What are Futures? – Meaning of Futures

Futures are a type of derivatives. What are derivatives? Derivatives are weapons of mass destruction! These are not our words. These words belong to the world’s greatest investor – Mr Warren Buffett. But we would like to respectfully disagree. Futures can be a real money maker provided you know how to trade them. And the first step in trading futures is to understand exactly what are futures and how a futures contract works. But before understanding what are futures, we need to take a small detour and first understand what are derivatives. Because futures are after all a type of derivative. Derivatives are financial contracts which derive their value from the value of the underlying asset. Let’s take the typical example of milk and curd. Curd is made from milk. So, if the price of milk rises, the price of curd will also increase. This means that curd has no value of its own. It ‘derives’ its value from the value of the underlying asset ‘milk’.- If price of underlying asset increases – the price of derivative will also increase.

- If price of underlying asset decreases – the price of derivative will also decrease.

There are 4 types of Derivatives Contracts in India

Watch this video to know everything about Futures Contract in India

What are Futures? – Example of Futures

Futures is a standardised agreement to buy or sell the underlying asset at a pre-determined price on a specific date. The underlying asset can be a stock, currency, commodities or an index. In the above example: You have already decided that you will pay Rs 35,000 for a Dubai ticket. This is your pre-determined price. Even if the airfare increases after 3 months to say Rs 40,000 you will still pay only Rs 35,000. Similarly, even your date of travel is already decided in advance. This is your specific date. Both you and the airlines are bound by an agreement. You have to pay them Rs 35,000 and they have to reserve a seat for you on a specific date. So, every futures contract has the following:- A pre-determined price

- A pre-determined date

- 2 parties – the buyer and the seller.

- Buy shares of Reliance Industries from the spot market.

- Buy futures or options with Reliance Industries as the underlying.

- Superior returns – 144% vs 25%

- Access to better volumes – In the spot market you could buy only 50 shares. But in the futures contract, you bought 250 shares!

- Lower Capital – In spot market you invested Rs 1 Lakh, whereas in the futures market you invested only Rs 64,700.

Basics of Futures Contract in India

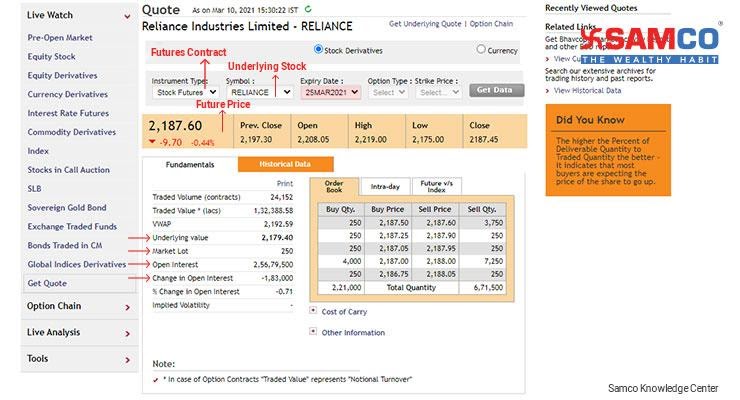

1. Lot Size: Lot size is similar to buying milk from the market. There are standard lots. You can buy milk in 250 ml, 500 ml and 1 litre quantities. You cannot ask the shop keeper to give you half a glass of milk! Similarly, futures contracts also have lot sizes. For example:- The lot size of Reliance Industries futures is 250 shares.

- The lot size of State Bank of India is 3000 shares.

- The lot size of Nifty Futures is 50 shares.

