- The demand for gold will never go down. It is a prerequisite in our weddings or any auspicious occasion.

- Central Banks across the globe own trillions in gold bullions.

- Gold is a store of value during geopolitical tensions or economic downturns.

In this article:

In this article:

- What is Gold Futures?

- Advantages of Gold Futures.

- Factors Affecting Gold Futures

- How Does Gold Futures Work?

What is Gold Futures?

Futures is a contract between two parties to exchange the underlying asset in the future at a pre-decided date and price. The underlying asset can be –- Equities (stocks), Bonds etc.

- Currencies (Indian Rupee, US Dollar, Great Britain Pound etc.)

- Commodities (gold, silver, iron etc.)

- Weather (yes, there are futures contracts on weather as well) etc.

Watch this video to learn about commodities

Let us understand gold futures trading with a simple example –Gold Futures Contract Example

Mr Verma’s daughter is set to marry after six months. He wants to gift her 50 tola or 500 grams of gold. The price of gold on 1st September 2021 is Rs 47,090 per 10 grams. Mr Verma expects that the price of gold will increase as the third wave of the pandemic spreads. So, investors will shift from risky assets like equities to a safe haven, which is gold. This will increase gold’s demand and price. Worried, he approaches his trusted Jeweller, MahaKalyan Jewellers. The jeweller disagrees with Mr Verma. He believes that the market has already accounted for the third wave. So investors will stay invested in equities and the demand for gold will fall. This will also lead to a fall in gold prices. This is when both of them decide to enter into a gold futures contract. It is mutually decided that Mr Verma will buy 500 grams of gold from MahaKalyan Jewellers on 1st March 2022 at Rs 47,500 per 10 grams. In the above agreement –- Mr Verma is the buyer of the futures contract. He is said to be ‘long on gold’.

- MahaKalyan Jewellers is the seller of the futures contract. They are said to be ‘short on gold’.

- Rs 47,090 is the spot price of gold.

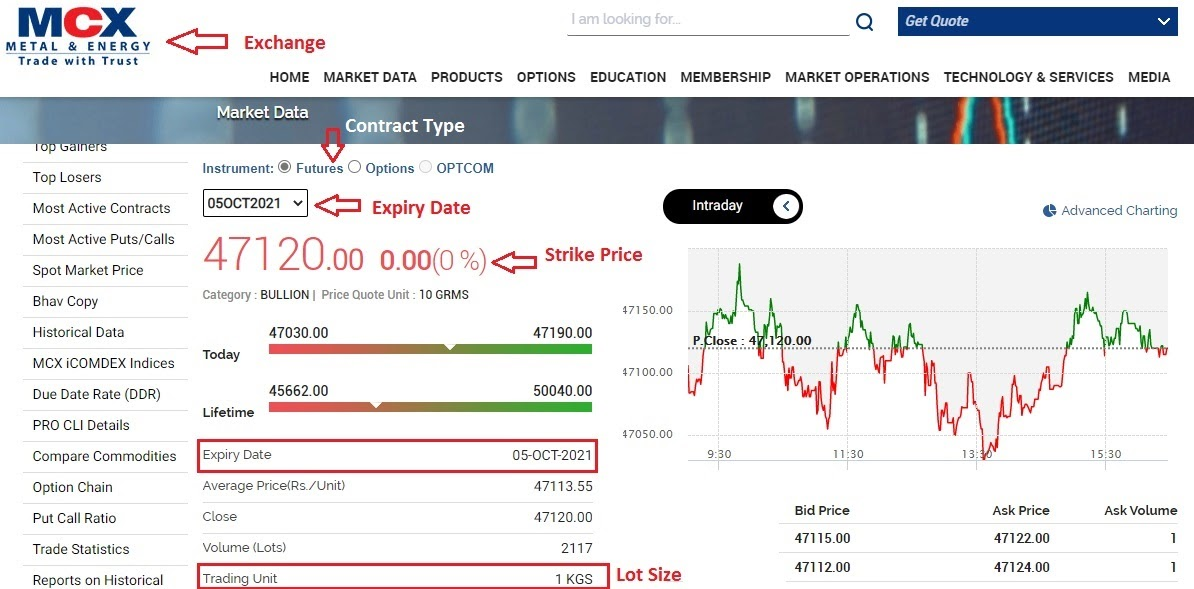

- Rs 47,500 is the strike price of gold futures contract. This is the price at which gold will be exchanged on expiry.

