract but there is no seller available? Or there are few sellers available but not at the price you desire.

That’s why liquidity is important.

Liquidity is the degree to which an asset can be purchased or sold on the market immediately.

Options that are liquid are likely to trade more easily at a fair market price. All option contracts are not liquid in India. Nifty, Bank Nifty and, only few other stock options have high liquidity.

An illiquid stock option means that it may take longer to enter or exit the trade near its current market price. This also affects the asset price at which you enter or exit ultimately affecting your profits.

-

Other costs

There are many charges involved while trading options in Indian market.

There are Brokerage Charges, Securities Transaction Tax (STT), Transaction Charges, SEBI charges, etc.

The brokerage charge is the biggest charge that you must pay while transacting in the stock market. If you trade frequently in options then brokerage can be a major cost. These costs may eat up your profits.

As always, Samco is here to save you from paying high brokerages. At Samco, our clients pay only Rs. 20 per order with no other hidden brokerage charges.

This is regardless of the trade size or segment. So, whether you transact in the cash segment or futures & options, intraday or positional, you pay a flat fee of Rs. 20 per order.

We have helped our clients save crores in brokerage. You can do that too by opening a FREE Demat account with Samco.

These were few disadvantages of trading options. But wait…we will be sharing some option trading strategies in this article ahead as we promised earlier. So stay tuned! But before we do that, let’s understand one main concept of moneyness in an option contract –

The Moneyness of an Options Contract

Moneyness tells you whether a call or put option will make money if exercised immediately.

An options contract can be:

- In-The-Money (ITM) = Profit

- Out-Of-The-Money (OTM) = Loss

- At-The-Money (ATM) = No profit, nor loss

This classification helps the trader to decide which strike (exercise price) to trade in the market. Let’s understand the moneyness and the three scenarios one faces while trading in options –

Let stock price be (S) and exercise price by (X). To recall their meaning, stock price is the current market price and exercise price is the price you agreed upon at the start of the contract.

-

In-the-money (ITM)

An options contract is in the money if the immediate exercise of an option creates a positive payoff. You make a profit by exercising in-the-money option contracts.

In the money call option –

If S – X > 0, a call option is in the money. If the stock price is greater than exercise price, the options contract is in-the-money.

(S – X) is the amount of payoff a call option holder would receive for immediate exercise. That is, buying a share at exercise price (X) and selling it in the market for a greater price (S).

For example, a call option with a strike of Rs. 150 will be in the money if the underlying stock is trading at Rs. 200 per share.

The difference between the current market price and the exercise price is the amount of the premium for the option.

So, if you want to buy a particular in-the-money call option, you will have to pay a premium of Rs. 50 per share.

In the money put option –

If X – S > 0, a put option is in the money.

(X – S) is the amount of payoff received from the immediate exercise of the put option. That is, buying a share for S and exercising put option to receive X amount for that share.

With put option, you expect the underlying’s price to fall.

For example, a put option with a strike of Rs. 150 will be in the money if the underlying stock is trading below Rs. 150 per share.

-

Out-of-the-money (OTM)

If the immediate exercise of an option contract results in a loss (negative payoff), it is out the money. You will not make money by exercising it.

Out of the money call option –

If S – X < 0, a call option is out of the money.

Out of the money put option –

If X – S < 0, a put option is out of the money.

Say, for example, a stock that is trading at Rs. 200. For such a stock, call options with exercise prices above Rs. 200 would be OTM calls. Whereas, for put options with exercise prices below Rs. 200 would be OTM puts.

Out-of-the-money option contracts are not worth exercising.

-

At-the-money

This is a no-profit and no-loss type of scenario. In other words, the strike price and the exercise price are the same (S = X).

