Sunil Singhania’s portfolio is the talk of the town thanks to the outperformance of Abakkus Asset Managers. Launched in September 2018, Abakkus is already creating a name for itself in the stock market. The networth of Sunil Singhania’s portfolio has skyrocketed to Rs 1,829.78 crore in May 2022. This is an absolute growth of nearly 8,105%! It is this type of growth that has created a lot of buzz around Sunil Singhania’s portfolio. Investors are curious to know which stocks Sunil Singhania is investing in. What does Sunil Singhania’s portfolio look like? Which stocks has Sunil Singhania bought and sold in March 2022?

The idea is simple. Investors want to copy Sunil Singhania’s portfolio and reap the benefit of expert stock selection without paying the management fees. You see, there are two types of investors in the stock market – The fundamentalists and the shortcut-loving investors. The fundamentalists spend hours studying the fundamentals of a company. On the other hand, the shortcut-loving investors simply copy the portfolio of market legends. So, instead of spending hours studying balance sheets, they wait. For what? For quarterly declarations by big investors like Rakesh Jhunjhunwala and Vijay Kedia. And a new name is now added to this list – Sunil Singhania’s portfolio.

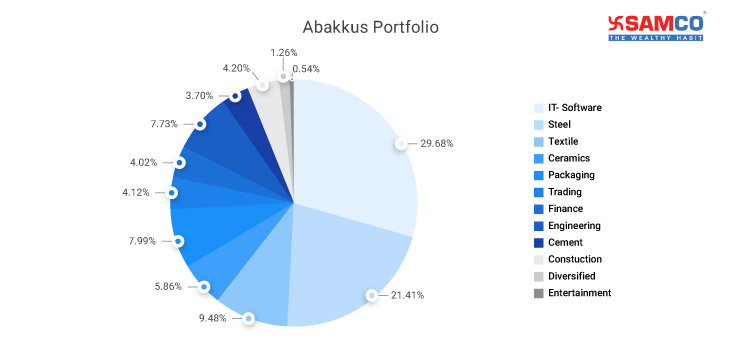

Abakkus Asset Managers is one of the most successful asset managers in India. So, it’s natural to assume that the portfolio of Abakkus might hold key to long-term wealth creation. The largest holding in Sunil Singhania’s portfolio is Rupa & Company Ltd. They first purchased the stock in December 2020. Since then, the share price of Rupa & Company Ltd has rallied by a whopping 120.33%! Subsequently, Sunil Singhania increased his stake in the company to 3.20% in March 2022. In this period, the stock of Rupa & Company Ltd rallied by 20.10%.

With such exceptional returns, I’m sure you want to know what other stocks make up Sunil Singhania’s portfolio. And we will discuss exactly this today. We will take a look at the stocks bought and sold by Sunil Singhania in the March 2022 quarter.

Sunil Singhania’s portfolio is the talk of the town thanks to the outperformance of Abakkus Asset Managers. Launched in September 2018, Abakkus is already creating a name for itself in the stock market. The networth of Sunil Singhania’s portfolio has skyrocketed to Rs 1,829.78 crore in May 2022. This is an absolute growth of nearly 8,105%! It is this type of growth that has created a lot of buzz around Sunil Singhania’s portfolio. Investors are curious to know which stocks Sunil Singhania is investing in. What does Sunil Singhania’s portfolio look like? Which stocks has Sunil Singhania bought and sold in March 2022?

The idea is simple. Investors want to copy Sunil Singhania’s portfolio and reap the benefit of expert stock selection without paying the management fees. You see, there are two types of investors in the stock market – The fundamentalists and the shortcut-loving investors. The fundamentalists spend hours studying the fundamentals of a company. On the other hand, the shortcut-loving investors simply copy the portfolio of market legends. So, instead of spending hours studying balance sheets, they wait. For what? For quarterly declarations by big investors like Rakesh Jhunjhunwala and Vijay Kedia. And a new name is now added to this list – Sunil Singhania’s portfolio.

Abakkus Asset Managers is one of the most successful asset managers in India. So, it’s natural to assume that the portfolio of Abakkus might hold key to long-term wealth creation. The largest holding in Sunil Singhania’s portfolio is Rupa & Company Ltd. They first purchased the stock in December 2020. Since then, the share price of Rupa & Company Ltd has rallied by a whopping 120.33%! Subsequently, Sunil Singhania increased his stake in the company to 3.20% in March 2022. In this period, the stock of Rupa & Company Ltd rallied by 20.10%.

