There are 25 stocks in Dolly Khanna’s portfolio where she holds more than 1% stake in the company. She recently added six new stocks to her portfolio. The newest entrants in Dolly Khanna’s portfolio include Goa Carbons Ltd, Nahar Spinning Mills Ltd, and Sharda Cropchem Ltd etc. Dolly Khanna’s portfolio also includes the lesser-known Pondy Oxides & Chemicals Ltd. Dolly Khanna holds 3.6% stake in the company valued at Rs 18.30 crore. This stock in Dolly Khanna’s portfolio has rallied by a whopping 49% in the last three months (January to March 2022).

Another stock in Dolly Khanna’s portfolio is Rama Phosphates Ltd. Dolly Khanna held 1.8% stake in the company in June 2021. This increased to 2.6% in March 2022. Since its entry in Dolly Khanna’s portfolio, this fertilizer stock is up by 132% (June 01, 2021 to April 18 2022). The list of such stellar stocks is long. In fact, almost every stock that Dolly Khanna touches turns to gold.

So, which other stocks are a part of Dolly Khanna’s portfolio? We will look at the top seven stocks in Dolly Khanna’s portfolio shortly. We will also take a look at the stocks that Dolly Khanna bought and sold in March 2022 quarter. Additionally, we will understand the strategy that goes behind creating Dolly Khanna’s portfolio. But before that, let us begin with a brief background of Dolly and Rajiv Khanna.

Dolly and Rajiv Khanna might be two of the most underrated investors of our generation. You will rarely see them on TV shows or selling books or tickets to their seminars. These two millionaires do not own flashy jets or sea-facing bungalows. They do not claim to be stock market gurus. In fact, Dolly and Rajiv Khanna might just be the most humble millionaire couple you have come across. In terms of Networth, they are way behind the likes of Rakesh Jhunjhunwala, Vijay Kedia, and Mohnish Pabrai etc. They do not have any formal training in stock markets. But what they do have is patience and a knack for good stock picking.

Dolly Khanna’s portfolio is managed by her husband, Rajiv Khanna. He is a chemical engineer by profession and a graduate from IIT-Madras. In 1986, he started his own frozen yogurt company called Kwality Milk Foods. They later sold their business to FMCG giant Hindustan Unilever Ltd. Rajiv Khanna had no clue regarding what to do with the sale proceeds. So, he did what a majority of Indian investors would do; he invested his entire corpus in bank fixed deposits. And that would have been the end of his story. After all, millions of investors invest in bank fixed deposits and remain anonymous. So, why would the world bother about Dolly Khanna and her portfolio?

But as Rajiv Khanna says, the biggest catalyst in his wealth creation is luck. So as luck would have it, Rajiv and Dolly Khanna went house hunting in the early 1990s. They were impressed with the sales office of Unitech Builders. So, instead of buying an apartment, Rajiv Khanna invested in the stock of Unitech Ltd. He invested nearly 7 Lakhs in the stock and then forgot about it. Cut to early 2000s and his investment of Rs 7 Lakh had turned into Rs 25 crore. This taught in the most important lesson when creating wealth – Patience is an investors’ biggest ally.

Another key standard out lesson from Dolly Khanna’s portfolio is to look around. Yes, the greatest of investment ideas are the ones that are found around you. Dolly Khanna invested in stocks of Fem, a cosmetics company. The reason was simple – her daughter and female friends raved about how good Fem products were. Similarly, her neighbor’s son worked for Satyam Computers (now Tech Mahindra). So, she decided to look around, found the company’s fundamentals promising and invested in the stock.

There are 25 stocks in Dolly Khanna’s portfolio where she holds more than 1% stake in the company. She recently added six new stocks to her portfolio. The newest entrants in Dolly Khanna’s portfolio include Goa Carbons Ltd, Nahar Spinning Mills Ltd, and Sharda Cropchem Ltd etc. Dolly Khanna’s portfolio also includes the lesser-known Pondy Oxides & Chemicals Ltd. Dolly Khanna holds 3.6% stake in the company valued at Rs 18.30 crore. This stock in Dolly Khanna’s portfolio has rallied by a whopping 49% in the last three months (January to March 2022).

