Stockbrokers levy a charge for every trade you make through their trading platforms. This charge, known as the brokerage, can quietly chip away at your profits over time, especially if you are an active trader. Fortunately, opting for the lowest brokerage trading account in India can help make a meaningful difference to your overall returns.

Here is where Samco Securities stands out. Known for its transparent and low pricing structure, comprehensive trading-related tools and robust customer support, Samco empowers you to save more with every transaction.

Understanding Brokerage Charges

When looking for the lowest brokerage in India, it is essential to understand how different pricing models impact your trading costs.

Stockbrokers in India usually offer two types of brokerage plans: percentage-based brokerage plans and flat-fee brokerage plans. Flat-fee models charge a fixed rate per trade, irrespective of the trade size or value. Percentage-based models, on the other hand, charge a percentage of the trade value as brokerage. This means that the larger your trades are, the more you will have to pay brokerage fees.

Since brokerage is a recurring cost, high fees can reduce your net returns, especially if you trade frequently. As a result, your trading strategy becomes less efficient. Fortunately, you can preserve your profits and improve your trading performance in the long term by choosing the best discount broker in India offering a flat-fee brokerage plan.

Samco’s Competitive Edge

When it comes to the lowest brokerage trading account in India, Samco Securities stands out with its flat fee and transparent pricing model. Here are some benefits that you get to enjoy by partnering with Samco.

1 Low Brokerage Charges

Samco charges a flat Rs. 20 per executed order across equity F&O, commodity and currency segments to keep trading costs in check. For equity delivery trades, the brokerage starts at 2.5% of the turnover up to a maximum of Rs. 20 per executed order. For equity intraday trades, the brokerage starts at 0.25% of the turnover up to a maximum of Rs. 20 per executed order.

2 Free Account Opening

Samco lets you open a trading and demat account completely free of charge. Since there are no upfront fees, you can get started on your trading journey instantly by simply completing the paperless application process.

3 Zero Demat AMC for the First Year

Samco waives the demat Annual Maintenance Charges (AMC) for the first year. This allows you to enjoy added savings during the initial phase of your trading journey.

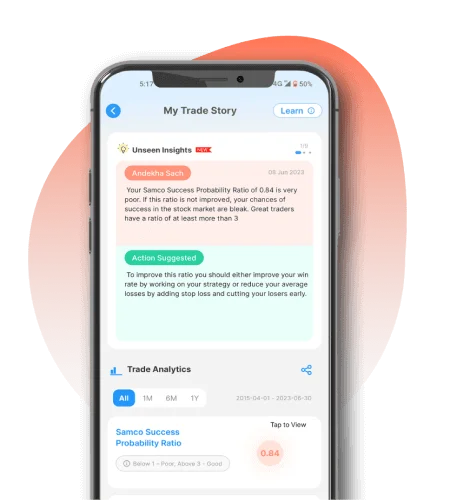

4 Advanced Tools

Samco offers a suite of intelligent trading tools like TradingView charts, Margin Trading Facility (MTF) and StockPlus. These features are designed to enhance profitability and make your trading journey more rewarding.

Comparative Analysis with Other Brokers

Selecting the right stockbroker is essential to maximise profits and minimise costs. The best way to identify the ideal platform is to compare brokerage charges in India. Here is a table comparing multiple stockbrokers, their charges and the features they offer.

| Particulars | Samco Securities | Zerodha | 5Paisa | Angel One | Shoonya | Fyers |

|---|---|---|---|---|---|---|

| Brokerage Fees |

Starts from 2.5% of the turnover up to a maximum of Rs. 20 per executed order for equity delivery trades Starts from 0.25% of the turnover up to a maximum of Rs. 20 per executed order for equity intraday trades Rs. 20 per executed order for equity F&O, currency and commodity trading segments |

Zero brokerage for the equity delivery segment Rs. 20 per executed order or 0.03% of the trade value, whichever is lower, for equity intraday and futures contracts Rs. 20 per executed order for options contracts |

