Market Performance: A Broad-Based Weakness

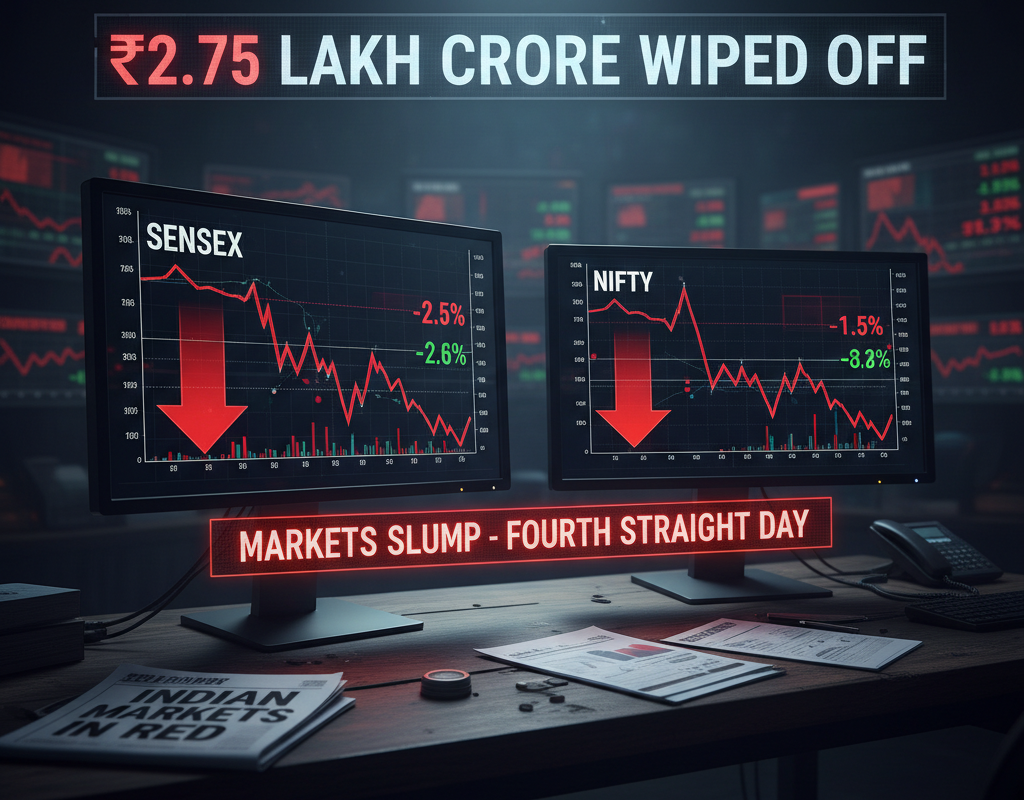

The Indian stock market continued its consolidation on Wednesday, December 3, as both the Sensex and Nifty 50 ended lower for the fourth day in a row. Despite some late-session buying, investor sentiment remained cautious, leaving benchmark indices in the red.

- Sensex closed at 85,107, down 31 points or 0.04%.

- Nifty 50 ended at 25,986, shedding 46 points or 0.18%.

The broader market felt sharper pressure:

- BSE Midcap index fell 0.95%.

- BSE Smallcap index slipped 0.43%.

As a result, the overall market capitalization of BSE-listed stocks dropped by ₹2.76 lakh crore, now standing at ₹469.69 lakh crore.

Main News: What Drove Today’s Fall?

Markets grappled with a mix of global cues and domestic factors.

- Rupee pressure: The Indian rupee weakened to a record low, affecting investor confidence.

- FII outflows: Foreign institutional investors remained net sellers, intensifying selling pressure.

- Global uncertainty: Investors are watching upcoming Fed and ECB monetary policies, while Japanese bond yields surged on expectations of BOJ tightening.

- Domestic policy: The RBI’s forthcoming policy decision is being closely monitored, particularly by banks, as expectations of a rate cut have softened following strong Q2 GDP data.

Overall, equities are in a phase of consolidation, with investors weighing global volatility against domestic growth signals.

Company Details: Top Gainers and Losers

The market today saw mixed performances across sectors and individual stocks, highlighting a selective buying trend.

Worst Nifty 50 Losers

- Max Health – down 2.9%

- BEL, Adani Enterprises, Tata Consumer – each down over 2%

- Shriram Finance, M&M – down around 1.8%

Top Nifty 50 Performers

- Wipro – up 1.61%

- Hindalco – up 1.46%

- TCS – up 1.41%

- ICICI Bank – up 1.38%

- HDFC Bank – up 1.04%

Sectoral Trends

- IT Sector: Best performer, rising 0.76%, boosted by rupee weakness.

- Automobile Sector: Worst hit, Nifty Auto down 1.20%.

Most Active Stocks

Trading volumes were robust in several stocks:

- Vodafone Idea topped with 117.61 crore shares traded on NSE.

- Other active names: Easy Trip Planners, SPARC, Bank of Maharashtra, YES Bank (10–12 crore shares each).

Stocks with Significant Moves

Biggest Gainers (10%+)

- Hikal – surged 13.6%

- On Mobile – up 10.64%

- Midwest Limited – up 10%

Biggest Losers (10%+)

- Indowind Energy RE – down 18.5%

- Adani Enterprises RE – down 11.95%

- Patel Retail – down 10.8%

52-Week Highs and Lows

- 52-week highs: 28 stocks

- 52-week lows: 228 stocks, including Awfis, Delta Corp, Dhan Laxmi Bank, Glottis, HG Infra, IREDA, Ola Electric, NDTV, Page Industries, Quess Corp, SJVN

Market Breadth: Advance-Decline Ratio

- The advance-decline ratio clearly favored sellers at 1:2.

- NSE: 1,052 stocks advanced, while 2,074 stocks declined.

This indicates cautious investor sentiment, with more stocks under pressure than those gaining.

Summary

The Indian stock market is navigating a consolidation phase, as global uncertainties and domestic pressures continue to weigh on the indices. Over the past four sessions, Sensex and Nifty have declined, erasing a combined ₹2.75–2.76 lakh crore in market capitalization.

- Select sectors like IT and banking showed resilience.

- Auto and midcap stocks faced selling pressure.

- Liquidity and FII movements remain key drivers in the near term.

Investors continue to monitor global monetary policies, currency fluctuations, and RBI policy updates, which will influence market direction in the coming days.

Easy & quick

Easy & quick

Leave A Comment?