Quick reference table to understand moneyness in options –

| Moneyness in Options – Reference Chart | ||

| Moneyness | Call Options | Put Options |

| In the money (ITM) | Stock Price > Strike Price | Stock Price < Strike Price |

| Stock Price = Strike Price | Stock Price = Strike Price | |

| Out of money (OTM) | Stock Price < Strike Price | Stock Price > Strike Price |

Factors that affect and determine the Option Value –

There are several factors involved in the valuation of options. These are:

-

Price of the underlying asset or the stock price

Value of the call option increases when the value of the underlying asset increases. For a put option, the relationship is reversed. The value of put options increases when the value of the underlying decreases.

For call options –

Higher the price of the underlying asset, greater will be its intrinsic value. Thus, higher will be the value of the call option.

Lower the price of the underlying asset, less will be the intrinsic value. Thus, lower will be the value of the call option.

For put options –

An increase in the price of the underlying reduces the value of the put option. And a decrease in the price of the underlying increases the value of the put option.

-

The exercise price

A higher exercise price decreases the value of call options. A lower exercise price increases the value of call options.

A higher exercise price increases the value of put options. A lower exercise price decreases the value of put options.

-

The volatility of the underlying asset

Volatility is what makes options valuable. With volatility, the chances of making money are higher. Thus, options on volatile stocks are usually more expensive than the less volatile ones.

An increase in the volatility of the price of the underlying asset increases the value of both, put and call options.

-

Time to expiration

All the options come with a definite lifespan. The more time available until expiry, the greater are the chances of making profitable moves. The logic is… longer time to expiration increases the expected market volatility. This ultimately increases the value of put and call options.

So far, we have learned and understood what are option, the risks and advantages of trading options, moneyness in options contract, and factors that affect option pricing.

Now, let’s move on and understand five very important advanced concepts in options trading.

Don’t worry, we have simplified these concepts for you to understand easily.

What Are Option Greeks?

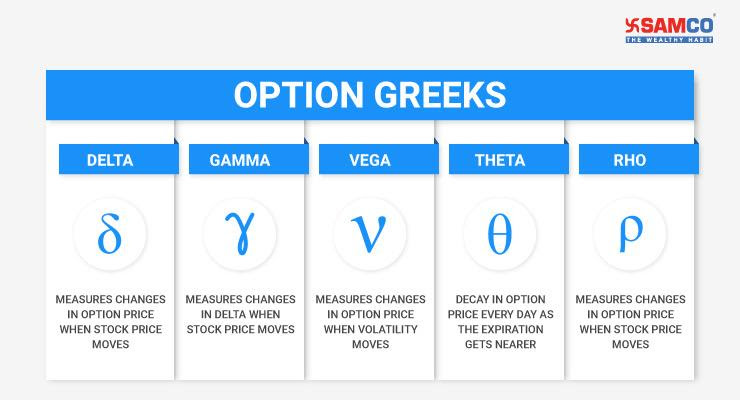

In options trading, the term Greeks is used to define the different dimensions of risk involved in taking an options position.

These variables are represented using Greek symbols and are called greeks. Traders use these values to evaluate and manage options risk and portfolios. However, note that the associated number can change over time.

Each variable has a number associated with it. That number indicates how the option moves or the risk associated with that option.

The primary Greeks are delta, gamma, theta, vega, and rho.