With such exceptional returns, I’m sure you want to know what other stocks make up Sunil Singhania’s portfolio. And we will discuss exactly this today. We will take a look at the stocks bought and sold by Sunil Singhania in the March 2022 quarter.

Who is Sunil Singhania?

Sunil Singhania is a veteran of the stock market. He was the global head of equities with Reliance Capital. He managed assets worth Rs 4 lakh crore. He also played a key role in helping Reliance Mutual Fund become one of the largest asset management companies (AMCs) in India. He was the fund manager of Reliance Growth Fund which grew at 100x since its inception in 1995. A Chartered Financial Analyst (CFA), Sunil Singhania is the first Indian on the CFA Global Board of Governors.What is Abakkus Asset Managers?

Abakkus Asset Managers is a boutique asset management or wealth management firm. It manages assets worth nearly Rs 8,000 crore. The term Abakkus is a play of words on Abacus, which is a beaded device used to learn the basics of mathematics. Their ideology is to follow the basics of investing and uncomplicate investment decisions. This belief is even reflected in their tagline, ‘believe in basics’. Abakkus offers the following services to its investors -- Alternative Investment Funds (AIFs) which includes Abakkus Growth Fund – 1 and Abakkus Emerging Opportunities Fund – 1. Abakkus Growth Fund is a close-ended fund which invests in 30-40 companies. The portfolio follows both bottom-up and top-down approach to investing and focuses on sustainable businesses with high Return on Equity. Abakkus Emerging Opportunities Fund is a mid and small-cap bias fund investing in a portfolio of 30-40 companies following a bottom-up approach.

- Portfolio Management Services (PMS) – Abakkus has two products in the PMS segment – Abakkus All Cap Approach and Abakkus Emerging Opportunities Fund.

- Institutional Offerings.

- Abakkus Smart, a Registered Investment Advisor (RIA) in the retail segment.

Philosophy behind Abakkus Portfolio

Sunil Singhania’s portfolio is based on the MEETS framework. The term MEETS stands for Management, Earnings, Events or Trends, Timing and Structure. Let us understand the MEET framework in detail –- Management – The first preference is given to stocks with quality management and a long-term track record. The company studies the capex expenditure and its impact on ROE.

- Earnings – In the next step, Abakkus studies the projected vs actual, and cyclical vs structural earnings. They look for companies that can double profits in four years. Or, where EV/EBITDA (Enterprise value / earnings before interest, depreciation and tax) can halve in four years.

- Events – Abakkus studies the movement of a stock due to market events, reaction to disruptive or new themes in the market.

- Timings – Abakkus looks for bargains in the market. So, they focus on companies which are trading below their intrinsic value.

- Structure – Abakkus only invests in companies with economic moats, and consistent growth in profits.

Let us now look at the portfolio of Sunil Singhania as of March 31, 2022

Let us now look at the portfolio of Sunil Singhania as of March 31, 2022

Sunil Singhania’s Portfolio – March 2022 Quarter

| STOCK | HOLDING VALUE (RS.) | QTY HELD | MAR 2022 CHANGE % | MAR 2022 HOLDING % | DEC 2021 % | SEP 2021 % | JUN 2021 % | MAR 2021 % | DEC 2020 % | SEP 2020 % | JUN 2020 % | MAR 2020 % |

| Mastek Ltd. | 300.8 | 1,258,015 | 0.00% | 4.20% | 4.20% | 4.80% | 5.70% | 5.70% | 5.80% | 5.90% | 5.70% | 5.60% |

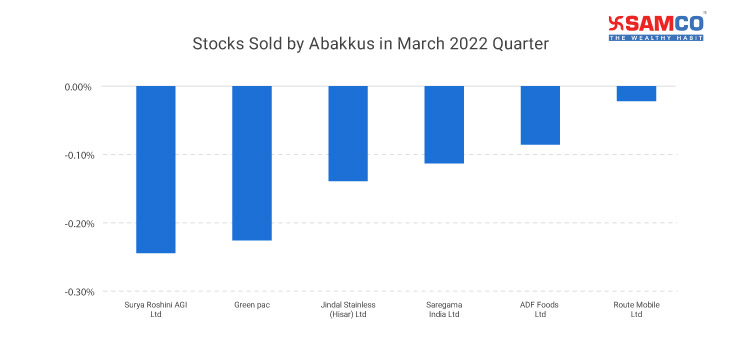

| Route Mobile Ltd. | 260.5 | 1,763,445 | 0.00% | 2.80% | 2.80% | 3.30% | 3.40% | 3.40% | 3.50% | 3.50% | - | - |

