Radhakishan Damani is one of the most successful investors in India. Hence, retail investors often track the portfolio of Radhakishan Damani to understand which shares he is buying and selling in a particular quarter. Investors do this because they believe that legendary investors like Radhakishan Damani have a proven track record of making crores from the market by picking solid stocks. As of March 2022, Radhakishan Damani’s portfolio is worth a whopping Rs. 1.42 lakh crore. There are 17 stocks in his portfolio out of which the biggest exposure is the 74.98% stake he owns in his retail business, Avenue Supermarts Ltd. Apart from this, his portfolio includes popular companies such as 3M India Ltd, United Breweries Ltd, VST Industries Ltd and a lot more.

In the quarter ending March 2022, he sold a 0.09% stake in Metropolis Healthcare Ltd. and a 0.32% stake in India Cements Ltd. In the same quarter, he also increased his stake in United Breweries Ltd. by 0.01% and VST Industries Ltd. by 0.08%.

I know by now you might be wondering which are the other stocks in Radhakishan Damani's portfolio?. We will take a look at it shortly, but before that let’s take a look at the background of Radhakishan Damani.

Radhakishan Damani is a self-made billionaire. He started his career as a small businessman. Eventually he started investing. In the initial years of investing, he spent a lot of time observing and speculating in the markets. He even dropped out of college to start his own stockbroking business. During those times, he used to invest a lot of his time in analysing undervalued stocks. These undervalued stocks soon saw a good bullish rally and eventually turned into multibaggers. These multi-baggers were HDFC bank, Gillette India, Century Textiles, India Cement, VST Industries, TV Today Network, Blue Dart, Sundaram Finance, 3M India and a lot more. He has holdings in a few of these companies even today. So, it is safe to say that he is one of the most successful value investors in India.

The one thing that we have learnt from Radhakishan Damani is that you must always focus and buy fundamentally strong stocks at cheaper valuations.

Radhakishan Damani is one of the most successful investors in India. Hence, retail investors often track the portfolio of Radhakishan Damani to understand which shares he is buying and selling in a particular quarter. Investors do this because they believe that legendary investors like Radhakishan Damani have a proven track record of making crores from the market by picking solid stocks. As of March 2022, Radhakishan Damani’s portfolio is worth a whopping Rs. 1.42 lakh crore. There are 17 stocks in his portfolio out of which the biggest exposure is the 74.98% stake he owns in his retail business, Avenue Supermarts Ltd. Apart from this, his portfolio includes popular companies such as 3M India Ltd, United Breweries Ltd, VST Industries Ltd and a lot more.

In the quarter ending March 2022, he sold a 0.09% stake in Metropolis Healthcare Ltd. and a 0.32% stake in India Cements Ltd. In the same quarter, he also increased his stake in United Breweries Ltd. by 0.01% and VST Industries Ltd. by 0.08%.

I know by now you might be wondering which are the other stocks in Radhakishan Damani's portfolio?. We will take a look at it shortly, but before that let’s take a look at the background of Radhakishan Damani.

Radhakishan Damani is a self-made billionaire. He started his career as a small businessman. Eventually he started investing. In the initial years of investing, he spent a lot of time observing and speculating in the markets. He even dropped out of college to start his own stockbroking business. During those times, he used to invest a lot of his time in analysing undervalued stocks. These undervalued stocks soon saw a good bullish rally and eventually turned into multibaggers. These multi-baggers were HDFC bank, Gillette India, Century Textiles, India Cement, VST Industries, TV Today Network, Blue Dart, Sundaram Finance, 3M India and a lot more. He has holdings in a few of these companies even today. So, it is safe to say that he is one of the most successful value investors in India.

The one thing that we have learnt from Radhakishan Damani is that you must always focus and buy fundamentally strong stocks at cheaper valuations.

Here is a video you must watch to learn how to find undervalued stocks

In 2001, after being on the top of his trading and wealth creation journey, he decided to focus on starting his own retail business called D’Mart. The first D’Mart store was opened in Powai, Mumbai in 2002. Today D’Mart has a well-established presence in 284 locations across India. Let us look at the stocks held by Mr Radhakishan Damani as of March 2022 quarter. In this article:

In this article:

- List of stocks from Radhakishan Damani’s portfolio

- Top stocks from Radhakishan Damani’s portfolio

- Stocks that Radhakishan Damani bought in January – March 2022 quarter

- Stocks that Radhakishan Damani sold in January – March 2022 quarter

List of stocks from Radhakishan Damani’s portfolio as of March 2022

| Company name | March 2021 | June 2021 | Sept 2021 | Dec 2021 | March 2021 | Total value of holdings (Rs. in crores) | |

| 1 | 3M India Ltd. | 1.48 % | 1.48 % | 2.96 % | 1.48 % | 1.48 % | Rs. 332.86 |

| 2 | Andhra Paper Ltd. | 1.26 % | 1.26 % | 1.26 % | 1.26 % | 1.26 % | Rs. 16.78 |

| 3 | Aptech Ltd. | 3.09 % | 3.08 % | 3.08 % | 3.04 % | 3.04 % | Rs. 45.69 |

| 4 | Astra Microwave Products Ltd. | 1.03 % | 1.03 % | 1.03 % | 1.03 % | 1.03 % | Rs. 22.56 |

| 5 | Avenue Supermarts Ltd. | 69.42 % | 74.98 % | 74.98 % | 74.98 % | 74.98 % | Rs. 1,91,572.80 |

| 6 | BF Utilities Ltd. | 1.30% | 1.30 % | 1.30 % | 1.28 % | 1.28 % | Rs. 18.48 |

| 7 | Blue Dart Express Ltd. | 1.96 % | 1.68 % | 1.47 % | 1.47 % | 1.40 % | Rs. 227.12 |

| 9 | Mangalam Organics Ltd. | 2.17 % | 2.17 % | 2.17 % | 2.17 % | 2.17 % | Rs. 15.90 |

| 10 | Metropolis Healthcare Ltd. | 1.74 % | 1.61 % | 1.39 % | 1.23 % | 1.14 % | Rs. 139.88 |

| 13 | Sundaram Finance Ltd. | 2.37 % | 2.37 % | 2.37 % | 2.37 % | Filing Due | Rs. 529.73 |

| 14 | The India Cements Ltd. | 21.14 % | 12.68 % | 21.14 % | 21.14 % | 20.82 % | Rs. 1,334.29 |

| 15 | Trent Ltd. | 1.52 % | 1.52 % | 1.52 % | 1.52 % | 1.52 % | Rs. 663.75 |

| 16 | United Breweries Ltd. | 1.21 % | 1.23 % | 1.23 % | 1.20 % | 1.21 % | Rs. 507.38 |

| 17 | VST Industries Ltd. | 30.16 % | 30.16 % | 32.26 % | 32.26 % | 32.34 % | Rs. 1,610.26 |

Top Stocks in Radhakishan Damani’s Portfolio

1. 3M India Ltd.

3M India Ltd. is a subsidiary of 3M Company, USA. Initially, it started its business as a mining company, but later it evolved into one of the world’s leading conglomerates with presence in more than 70 countries. As of March 2022, Radhakishan Damani holds 1.48% stake in the company. In September 2021, he had increased his stake to 2.96% but later reduced it back to 1.48%. Let’s take a look at the business segments of the company.- Manufacturing of safety and industrial goods

- Manufacturing of transportation and electronics

- Manufacturing of health care products

- Manufacturing of consumer care products

- The company generates 34.65% of its revenues from the safety and industrial business.

- 64% from the transportation & electronics segment.

- 64% from the health care segment.

- 12% from the consumer segment.

Let’s take a look at the key financial data of 3M India Ltd.

Let’s take a look at the key financial data of 3M India Ltd.

| Market Cap (Cr): Rs. 20,867 Cr. | Face Value: Rs. 10 | EPS: Rs. 201 |

| Book Value: Rs. 2,053 | Roce (%): 9.32 | Debt to Equity: 0.01 |

| Stock PE: 92.2 | ROE (%): 6.90 | Dividend Yield (%): 0 |

| Promoter’s Holdings (%): 75 | Total Debt (Cr): Rs. 29.4 |

2. Andhra Paper Ltd

Andhra Paper is engaged in the business of manufacturing and sale of paper. But they have added a unique element to their business by offering low-cost low carbon sustainable products to their customers. As of March 2022, Radhakishan Damani holds a 1.26% stake in the company. The company produces paper for various purposes such as writing, printing, and it also manufactures paper for a diverse range of applications such as photos, batteries, cups, charts, etc. If we look at the performance of the stock in the last one year, the stock has offered a return of a whopping 40% while the benchmark Index Nifty 50 has offered a return of 8% as on 13th May 2022. Let’s take a look at the key financial data of Andhra Paper Ltd.