Let’s look into these elements in brief below –

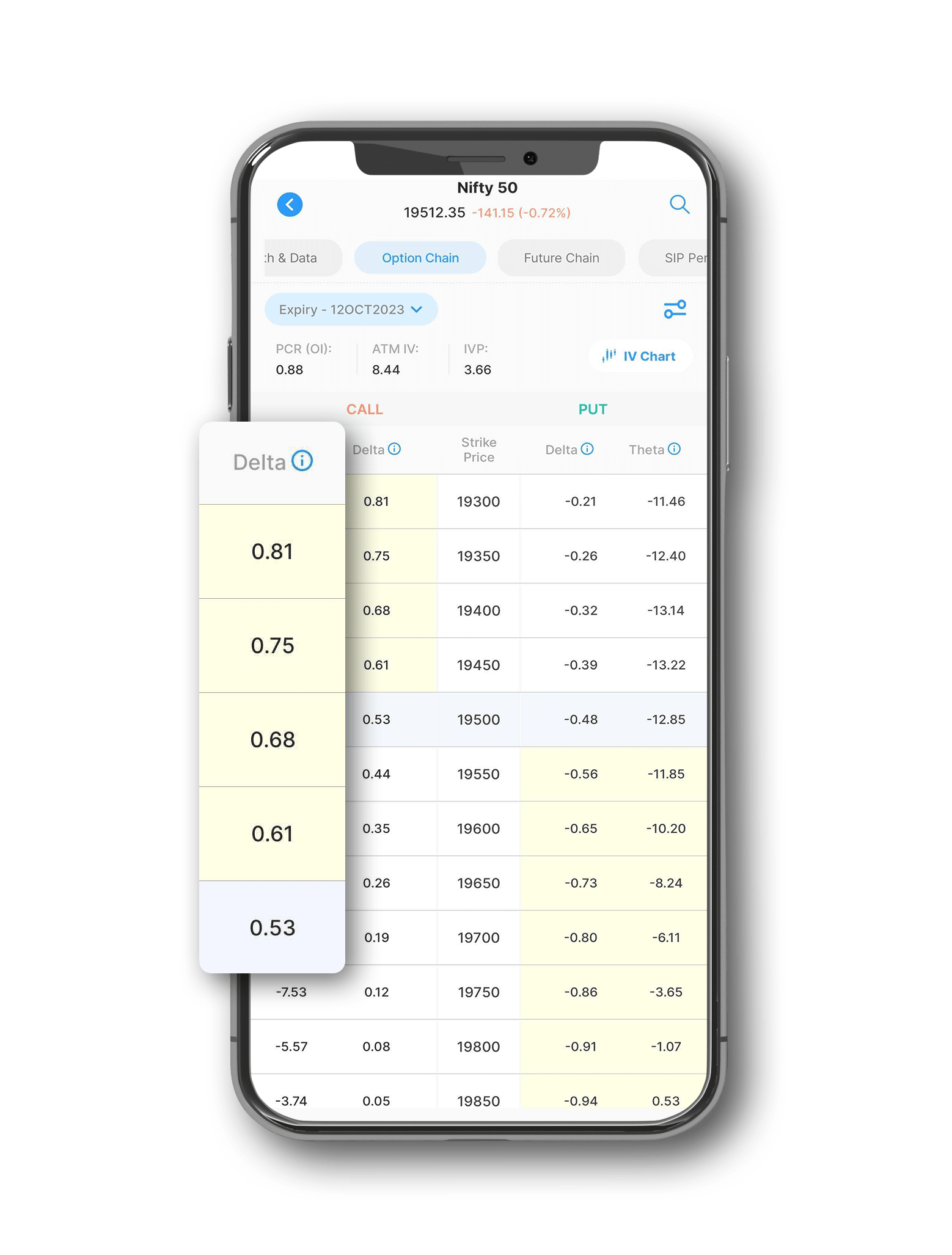

Delta (Δ) depicts the price sensitivity of the option. That is, it measures the rate of change between the option’s price and the underlying asset’s price.

Delta of a call option ranges between zero and one. Whereas, the delta of a put option is between zero and negative one.