| Jindal Stainless (Hisar) Ltd. | 258.2 | 8,997,773 | -0.10% | 3.80% | 4.00% | 3.90% | 4.00% | 3.90% | 3.70% | 3.30% | 2.10% | 2.10% |

| Rupa & Company Ltd. | 128 | 2,535,000 | 1.10% | 3.20% | 2.00% | 2.00% | 2.00% | 1.50% | 1.50% | - | - | - |

| Acrysil Ltd. | 110.9 | 1,643,050 | 0.00% | 6.20% | 6.10% | 6.20% | 6.50% | 6.50% | 6.50% | - | - | - |

| Polyplex Corporation Ltd. | 106.1 | 430,183 | 0.00% | 1.40% | 1.40% | 1.50% | 1.60% | 1.70% | 1.60% | 1.40% | 1.40% | 1.10% |

| Somany Home Innovation Ltd. | 77.9 | 2,639,583 | 0.00% | 3.70% | 3.70% | 3.60% | 3.50% | 3.50% | 3.30% | 2.80% | 2.80% | 2.80% |

| IIFL Securities Ltd. | 76.1 | 9,598,900 | 0.10% | 3.20% | 3.10% | 3.10% | 3.70% | 3.60% | 3.40% | 3.20% | 3.10% | 3.10% |

| Ion Exchange (India) Ltd. | 71 | 414,000 | 0.00% | 2.80% | 2.80% | 2.70% | 2.60% | 2.60% | 2.30% | 1.70% | - | - |

| HIL Ltd. | 69.9 | 204,721 | 0.10% | 2.70% | 2.60% | 2.60% | 2.50% | 2.50% | 2.30% | 1.80% | 1.70% | - |

| Technocraft Industries (India) Ltd. | 62.2 | 659,557 | 0.10% | 2.70% | 2.60% | 2.60% | 2.50% | 2.40% | 2.40% | - | - | - |

| Sarda Energy & Minerals Ltd. | 60.1 | 605,300 | 0.10% | 1.70% | 1.60% | 1.20% | 1.00% | 1.00% | - | - | - | - |

| HG Infra Engineering Ltd. | 53 | 973,187 | 0.00% | 1.50% | 1.50% | 1.50% | 1.50% | 1.50% | 1.00% | - | - | - |

| Siyaram Silk Mills Ltd. | 51.3 | 913,044 | 0.00% | 2.00% | 1.90% | 1.90% | 1.90% | 1.60% | 1.30% | 1.20% | 1.20% | 1.20% |

| The Anup Engineering Ltd. | 46.4 | 565,000 | 0.10% | 5.70% | 5.60% | 5.80% | 5.80% | 5.90% | 5.60% | 5.50% | 4.90% | 4.80% |

| AGI Greenpac Ltd. | 29.3 | 1,206,364 | -0.20% | 1.90% | 2.10% | 2.70% | 2.70% | 2.70% | 3.00% | 2.70% | 2.70% | 2.70% |

| Dynamatic Technologies Ltd. | 28.8 | 157,273 | 0.40% | 2.50% | 2.10% | 2.00% | - | - | - | - | - | - |

| PSP Projects Ltd. | 26.4 | 545,000 | 0.00% | 1.50% | 1.50% | 1.50% | - | - | - | - | - | - |

| Surya Roshni Ltd. | 24.5 | 651,414 | -0.20% | 1.20% | 1.40% | 1.40% | 1.40% | 1.40% | - | - | - | - |

| DCM Shriram Industries Ltd. | 23.8 | 2,590,000 | 0.00% | 3.00% | 3.00% | 3.00% | 3.00% | - | - | - | - | - |

| Rajshree Polypack Ltd. | 15.8 | 877,418 | 0.10% | 7.80% | 7.70% | 8.20% | - | 8.80% | - | 8.80% | - | 8.70% |

| Saregama India Ltd. | 10.3 | 259,880 | -0.10% | 1.40% | 1.50% | 1.60% | 1.70% | 1.70% | 1.40% | - | - | - |

Let us look at the five stocks where Sunil Singhania has increased his stake in the quarter ending March 2022.

