What is the Full Form of GAIL? – GAIL Full Form

What is the full form of GAIL? The full form of GAIL is Gas Authority Of India Ltd. It operates a network of 13,340 kms across India (as of 10th September 2021). GAIL dominates 70% of India’s gas transmission market and 50% gas trading share. GAIL also has a presence in the following segments:

- Trading

- Transmission

- Liquified Petroleum Gas (LPG) production and transmission

- Liquified Natural Gas (LNG) re-gasification

- Petrochemicals

- City gas, exploration & production, and other areas of the natural gas value chain.

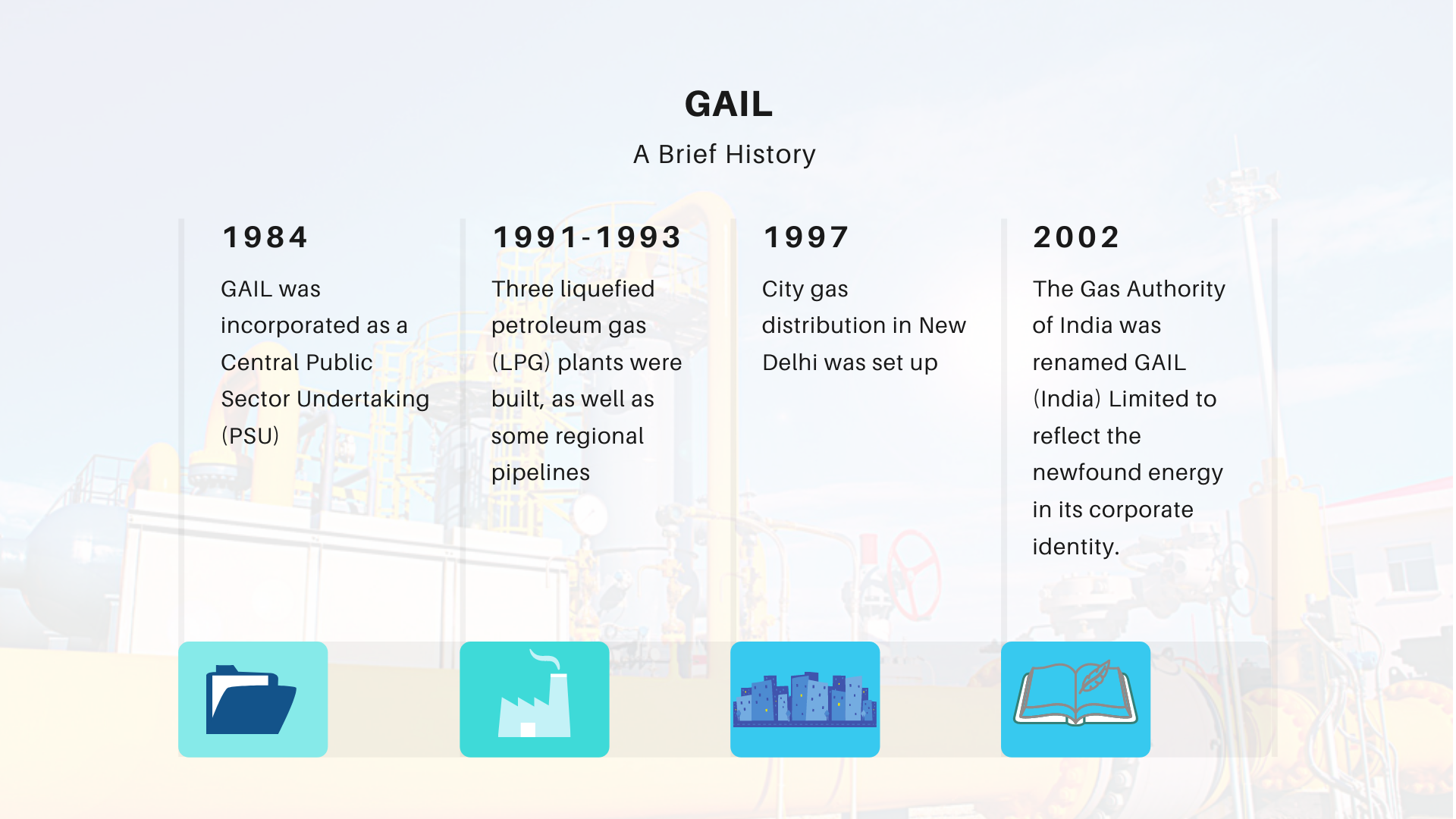

History of GAIL

GAIL’s LOGO

Key Personnel at GAIL

- Shri Anjani Kumar Tiwari. Director (Finance)

- Shri Manoj Jain- CMD, Director (Projects) and Director (HR)

- Shri E.S. Ranganathan-Director (Marketing)

- Shri M V Iyer-Director (Business Development)

- Shri Ashish Chatterjee-Government Nominee Director.

- Smt. Usha Suresh-Government Nominee Director.