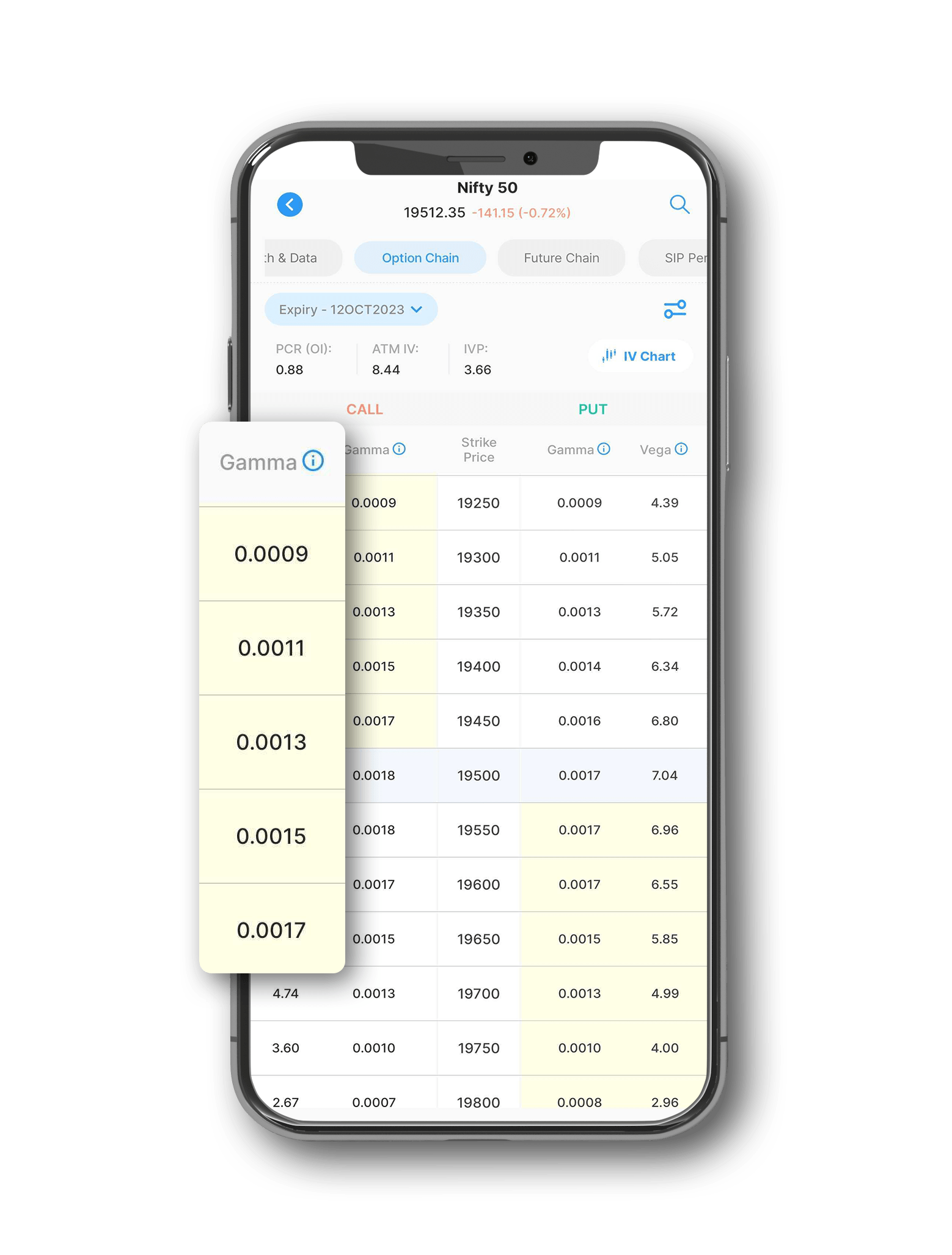

Gamma (Γ) also depicts an option’s price sensitivity but with respect to Delta. It measures the rate of change between an option’s delta and the underlying asset’s price. It helps to determine how stable an option’s delta is. Higher gamma values state that delta could drastically change in response to minute movements in the underlying assets price.

For options that are at the money, Gamma is higher. It is lower for options that are in-the-money and out-of-the-money.