Let’s take a look at the key financial data of Andhra Paper Ltd.

| Market Cap (Cr): Rs. 1,318 | Face Value: Rs. 10 | EPS: Rs. 35.1 |

| Book Value: Rs. 275 | Roce (%): 18 | Debt to Equity: 0.05 |

| Stock PE: 9.47 | ROE (%): 13.5 | Dividend Yield (%): 1.56 |

| Promoter’s Holdings (%): 72.2 | Total Debt (Cr): Rs. 58.6 |

3. Aptech Ltd.

The company is a pioneer in the non-formal education and training business in the country with a significant global presence. The company generates 73% revenue by providing individual training and 27% of revenue by offering corporate trading. In March 2021, Radhakishan Damani held a 3.09% stake in the company which eventually decreased to 3.04% by March 2022. If we look at the performance of the stock in the last one year, the stock has outperformed the benchmark index Nifty 50. It has offered a return of 28% while the benchmark Index Nifty 50 has offered a return of 8% as on 13th May 2022. Let’s take a look at the key financial data of Aptech Limited

Let’s take a look at the key financial data of Aptech Limited

| Market Cap (Cr): Rs. 1,200 | Face Value: Rs. 10 | EPS: Rs. 12 |

| Book Value: Rs. 50.8 | Roce (%): 23.2 | Debt to Equity: 0 |

| Stock PE: 24.3 | ROE (%): 26.3 | Dividend Yield (%): 1.67 |

| Promoter’s Holdings (%): 47.7 | Total Debt (Cr): Rs. 0.17 |

4. Astra Microwave Products Ltd.

The company focuses on designing, developing and manufacturing sub systems for radio and microwave systems used in defence space, meteorology and telecommunication. Radhakishan Damani holds a 1.03% stake in the company which amounts to Rs. 22.56 crores as of March 2022. If we look at the performance of the stock in the last one year, the stock has outperformed the index. It offered a return of 77% while the benchmark Index Nifty 50 has offered a return of 8% as on 13th May 2022. Let’s take a look at the key financial data of Astra Microwave Products.

Let’s take a look at the key financial data of Astra Microwave Products.

| Market Cap (Cr): Rs. 2,030 | Face Value: Rs. 2 | EPS: Rs. 6.23 |

| Book Value: Rs. 65.2 | Roce (%): 10 | Debt to Equity: 0.16 |

| Stock PE: 37.6 | ROE (%): 5.25 | Dividend Yield (%): 0.50 |

| Promoter’s Holdings (%): 8.71 | Total Debt (Cr): Rs. 91.3 Cr. |

5. Avenue Supermarts Ltd.

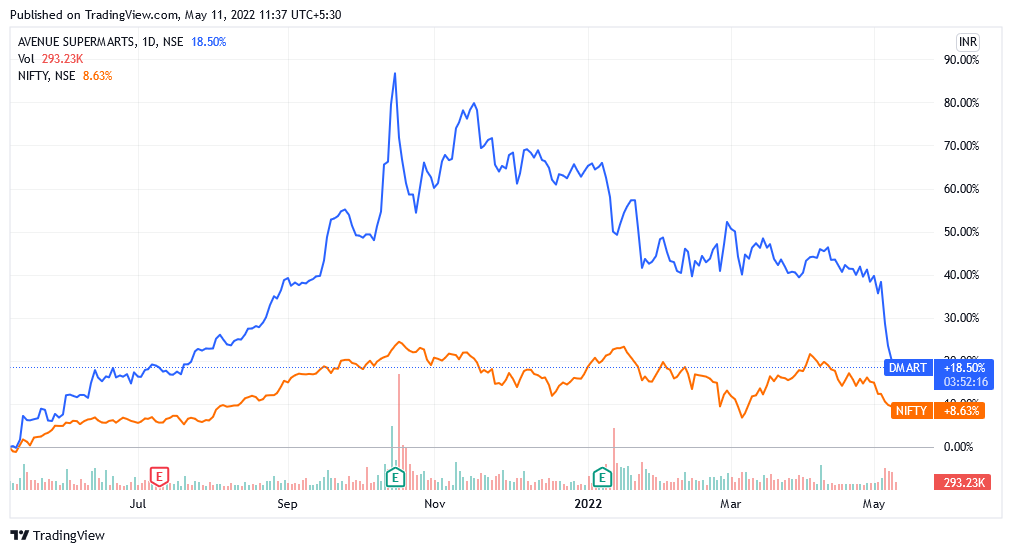

Avenue Supermarts Limited is an Indian company which owns and operates D’Mart stores. Radhakishan Damani owns 74.98% stake in the company. Avenue Supermarts operates in 234 stores across 11 states. They have 11.8 million square feet of retail business area across India. The company generates 52% revenue from the food segment and 20% from the apparel segment. If we look at the performance of the stock in the last one year, the stock has offered a return of 14% while the benchmark Index Nifty 50 has offered a return of 8% as on 13th May 2022. Let’s take a look at the key financial data of Avenue supermarts.