- The price of 1 futures contract of Reliance Industries is Rs 2,186

- The price of 1 futures contract of State Bank of India is Rs 386.75

- The contract size of 1 Reliance Futures contract is Rs 5,46,500 (Rs 2,186*250)

- The contract size of 1 State Bank of India futures contract is Rs 11,60,250 (Rs 386.75*3,000)

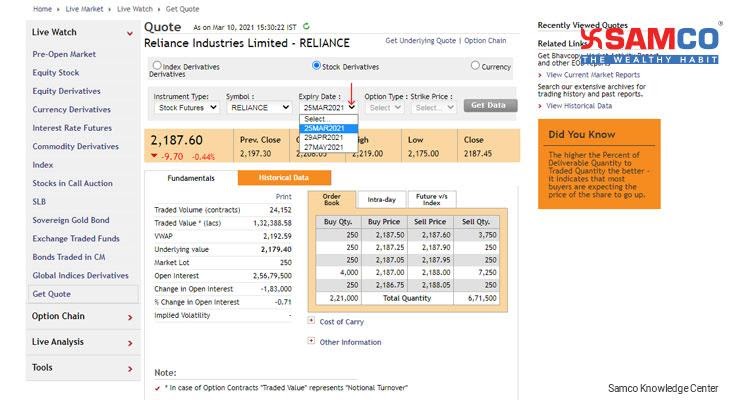

- Futures contract expiring on 25th March 2021 – Current Month

- Futures contract expiring on 29th April 2021 – Next Month

- Futures contract expiring on 27th May 2021 – Far Month

How Do Futures Work? – Workings of a Futures Contract

Suppose you buy one lot of Reliance futures expiring on 25th March 2021. Your cost price is Rs 2,186 per lot. Your contract value is Rs 5,46,500. You are the buyer so you expect the share price of Reliance Industries to increase. Since you are the buyer, there definitely must be a seller who sold you the futures contract. So, the seller’s position will be also be worth Rs 5,46,500. You have till 25th March 2021 to square-off (close) your position. On 20th March 2021, the value of your Reliance futures contract increases from Rs 2,186 to Rs 2,500. So, you have made a profit of Rs 93,000. Your profit is the seller’s loss. So, the seller makes a loss of Rs 93,000. This is why futures are known to be a zero-sum game. By selling your futures contract, you have squared-off or closed your buy position. The exchange will debit the sellers trading account by Rs 93,000 and credit your trading account with Rs 93,000. This is known as cash-settlement. Here only the difference amount is credited or debited to buyers and sellers trading account. But cash settlements can be done only if you square-off your positions before expiry. Let us assume that did not sell your futures contract till 25th March 2021. In that case, you will actually have to take delivery of 250 shares and the seller will have to make delivery of the 250 shares. This is known as physical settlement. This happens only if you DO NOT square off your position before expiry. 9. Open Interest: Open interest or OI, shows the number of open contracts or position on a given date. A high open interest shows high liquidity.- Open Interest increases when new contracts are added

- Open Interest decreases when contracts are settled / squared-off.

Advantages of Futures

- Leverage: This is one of the biggest advantages of a futures contract. When you buy equity shares in the spot market, you have to pay the entire contract value upfront. This is not the case with futures as you can take exposure to positions by paying just the initial margin. As we saw in the previous example, you could take positions worth Rs 5,46,500 with an initial capital of Rs 64,700 only. This helps trader’s access huge positions with limited capital.

- Higher Returns with Limited Capital: The by-product of high leverage is that investors get the opportunity to earn higher returns. Since investors can access higher positions, they can earn superior profits compared to the spot market. In the previous example, the profit in the cash market was 25% whereas futures profit was a whopping 144%. Hence, higher returns due to high leverage is the second biggest advantage of futures.

- Hedging of Risk: Futures is not only for speculators or arbitrageurs. Futures are actively used by hedgers to hedge their spot market positions. Suppose an investor holds 250 shares of Reliance Industries in the spot market. However he is worried that the stock might fall in the short-term. To hedge against this, he can sell futures contract on Reliance to hedge this spot market position.

- Short-Selling Opportunities: When you short-sell in the spot market, you have to cover your position within the same trading day. Due to this, investors are forced to square-off even if they are facing a loss. However, this is not the case with futures. In futures, you do not have to square-off your position in the same day. You can hold your futures contract till expiry. So, investors have ample time to cover their short selling positions.

Easy & quick

Easy & quick

Leave A Comment?