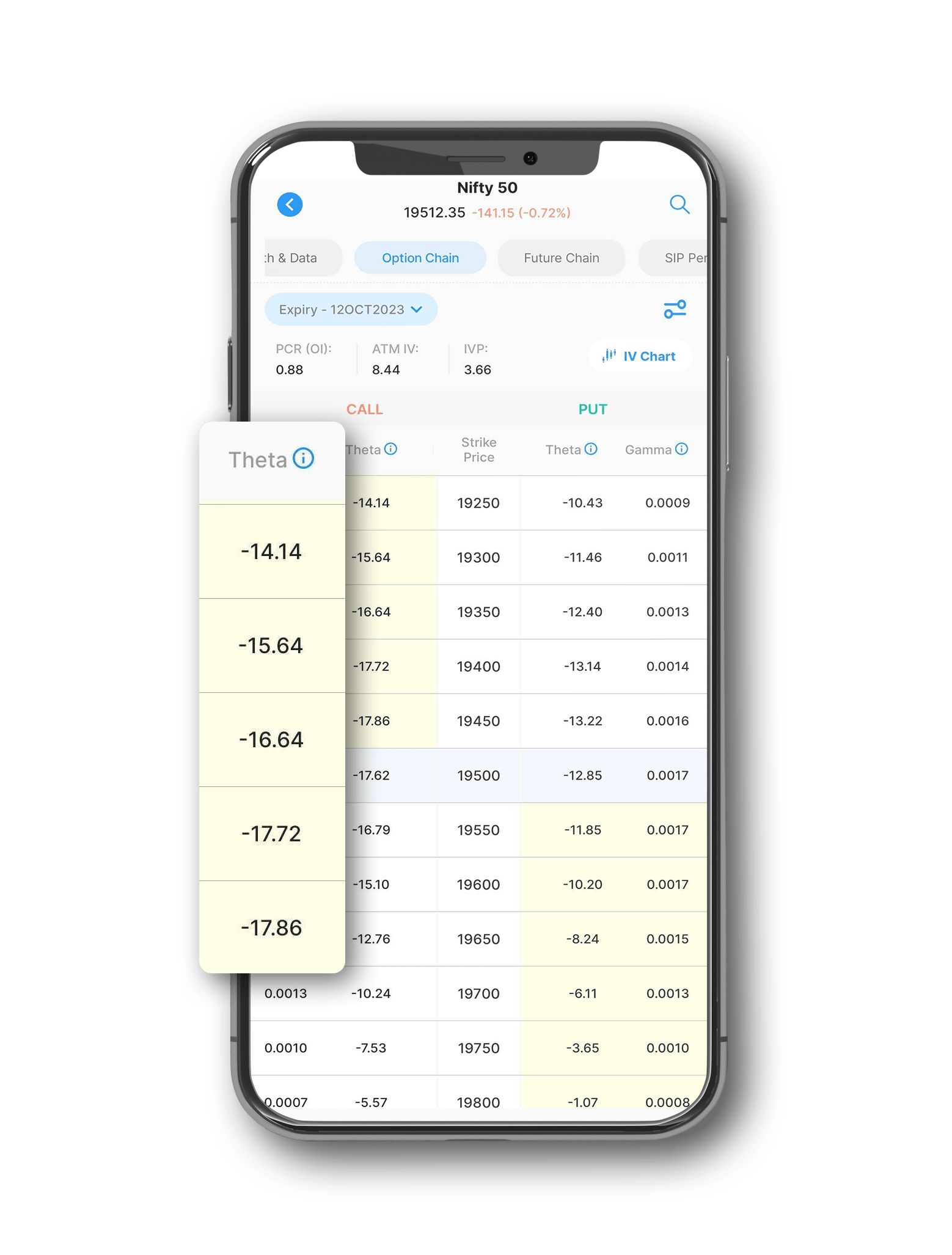

Theta (Θ) represents the option’s time sensitivity. It measures the rate of change between the option price and time.Theta increases when options are at the money. It decreases when they are in the money and out-of-the-money.

Long calls and long puts will usually have negative Theta. Short calls and short puts will have positive Theta.