Another stock in Dolly Khanna’s portfolio is Rama Phosphates Ltd. Dolly Khanna held 1.8% stake in the company in June 2021. This increased to 2.6% in March 2022. Since its entry in Dolly Khanna’s portfolio, this fertilizer stock is up by 132% (June 01, 2021 to April 18 2022). The list of such stellar stocks is long. In fact, almost every stock that Dolly Khanna touches turns to gold.

So, which other stocks are a part of Dolly Khanna’s portfolio? We will look at the top seven stocks in Dolly Khanna’s portfolio shortly. We will also take a look at the stocks that Dolly Khanna bought and sold in March 2022 quarter. Additionally, we will understand the strategy that goes behind creating Dolly Khanna’s portfolio. But before that, let us begin with a brief background of Dolly and Rajiv Khanna.

Dolly and Rajiv Khanna might be two of the most underrated investors of our generation. You will rarely see them on TV shows or selling books or tickets to their seminars. These two millionaires do not own flashy jets or sea-facing bungalows. They do not claim to be stock market gurus. In fact, Dolly and Rajiv Khanna might just be the most humble millionaire couple you have come across. In terms of Networth, they are way behind the likes of Rakesh Jhunjhunwala, Vijay Kedia, and Mohnish Pabrai etc. They do not have any formal training in stock markets. But what they do have is patience and a knack for good stock picking.

Dolly Khanna’s portfolio is managed by her husband, Rajiv Khanna. He is a chemical engineer by profession and a graduate from IIT-Madras. In 1986, he started his own frozen yogurt company called Kwality Milk Foods. They later sold their business to FMCG giant Hindustan Unilever Ltd. Rajiv Khanna had no clue regarding what to do with the sale proceeds. So, he did what a majority of Indian investors would do; he invested his entire corpus in bank fixed deposits. And that would have been the end of his story. After all, millions of investors invest in bank fixed deposits and remain anonymous. So, why would the world bother about Dolly Khanna and her portfolio?

But as Rajiv Khanna says, the biggest catalyst in his wealth creation is luck. So as luck would have it, Rajiv and Dolly Khanna went house hunting in the early 1990s. They were impressed with the sales office of Unitech Builders. So, instead of buying an apartment, Rajiv Khanna invested in the stock of Unitech Ltd. He invested nearly 7 Lakhs in the stock and then forgot about it. Cut to early 2000s and his investment of Rs 7 Lakh had turned into Rs 25 crore. This taught in the most important lesson when creating wealth – Patience is an investors’ biggest ally.

Another key standard out lesson from Dolly Khanna’s portfolio is to look around. Yes, the greatest of investment ideas are the ones that are found around you. Dolly Khanna invested in stocks of Fem, a cosmetics company. The reason was simple – her daughter and female friends raved about how good Fem products were. Similarly, her neighbor’s son worked for Satyam Computers (now Tech Mahindra). So, she decided to look around, found the company’s fundamentals promising and invested in the stock.

In this article:

Dolly Khanna’s Portfolio as of March 31, 2022 Top 7 Stocks in Dolly Khanna’s Portfolio 1. Polyplex Corporation Ltd 2. Sharda Cropchem Ltd 3. Sandur Manganese & Iron Ores Ltd 4. Rain Industries Ltd 5. KCP Ltd 6. Butterfly Gandhimathi Appliances Ltd 7. Nitin Spinners Ltd Stocks that Dolly Khanna bought in January – March 2022 quarter Stocks that Dolly Khanna sold in January – March 2022 quarter So, the two most important things to learn from Dolly Khanna’s portfolio are:- Stay invested for the long-term.

- Invest in companies whose products you use in your daily life and whose business you understand. This is also known as investing as per your circle of competence.

