In a powerful market-moving post, former U.S. President Donald Trump sent shockwaves through the metals market after announcing import tariffs on copper. His Truth Social message wasn't subtle — calling out past U.S. leadership and strongly advocating for the defense-critical role of copper. Within hours, copper prices skyrocketed over 10%, reflecting investor recognition of its indispensable role across semiconductors, military systems, data centers, and green technologies.

But here’s where it gets even more interesting — silver could be next in line for a massive move.

What Trump Said About Copper

“Copper is necessary for Semiconductors, Aircraft, Ships, Ammunition, Data Centers, Lithium-ion Batteries, Radar Systems, Missile Defense Systems, and even, Hypersonic Weapons... Copper is the second most used material by the Department of Defense!”

With these words, Trump made it clear: industrial metals are national security assets. If copper is strategic — silver, with its cross-industry application and tighter supply, could be an even bigger beneficiary of global protectionism and inventory hoarding.

Silver: The Quiet Winner Waiting to Break Out

We’ve been tracking silver closely here at Samco — and our previous SAMShots dated June 3 and June 18 pointed out the development of a Cup and Handle formation on the weekly and yearly charts.

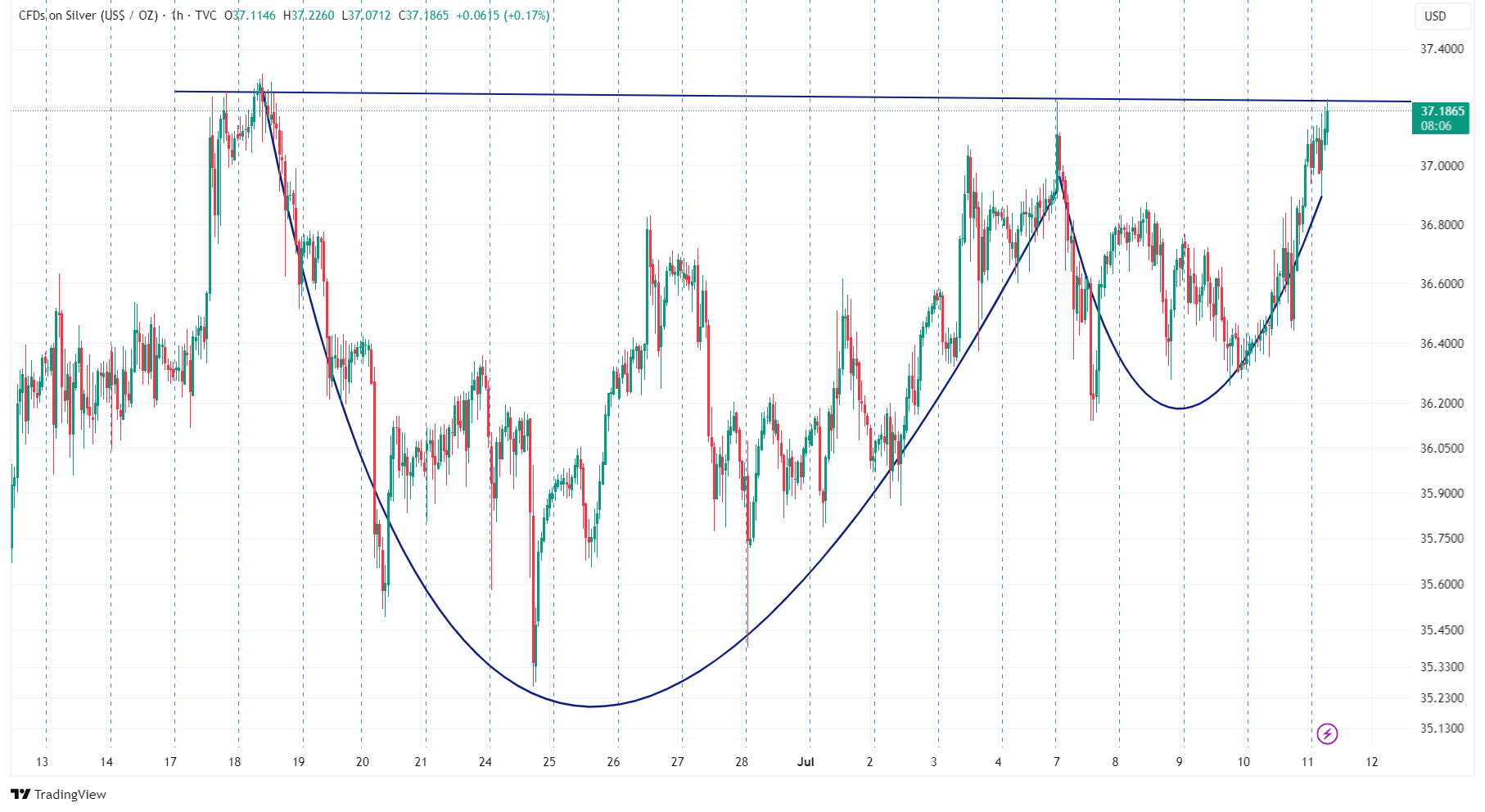

Now? That very same bullish pattern is visible on the intraday chart — and the metal is once again knocking on resistance levels near $37.20. A successful breakout above this neckline could unleash a massive upside rally, potentially fueled by:

- Physical supply shortages

- Export restrictions (China did it for rare earths — could silver be next?)

- Policy-driven hoarding by nations seeking industrial and military readiness

Chart Setup: Cup and Handle in Action

The intraday chart of Silver shows a textbook Cup & Handle formation — a pattern known for strong breakouts once the neckline is breached. With prices testing the previous highs, a strong move past $37.20 could trigger momentum buying and short covering, sending silver into a new bullish orbit.

Supply Crunch Is Real

Silver is already in structural deficit — meaning demand outstrips supply globally. If the U.S. or other countries follow Trump’s copper model and impose tariffs, bans, or stockpiling measures, silver prices could go parabolic.

Final Word: How Much Silver Do You Own?

At this point, it’s not about whether you should own silver — it’s about how much.

With:

- Geopolitical tensions rising

- Silver use increasing across EVs, solar panels, electronics, and defense

- A potential policy-led squeeze in industrial metals

Silver could be one of the smartest hedges and high-potential investments in 2025.

Stay Updated with Samco’s Market Insights

Don't miss out on the next big breakout. Follow #SAMShots for real-time chart setups, news-driven opportunities, and sharp technical analysis.

Easy & quick

Easy & quick

Leave A Comment?