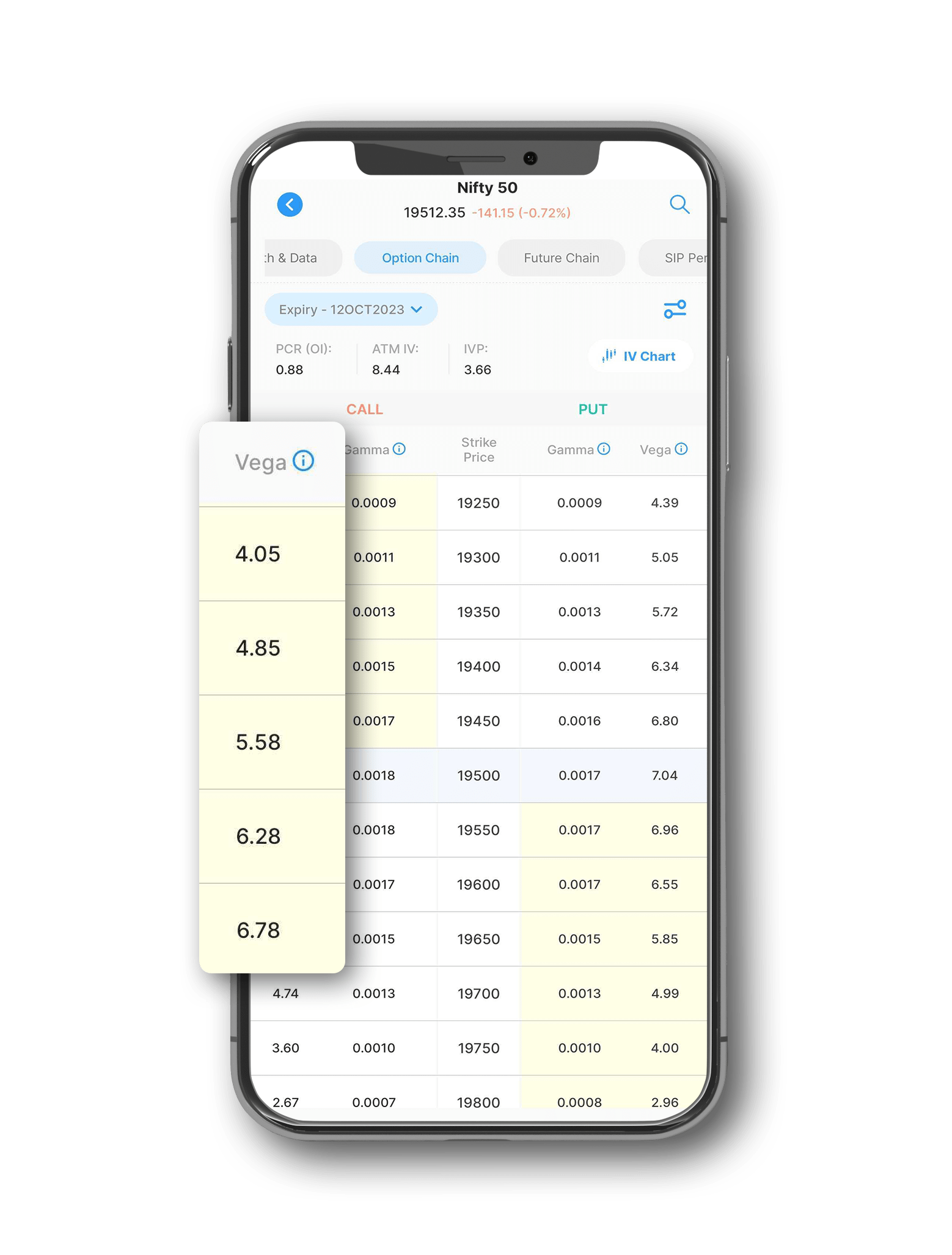

Vega (v) depicts sensitivity to the volatility of an option. It measures the rate of change between an option’s value and the underlying asset’s implied volatility.

Vega is greatest for at-the-money options that have longer times until expiration.

-

Rho (p)

Rho (p) depicts sensitivity to the interest rate. It measures the rate of change between the value of an option and the interest rate. Rho is maximum for at-the-money options with long time until expiration.

