But how do you analyse mutual funds? Do you need special softwares or technical expertise? Well, luckily you don’t require any special skills or technical knowledge. All you need to know is what to look for and what to avoid while analysing mutual funds

This article will teach you how to analyse mutual funds.

So, let’s begin.

But how do you analyse mutual funds? Do you need special softwares or technical expertise? Well, luckily you don’t require any special skills or technical knowledge. All you need to know is what to look for and what to avoid while analysing mutual funds

This article will teach you how to analyse mutual funds.

So, let’s begin.

How to Analyse Mutual Fund Performance?

No matter if you are planning to invest in a fund or wish to exit a fund, it is very essential to analyse mutual funds performance before making a decision. Here are some tips that will help you to analyse mutual funds.1. The underlying portfolio of stocks

A mutual fund is nothing but a pool of stocks. Hence your aim should be to analyse the quality of underlying stocks that a fund holds. To do this, you will need to do in-depth analysis of the company, its balance sheet, analyse management’s business decisions etc. For a common investor, this is quite cumbersome. But there is a simpler way of analysing mutual funds. RankMF’s proprietary engine evaluates more than 20 million data points daily to check the quality of underlying stocks. Here is an example of the quality of the underlying stocks of Axis Focused 25 Fund Regular Growth fund. This schemes has majorly invested in good quality stocks hence the overall quality of the scheme is great. Also, to create wealth, you need to invest in good quality mutual funds. If you are investing in a poor quality fund, it might give you returns in the short term but won’t deliver solid returns over the long term.

So, to analyse if your investment is in the ‘Sahi’ mutual fund, you can take advantage of RankMF’s unique portfolio analysis tool ‘SmartSwitch’.

SmartSwitch helps you analyse your current portfolio and switch all non performing loss making funds to better performing funds.

To know how to use this advanced feature - Click here.

Also, to create wealth, you need to invest in good quality mutual funds. If you are investing in a poor quality fund, it might give you returns in the short term but won’t deliver solid returns over the long term.

So, to analyse if your investment is in the ‘Sahi’ mutual fund, you can take advantage of RankMF’s unique portfolio analysis tool ‘SmartSwitch’.

SmartSwitch helps you analyse your current portfolio and switch all non performing loss making funds to better performing funds.

To know how to use this advanced feature - Click here.

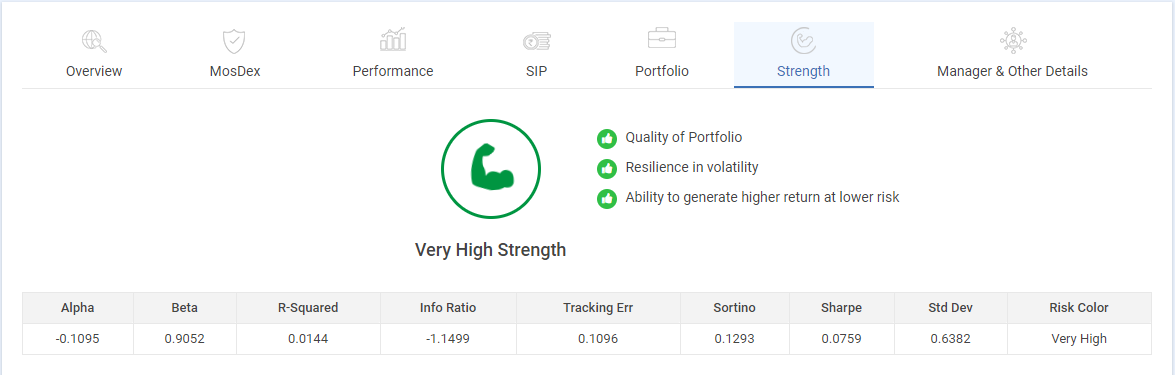

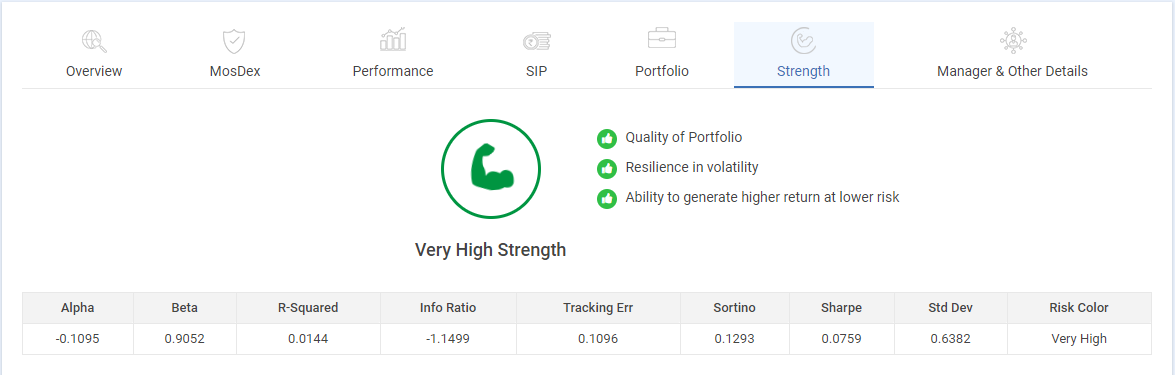

2. Strength of the portfolio

The strength of your fund indicates its ability to generate solid returns at a lower risk. So, to analyse your mutual fund schemes, it is important to judge the strength of the portfolio using basic financial ratios. The below financial ratios help in evaluating the strength of the portfolio:- Alpha

- Beta

- Standard deviation

- R-squared

- Tracking error

- Sharpe ratio, etc.