Rs. 20 per executed order for all trading segments |

Zero brokerage up to Rs. 500 for the first 30 days Rs. 20 per executed order or 0.01% of the trade value, whichever is lower, for the equity delivery segment Rs. 20 per executed order or 0.03% of the trade value, whichever is lower, for equity intraday Rs. 20 per executed order for futures and options contracts |

Zero brokerage for the equity delivery segment Rs. 5 per executed order or 0.03% of the trade value, whichever is lower, for equity intraday and derivatives |

Rs. 20 per executed order or 0.3% of the trade value, whichever is lower, for the equity delivery segment Rs. 20 per executed order or 0.03% of the trade value, whichever is lower, for equity intraday and futures contracts Rs. 20 per executed order for options contracts |

| Account Opening Charges | Zero | Zero | Zero | Zero | Zero | Zero |

| Demat AMC | Zero AMC for the first year Rs. 400 + GST per year (from the 2nd year onwards) |

Rs. 300 + GST per year | Rs. 25 + GST per month | Zero AMC for the first year | Zero | Zero |

| Additional Features | SmartSIP, StockBasket, TradingView charts, Margin Trading Facility (MTF) and StockPlus | Kite mobile platform, advanced charting tools and Margin Trading Facility (MTF) | FnO360 and Pledge for Margin | Portfolio advisory, basket orders and Margin Trading Facility (MTF) | TradingView charts, Fyers Pledge, Fyers Insights and Insta Options | SMART portal, pledge for margin, HFT and Algos |

Hidden Costs and How Samco Mitigates Them

Even if you choose a zero brokerage demat account, you might encounter certain hidden charges that reduce your returns. These indirect costs are not immediately visible but affect overall trading profitability. Here is a quick overview of some of them.

- DP Charges: Depository Participant (DP) charges are levied when you sell shares from your demat account.

- Exchange Transaction Charges: Brokers often pass on exchange transaction fees and clearing charges to you. These charges vary across segments and can inflate the cost per trade.

- GST Implications: Goods and Services Tax at 18% applies to brokerage, transaction charges, and other service fees.

Samco’s transparent fee structure ensures all such indirect costs are clearly disclosed upfront. By streamlining the various charges and offering flat-rate brokerage, Samco helps traders maintain better control over expenses and avoid unpleasant surprises.

Real-World Scenarios and Case Studies

To truly identify the best discount broker in India, you must explore the impact of brokerage on different types of traders.

- 1 High-Frequency Intraday Trader

Let us assume that you are a high-frequency intraday trader and you make around 20 trades per day with an average per-trade value of Rs. 10,000. Let us compare brokerage charges in India with Samco versus a broker that levies a percentage-based fee.

Samco: 20 trades per day x Rs. 20 per trade = Rs. 400

Percentage-Based Broker: (20 trades per day x Rs. 10,000) x 0.25% = Rs. 500 - 2 Long-Term Investor

On the other hand, if you are a long-term investor who makes just 4 equity delivery trades per month with an average per-trade value of Rs. 30,000, here is what your brokerage will be with Samco versus a stockbroker with a percentage-based brokerage.

Samco: 4 trades per month x Rs. 20 per trade = Rs. 100

Percentage-Based Broker: (4 trades per month x Rs. 30,000) x 0.25% = Rs. 300 - 3 Options Trader

Assume that you trade in options contracts, where you execute about 50 trades each month. The average per-trade value is around Rs. 8,500. Let us compare brokerage charges in India with Samco versus a broker that levies a percentage-based fee.

Samco: 50 trades per month x Rs. 20 per trade = Rs. 1,000

Percentage-Based Broker: (50 trades per month x Rs. 8,500) x 0.25% = Rs. 1,063

These examples highlight how Samco offers the lowest brokerage trading account in India compared to other options.

Conclusion

As you can see, even a small difference in brokerage fees can lead to significant savings, especially for active traders and intraday investors. If you are looking for the lowest brokerage in India without compromising on technology or support, Samco is your ideal partner. Opening an account with Samco is quick, 100% digital and free. From zero Demat AMC in the first year to advanced tools and features, the benefits begin the moment you start. Take control of your trading journey today with Samco.

Easy & quick

Easy & quick