We have a perfect video explaining to you how technical analysis can help you with options trading.

Shubham Agarwal, founder and CEO at @Quantsapp explains options greeks and also talks about the correct way to analyse Out The Money (OTM) Options and In The Money (ITM) Options. He is a highly qualified professional with over 16 years of experience. He is a CMT, CFA, CQF, CFTe, and Investment Banking Analyst.

So, if you want to become an options trader then you must watch this conversation without fail.

Now that we understand the functions of option Greeks, it’s time to move a step further and learn few options trading strategies. This is where you will put your learnings into action.

Options Trading Strategies

There are various options strategies available. These strategies help limit risk and maximize return. With time and dedication, you can learn how to take advantage of these strategies. Here are seven options strategies for beginners that every new option trader must know.

- Bull Call Spread

- Bull Put Spread

- Bear Call Spread

- Bear Put Spread

- The Long Straddle

- The Short Straddle

- The Long & Short Strangle

Let’s understand these strategies –

If you are fairly bullish about a stock or index, a bull call spread can be a profitable strategy. It is used when an investor expects a moderate rise in the asset’s price.

The idea behind this strategy is to create a range by using two call options.

In a bull call spread strategy, an investor simultaneously –

- Buys a call option at a specific strike price and

- Sells the same number of calls at a higher strike price

Note: Both call options must have the same underlying asset and expiration date.

Doing this, you restrict your maximum loss to the net premium you pay for the call positions. Whereas the maximum profit is equal to the difference in the call options strike prices and the net premium you pay for the position.

For a successful execution of this strategy, the stock price must rise to make a profit on the trade.

The bull put option spread works as an alternative to the bull call spread strategy. The strategy is profitable when you are moderately bullish about the stock or index.

In a bull put spread strategy, the investor will –

- Sell put option with a higher strike price and

- Buy another put option with a lower strike price

Note: Both put options must have the same underlying asset and expiration date.

You might be wondering why should one choose bull put spread over bull call spread if they are similar?

It is best executed when the market has plunged, put premiums are high, the volatility is also on the higher side. At the same time, you have a moderately bullish outlook towards the market ahead.

The difference between the two premiums from the options is your net profit.

A bear call spread is also called the bear call credit spread. Investors use this options strategy when they expect a decline in the underlying asset’s price.

A bear call spread is done by –

- Selling call options at a specific strike price

- Buying the same number of calls at a higher strike price.

Note: Both call options must have the same underlying asset and expiration date.

Bear call spread is best executed when investors are moderately bearish on the markets. It is best for investors with limited risk appetite.

This strategy is also called a credit call spread or a short call spread. The idea behind this strategy is to generate option premium income based on investor’s bearish view of a stock.

Investors use this option strategy when they have a bearish opinion for the underlying asset. They expect the asset’s price to decline.

A bear put spread strategy consists of –

- Buying one put option at a specific strike price and

- Selling another put at a lower strike.

Note: Both put options must have the same underlying asset and expiration date.

By implementing this strategy, you offset some of the costs. But the stock price needs to fall for you to make money.

The investor restricts the maximum loss to the net premium paid for the position. Whereas the maximum profit is equal to the difference between the strike prices and the net premium paid for the put position.

-

Long Straddle

Has it ever happened that you strongly anticipated a stock price to rise but the price went down drastically? You expected a good quarterly result and entered a long position. But instead, negative news broke out and you ended up with heavy losses. If you might know this earlier, you might have entered a short position to bag profits.

Well, here is an options trading strategy which you might be interested in – Long straddle strategy.

The profitability in the long straddle strategy does not depend on the market direction. In simple words, it is not affected by the direction in which the market moves. The market price can move in any direction, but it has to move big.

You will generate profits as long as there is a major directional movement in the price. This is also known as Market Neutral strategy.

To execute the long straddle options strategy, the investor must –

- Buy a call option, and

- Buy a put option

The investor purchases both – a long call as well as a long put option.

