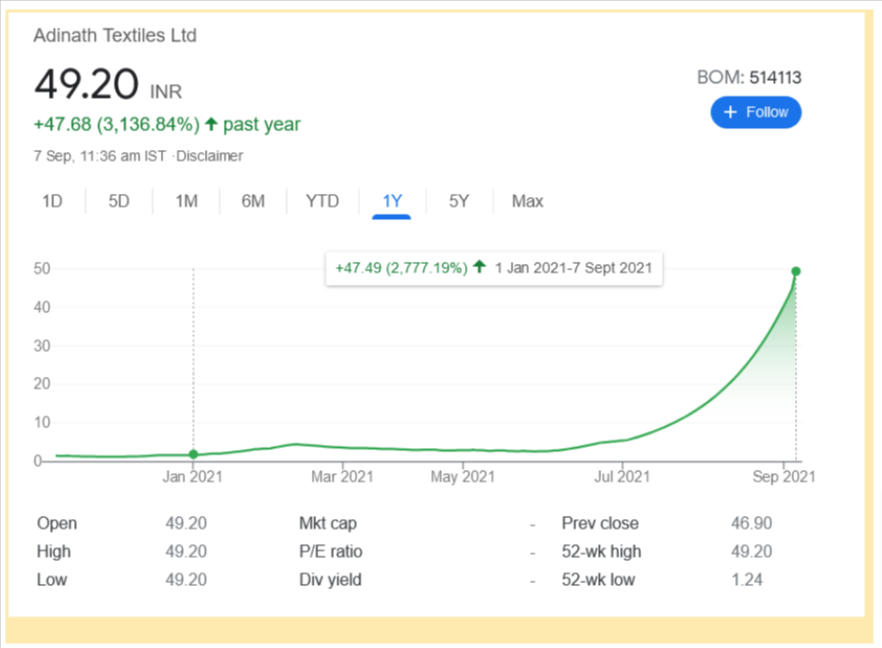

For instance, Adinath Textiles’ is a microcap company. Its shares were trading at Rs 1.71 on 1st January 2021. By 7th September 2021, its share price was Rs 49.20. This penny stock has delivered 2,777% returns in just 6 months! This jaw-dropping return potential is what attracts retail investors to penny stocks.

For instance, Adinath Textiles’ is a microcap company. Its shares were trading at Rs 1.71 on 1st January 2021. By 7th September 2021, its share price was Rs 49.20. This penny stock has delivered 2,777% returns in just 6 months! This jaw-dropping return potential is what attracts retail investors to penny stocks.

If only you knew that this stock was available at this cheap rate and that the price would skyrocket …

Isn’t that what you are thinking?

But wait, before you invest in penny stocks, it is important for you to understand the risks that come with penny stocks.

In this article, we will cover –

If only you knew that this stock was available at this cheap rate and that the price would skyrocket …

Isn’t that what you are thinking?

But wait, before you invest in penny stocks, it is important for you to understand the risks that come with penny stocks.

In this article, we will cover –

- What are Penny Stocks

- Features and characteristics

- How to analyse and investing in penny stocks

- Risks of investing in penny stocks

- Four points to remember before investing in Penny Stocks

- Brokerage while trading penny stocks

What are Penny Stocks?

The concept of penny stocks originated in the United States of America (USA). It is derived from the unit of currency called the penny. It is equivalent to one-hundredth of a US dollar. Penny stocks or penny shares are stocks which trade at a low price and have extremely low market capitalisation. The definition of penny stocks varies from country to country. For example, in India, stocks that are trading below Rs. 20 are commonly known as penny stocks. Whereas in the USA, stocks that are trading below $5 are considered as penny stocks. While in the United Kingdom, penny stocks are stocks that are trading below £1.How to find out if a stock is a penny stock?

Penny stocks are generally offered by companies with lower market capitalisation. Hence, penny stocks are also called nano-cap stocks, micro-cap stocks, and small-cap stocks. A company’s market capitalisation is determined by multiplying its current share price with the number of outstanding shares. The following table demonstrates the classification of companies based on their market-capitalisation rates –| Classification | Market Capitalisation |

| Large-cap companies | Rs. 20,000 Crore or above |

| Mid-cap companies | Rs. 5,000 Crore – 20,000 Crore |

| Small-cap companies | Rs. 500 Crore – 5,000 Crore |

| Micro-cap companies | Rs. 100 Crore – 500 Crore |

| Nano-cap companies | Below Rs. 100 Crore |

Let’s understand the features and characteristics of penny stocks.