Dolly Khanna’s Portfolio as of March 31, 2022

| Stocks in Dolly Khanna's Portfolio | Value of Holding (Rs crore ) | Quantity Held | % Holding |

| Polyplex Corporation Ltd. | 108.20 | 409,070 | 1.30% |

| Sharda Cropchem Ltd. | 86.50 | 1,243,710 | 1.40% |

| Sandur Manganese & Iron Ores Ltd. | 62.50 | 137,608 | 1.50% |

| Rain Industries Ltd. | 62.50 | 3,430,925 | 1.00% |

| KCP Ltd. | 58.30 | 4,771,855 | 3.70% |

| Butterfly Gandhimathi Appliances Ltd. | 45.40 | 320,292 | 1.80% |

| Nitin Spinners Ltd. | 25.70 | 993,016 | 1.80% |

| Mangalore Chemicals & Fertilizers Ltd. | 22.80 | 1,963,104 | 1.70% |

| Nahar Spinning Mills Ltd. | 22.10 | 381,973 | 1.00% |

| Rama Phosphates Ltd. | 22.00 | 452,987 | 2.60% |

| Pondy Oxides & Chemicals Ltd. | 18.30 | 211,461 | 3.60% |

| New Delhi Television Ltd. | 17.90 | 832,228 | 1.30% |

| RSWM Ltd. | 15.80 | 307,325 | 1.30% |

| Khaitan Chemicals & Fertilizers Ltd. | 14.70 | 989,591 | 1.00% |

| NCL Industries Ltd. | 13.80 | 722,917 | 1.60% |

| Prakash Pipes Ltd. | 10.30 | 572,323 | 2.40% |

| Control Print Ltd. | 8.00 | 173,207 | 1.10% |

| Talbros Automotive Components Ltd. | 7.10 | 139,873 | 1.10% |

| Goa Carbons Ltd. | 7.00 | 126,117 | 1.40% |

| Ajanta Soya Ltd. | 6.10 | 234,666 | 1.50% |

| Tinna Rubber and Infrastructure Ltd. | 4.40 | 137,057 | 1.60% |

| Deepak Spinners Ltd. | 2.90 | 101,781 | 1.40% |

| Aries Agro Ltd. | 2.90 | 174,058 | 1.30% |

| Indo Tech Transformers Ltd. | 2.70 | 122,284 | 1.20% |

| Simran Farms Ltd. | 1.40 | 77,135 | 2.00% |

Top 7 Stocks in Dolly Khanna’s Portfolio

- Polyplex Corporation Ltd is the biggest stock in Dolly Khanna’s portfolio. She holds 4.09 Lakh shares of the company valued at Rs 108.20 crore (as of March 31, 2022). She has increased her stake in the company from 1% in December 2021 to 1.30% in March 2022. The company is the seventh largest producer of plastic film substrates like thin polyester (PET), CPP used in flexible packaging industry. Its revenue jumped from Rs 4,487 crore in March 2020 to Rs 4,918 crore in March 2021. There was also a gigantic jump in their net profit. Their net profit jumped from Rs 282 crore in March 2020 to Rs 512 crore in March 2021.

| Market Cap (Cr): Rs 8,161 | Face Value (₹): 10 | EPS (₹): 161.92 |

| Book Value (₹): 998 | ROCE (%): 26.5 | Debt to Equity: 0.27 |

| Stock P/E: 16.0 | ROE (%): 16.8 | Dividend Yield (%): 6.28 |

| Revenue (Cr): 6,033 | Earnings (Cr): 1,144 | Cash (Cr): 945 |

| Total Debt (Cr): 828 | Promoter’s Holdings (%): 50.97 |

- The next stock in Dolly Khanna’s portfolio is Sharda Cropchem Ltd. Its core business is of exporting agrochemicals. It also produces products such as conveyor belts, rubber belts, dyes and dyes intermediates. Its revenue saw a decent jump of 19.62% in March 2020 and March 2021. There was a huge spike in its net profit as well. Its net profit rose from Rs 185 crore in March 2020 to Rs 229 crore in 2021.