- Smt. Banto Devi Kataria- Non-official (independent) director

- Smt. Shubha Naresh Bhambhani- Chief Vigilance Officer, GAIL

- Shri A.K. Jha- Company secretary

Subsidiaries of GAIL

- Brahmaputra Cracker and Polymer Limited (BCPL)

- GAIL Gas Limited

- GAIL Global (Singapore) Pte Limited

- GAIL GLOBAL (USA) INC., (GGUI)

- GAIL GLOBAL USA LNG LLC (GGULL)

- Konkan LNG Limited (KLL)

Joint Ventures of GAIL

- Aavantika Gas Limited (AGL)

- Bhagyanagar Gas Limited (BGL)

- China Gas Holdings Limited (China Gas)

- Central U.P. Gas Limited (CUGL)

- Fayum Gas Company (Fayum Gas)

- Green Gas Limited (GGL)

- Indraprastha Gas Limited (IGL)

- Mahanagar Gas Limited (MGL)

- Maharashtra Natural Gas Limited (MNGL)

- National Gas Company (Natgas)

- ONGC Petro-additions Limited (OPaL)

- Petronet LNG Limited (PLL)

- South-East Asia Gas Pipeline Company Limited (SEAGP)

- TAPI Pipeline Company Limited (TPCL)

- Tripura Natural Gas Company Limited (TNGCL)

- Talcher Fertilizers Limited

- Vadodara Gas Limited (VGL)

Latest Shareholding Pattern of GAIL (As on 10th September 2021)

| Mar 2018 | Mar 2019 | Mar 2020 | Mar 2021 | |

| Promoters | 53.96% | 52.64% | 52.06% | 51.82% |

| Foreign Institutional Investors (FIIs) | 17.41% | 20.86% | 16.3% | 15.63% |

| Domestic Institutional Investors (DIIs) | 16.24% | 14.65% | 18.31% | 19.32% |

| Government | 7.43% | 8.13% | 8.31% | 8.47% |

| Public | 4.97% | 3.72% | 5.02% | 4.76% |

Latest Profit and Loss Account of GAIL (As on 10th September 2021)

| Mar 2016 | Mar 2017 | Mar 2018 | Mar 2019 | Mar 2020 | TTM | |

| Sales | 52,053 | 48,552 | 54,496 | 76,190 | 72,508 | 57,372 |

| Expenses | 47,524 | 42,537 | 46,701 | 66,283 | 63,495 | 50,127 |

| Operating Profit | 4,529 | 6,015 | 7,796 | 9,907 | 9,013 | 7,245 |

| OPM | 9 | 12 | 14 | 13 | 12 | 13 |

| Other Income | 737 | 1218 | 954 | 1751 | 3,805 | 2,834 |

| Interest | 822 | 509 | 295 | 159 | 309 | 179 |

| Depreciation | 1496 | 1541 | 1,527 | 1,667 | 2,080 | 2,179 |

| Profit before tax | 2,949 | 5,183 | 6,928 | 9,831 | 10,429 | 7,725 |

| Tax | 37 | 35 | 31 | 33 | 9 | 20 |

| Net Profit | 1,869 | 3,368 | 4,799 | 6,546 | 9,422 | 6,136 |

[Read More: How to Read an Income Statement of a Company]

Latest Key Financial Ratios of GAIL (As on 10th September 2021)

| Market Cap (Cr): 64,452 | Face Value (₹): 10 | EPS (₹): 17.06 |

| Book Value (₹): 120 | Roce (%): 13.5 | Debt to Equity: 0.16 |

| Stock P/E: 8.46 | ROE (%): 12 | Dividend Yield (%): 3.44 |

| Revenue (Cr): 61,776 | Earnings (Cr): 7,130 | Cash (Cr): 2,025 |

| Total Debt (Cr): 7,873 | Promoter’s Holdings (%): 52.12 |

Latest Balance Sheet of GAIL (As on 10th September 2021)

| Mar 2016 | Mar 2017 | Mar 2018 | Mar 2019 | Mar 2020 | Mar 2021 | |

| Share Capital | 1,268 | 1,691 | 2,255 | 2,255 | 4,510 | 4,440 |

| Reserves | 35,135 | 37,614 | 39,424 | 43,749 | 44,758 | 48,742 |

| Borrowings | 9,052 | 6,553 | 3,876 | 2,224 | 6,912 | 7,873 |

| Other Liabilities | 13,608 | 12,433 | 15,798 | 20,199 | 18,754 | 20,350 |

| Total Liabilities | 59,063 | 58,291 | 61,353 | 68,426 | 74,934 | 81,405 |

| Fixed Assets | 29,946 | 28,302 | 28,860 | 31,475 | 37,121 | 40,188 |

| Cwip | 3,688 | 4,126 | 5,938 | 9,738 | 11,666 | 13,400 |

| Investments | 9,844 | 10,125 | 10,452 | 10,722 | 9,893 | 13,058 |

| Other Assets | 15,584 | 15,737 | 16,102 | 16,493 | 16,253 | 14,760 |

| Total Assets | 59,063 | 58,291 | 61,353 | 68,426 | 74,934 | 81,405 |

| Inventories | 1,643 | 1,728 | 1,951 | 2,522 | 3,203 | 3,010 |

| Trade Receivables | 2,723 | 2,751 | 3,430 | 4,363 | 4,818 | 3,502 |

| Cash & Bank | 1,846 | 1,421 | 2,859 | 1,425 | 1,250 | 2,025 |

| Loans and Advances | 4,545 | 4,452 | 2,974 | 3,061 | 3,201 | 1,883 |

| Trade Payables | 2,909 | 2,741 | 3,904 | 3,876 | 3,922 | 4,453 |

[Read More: How to Read a Balance Sheet of a Company]