Let us look at the five stocks where Sunil Singhania has increased his stake in the quarter ending March 2022.

- Rupa & Company Ltd is a textile company which manufactures knitted apparels, inner wear, casual and fashion wear. Sunil Singhania has increased his stake in the company from 2% to 3.20% in March 2022 quarter. Its most popular brands include Frontline, Euro Fashion Inners, Softline, and Thermocot etc. The company has a production capacity of 7 Lakh apparels per day. With a market capitalisation of Rs 4,268 crore, making it the third-biggest textile company in India.

The company has had a good financial year 2021. Its revenue jumped 34% to Rs 1,261 crore in March 2021. Its profit after tax (PAT) skyrocketed 126.25% in 2020-21 to Rs 181 crore. There is more good news for investors. The company’s earnings per share also jumped from Rs 10.08 in 2019-20 to Rs 22.04 in 2020-21. It also delivered a return on equity of 30.50% and a return on capital employed of 25.60%.

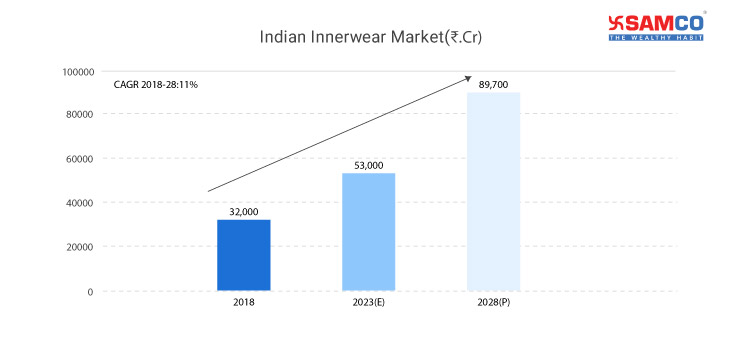

Rupa & Company Ltd. is committed to growing internationally. It is expanding its product line to new markets like UAE, USA, Singapore and Russia etc. Being the third biggest player in the textile industry, it is perfectly poised to capitalize on the 28.11% projected growth in the Indian innerwear segment.

The company has had a good financial year 2021. Its revenue jumped 34% to Rs 1,261 crore in March 2021. Its profit after tax (PAT) skyrocketed 126.25% in 2020-21 to Rs 181 crore. There is more good news for investors. The company’s earnings per share also jumped from Rs 10.08 in 2019-20 to Rs 22.04 in 2020-21. It also delivered a return on equity of 30.50% and a return on capital employed of 25.60%.

Rupa & Company Ltd. is committed to growing internationally. It is expanding its product line to new markets like UAE, USA, Singapore and Russia etc. Being the third biggest player in the textile industry, it is perfectly poised to capitalize on the 28.11% projected growth in the Indian innerwear segment.

Key Financial Ratios of Rupa & Company Ltd as on May 17, 2022

Key Financial Ratios of Rupa & Company Ltd as on May 17, 2022

| Market Cap (Cr): Rs 4,278 | Face Value (₹): 1 | EPS (₹): 26.20 |

| Book Value (₹): 104 | ROCE (%): 30.50 | Debt to Equity: 0.35 |

| Stock P/E: 20.50 | ROE (%): 25.60 | Dividend Yield (%): 0.59 |

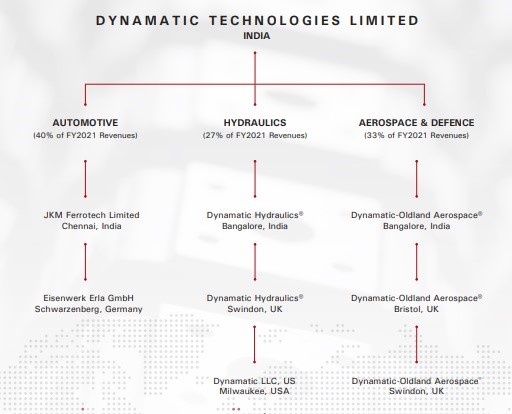

- Dynamatic Technologies Ltd. is the next stock where Sunil Singhania has increased his stake in the March 2022 quarter. It is one of the largest manufacturers of hydraulic gear pumps and automotive turbochargers. It also manufactures agricultural tractors, mining equipment, and aerospace and defense equipment. The company also has international presence in Europe, UK, USA, and Canada.