- Low liquidity

- Limited historic information

- Multibagger Stock

- Low-cost:

How should one go about analysing and investing in penny stocks?

Penny stocks are riskier than the blue-chip, large cap or mid cap stocks. However, they present us with huge growth potential. But not all penny stocks outperform other investment options. This is why penny stocks are not recommended for investors with low-risk appetite. Your investment portfolio must be diversified. You must not invest a major portion of your corpus in penny stocks. Penny stocks usually lure retail investors for their cheap availability and their potential to become multi-baggers. But remember, high returns come with high risks. In this video, we have discussed a model portfolio of five best penny stocks in India which you can buy keeping your risk appetite in mind. The video will also enable you to make your own checklist of factors to check before identifying penny stocks for long term investing. Watch: How to Analyse Best Penny Stocks in IndiaRisks of investing in penny stocks

Penny stocks are highly lucrative if you do your homework before investing in them. Though there is only limited information available, you must learn how to make the most of the data available. If you are able to find and invest in a fundamentally strong penny stock, you can make an enormous fortune. Recommended Read: Five-Step Framework to Company Analysis Penny stocks have extremely low trading volumes. s. This makes them an easy target to manipulate the stock price. Unethical operators would invest or dump penny stocks in large quantities, which causes wide range fluctuation in stock prices.Risk of Stock Exchange restrictions

Since penny stocks are issued by ultra-small companies, their compliance with the law and the stock market regulations may be casual. This usually attracts adverse regulatory action from the stock exchanges. They can impose upper and lower circuits on the companies to prevent excessive speculation in them. The imposition of a circuit adversely impacts the ability of the trader to exit the stock when he wants to. If the company continues to de-comply with regulatory laws and rules, The Securities and Exchange Board of India (SEBI) has the power to order such companies to delist from the exchanges.Four points to remember before investing in penny stocks

Before you invest in penny stocks, keep these four things in mind. This will ensure that you don’t just invest because the stock is cheap but because it is fundamentally strong.- Draw a line

- Diversify your portfolio

- Regularly monitor the performance

- Don’t trust the data blindly

List of stocks trading below Rs. 10 in India

More than 900 stocks are trading below Rs. 10 on Indian stock exchanges. Of course, the majority of these stocks might not be worth investing. So how to decide which penny stock to invest in? Watch this video by Mr. Kedar Kailaje where he shares an exclusive case study discussing how a penny stock worth Rs.1 became a multi bagger. To know which company he is talking about and how to find such outstanding growth opportunities, watch the video now. Watch: How a Penny Stock Became a Multibagger | Stock Market Case StudyBrokerage while trading penny stocks

Traders and investors in penny stocks must be careful of the amount of brokerage that they pay which can really eat into their profits. A large number of full-service brokers in India follow a practice of minimum brokerage per share. For instance, if you trade a stock of Rs. 5, then instead of your normal brokerage slab of 0.5% on delivery trades, you would be charged a minimum per share brokerage slab of let’s say Rs. 0.05 per share. Usually at 0.5%, your brokerage per share would work out to Rs. 0.025 per share but because of minimum per share brokerage, the brokerage applicable would be Rs. 0.05 per share. So, let’s say you bought 10,000 shares of Rs. 5, your brokerage would be Rs. 500 (i.e., 10000 shares * 0.05 per share) instead of the usual brokerage of Rs. 250 on total turnover. Whereas in case of discount brokers, there is a fixed brokerage applicable like Rs. 20 or less. It never goes beyond the fixed brokerage as levied by the broker. So, while trading penny stocks with Samco, the applicable brokerage is Rs. 20 per executed order or 0.2%, whichever is lower. So, in the above example, the brokerage applicable would only be Rs. 20 and not Rs. 500.End Note:

Before buying penny stocks, doing your homework is crucial. Don’t be dependent on tips and recommendations. You might have read many success stories of investing in penny stocks and building a fortune. But what they don’t tell you is that not everyone is able to find such multi-baggers. Penny stocks are high risk trades. Don’t make the mistake of committing a large portion of your investment portfolio to it. Invest smartly and responsibly. Allot a small portion of your portfolio to the best penny stocks in India. To save your time, we have curated a list of best penny stocks to buy right now listed in India. Open a FREE Demat account with Samco, the best discount broker in India and start your investment journey today!

Easy & quick

Easy & quick

Leave A Comment?