Note: Both these options must have the same underlying asset, strike price, and expiration date.

While using this strategy, the investor hopes for the underlying price to move strong.

Call options benefit from the underlying asset’s upward move. Whereas put options benefit from the underlying asset’s downward move. Both of these components cancel out minor small moves in either direction.

Thus, the goal here is to profit from a very strong move. Usually, such events are triggered by a newsworthy event that has the potential to influence the prices. Example Election results. The only risk here is that the market might not react as anticipated to the news event.

-

Short Straddle

The short straddle strategy is the opposite of the long straddle. Here, the investor places a bet that the market will stay in the defined range and won’t move.

To implement this strategy, the investor must –

- Sell a call option

- Sell a put option

Note: Both these options must have the same underlying asset, strike price, and expiration date.

Investors execute this strategy when they believe the underlying asset will not show any significant movement.

Just like a long straddle, a short straddle is developed around major news or events.

The maximum profit for an investor is the premium they collect by writing the options. The aim is to let both the put and call expire worthless.

However, the biggest risk involved is that the potential loss can be unlimited. Hence, new traders must avoid dealing with short straddles.

-

The Long & Short Strangle

A strangle is similar to the straddle option strategy. The difference between the two is that strangle uses options at different strike prices whereas straddle uses options at the same strike price.

This is done to lower the cost of trade implementation.

A long strangle requires you to –

- Buy out-of-money call option, and

- But out-of-money put options

The short strangle strategy is the opposite of the long strangle.

A short strangle requires you to –

- Sell out of money call options

- Sell out of money put options

This strategy helps reduce the strategy cost. When you compare ATM strike with OTM strike, the OTM will always trade cheaper. Hence, implementing a strangle strategy is cheaper than setting up a straddle strategy.

Conlcusion:

Mark Cuban, an American billionaire entrepreneur with a net worth of over US $ 4.3 billion once said –

‘I am telling you, the world’s first trillionaires are going to come from somebody who masters financial derivatives … and applies it in ways we never thought of.’

To win in options trading, you need a broker who provides hassle-free margins with minimum costs and charges. This is where Samco App is the perfect match.

Samco App is our advanced trading platform powered by the proprietary Giga Trading Engine. It will help recognize opportunities, trends, and patterns seamlessly. Samco App uses powerful computing and analytical technology to offer the best trading experience to you like –

- Get a personalized and customized actionable stock news feed

- You can directly place a trade from an actionable news feed

- Best chart experience with a rich UI

- Load the cross-hairs, draw lines, and assign more than 100 indicators on your charts

- Get notifications and track every move in your portfolio

- Set bundled trigger alerts for price/volume movements

To enjoy all these benefits, open a FREE Demat account with Samco , the best discount broker in India.

Disclaimer: INVESTMENT IN SECURITIES MARKET ARE SUBJECT TO MARKET RISKS, READ ALL THE RELATED DOCUMENTS CAREFULLY BEFORE INVESTING. The asset classes and securities quoted in the film are exemplary and are not recommendatory. SAMCO Securities Limited (Formerly known as Samruddhi Stock Brokers Limited): BSE: 935 | NSE: 12135 | MSEI- 31600 | SEBI Reg. No.: INZ000002535 | AMFI Reg. No. 120121 | Depository Participant: CDSL: IN-DP-CDSL-443-2008 CIN No.: U67120MH2004PLC146183 | SAMCO Commodities Limited (Formerly known as Samruddhi Tradecom India Limited) | MCX- 55190 | SEBI Reg. No.: INZ000013932 Registered Address: Samco Securities Limited, 1004 - A, 10th Floor, Naman Midtown - A Wing, Senapati Bapat Marg, Prabhadevi, Mumbai - 400 013, Maharashtra, India. For any complaints Email - grievances@samco.in Research Analysts -SEBI Reg.No.-INHO0O0005847.

Easy & quick

Easy & quick

Leave A Comment?