- 1st March is the expiration date for the contract.

- 500 grams of gold is the lot size.

- Gold price increases – the new price is Rs 49,500 per 10 grams.

- Gold price remains flat – the price is unchanged at Rs 47,500 per 10 grams.

- Gold price decreases – the new price is Rs 45,500 per 10 grams.

Scenario 1: From Mr Verma’s Point of View – Gold price increases to Rs 49,500 per 10 grams.

Mr Verma’s prediction has come true. Now, he will buy 500 grams of gold from MahaKalyan Jewellers at Rs 47,500 instead of buying it from the market at Rs 49,500. So, he has made a profit of Rs 2,000 (Rs 49,500 – Rs 47,500) per 10 gram. His total profit is Rs 1 lakh.Scenario 1: From MahaKalyan Jeweller’s Point of View – Gold price increases to Rs 49,500 per 10 grams.

MahaKalyan jewellers are forced to sell 500 grams of gold to Mr Verma at Rs 2,000 less than the market rate. So, even though they can sell 500 grams at Rs 49,500, because they have entered into a futures contract with Mr Verma, they have to honour the contract. They suffer a loss of Rs 1,00,000.Scenario 2: Gold price remains flat – Rs 47,500.

This is a no-profit, no-loss situation for both Mr Verma and MahaKalyan Jewellers. Since the market price is equal to the strike price, both of them honor the futures contract.Scenario 3: Gold price decreases to Rs 45,500 – Mr Verma’s Point of View

Now, Mr Verma is at a loss. He can buy 500 grams of gold from the market at Rs 45,500 but he cannot do so. He is obligated to buy it at Rs 2,000 extra i.e. Rs 47,500. His total loss is Rs 1 lakh.Scenario 3: Gold price decreases to Rs 45,500 – MahaKalyan Jewellers Point of View

This is exactly what MahaKalyan jewellers expected. Now, they can sell 500 grams of gold to Mr Verma at Rs 47,500 instead of selling it in the market at Rs 45,500. They have made a profit of Rs 2,000 per 10 grams or Rs 1 Lakh in total.| Party / Position | Expectations | Profit |

| Buyer / Long Position | Price will increase | Spot Price > Strike Price |

| Seller / Put Position | Price will decrease | Strike Price > Spot Price |

There are four types of MCX gold futures contracts –

There are four types of MCX gold futures contracts –

- MCX gold futures – 1 Kg gold.

- Mini MCX gold futures – 100 grams of gold.

- Guinea MCX gold futures – 8 grams of gold.

- Petal MCX gold futures – 1 gram of gold.