Let’s take a look at the key financial data of Avenue supermarts.

| Market Cap (Cr): Rs. 2,22,187 Cr. | Face Value: Rs. 10 | EPS: Rs. 22.8 |

| Book Value: Rs. 196 | Roce (%): 12.7 | Debt to Equity: 0.04 |

| Stock PE: 150 | ROE (%): 9.45 | Dividend Yield (%): 0 |

| Promoter’s Holdings (%): 75 | Total Debt (Cr): Rs. 510 |

6. BF Utilities Ltd.

The company focuses on generating power through wind mills. This power is then supplied to Bharat Forge Ltd. in Pune. It generates 95% revenue from its windmills and 4% from its subsidiary infrastructure business named Nandi Infrastructure Corridor Enterprises Limited. As of March 2022, Radhakishan Damani holds 1.28% stake in the company. If we look at the performance of the stock in the last one year, the stock has offered the same return of 8% as Nifty 50 as on 13th May 2022. Let’s take a look at the key financial data of BF Utilities.

Let’s take a look at the key financial data of BF Utilities.

| Market Cap (Cr): Rs. 1,219 Cr. | Face Value: Rs. 5 | EPS: Rs. -0.66 |

| Book Value: Rs. -57.4 | Roce (%):12.5 | Debt to Equity: 0 |

| Stock PE: 0 | ROE (%): 0 | Dividend Yield (%): 0 |

| Promoter’s Holdings (%):56.7 | Total Debt (Cr): Rs. 1,681 |

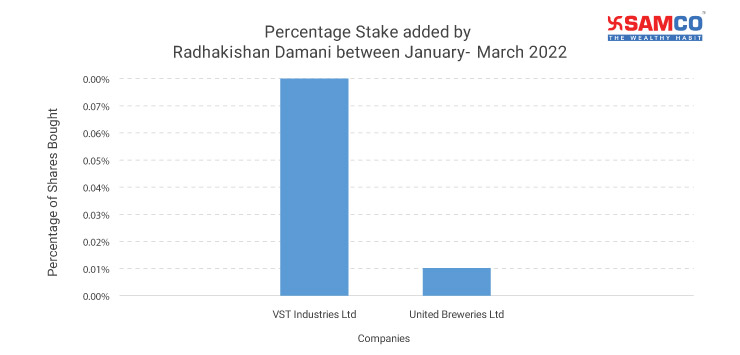

Stocks Radhakishan Damani bought in January – March 2022 quarter

Radhakishan Damani added a stake in these two companies from January to March 2022.

Radhakishan Damani added a stake in these two companies from January to March 2022.

- VST Industries Ltd. (0.08%)

- United Breweries Ltd. (0.01%)

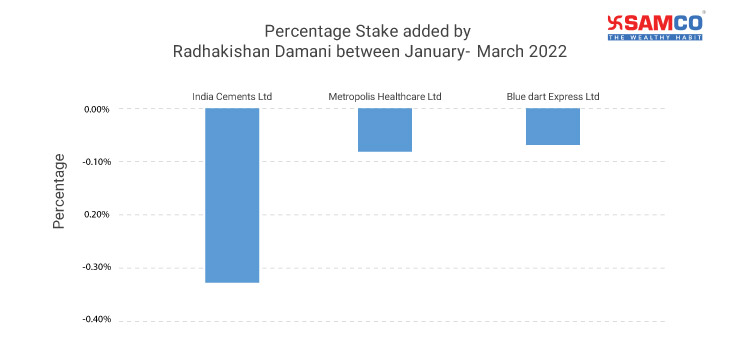

Stocks Radhakishan Damani sold in January – March 2022 quarter

Radhakishan Damani sold his stake in these two companies from January to March 2022.

Radhakishan Damani sold his stake in these two companies from January to March 2022.

- Metropolis Healthcare Ltd. (0.09%)

- India Cements Ltd. (0.32%)

- Blue Dart Express Ltd. (0.07%)

Easy & quick

Easy & quick

Leave A Comment?