Latest Mutual Funds Holdings & Trends of GAIL

| Schemes | Quantity | As on |

| HDFC BALANCE ADVANTAGE FUND – REGULAR PLAN – GROWTH | 58,523 | 31-08-2021 |

| SBI FLEXICAP FUND – GROWTH | 31,884 | 31-08-2021 |

| HDFC FLEXICAP FUND – GROWTH OPTION | 22,503 | 31-08-2021 |

| HDFC TOP 100 FUND – REGULAR PLAN – GROWTH | 20,052 | 31-08-2021 |

| FRANKLIN INDIA FOCUSED EQUITY FUND-GROWTH | 18,269 | 31-08-2021 |

| KOTAK EQUITY ARBITRAGE FUND – REGULAR PLAN – GROWTH | 18,054 | 31-08-2021 |

| FRANKLIN INDIA BLUECHIP FUND – GROWTH | 17,538 | 31-08-2021 |

| DSP TAX SAVER FUND – GROWTH | 13,369 | 31-08-2021 |

| FRANKLIN INDIA FLEXI CAP FUND – GROWTH | 13,154 | 31-08-2021 |

| SBI BALANCED ADVANTAGE FUND – REGULAR PLAN – GROWTH | 11,729 | 31-08-2021 |

Valuation Analysis of GAIL (As on 10th September 2021)

Valuation analysis helps you analyse how overvalued or undervalued a stock is using the margin of safety index. Watch this video to know how to find undervalued stocks in the market. It is the difference between the intrinsic value and the current value of a share. Intrinsic value is the true value of a share.

From the investor’s perspective –

If the market price is significantly lower than the stock’s intrinsic value, the stock has a high margin of safety. It is a buy signal.

From a seller’s point of view –

If the market price is significantly higher than the intrinsic value, it is a short sell opportunity. GAIL has a high margin of safety

Latest Samco Stock Ratings of GAIL : 2 out of 5 Stars (As on 10th September 2021)

PROS

- Great Cash Conversion of Profits: GAIL is able to convert 89.23% of operating earnings into operating cash flow. This signals a great working capital cycle and large cash flows for either funding or dividends. This has a positive impact on GAIL’s shareholders.

CONS

- Low Sustainable RoE: GAIL’s return on equity (ROE) is lower than the expected cost of capital. This means that the underlying business will destruct value over a period of time due to its inability to generate superior returns on capital.

- Low Return on Capital Employed: GAIL is unable to generate sufficient return on capital employed. This has affected its ability to generate high returns for shareholders after accounting for taxes, interest and other non-equity stakeholders.

- Highly Cyclical Industry: GAIL operates an extremely cyclical business with unpredictable earnings and cash flows. This can result in very high stock price volatility and returns which could negatively impact shareholder returns.

- Capital Intensive Business: GAIL operates an extremely capital intensive business with a low Asset turnover ratio of 1.11. A low asset turnover ratio negatively impacts RoE and reduces shareholder returns. Also due to the capital intensive nature of business, growth of the business would need to be funded either via increasing borrowings or diluting shareholding, both of which negatively impacts shareholder value and returns.

- Extremely Speculative Stock: GAIL’s stock is extremely speculative in nature which is likely to work negatively to impact long term shareholders of the company.

- Low Shareholder Pedigree: GAIL has a very poor long term shareholder base and a large part of the shareholders are short term shareholders. This increases stock volatility and high speculative activity works negatively for long term shareholders of the company.

Competitor Analysis of GAIL (As on 10th September 2021)

| Company | Price (Rs) | Market Cap (Cr) | P/E | EPS (Rs) | Dividend Yield (%) | ROE (%) |

| A2Z INFRA ENGINEERING LIMITED | 4.35 | 76.6 | 0 | -4.06 | 0 | -21.80% |

| Indraprastha Gas Ltd | 564.3 | 39,501 | 27.9 | 20.21 | 0.02 | 19.80% |

| Va Tech Wabag Ltd | 335.5 | 2,086 | 17.4 | 19.33 | 0 | 8.52% |

Visit Samco’s share pages to check the star ratings for every listed company. Search for stocks to get live prices, ratings, valuation and analysis. Open a FREE Demat account with Samco and experience world class trading.

Easy & quick

Easy & quick

Leave A Comment?