| Gold Futures | Gold |

| Symbol | GOLD |

| Description | GOLDMMMYY |

| Contract Start Date | 16th of every month |

| Last Trading Date | 5th of contract expiry month |

| Trading Unit | 1 Kg |

| Maximum Order Size | 10 Kg |

| Initial Margin | 6% of contract value |

| Delivery | Compulsory |

Factors Affecting Gold Prices & Gold Futures

Demand and Supply: China, South Africa, Australia are some of the biggest producers of gold in the world. While India is one of the largest importers of gold. In India, gold is in heavy demand during wedding season or auspicious occasions like Diwali and Akshay Tritiya. Even monsoon or a good harvesting season affects gold prices as a big chunk of gold’s demand comes from rural India. A good monsoon means good harvest, sales and higher disposable income. Due to unlimited demand but limited supply, there are high fluctuations in the price of the yellow metal. Gold & US Dollar: Since gold is imported in India, payments are made in US dollars. A weak dollar means you can buy more gold with less dollars. So, the demand for gold automatically goes up when the dollar becomes weak. Central banks consider this a great buying opportunity. Also, when the currency of the biggest economy of the world falls, there is a pessimistic atmosphere in the markets. At this point, investors move from risky assets to gold, which increases its price. Mining & Distribution Costs: Gold is mined in far-off countries and then exported to India. So, it has mining, refining, transport and distribution costs attached with it. Any increase in these factors will cause an automatic rise in the price of gold and gold futures. Since gold has been mined for centuries now, mining and distributing companies have mined-off easy gold. Now they need to mine deeper to find quality gold. This means mining companies have to invest more money and manpower to find quality gold. High costs also drive up the prices of gold and gold futures. Central Banks: They are some of the biggest consumers of gold in the world. Central banks of most countries maintain huge gold reserves as a store of value and to maintain the value of the domestic currency. The Reserve Bank of India has to maintain a minimum reserve of Rs 200 crores in gold bullion before printing fresh currency. So, when central banks are on a buying spree, it automatically causes an increase in the price of gold and gold futures. Interest Rates: Gold prices and interest rates have an inverse relationship. When interest rates in the market are low, investors prefer investing in gold where they find a store of value and inflation-adjusted returns are positive. Whereas when interest rates are high, investors will shift from gold to fixed income instruments for higher inflation-adjusted returns. Geopolitical Tensions: During geopolitical tensions or wars, gold becomes the preferred choice for investors since it is a store of value. So, while currency depreciates, gold will retain its value and hence the demand and price of gold goes up during geopolitical tensions or trade wars.Advantages of Gold Futures

- No Storage Cost: When you buy physical gold, you either store in your home or a bank locker. When you store it at home, there is an ever-present danger of theft or loss. When you store physical gold in bank lockers, you have to pay an annual locker charge. And mind you, even bank lockers are not 100% insured. This hassle, cost and fear is eliminated when you invest in gold futures. These electronic contracts are bought and sold through demat accounts and are highly secured.

- Less Capital Required: If you want to buy 1 kg of gold today, you will have to shell out Rs 47.09 Lakhs (Rs 47,090/10*100 grams). But you can take the same position in gold futures for a fraction of the cost. This is because gold futures are highly leveraged. We know that 1 gold futures contract has 1 kg of the underlying asset. The current price of gold futures maturing on 5th October 2021 is Rs 47,119. So, the total value of your contract is Rs 47.11 Lakhs. But you do not have to pay the entire amount upfront. You only have to deposit a margin amount to enter into this contract. Let’s assume that the margin required for gold futures is 4%. In this case, you can take exposure to 1 Kg gold futures contract with a margin amount of Rs 2.82 Lakhs only.

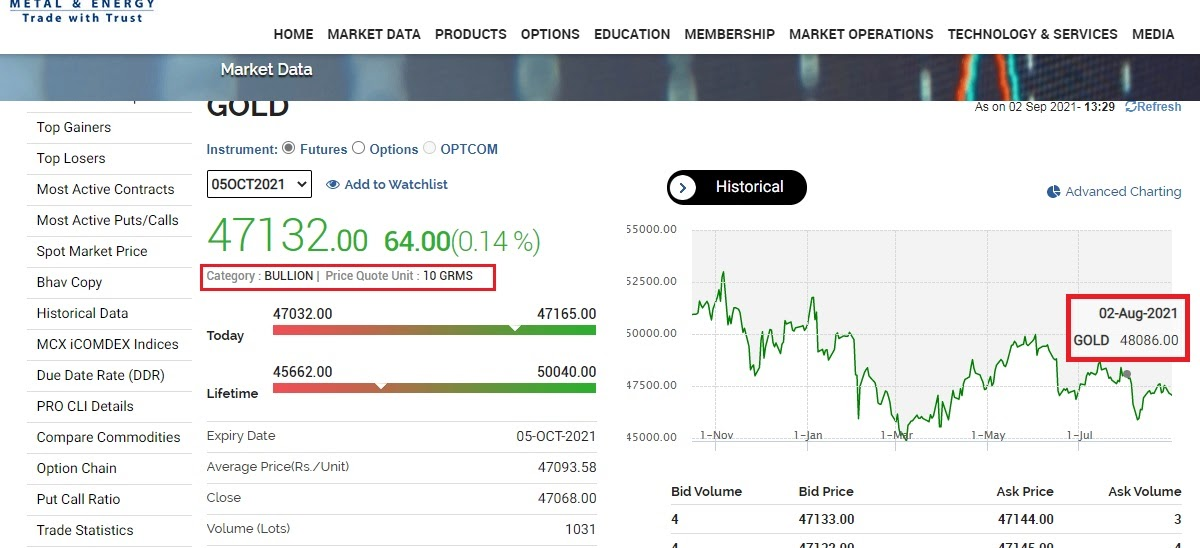

- Intraday Profit Booking Allowed: When you buy stocks for delivery, they are credited in your Demat account after two days (T+2 day settlement). So, even if there is an intraday opportunity available, you cannot sell the stocks before T+2 days. But in the case of gold futures, you can trade intraday as well.Take the below example – On 2nd September 2021 –