The company has suffered during the lockdown as its total revenues have fallen by 9.10% between March 2020 and 2021. However, its aerospace division did witness a growth of 6% y-o-y basis. 2021 was a bad year for the company as it incurred a loss of Rs 21 crore, after nearly seven profitable years.

Key Financial Ratios of Dynamatic Technologies Ltd as on May 17, 2022

The company has suffered during the lockdown as its total revenues have fallen by 9.10% between March 2020 and 2021. However, its aerospace division did witness a growth of 6% y-o-y basis. 2021 was a bad year for the company as it incurred a loss of Rs 21 crore, after nearly seven profitable years.

Key Financial Ratios of Dynamatic Technologies Ltd as on May 17, 2022

| Market Cap (Cr): Rs 1,252 | Face Value (₹): 10 | EPS (₹): -11.50 |

| Book Value (₹): 572 | ROCE (%): 5.01 | Debt to Equity: 1.90 |

| Stock P/E: - | ROE (%): -5.90 | Dividend Yield (%): 0 |

- The third stock where Sunil Singhania has increased his stake in March 2022 quarter is IIFL Securities Ltd. IIFL is a market leader in retail and institutional equities, financial product distribution, investment banking, and financial planning. There is a 42% growth in company’s revenue to Rs 1,060 crore in March 2022. Consequently, its net profit jumped from Rs 173 crore in March 2021 to Rs 284 crore in March 2022.

| Market Cap (Cr): Rs 2,424 | Face Value (₹): 2 | EPS (₹): 9.35 |

| Book Value (₹): 31.20 | ROCE (%): 36.90 | Debt to Equity: 0.35 |

| Stock P/E: 8.47 | ROE (%): 33.30 | Dividend Yield (%): 3.88 |

- HIL Ltd. is one of the leading companies in the building and construction industry. It manufactures asbestos FC sheets, colored steel sheets, Aerocon panels and boards etc. The company had a good financial year as its revenue grew to Rs 1,973 crore in March 2022. This was an increase of 26%. However, its net profit declined by 1.06% to Rs 186 crore in March 2022.

Key Financial Ratios of HIL Ltd. as on May 17, 2022

Key Financial Ratios of HIL Ltd. as on May 17, 2022

| Market Cap (Cr): Rs 2,591 | Face Value (₹): 10 | EPS (₹): 247 |

| Book Value (₹): 1,552 | ROCE (%): 23.80 | Debt to Equity: 0.07 |

| Stock P/E: 13.90 | ROE (%): 19.50 | Dividend Yield (%): 1.16 |

- And finally the fifth company where Sunil Singhania has increased his holding in March 2022 quarter is Technocraft Industries (India) Ltd. It has five main businesses – Drum closures, scaffolding systems, cotton yarn, fabric, garments and engineering services. The company’s revenue declined 4.75% to Rs 1,294.54 crore in March 2021. Despite this the net profit jumped by 19% to Rs 146.83 crore in March 2021.

Key Financial Ratios of Technocraft Industries (India) Ltd. as on May 17, 2022

Key Financial Ratios of Technocraft Industries (India) Ltd. as on May 17, 2022

| Market Cap (Cr): Rs 2,322 | Face Value (₹): 10 | EPS (₹): 95.45 |

| Book Value (₹): 493 | ROCE (%): 12.10 | Debt to Equity: 0.36 |

| Stock P/E: 10.20 | ROE (%): 12.30 | Dividend Yield (%): 0 |

This completes our discussion on Sunil Singhania’s portfolio. Now there are a lot of mid and small cap stocks in Sunil Singhania’s portfolio, which makes it extremely risky. So, instead of blindly following what Sunil Singhania buys and sells, maybe you should do your own research. Sounds time consuming? Or boring? Well, we have just the solution for you…presenting Samco Stock Rating. This proprietary system gives you pros and cons of nearly 3,000 stocks listed in the market. Check out Samco Stock Rating system here.

This completes our discussion on Sunil Singhania’s portfolio. Now there are a lot of mid and small cap stocks in Sunil Singhania’s portfolio, which makes it extremely risky. So, instead of blindly following what Sunil Singhania buys and sells, maybe you should do your own research. Sounds time consuming? Or boring? Well, we have just the solution for you…presenting Samco Stock Rating. This proprietary system gives you pros and cons of nearly 3,000 stocks listed in the market. Check out Samco Stock Rating system here.

Leave A Comment?