‘We fear what we do not understand’. This quote perfectly sums up the relationship between mutual funds and Indian investors.

Mutual fund is probably the most ‘misunderstood’ financial product. Majority of investors believe that mutual funds are too complicated. And what is complicated must be risky.

Fortunately, this is not true.

But since the best way to overcome your fears is to face them, let us understand how mutual funds work.

‘We fear what we do not understand’. This quote perfectly sums up the relationship between mutual funds and Indian investors.

Mutual fund is probably the most ‘misunderstood’ financial product. Majority of investors believe that mutual funds are too complicated. And what is complicated must be risky.

Fortunately, this is not true.

But since the best way to overcome your fears is to face them, let us understand how mutual funds work.

What is a Mutual Fund?

A Mutual fund is a well-regulated investment vehicle which collects money from various investors and invests them in multiple assets.- If your mutual fund invests in stocks, it is an Equity mutual fund.

- If your mutual fund invests in bonds, debentures etc. It is a Debt mutual fund.

- If your mutual fund invests in both stocks and bonds, it is a Hybrid mutual fund.

- You make profits when the share price of underlying stocks increases.

- You make losses when the share price of underlying stocks decreases.

How Mutual Funds Work – Net Asset Value & Units

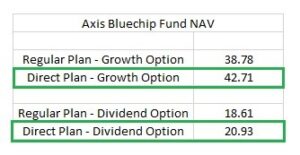

When you invest in a mutual fund scheme, you buy ‘units’ at a particular price. This price is known as Net Asset Value (NAV). This is similar to paying Rs 10 for 1 Dairy Milk. NAV is always quoted on per unit basis. The NAV of newly launched mutual fund, also known as a New Fund Offer (NFO) is always Rs 10. Post launching, NAV is calculated daily using the below formula. The formula for Calculating NAV = Total Assets – Total Liabilities / Total Outstanding units A rise or fall in NAV shows whether you made a profit or a loss. For example, suppose you invested Rs 1,000 in Axis Bluechip Fund – Regular – Growth. The fund’s NAV is Rs 38.78. This means that you can buy 1 unit for Rs 38.78. When you invest Rs 1,000 in the fund, you get 25.76 units (Rs 1,000/Rs 38.78). After a month:- If the NAV increases to Rs 42, then the value of your Rs 1,000 will be Rs 1,083 (25.76 units * Rs 42).

- If the NAV falls to Rs 34, then the value of your Rs 1,000 will fall to Rs 876.

The NAV of direct plans is always higher than regular plans. The reason for this is that direct plans have lower expense ratio since brokerage is not paid in case of direct plans.

NAV measures the total increase or decrease in share price of various underlying stocks. This leads us to the concept of diversification.

The NAV of direct plans is always higher than regular plans. The reason for this is that direct plans have lower expense ratio since brokerage is not paid in case of direct plans.

NAV measures the total increase or decrease in share price of various underlying stocks. This leads us to the concept of diversification.

How Mutual Funds Work – Diversification

When your fund manager collects money from lakhs of investors, he doesn’t invest it all in one stock. No, your smart fund manager splits the total amount into multiple stocks. This is known as diversification. Suppose you received Rs 100 from a relative. But you are scared that your brother/sister might steal this money. So, you decide to divide Rs 100 in 10 small parts and hide it across the house. You hide Rs 20 in your compass box. Rs 10 is hidden in a math textbook and so on. The idea behind this is to not lose the entire Rs 100. So, even if your brother/sister finds Rs 20 hidden in the compass box, what are the chances that they’ll find out all 10 hidden places? Almost nil. This is exactly how diversification works. Your fund manager will divide the collected money in various parts. He will then invest it in stocks of many companies. For example: Axis Bluechip Fund invests equally in 30 different stocks. So, when you invest Rs 1,000 in the fund, you invest in all 30 stocks. If 10 stocks go down and the remaining 20 stocks go up, your net position remains positive. Remember, what are the chances of all 30 stocks falling at the same time? Almost nil! This is why diversification works in a mutual fund.How Mutual Funds Work – Calculating Profits & Losses

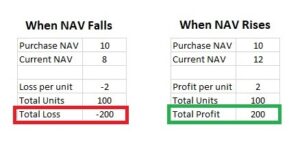

The NAV of your mutual fund is directly related to the value of stocks in the portfolio.- When stock prices rise, NAV goes up.

- When stock prices fall, NAV does down.

- If buying NAV > current NAV = Loss

- If current NAV > buying NAV = Profit

How Mutual Funds Work – Types of Investment Options

Every mutual fund scheme offers two types of investment options:- Growth Option

- Dividend Option

- Your cost price = 100 units * Rs 10 = Rs 1,000

- Your selling price = 100 units * Rs 20 = Rs 2,000

- Profit = Selling price – Cost price

How Mutual Funds Work – Fund Manager

You need a Pilot to fly an airplane. Similarly, your mutual funds are also run by financial experts known as fund managers. These fund managers decide which stocks or bonds your money should be invested in. You can measure the performance of the fund manager using Alpha. Axis Bluechip Fund has an Alpha of 4.04. This means that the fund managed was able to outperform the benchmark by 4.04%. Fund managers are appointed by Asset Management Companies (AMCs). They charge a fee to manage the portfolio known as ‘expense ratio’.How Mutual Funds Work – Expense Ratio

The fund manager charges a fee in the form of expense ratio. Every mutual fund scheme has a different expense ratio which is deducted from the fund’s NAV. Hence, a high expense ratio directly impacts your mutual fund returns. But fund houses cannot charge more than 2.5% expense ratio (for equity funds). Expense ratio also differs for regular and direct plans. Since direct plans have no ‘commission/brokerages’, their expense ratios are lower than regular plans.| Axis Bluechip Fund Expense Ratio | |

| Regular Plan | 1.83% |

| Direct Plan | 0.50% |

How Mutual Funds Work – Exit Loads

Mutual funds are highly liquid. You can buy and sell mutual funds on a daily basis. In case of liquid funds, the redemption proceeds are received in 1 day. Redemption from equity funds take T+2 working days. So, if you redeem on Monday, the amount will be credited to your account on Wednesday. While you can redeem from mutual funds anytime, they do have exit loads. Exit loads are a penalty that you pay if you sell your units before a particular tenure.- Overnight fund has no exit load.

- Liquid fund has exit load period of 7 days.

- Equity fund has exit load period of 365 days.

- Credit risk fund has exit load period of 540 days.

Easy & quick

Easy & quick

Leave A Comment?