- 9.00 am – I buy a gold futures contract on Gold (1 Kg of underlying gold) for Rs 47,216 per 10 grams.

- Total Value of my position = 4721.6*1000 = Rs 47,21,600

- Margin Required = 6% of contract value = Rs 2,83,296

- During the day, it hit a high price of Rs 47,369. I sell my one lot at this price.

- Total sale price = Rs 4736.9*1000 = Rs 47,36,900

- Total Profit is Rs 15,300 on an investment of Rs 2,83,296. This is a gain of 5.40% in one day

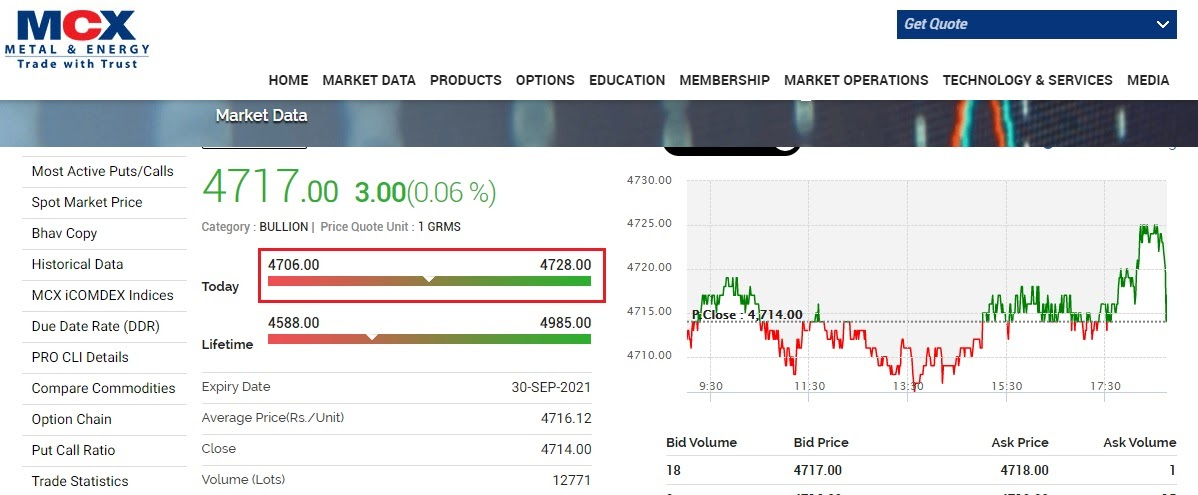

- On 1st September 2021, at 10.01 am. GoldPetal futures were trading at Rs 4,719. Suppose, I sold (short sell) one lot of GoldPetal futures.

- At 13.39 pm, it fell to Rs 4,707. I covered my short sell and bought one lot at Rs 4,707.

- The difference, Rs 13 (4,719-4,707) is my profit. This kind of short selling opportunity is possible only in the case of gold futures, not physical gold.

I go long on Gold futures contract on 2nd August 2021 at a price of Rs 48,086 per 10 grams. 1 Gold futures contract is for 1 Kg underlying gold.

I go long on Gold futures contract on 2nd August 2021 at a price of Rs 48,086 per 10 grams. 1 Gold futures contract is for 1 Kg underlying gold.

- Total Contract Value = Lot Size * Price

- Initial Margin Required = 6% of Contract Value

- Leverage = Contract Value / Margin Required

Settlement of Gold Futures

A Gold futures contract can be settled in two ways –- Cash Settlement

- Delivery Settlement

Easy & quick

Easy & quick

Leave A Comment?