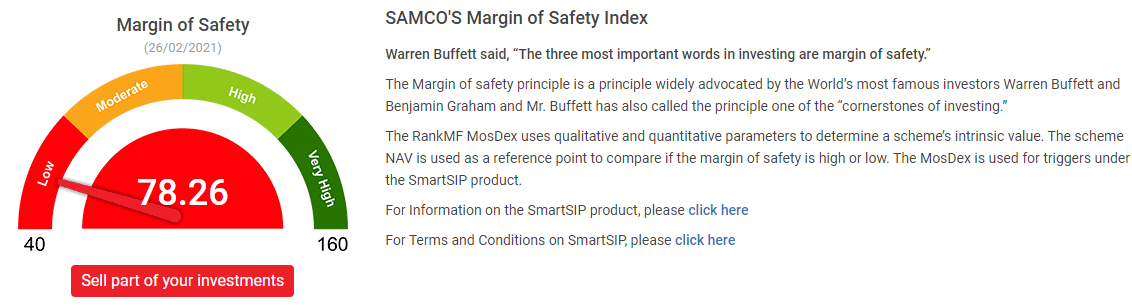

3. The Margin of Safety Index

For analysing a mutual fund’s performance, you must know the MosDex of a fund. Remember how we wait for sales to get bigger discounts on the products? Similarly, while investing in mutual funds, we need to analyse when the fund is available at a discounted price.

3. The Margin of Safety Index

For analysing a mutual fund’s performance, you must know the MosDex of a fund. Remember how we wait for sales to get bigger discounts on the products? Similarly, while investing in mutual funds, we need to analyse when the fund is available at a discounted price.

How does MosDex work?

If the MosDEX value is high, it means the scheme is undervalued. A high MosDEX value indicates that this is the right time to invest in the scheme. If the MosDEX value is low, it means that the scheme is expensive.A low MosDEX value indicates that this is not the right time to invest in the scheme.- MosDex below 80: Partial profit booking by redeeming some equity fund units and shifting to liquid funds.

- MosDex between 80 to 90: The SIP amount will be invested in liquid funds.

- MosDex between 90-105: SIP amount will continue to be invested in the equity fund. Also, the profits parked in the liquid fund will also be re-invested in an equity fund.

- MosDex above 105: Markets are undervalued hence, SmartSIP continues to invest in equity funds whereas SmartSIP Plus invests double the SIP value to buy more units.

MosDex simply helps you figure out the right opportunity to buy your fund at a discounted price. SmartSIP works on the same principle.

MosDex simply helps you figure out the right opportunity to buy your fund at a discounted price. SmartSIP works on the same principle.

- When the MosDex value is low, SmartSIP will not buy equity fund units. It will instead buy liquid fund units. When the Mosdex value is high, SmartSIP will double the SIP amount. The goal is to buy equity funds at a cheap price as the market is really undervalued.

4. Fund Performance Vs Benchmark Performance

Each mutual fund scheme has a benchmark index. This benchmark helps you to track the performance of the fund. A good fund will consistently beat its benchmark returns. Here are a few funds with their benchmark indexes.|

Mutual Fund |

Category | Benchmark Index |

| Axis Focused 25 Fund Regular Growth | Equity - Focused Fund | S&P BSE 200 - TRI |

| Axis ESG Equity Fund Regular Growth | Equity - Thematic Fund | Nifty 100 ESG Index - TRI |

| Motilal Oswal Focused 25 Fund - Regular Growth | Equity - Focused Fund | NIFTY 50 - TRI |

| Nippon India Japan Equity Fund - Growth Plan - Growth Option | Equity - Thematic Fund - Global | TOPIX (Tokyo Stock Price Index) |

| Hdfc Index Fund - Sensex Plan - Regular Plan - Growth | Index Funds - Sensex | S&P BSE SENSEX - TRI |

5. Portfolio churning ratio

Portfolio churning shows the number of times your fund manager buys and sells stocks from your portfolio. Most fund managers churn portfolios unnecessarily to increase their fund management fees. Such churning may affect your gains in the long term. A high portfolio churning ratio will simply increase your cost and not returns. So, invest in funds that have low churning ratios. Final Thoughts Analysing mutual funds is not easy. Common investors do not have the time, resources or even inclination to analyse mutual funds. Hence, RankMF with the help of advanced technology and research experts has made a research engine that evaluates more than 20 million data points daily. It rates and ranks all mutual fund schemes in India and gives the most honest answer to, “kaunsa mutual fund Sahi hai?” So, whether you are looking for the ‘Sahi’ mutual fund or wish to invest in a smarter way via SmartSIP or want to switch funds. RankMF is the ultimate one-stop-shop for you! It not only helps investors choose and invest in the right mutual fund schemes but also generate better returns and achieve their financial goals. So, open a FREE RankMF account today and start making your dreams come true!

Easy & quick

Easy & quick

Leave A Comment?