| Market Cap (Cr): Rs 6,255 | Face Value (₹): 10 | EPS (₹): 33.94 |

| Book Value (₹): 184 | ROCE (%): 23.2 | Debt to Equity: 0.02 |

| Stock P/E: 20.40 | ROE (%): 16.8 | Dividend Yield (%): 0.75 |

| Revenue (Cr): 3,233 | Earnings (Cr): 596 | Cash (Cr): 229 |

| Total Debt (Cr): 34 | Promoter’s Holdings (%): 74.82 |

- Sandur Manganese & Iron Ores Ltd. is the newest entrant in Dolly Khanna’s portfolio. She bought 1.37 Lakh shares of the company valued at Rs 62.50 crore. It is involved in the mining of low phosphorous manganese, and iron ore in Karnataka. The company has generated revenue of Rs 747 crore in March 2021. This was a jump of 26% from its revenue of Rs 592 crore in March 2020.

| Market Cap (Cr): Rs 4,046 | Face Value (₹): 10 | EPS (₹): 138.92 |

| Book Value (₹): 746 | ROCE (%): 37.5 | Debt to Equity: 0.00 |

| Stock P/E: 7.93 | ROE (%): 23.8 | Dividend Yield (%): 0.56 |

| Revenue (Cr): 608 | Earnings (Cr): 189 | Cash (Cr): 69 |

| Total Debt (Cr): 340 | Promoter’s Holdings (%): 73.24 |

- Rain Industries Ltd. is also a prominent stock in Dolly Khanna’s portfolio. She owns shares worth Rs 62.2 crore (as of April 22, 2022). It is a leading integrated producer of carbon, cement, and advanced materials products. Its revenue grew by a whopping 38.81% from Rs 10,465 crore in March 2020 to Rs 14,527 crore in March 2021. Its net profit also jumped by 42.71% to reach Rs 558 crore in March 2021.

| Market Cap (Cr): Rs 6,081 | Face Value (₹): 2 | EPS (₹): 17.20 |

| Book Value (₹): 182 | ROCE (%): 11.9 | Debt to Equity: 1.40 |

| Stock P/E: 10.8 | ROE (%): 9.69 | Dividend Yield (%): 0.55 |

| Revenue (Cr): 13,141 | Earnings (Cr): 2,253 | Cash (Cr): 1,384 |

| Total Debt (Cr): 8,489 | Promoter’s Holdings (%): 41.14 |

- KCP Ltd. is the fifth largest stock holding in Dolly Khanna’s portfolio. It is in the business of manufacturing cement, sugar, heavy engineering, and power generation. Their revenue numbers jumped by nearly 21% between March 2020 and 2021. Their profit jumped 503% from Rs 27 crore in March 2020 to Rs 163 crore in March 2021.

| Market Cap (Cr): Rs 1,577 | Face Value (₹): 1 | EPS (₹): 17.40 |

| Book Value (₹): 86.1 | ROCE (%): 21.6 | Debt to Equity: 0.35 |

| Stock P/E: 7.03 | ROE (%): 17.8 | Dividend Yield (%): 1.64 |

| Revenue (Cr): 2,117 | Earnings (Cr): 441 | Cash (Cr): 488 |

| Total Debt (Cr): 388 | Promoter’s Holdings (%): 43.78 |

- The next stock in Dolly Khanna’s portfolio is Butterfly Gandhimathi Appliances Ltd. The company manufactures LPG stoves, Aluminium and stainless steel pressure cookers, mixer grinders etc. It is one of the largest kitchen appliances companies in India. The company has posted good growth numbers in the last one year. Its revenue has jumped from Rs 676 crore to Rs 862 crore. Even its net profit has skyrocketed from Rs 4 crore in March 2020 to Rs 36 crore in March 2022.

