Bear Markets Definition

A bear market is a state of market in which securities prices fall amid widespread pessimism. Security prices catch the downward spiral which to some extent is also self-sustaining. Investors and traders anticipate slowdown in the economy, contraction in GDP, heavy outflow of liquidity from the system, recession in the economy and the same time corporates expect slow down in revenues and profits, expansion plans are on hold, only way to raise money is through debts as the IPO market has virtually become dead, companies announce buyback of shares to prop up the share prices, employees become scared for likely loss of jobs, they spend less, there is compete despair and loss of faith in the capital market, front line good quality shares are sold to raise the cash levels, financial intermediaries are closing down businesses due to bleak future, such instances marks the bottom of bear market sometimes in the form of panics. In the middle of such pessimism, arises the seed of bull market.

How to identify bear markets in charts?

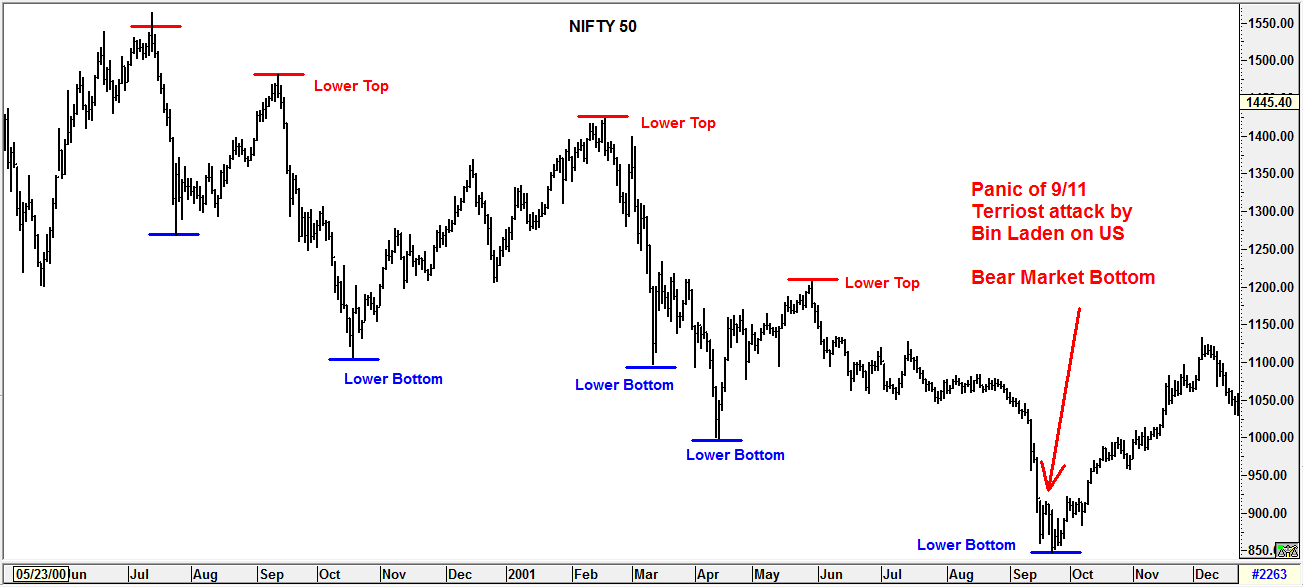

The price chart of a bear market will show lower tops and lower bottoms in the price movements. The same situation is visible on many of the individual stocks and sectors. There is fall in volumes as the prices are going up which is termed as bear market rally but when downward movement resumes volumes sometimes are heavy on panic days.