| Market Cap (Cr): Rs 2,525 | Face Value (₹): 10 | EPS (₹): 24.81 |

| Book Value (₹): 140 | ROCE (%): 21.4 | Debt to Equity: 0.11 |

| Stock P/E: 56.90 | ROE (%): 17.4 | Dividend Yield (%): 0.21 |

| Revenue (Cr): 0 | Earnings (Cr): 89 | Cash (Cr): 72 |

| Total Debt (Cr): 26 | Promoter’s Holdings (%): 64.78 |

- The next big stock in Dolly Khanna’s portfolio is Nitin Spinners Ltd. It is engaged in the business of cotton and yarn fabrics. The company’s revenue has jumped 12.95% to Rs 1,622 crore in March 2021. Its net profit also grew from Rs 24 crore in March 2020 to Rs 69 crore in March 2021.

| Market Cap (Cr): Rs 1,386 | Face Value (₹): 10 | EPS (₹): 50.42 |

| Book Value (₹): 125 | ROCE (%): 11 | Debt to Equity: 1.14 |

| Stock P/E: 4.87 | ROE (%): 13 | Dividend Yield (%): 0.58 |

| Revenue (Cr): 0 | Earnings (Cr): 588 | Cash (Cr): 16 |

| Total Debt (Cr): 734 | Promoter’s Holdings (%): 56.1 |

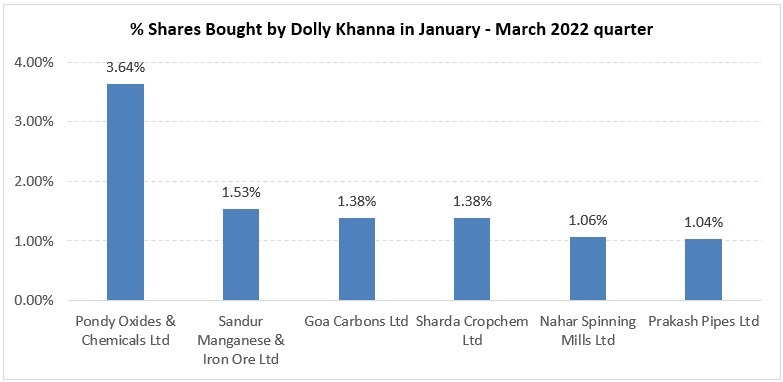

Stocks that Dolly Khanna bought in January – March 2022 quarter

Dolly Khanna added the following six shares in her portfolio in the January to March 2022 quarter.

Dolly Khanna added the following six shares in her portfolio in the January to March 2022 quarter.

- Pondy Oxides & Chemicals Ltd.

- Sharda Cropchem Ltd.

- Sandur Manganese & Iron Ore Ltd.

- Goa Carbons Ltd.

- Nahar Spinning Mills Ltd.

- Prakash Pipes Ltd.

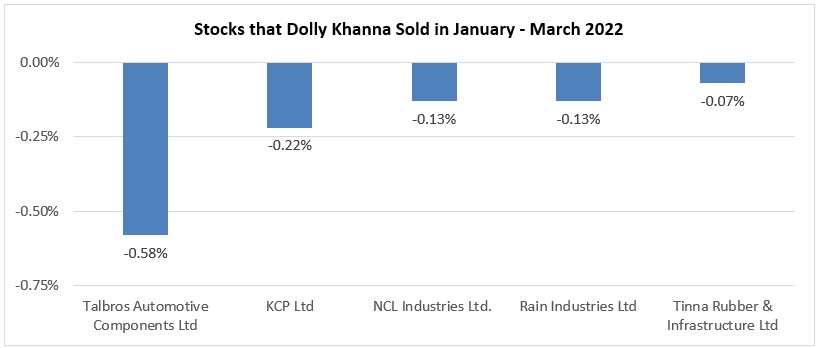

Stocks that Dolly Khanna sold in January – March 2022 quarter

Know which of the stocks in Dolly Khanna’s portfolio are worth investing using Samco Stock Rating. Open a FREE Samco Demat account today and start creating wealth like Dolly Khanna!

Know which of the stocks in Dolly Khanna’s portfolio are worth investing using Samco Stock Rating. Open a FREE Samco Demat account today and start creating wealth like Dolly Khanna!

Easy & quick

Easy & quick

Leave A Comment?