[caption id="attachment_2314" align="aligncenter" width="1301"]

Bear Markets Definition

A bear market is a state of market in which securities prices fall amid widespread pessimism. Security prices catch the downward spiral which to some extent is also self-sustaining. Investors and traders anticipate slowdown in the economy, contraction in GDP, heavy outflow of liquidity from the system, recession in the economy and the same time corporates expect slow down in revenues and profits, expansion plans are on hold, only way to raise money is through debts as the IPO market has virtually become dead, companies announce buyback of shares to prop up the share prices, employees become scared for likely loss of jobs, they spend less, there is compete despair and loss of faith in the capital market, front line good quality shares are sold to raise the cash levels, financial intermediaries are closing down businesses due to bleak future, such instances marks the bottom of bear market sometimes in the form of panics. In the middle of such pessimism, arises the seed of bull market.

How to identify bear markets in charts?

The price chart of a bear market will show lower tops and lower bottoms in the price movements. The same situation is visible on many of the individual stocks and sectors. There is fall in volumes as the prices are going up which is termed as bear market rally but when downward movement resumes volumes sometimes are heavy on panic days.

[caption id="attachment_2314" align="aligncenter" width="1301"] Identifying Bear Markets and Bear Market Chart Patterns[/caption]

How to identify bear market bottoms in chart?

In general bear market bottoms are studied better on the averages, i.e. on the stock indices, example Sensex or Nifty. Observing bear market bottoms over the past many years will throw lot of learnings. The bottom formation in the bear market is generally fast and swift. There are three or four broad sections or phases of down moves, after which market loses its steam on the downside. At other times capitulation occurs due to outcome of some major event which results into panic bottoms, which eventually sows the seeds of beginning of a new bull market.

[caption id="attachment_2315" align="aligncenter" width="1303"]

Identifying Bear Markets and Bear Market Chart Patterns[/caption]

How to identify bear market bottoms in chart?

In general bear market bottoms are studied better on the averages, i.e. on the stock indices, example Sensex or Nifty. Observing bear market bottoms over the past many years will throw lot of learnings. The bottom formation in the bear market is generally fast and swift. There are three or four broad sections or phases of down moves, after which market loses its steam on the downside. At other times capitulation occurs due to outcome of some major event which results into panic bottoms, which eventually sows the seeds of beginning of a new bull market.

[caption id="attachment_2315" align="aligncenter" width="1303"] Identifying Bear Markets bottoms and reversals using price volume technical analysis[/caption]

Conclusion

It is the earnest desire of every trader and investor to buy at the bear market bottoms, but it seldom happens. The emotion of fear is so powerful, the crowd behavior is so intense, unconscious herding is so much subtle that it becomes impossible to go against the consensus. Majority continues to follow the crowd opinion and thus they fail to buy at the bottom. In fact, it is the ugly spell of fear which freezes the independent state of mind. It is only by practice, observing and studying the past bear market behaviors that the investor will be able to buy at or near the bottom. Buying shares at bottom and thereafter ridding the investment with patience generates very high compounded returns for years to come. The famous saying of Warren Buffet “when everyone is fearful, it is time to be greedy (meaning buy) and when everyone is greedy it is time to be fearful (meaning sell)” is nothing but an anecdote/signal to buy at the bottom. Every investor should learn to love the bear markets because only they make them rich.

Additional Reference Link

Identifying Bear Markets bottoms and reversals using price volume technical analysis[/caption]

Conclusion

It is the earnest desire of every trader and investor to buy at the bear market bottoms, but it seldom happens. The emotion of fear is so powerful, the crowd behavior is so intense, unconscious herding is so much subtle that it becomes impossible to go against the consensus. Majority continues to follow the crowd opinion and thus they fail to buy at the bottom. In fact, it is the ugly spell of fear which freezes the independent state of mind. It is only by practice, observing and studying the past bear market behaviors that the investor will be able to buy at or near the bottom. Buying shares at bottom and thereafter ridding the investment with patience generates very high compounded returns for years to come. The famous saying of Warren Buffet “when everyone is fearful, it is time to be greedy (meaning buy) and when everyone is greedy it is time to be fearful (meaning sell)” is nothing but an anecdote/signal to buy at the bottom. Every investor should learn to love the bear markets because only they make them rich.

Additional Reference Link

Leave A Comment?